Life Insurance Types Term Term Insurance Can Be Bought For 1, 5, 10, Or 20 Years, And Is Renewable Without Needing To.

Life Insurance Types Term. Term Life Insurance Is The Best Life Insurance Policy For Applicants Looking To Obtain The Largest Amount Of Insurance For The Lowest Possible Cost.

SELAMAT MEMBACA!

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

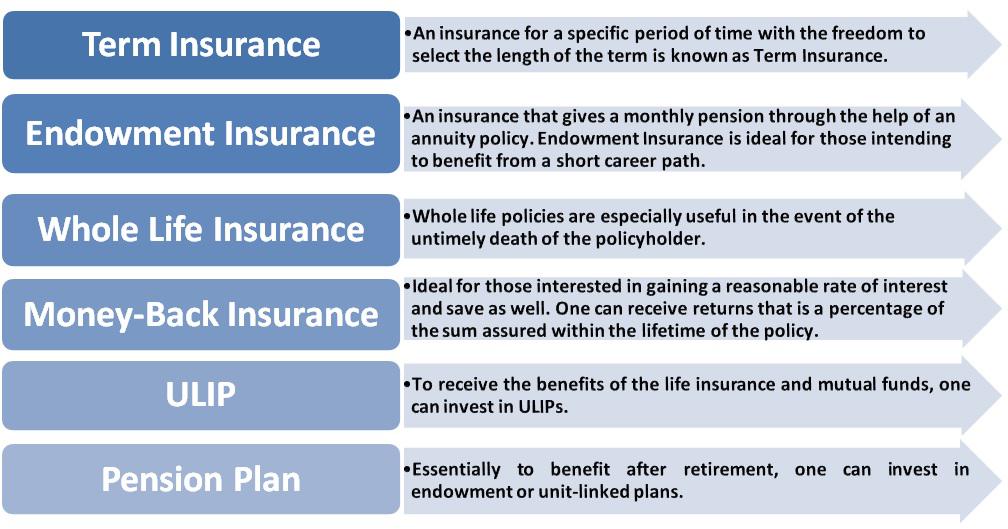

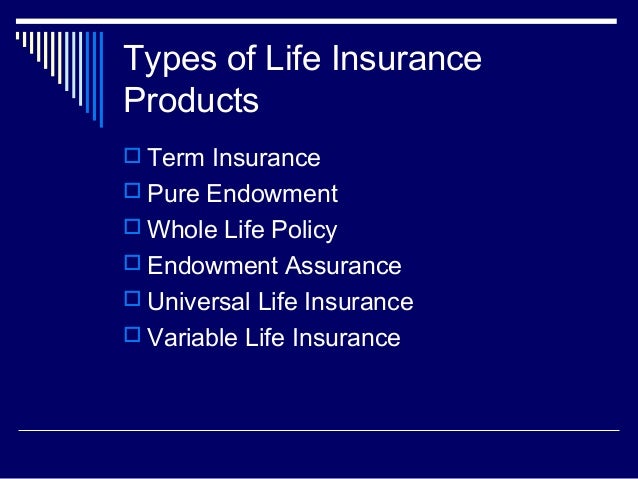

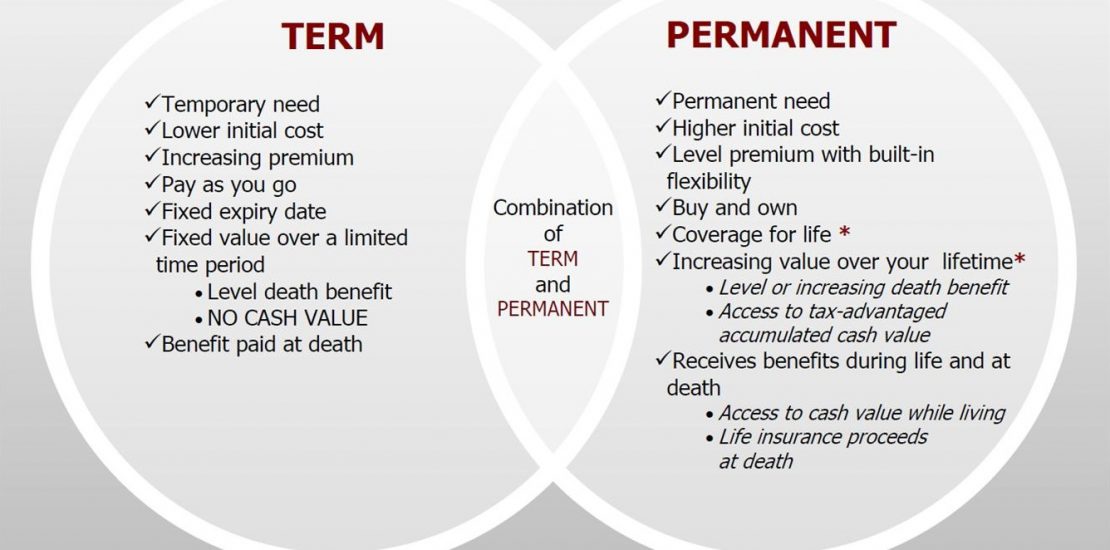

Within both of these main types of life insurance are different types of policies.

The table below outlines various types of policies, including different types within term and permanent life, and what they.

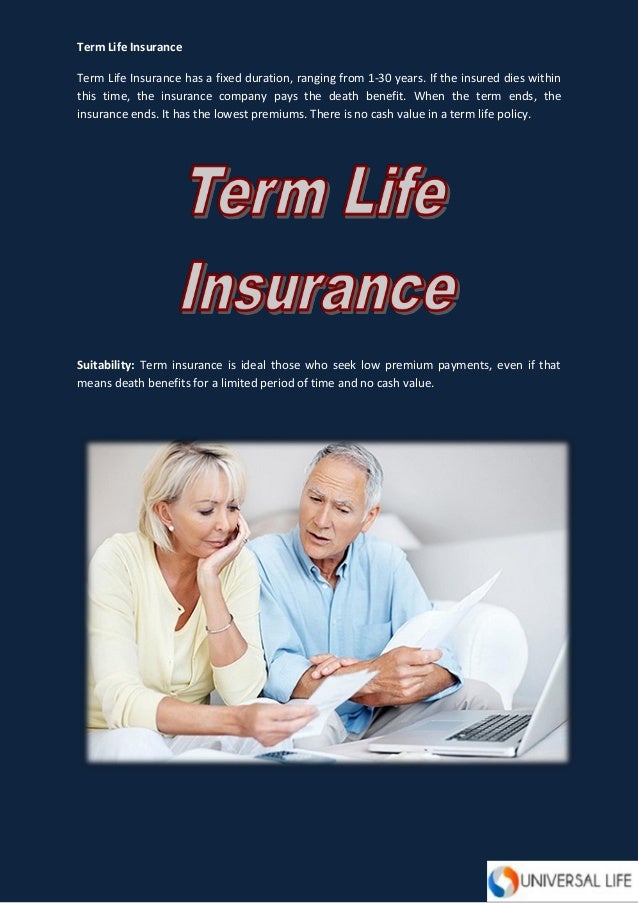

Term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Typically policies will last 10, 15, 20, or 30 years, but there are also other.

Who will benefit from term life?

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Learn about and compare the different types of life insurance policies.

What are the differences between term life & permanent life?

Your premium bought the protection that you had but didn't need, and you've received fair value.

Understanding the types of life insurance policies doesn't have to be complicated.

In a term policy, it's defined as a specific number of years, such as 10, 20, or 30.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance types fall into two main buckets:

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one thing only:

Pays the people you choose—your spouse, children, or other beneficiaries—a fixed amount of money if you die.

There are five types of term life insurance, each following a basic model of coverage for a set period of time.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

Term life insurance is a much more affordable kind of life insurance policy because it operates within a set period of time, only pays out the death benefit and while term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance coverage.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

Life insurance falls into two categories:

Term life policies provide coverage for a specified period, while permanent life insurance offers extended protection.

Term life insurance is a life insurance policy that covers the policyholder for a specific term, or amount of time.

Some types of life insurance policies require a medical examination.

During a medical exam, a medical technician will evaluate the potential policyholder's health, which may.

When it comes to types of life insurance, term may be the most popular but it's not the only option.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Term life insurance policies are the simplest, most popular, and the most often purchased;

.jpg)

Today, there is a wide variety of life insurance policies available, the most basic of which are term and permanent.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type term life can provide the most coverage for the least amount of money.

Understand the different types of life insurance so you can find the right cover today.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Its purpose is to make sure the mortgage is paid up if you were to die while you still owed money.

Term insurance is the cheapest life insurance policy available.

It covers a specific time period, and is usually purchased to cover the financial needs of children and surviving spouse until the children are grown.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

These types of life insurance policies are sold by mortgage lenders and are also referenced to as either mortgage life insurance or mortgage.

Consider term life insurance if you have a temporary need for coverage, a limited budget or a particular business application for it.

Compared to other types of life insurance, term life tends to be the least expensive coverage.

Would you'd like to learn more about this subject?

Have a question or comment?

Types of life insurance policies explained.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.

Ternyata Jangan Sering Mandikan BayiMengusir Komedo Membandel - Bagian 2Ini Manfaat Seledri Bagi KesehatanAwas!! Ini Bahaya Pewarna Kimia Pada MakananTips Jitu Deteksi Madu Palsu (Bagian 2)Saatnya Minum Teh Daun Mint!!Manfaat Kunyah Makanan 33 Kali4 Titik Akupresur Agar Tidurmu NyenyakVitalitas Pria, Cukup Bawang Putih SajaTernyata Madu Atasi InsomniaTerm life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years. Life Insurance Types Term. But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Once the term expires, the policyholder can either renew it for another term, convert the policy to permanent.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

Understanding the types of life insurance policies doesn't have to be complicated.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

Life insurance terminology you should know.

Life insurance is a type of insurance, or risk protection, that provides payment to a designated beneficiary after the policyholder's death.

Learn what the different types of life insurance are so that you can make the best decision when you're ready to buy.

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you.

In exchange for periodic payments, the insurance company provides money to your family (or whomever life insurance helps you provide financial security for your family.

Like other types of insurance, it's meant to minimize a specific risk.

Term life and whole life insurance explained with chart and infographics in pdf.

This is a crucial question when you want to choose the best life insurance products for your needs and budget.

Life insurance is of great importance to individuals.

Life insurance protect us from unforeseen hazards or danger.

Meaning, definition and types of marine insurance.

Life insurance provides for your family or some other named beneficiaries on your death.

Two general types are available:

Provides coverage only during the term of the policy and pays off only on the insured's death.

The most common type of permanent life insurance is whole life insurance.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

We'll explain each of these products soon.

Learn the life insurance definition and learn about other life insurance terminology.

A complete list from a to z. flexible premium policy:

Choosing the right life insurance policy depends on many factors, including the length of the policy, how much you're willing to spend and whether you can access policy money during retirement.

Learn about the different types of life insurance to decide which one meets your needs.

You will find life insurance definitions below that are commonly used in the life insurance industry for all types of insurance.

You will see on your life insurance.

There are several types of life insurance.

The most common are term, whole life and universal life insurance.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

The goal of this post, life insurance types explained is to help you understand your options.

Different permanent life insurance types.

Permanent life insurance, as the name suggests, is expected to last for the life of the insured.

Term insurance is the simplest form of life insurance available in the market.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

21 what is whole life insurance?

Choosing the right type of life insurance policy can be a daunting task without the right guidance.

It is always best to team up with an independent insurance agent to help you determine which life insurance policy best fits your situation.

So there are two types of insurance which speak:

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

Explaining the types of life insurance.

They both come in a variety of flavors, and if types of life insurance explained.

Despite all the different kinds of policies you can find, your policy will ultimately come from one of two families of coverage.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Life insurance & assurance | meaning, types, benefits and importance.

What is life insurance and how does it work?

In this article, we will explain life insurance meaning and importance.

Life insurance is a unique product that can fulfill a variety of needs.

Life insurance pays a cash, lump sum death benefit, upon the death of the insured.

Life insurance is a unique product that can fulfill a variety of needs. Life Insurance Types Term. Life insurance pays a cash, lump sum death benefit, upon the death of the insured.Petis, Awalnya Adalah Upeti Untuk Raja3 Jenis Daging Bahan Bakso TerbaikResep Segar Nikmat Bihun Tom YamResep Beef Teriyaki Ala CeritaKulinerNikmat Kulit Ayam, Bikin SengsaraTernyata Bayam Adalah Sahabat Wanita7 Makanan Pembangkit LibidoKhao Neeo, Ketan Mangga Ala ThailandCegah Alot, Ini Cara Benar Olah Cumi-CumiBuat Sendiri Minuman Detoxmu!!

Comments

Post a Comment