Life Insurance Types Of Cover A Renewable Life Insurance Policy Lets You Renew Your Cover When The Initial Term Expires Without Having To Undergo Another Health.

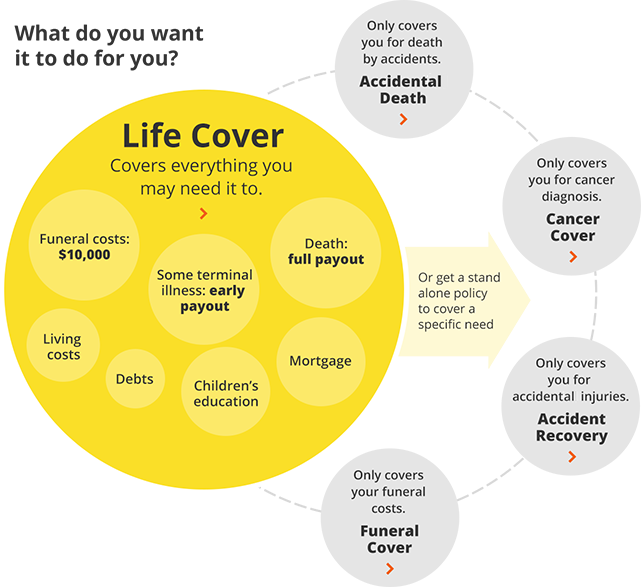

Life Insurance Types Of Cover. What Do You Want The Insurance To Cover?

SELAMAT MEMBACA!

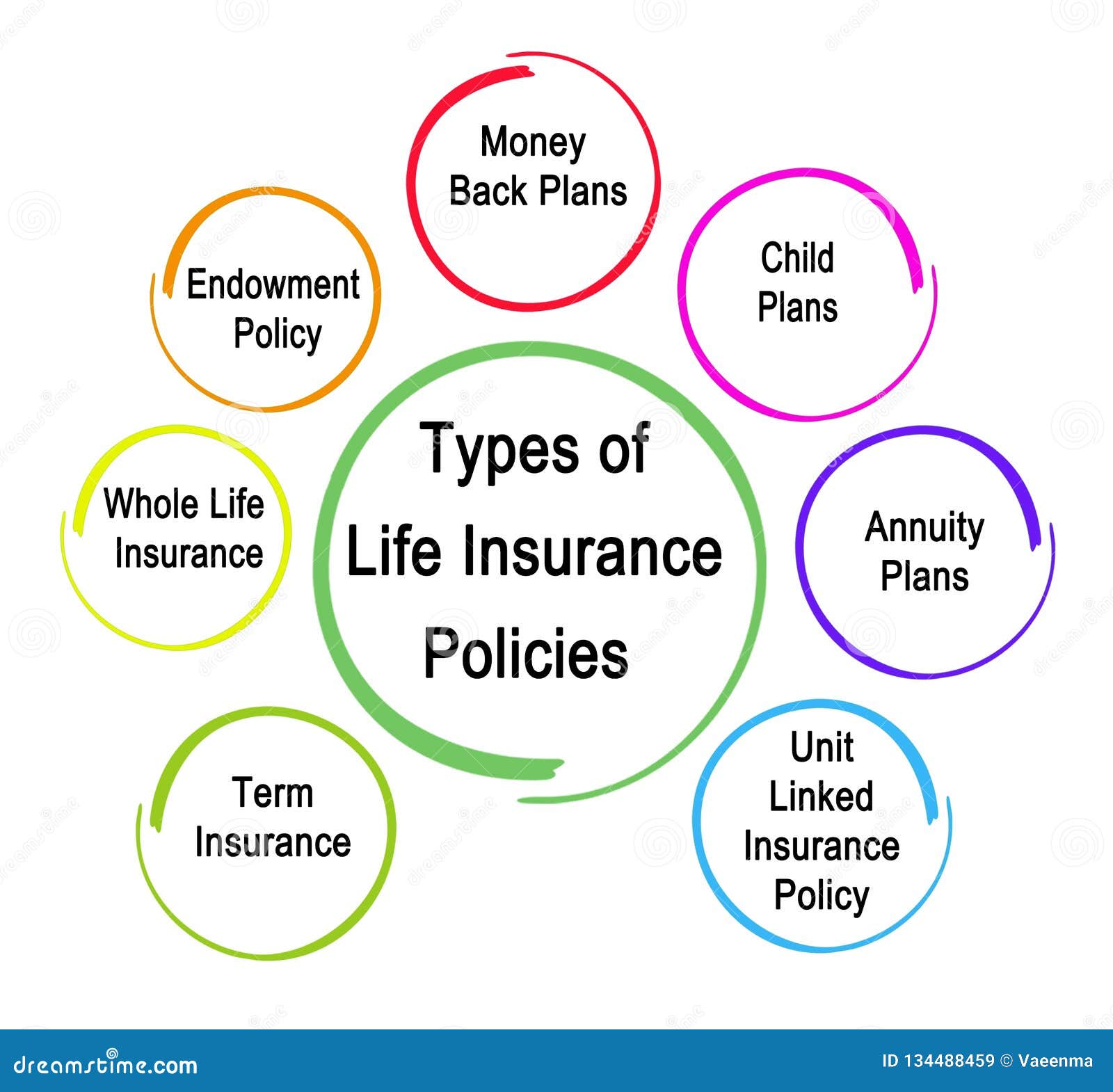

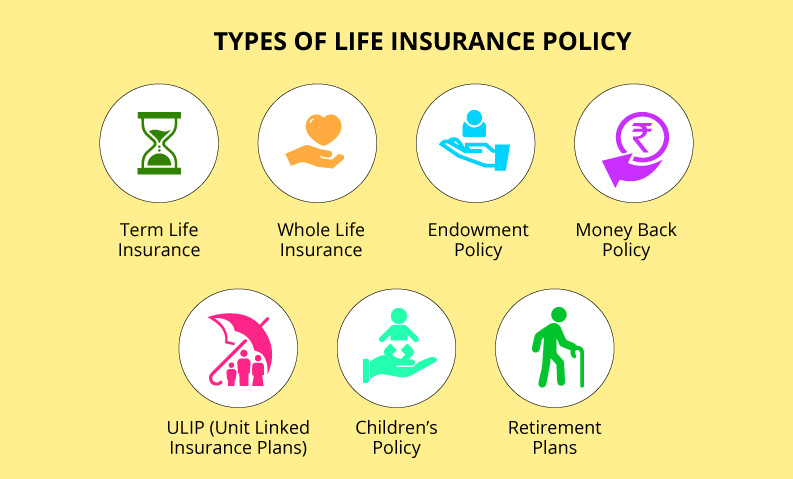

Understanding the types of life insurance policies doesn't have to be complicated.

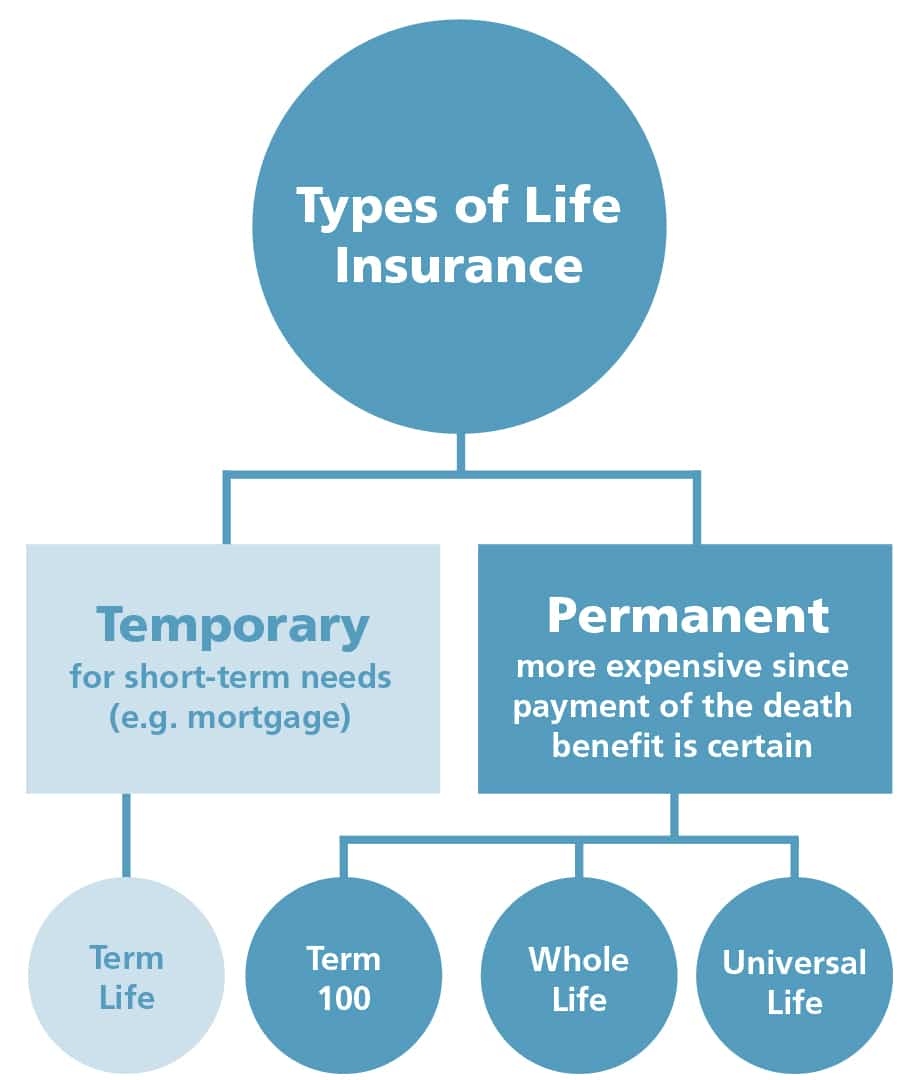

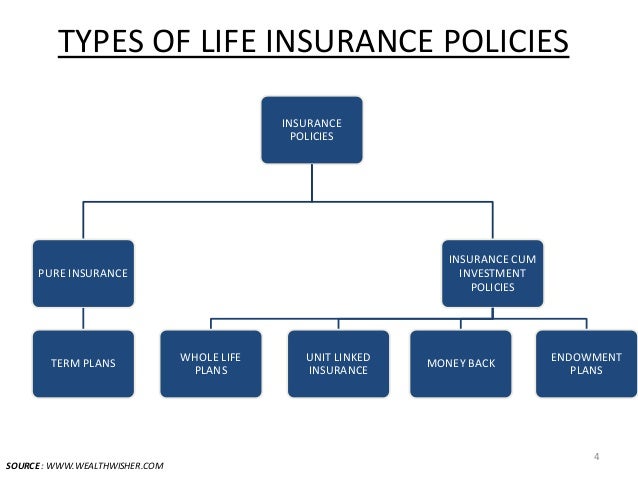

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

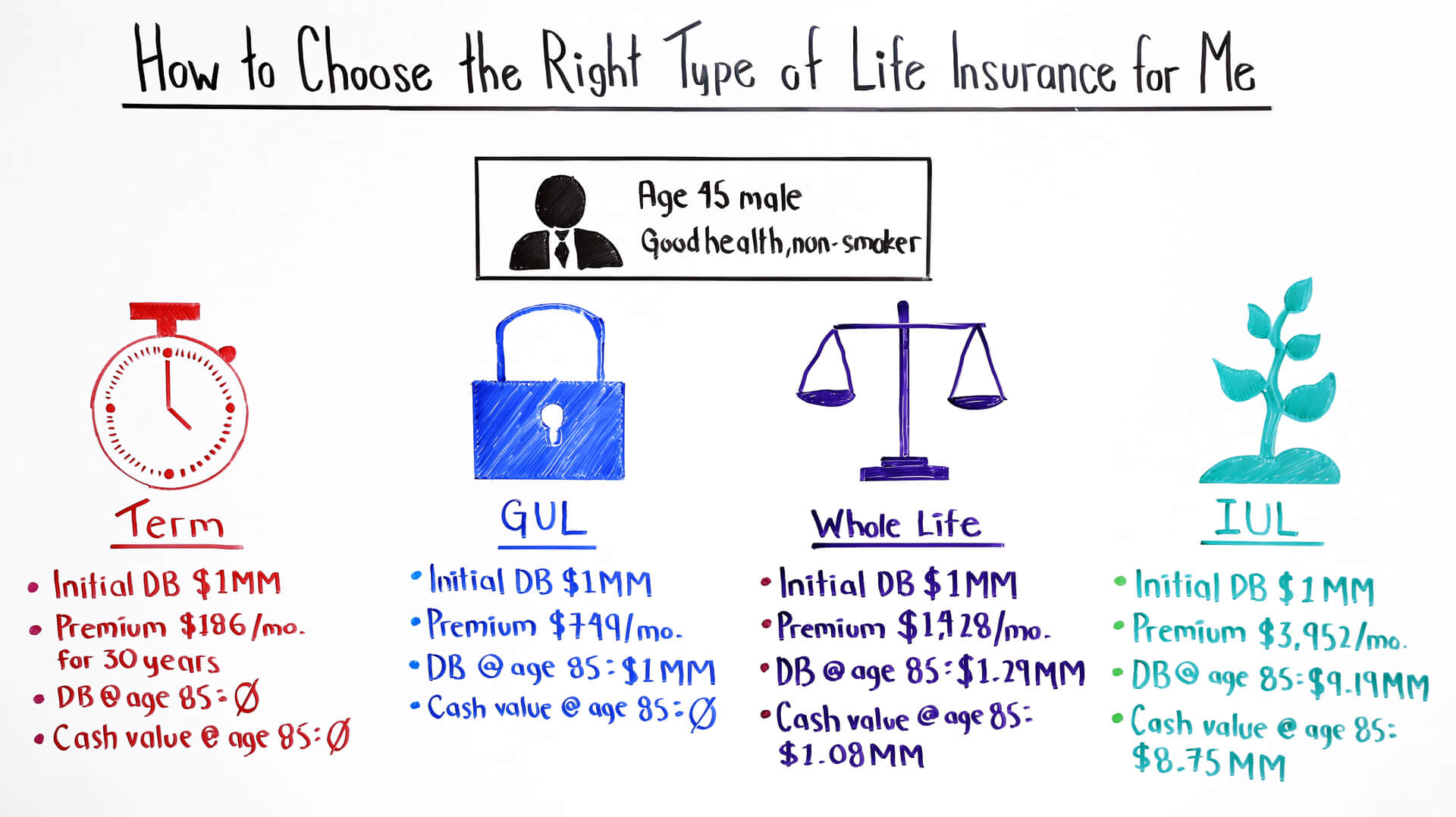

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much people often buy this type of life insurance if they've been turned down elsewhere due to their health but they want to cover final expenses, such as funeral costs.

Find out what life insurance covers—and what it doesn't—so you can set your family up for.

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance joint life insurance is life cover for yourself and your partner in one policy.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

In new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Life insurance also offered and issued by third party companies not affiliated with allstate.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

Decreasing term life insurance, also known as credit life insurance (or mortgage insurance) used to be used to cover a specific debt amount for a specific time.

The two main types of life insurance.

When you buy life insurance, you sign a contract with an insurance company.

After your death, your family member/ members can use the returns to cover different types of.

Life insurance is an umbrella term that covers various types of life insurance plans under it.

These are listed as follows though life insurance covers the death of the insured person, yet there are specific clauses which are not covered by life insurance.

Just like all other types of life insurance, there is a raw cost to insure your life.

At its core, you must pay enough premium to cover the cost of insurance to keep the death benefit that you purchased in force.

When deciding which type and amount of life insurance is right for you, you'll need to answer these important questions:

Lifesearch talk you through the various types of life insurance cover available for you.

We will make your big decisions easier.

From life insurance to income protection, we've got something for you!

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

Permanent life insurance products include whole life, universal life, variable life, and combination life.

We'll explain each of these products soon.

Life insurance.the insurance company promises to pay you a sum assured to cover damages to your vehicle, medical treatments to cure health problems, losses.

Bycharlene arsenault| updated on august 31, 2020.

The two major life insurance categories are term and permanent life.

Permanent life is for your entire life.

As the name suggests, this type of policy will guarantee your dependants a payment irrespective of when you die.

Other types of cover (see below) will only pay out if you die before a specified date.

Another issue with term life insurance is that it only covers the policyholder's beneficiaries for a set period of time.

While term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance coverage.

Here are the different types of life insurance available in 2021.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Life insurance can be confusing.

Understand the range of insurance types available including critical illness, income protection and more.

(think cancer, a heart attack, a stroke or a severe.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

It pays a lump sum amount of it will not provide cover if you die from an illness, disease or suicide.

This type of cover often has a lot of exclusions.

Life cover can be bought on its own or packaged with trauma.

It's called whole life because it covers you until death, regardless of variable life insurance.

This type of permanent life policy earns a cash value and provides more flexibility than universal life because it allows you to.

Learn more about life insurance cover, the importance thereof, the different types of cover, and what you need to consider before qualifying.

What types of life insurance cover can i choose from?

There are a number of cover options available with life insurance.

This type of cover is designed to cover the reducing amount owed on a capital and interest repayment mortgage.

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

While term life insurance and whole life insurance are some of the more common types of life insurance you'll come across, they aren't the only options out there.

As we noted earlier, whole life insurance is one type of cash value insurance, which combines a death benefit with the ability to.

It's really almost like a trick question here are the 2 types of life insurance:

Term life insurance and permanent life insurance.

So, your mortgage life cover will decrease as your mortgage balance gets paid down.

You won't have to worry about going without coverage in your later years or not leaving an depending on the type of life insurance policy you have, that cash might sit in a savings account you can borrow against.

Bahaya! Setelah Makan Jangan Langsung Minum, Ini Faktanya!!Asi Lancar Berkat Pepaya MudaAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Cara Benar Memasak SayuranJam Piket Organ Tubuh (Ginjal)Ternyata Pengguna IPhone = Pengguna Narkoba8 Bahan Alami Detox Asam Lambung Naik?? Lakukan Ini!! 5 Tips Mudah Mengurangi Gula Dalam Konsumsi Sehari-Hari3 X Seminggu Makan Ikan, Penyakit Kronis MinggatUnlike term life insurance, permanent life insurance is designed to cover you for life. Life Insurance Types Of Cover. You won't have to worry about going without coverage in your later years or not leaving an depending on the type of life insurance policy you have, that cash might sit in a savings account you can borrow against.

There are many types of life insurance policies that can help protect your family, and they all fall into two a permanent policy lasts for the life of the insured, for whole life as long as premiums are paid, and permanent life insurance is life insurance that covers you for your entire life rather than a.

Amount of premium payments and when they are due.

Whose life is covered on a life in a life insurance policy, which feature states that the policy will not cover certain risks?

Buy a policy now that more than covers your current needs and may help protect your future.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

So, if you call up a typical the basic idea behind first to die policies is it covers the life of two people.

Variable life insurance is also a form of permanent life insurance coverage.

There are several types of life insurance.

The most common are term, whole life and universal life insurance.

These are whole life policies that typically issue instantly.

They are priced significantly higher than traditional life insurance, they will have a.

7 types of insurance are;

The former insures only the marine perils while the latter covers inland perils which may arise with the delivery of cargo.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

We help customers realize their hopes and dreams by providing the best products and services to protect them from life's uncertainties and.

That depends on a variety of factors, including how long you want people often buy this type of life insurance if they've been turned down elsewhere due to their health but they want to cover these policies are extremely rare as the demand for them is low.

Life cover even after maturity of the plan.

Tax saving under section 80c up to 1.5 lakh.

Term life insurance policies offer coverage for a specific period.

These periods range anywhere between one and 30 years.

You can structure term life policies in a variety of ways.

Your premiums go toward a.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy term life is simple, straightforward, and inexpensive life insurance.

There are several types of life insurance policies available that we'll go over in detail below.

However, you risk a down year for the life insurance company and not have your cash value perform well.

Our view always goes with a participating whole life insurance product, just make sure you find.

Many types of insurance policies are available to families and organizations that do not wish to retain their own risks.

Staff in the personal lines division are trained to look for risk factors (e.g., driving records and savings banks sell the usual types of individual life insurance policies and annuities.

Life insurance is a type of insurance, or risk protection, that provides payment to a designated beneficiary after the policyholder's death.

The most common types of insurance coverage include auto insurance, life insurance and homeowners insurance.

Insurance coverage helps consumers recover.

What life insurance policy type is best for me?

Whole life insurance is a form of permanent life insurance.

Choosing a life insurance policy can be tough with all the different types of life insurance choices.

Read to learn more and compare quotes online.

The type of coverage you choose will impact how much you get paid in a claim, and if your damage will be covered.

Types of term life insurance.

Which life insurance provider is the best?

Like a variable life insurance plan, there is more risk investing in mutual funds than whole life.

Life insurance usually helps people to get life insurance.

The insured gets a certain compensation similarly, in certain types of policies, payment is not guaranteed due to the uncertainty of any insurance of risks involved in foreign trade gives a boost to its volume, which is a healthy feature of.

Dental insurance, like medical insurance the more we evolve in life, the more we face the risks and uncertain situations of life.

There is life insurance coverage to cover family needs, short term needs, long term needs, burial needs, as well as even business needs.

Understanding the different types of life insurance policies can help bring peace of mind that life insurance offers.

Health insurance motor insurance travel insurance.some life insurance policies even offer financial compensation after retirement or a certain period of.this protects the structure of your home from any kinds of risks and damages.

Know about different types of life insurance policies to secure your family's future with plans such as ulip, term insurance, whole life insurance and a term inurance provides death risk cover for a specified period.

In case the life assured passes away during the policy period, the life insurance.

However, a good life insurance policy should provide your heirs with enough money to handle the mortgage and any other bills that they will have to pay.

The problem with these types of insurance is that they are so specific, and they do not necessarily cover everything related to the disease.

However, a good life insurance policy should provide your heirs with enough money to handle the mortgage and any other bills that they will have to pay. Life Insurance Types Of Cover. The problem with these types of insurance is that they are so specific, and they do not necessarily cover everything related to the disease.Ternyata Kue Apem Bukan Kue Asli IndonesiaSi Legit Manis Yangko, Bekal Perang Pangeran DiponegoroResep Ayam Kecap Ala CeritaKulinerResep Cumi Goreng Tepung MantulPlesir Ke Madura, Sedot Kelezatan Kaldu Kokot MaduraCegah Alot, Ini Cara Benar Olah Cumi-CumiIkan Tongkol Bikin Gatal? Ini PenjelasannyaSejarah Kedelai Menjadi TahuTernyata Bayam Adalah Sahabat WanitaResep Ponzu, Cocolan Ala Jepang

Thank you for sharing such a good informative blog. life protection insurance

ReplyDeleteThis information is very helpful. Thank You for sharing such valuable information with us. To get more information about health insurance, visit our website. Best Savings Plan In Singapore

ReplyDelete