Life Insurance Types Term A Whole Life Policy Is A Form Of Permanent Life Insurance.

Life Insurance Types Term. That's Because It's Insurance That Does One Thing And One Thing Only:

SELAMAT MEMBACA!

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

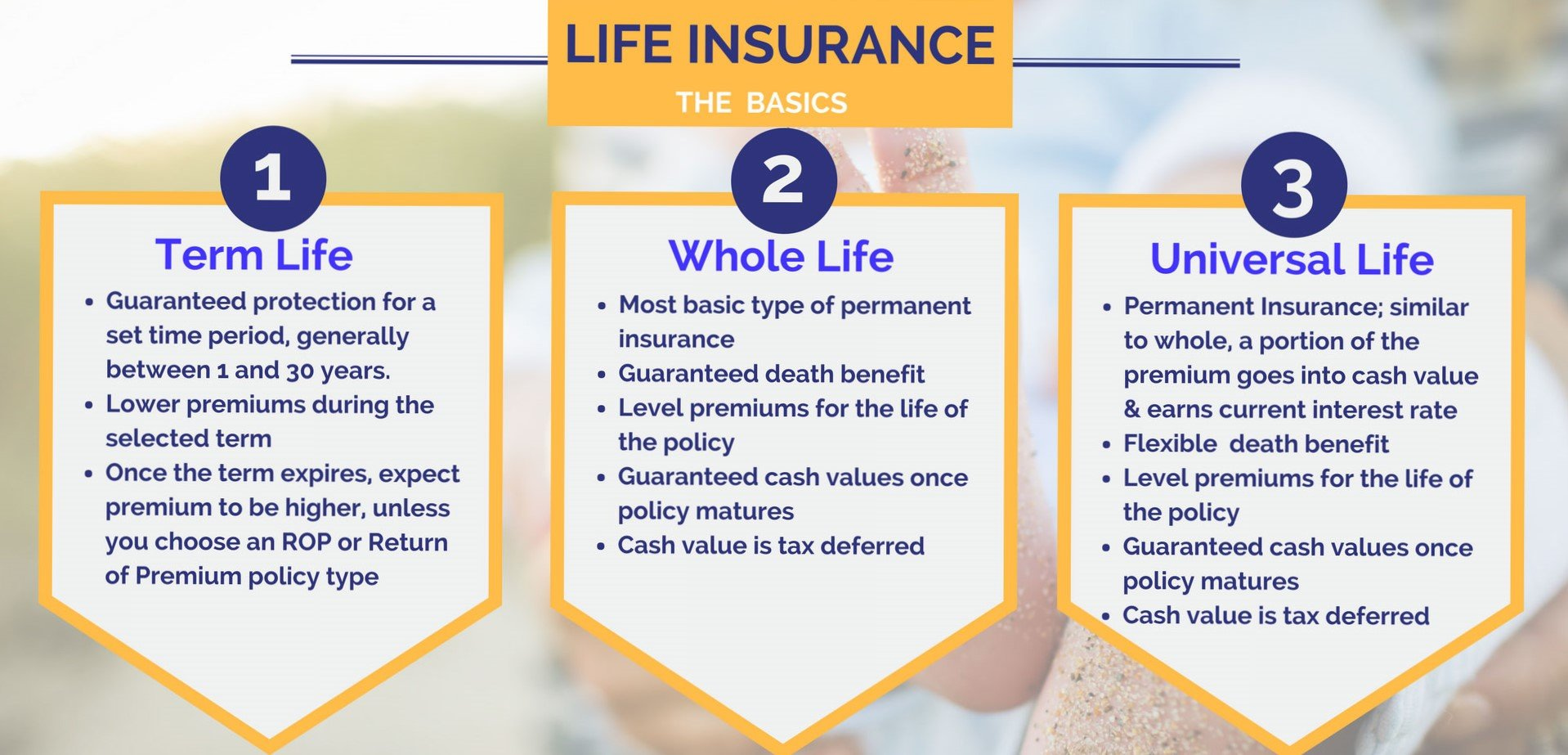

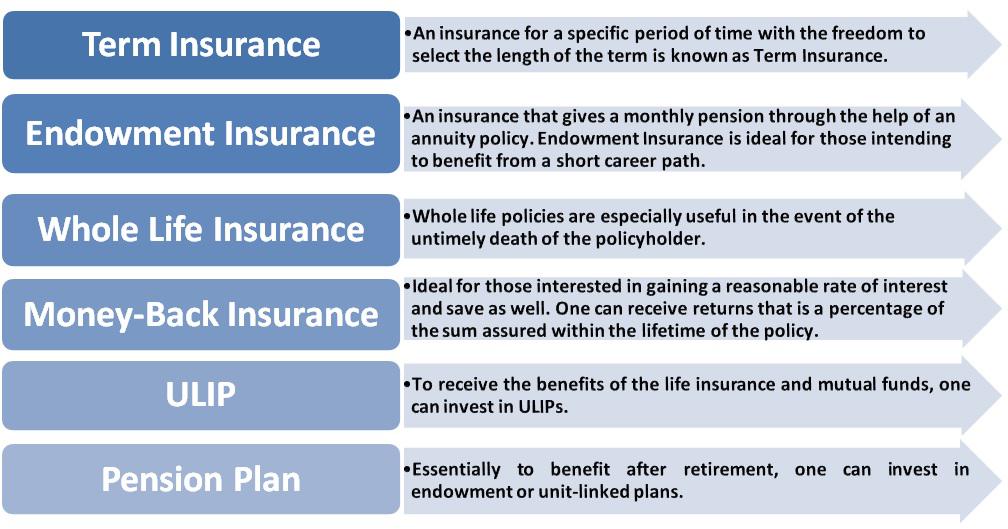

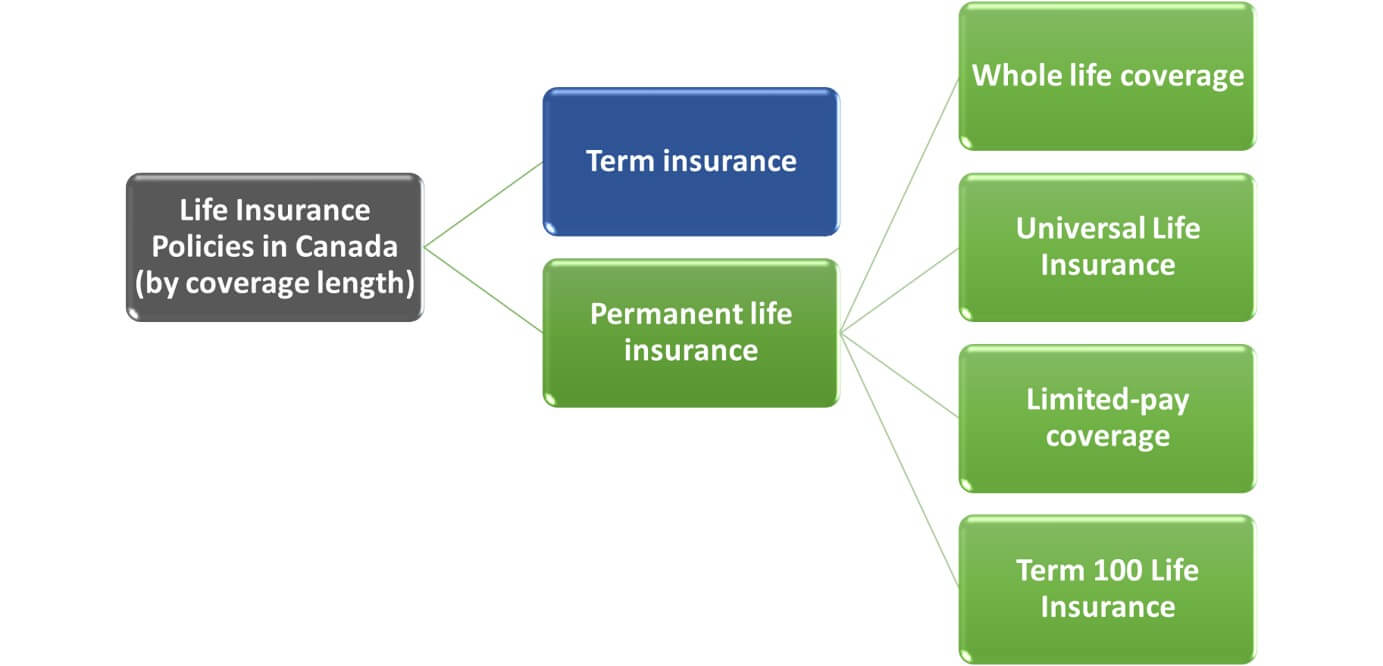

Within both of these main types of life insurance are different types of policies.

The table below outlines various types of policies, including different types within term and permanent life, and what they.

Term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Typically policies will last 10, 15, 20, or 30 years, but there are also other.

Who will benefit from term life?

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Learn about and compare the different types of life insurance policies.

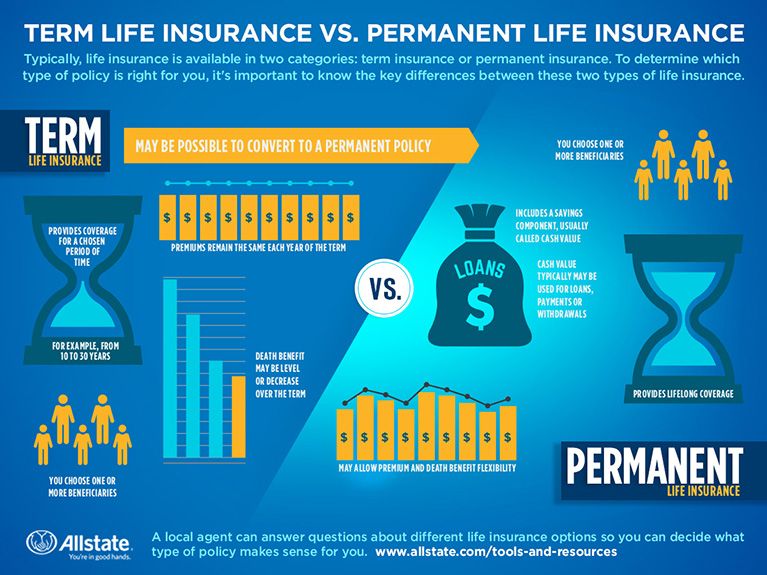

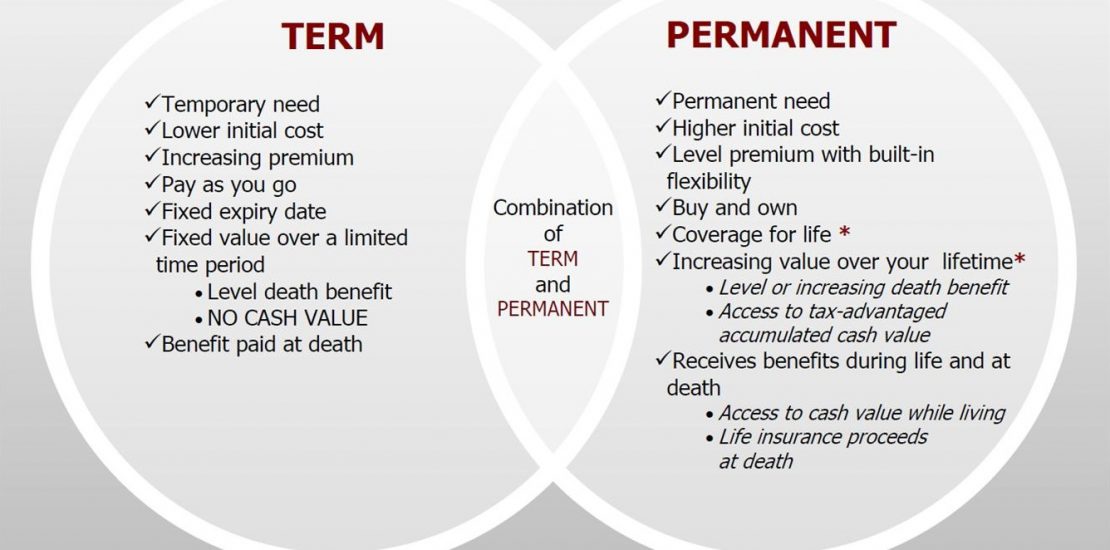

What are the differences between term life & permanent life?

Your premium bought the protection that you had but didn't need, and you've received fair value.

Understanding the types of life insurance policies doesn't have to be complicated.

In a term policy, it's defined as a specific number of years, such as 10, 20, or 30.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

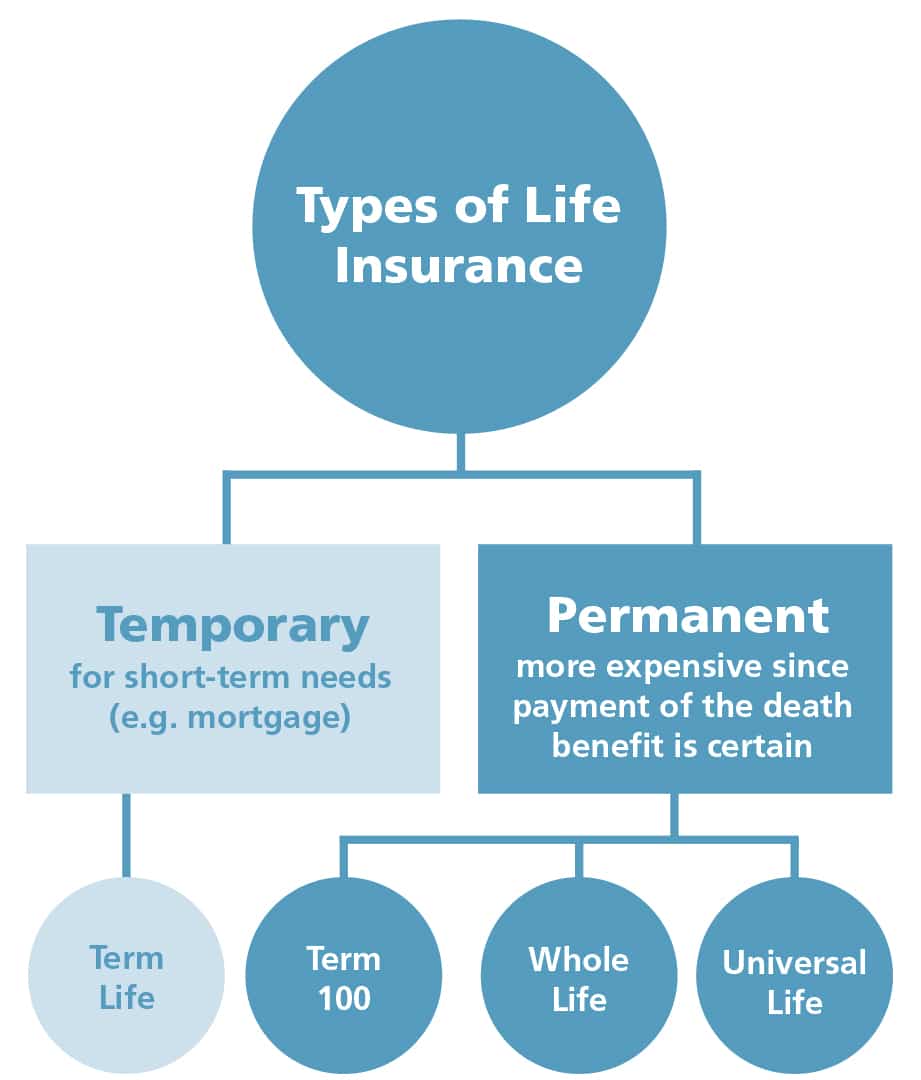

Life insurance types fall into two main buckets:

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one thing only:

Pays the people you choose—your spouse, children, or other beneficiaries—a fixed amount of money if you die.

There are five types of term life insurance, each following a basic model of coverage for a set period of time.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

Term life insurance is a much more affordable kind of life insurance policy because it operates within a set period of time, only pays out the death benefit and while term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance coverage.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

Life insurance falls into two categories:

Term life policies provide coverage for a specified period, while permanent life insurance offers extended protection.

Term life insurance is a life insurance policy that covers the policyholder for a specific term, or amount of time.

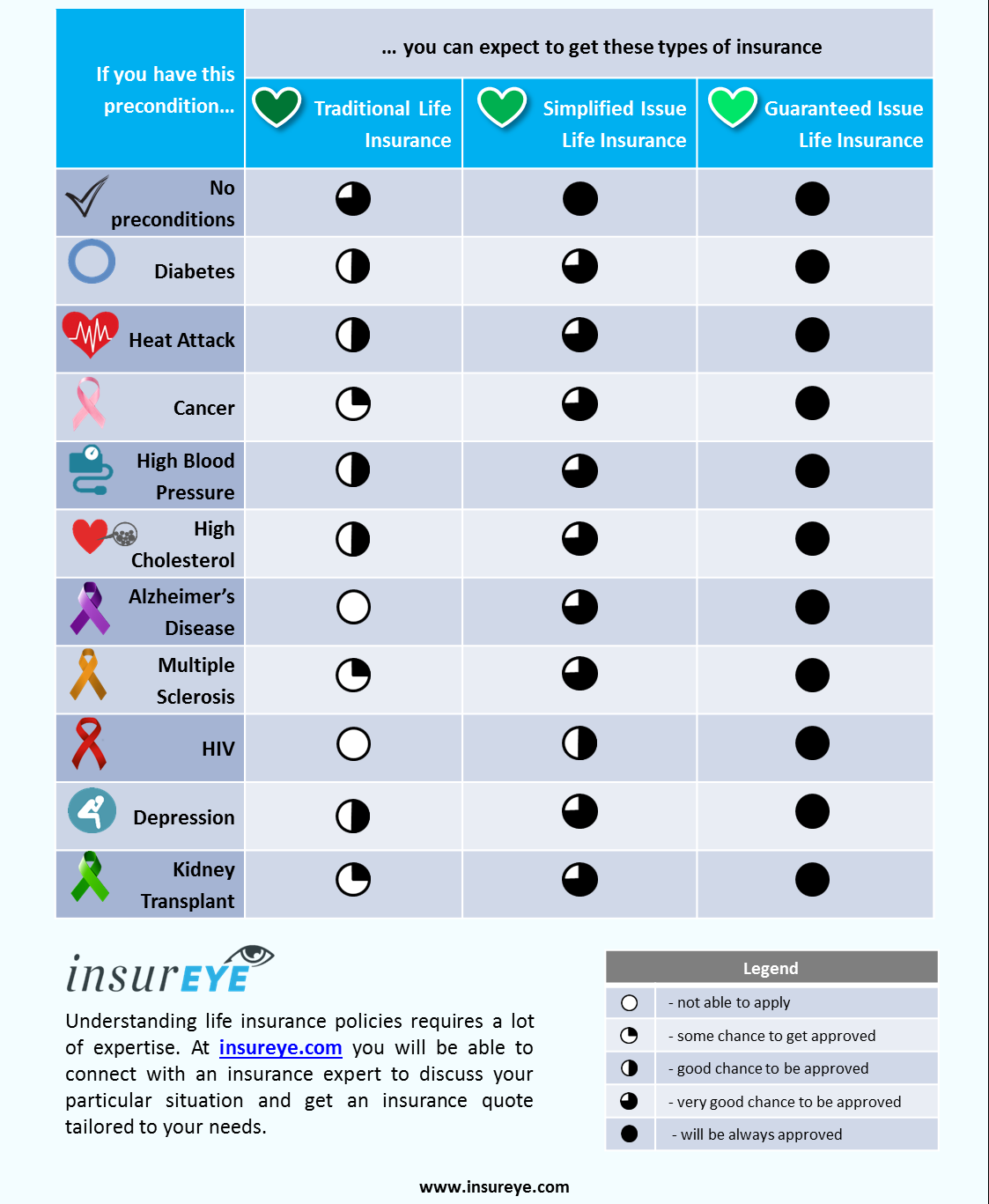

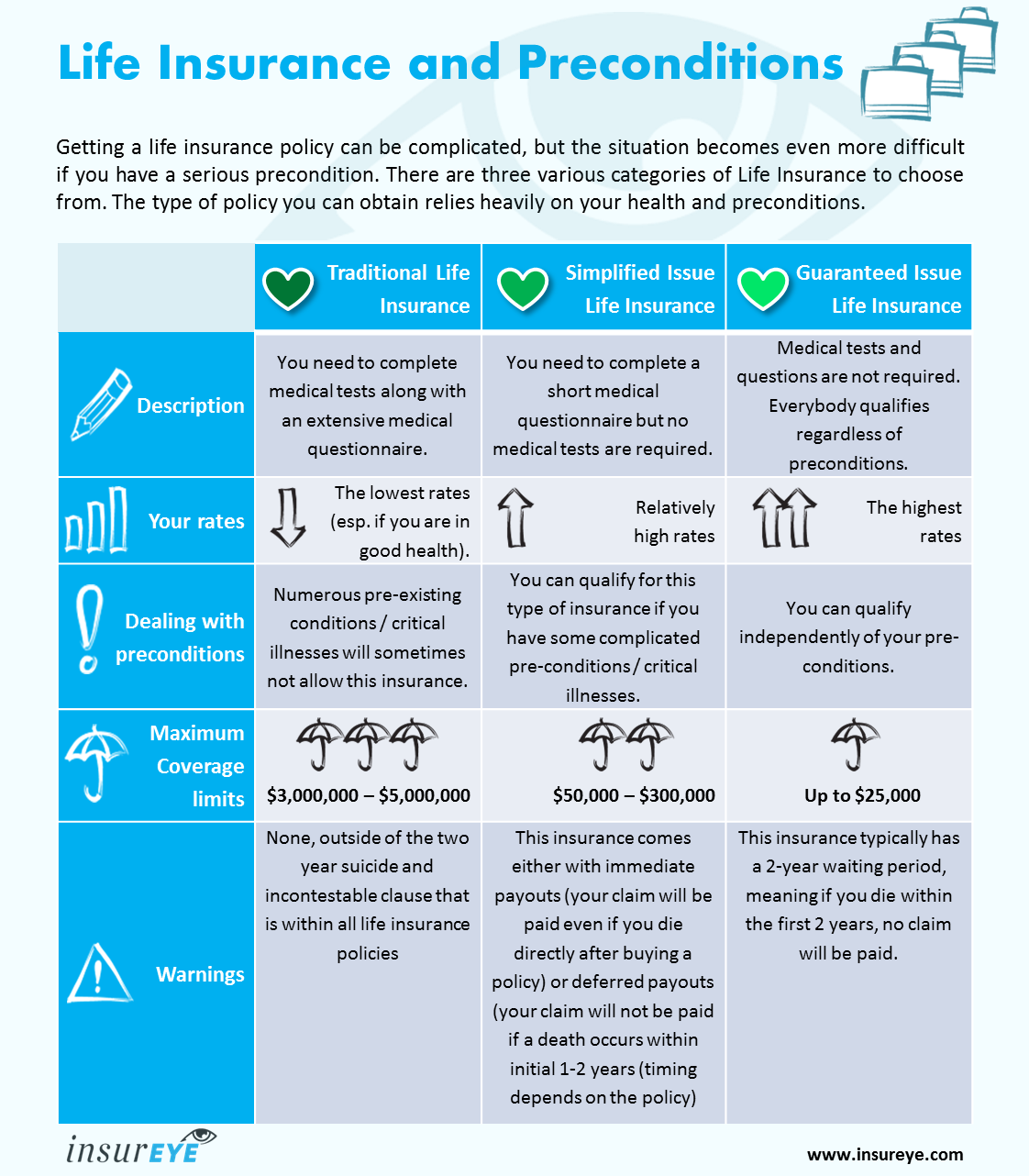

Some types of life insurance policies require a medical examination.

During a medical exam, a medical technician will evaluate the potential policyholder's health, which may.

When it comes to types of life insurance, term may be the most popular but it's not the only option.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Term life insurance policies are the simplest, most popular, and the most often purchased;

Today, there is a wide variety of life insurance policies available, the most basic of which are term and permanent.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type term life can provide the most coverage for the least amount of money.

Understand the different types of life insurance so you can find the right cover today.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Its purpose is to make sure the mortgage is paid up if you were to die while you still owed money.

.jpg)

Term insurance is the cheapest life insurance policy available.

It covers a specific time period, and is usually purchased to cover the financial needs of children and surviving spouse until the children are grown.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

These types of life insurance policies are sold by mortgage lenders and are also referenced to as either mortgage life insurance or mortgage.

Consider term life insurance if you have a temporary need for coverage, a limited budget or a particular business application for it.

Compared to other types of life insurance, term life tends to be the least expensive coverage.

Would you'd like to learn more about this subject?

Have a question or comment?

Types of life insurance policies explained.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.

Tips Jitu Deteksi Madu Palsu (Bagian 1)Ternyata Menikmati Alam Bebas Ada Manfaatnya3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTernyata Jangan Sering Mandikan Bayi5 Khasiat Buah Tin, Sudah Teruji Klinis!!Mana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Ternyata Tertawa Itu DukaMulti Guna Air Kelapa HijauIni Cara Benar Cegah HipersomniaMengusir Komedo MembandelTerm life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years. Life Insurance Types Term. But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.

Term life insurance is easier to understand and costs much less than whole life insurance, but it has an end date.

(decide which is right for you).

We'll provide an overview of these two popular types of life insurance so you can get an idea of what might be a good fit for you.

Find out more by contacting an insurance agent.

For one, it never expires as long as you keep making your premium payments.

Term life insurance is a type of life insurance that guarantees payment of a death benefit during a specified time period.

Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed whole life insurance costs more because it's designed to build cash value, which cost comparison:

Types of term life insurance include annual renewable and guaranteed level.

Whole life insurances are of different types:

If you need insurance for a term of less than 10 years, term life.

This difference in number of policies vs.

Total face amount stems in part from the fact that term life insurance tends to be less expensive than.

Term life insurance can be a great way to protect yourself.

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between 10 and 30 the biggest difference between the two types of policies is that while both pay a death benefit to your beneficiaries, whole life also provides.

Confused between term and whole life insurance?

Similar to whole life, except with two lives insured.

Which is best for you?

Things get complicated when you add in all the types of each category of life insurance.

Term and whole life insurance are the two most commonly purchased types of life insurance policies.

Term vs whole life insurance.

Term life insurance and whole life insurance policies differ in length of protection and cash benefits.

How do you know which is best for you?

Unlike term life policies, whole life insurance policies (also known as permanent life insurance) offer coverage for your entire life.

Even still, many times consumers are faced with a choice of term vs.

Term life insurance or whole life insurance:

What's the difference, which is best?

See the pros and cons of each, and find the best option for your family.

Whole life insurance policies consist of a death benefit — the amount the policyholder wants paid out to their beneficiaries upon their death — and a cash value component.

Part of each monthly or annual premium goes to the insurance company and part of it goes toward the cash value, which earns a.

The key difference between whole life insurance and term life insurance is, as the names may suggest, the duration the insurance lasts for.

Both feature a number of benefits, but it can be confusing.

It's important to note that loans accrue interest and can reduce the death benefit if they remain outstanding at the time of the insured's death.

Term life insurance premiums, which is what insurance companies call your monthly payments, are much cheaper than premiums for whole life insurance.

They're essentially variations of whole life insurance.

All three listed below include.

If you or your spouse passes away during this time, your beneficiaries typically this works out to be $7 per month in 20 yr term, vs $100 with whole life cash value.

Term insurance is sometimes referred to as pure life insurance because its sole purpose is to provide financial protection for your dependents in the event of your death.

Unlike whole/universal life insurance, a term policy has no value other than the death benefit.

One of the biggest benefits of.

It does not matter if you live for another 10 years or 90 years.

Find out which type is right for you.

This type of policy only pays your beneficiaries if your death occurs within the period of time.

Most whole life policies require you to pay below are monthly cost comparisons between term life vs.

Whole life insurance for a $500,000 policy.

Because there's no direct comparison, we.

These plans have pricier premiums, but they squirrel away savings that can help grow the benefit for those.

How is term life insurance different from whole life?

Term life insurance covers you for a specified length of time.

You can choose the term and how much coverage you want to buy.

Term and whole life insurance differ in costs, duration of coverage, and the inclusion of a cash value component for whole life.

Whole life is a type of permanent insurance policy, meaning that coverage extends for your entire lifetime so long as you continue to pay the premiums.

Whole life insurance provides coverage for the entire life of the person insured, as long as premiums are paid.

Whether you prefer term or whole life insurance will depend on many factors.

Find out how these types of life insurance differ and what each option term life insurance is insurance that covers a person, often the head of a household, for a specified period.

Not all life insurance policies work in the same way.

In fact, there are many differences between the different types of life insurance plans.

In fact, there are many differences between the different types of life insurance plans. Life Insurance Types Term. One of the most common questions we answer at intelliquote® is about the differences between term life insurance.Susu Penyebab Jerawat???Trik Menghilangkan Duri Ikan Bandeng5 Cara Tepat Simpan Telur3 Cara Pengawetan Cabai5 Makanan Pencegah Gangguan PendengaranResep Selai Nanas HomemadeResep Beef Teriyaki Ala CeritaKulinerResep Ayam Suwir Pedas Ala CeritaKulinerResep Ramuan Kunyit Lada Hitam Libas Asam Urat & Radang3 Jenis Daging Bahan Bakso Terbaik

Comments

Post a Comment