Life Insurance Types Wikipedia What's The Purpose Of A Life Insurance Policy If You Are Not Around To Enjoy Its Benefits?.

Life Insurance Types Wikipedia. When Deciding Between Term And Permanent Life Insurance, Which Includes Whole, Universal And Variable Universal Coverage, Consider The Option That.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

This guide will help you understand each.

No matter which type of life insurance you choose, it is very important to understand the specific rules and terms of each type of insurance and.

Understanding the types of life insurance policies doesn't have to be complicated.

Find out what's right for you.

There are many types of life insurance policies that can help protect your family, and they all fall into two main.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upon the death of an for faster navigation, this iframe is preloading the wikiwand page for life insurance.

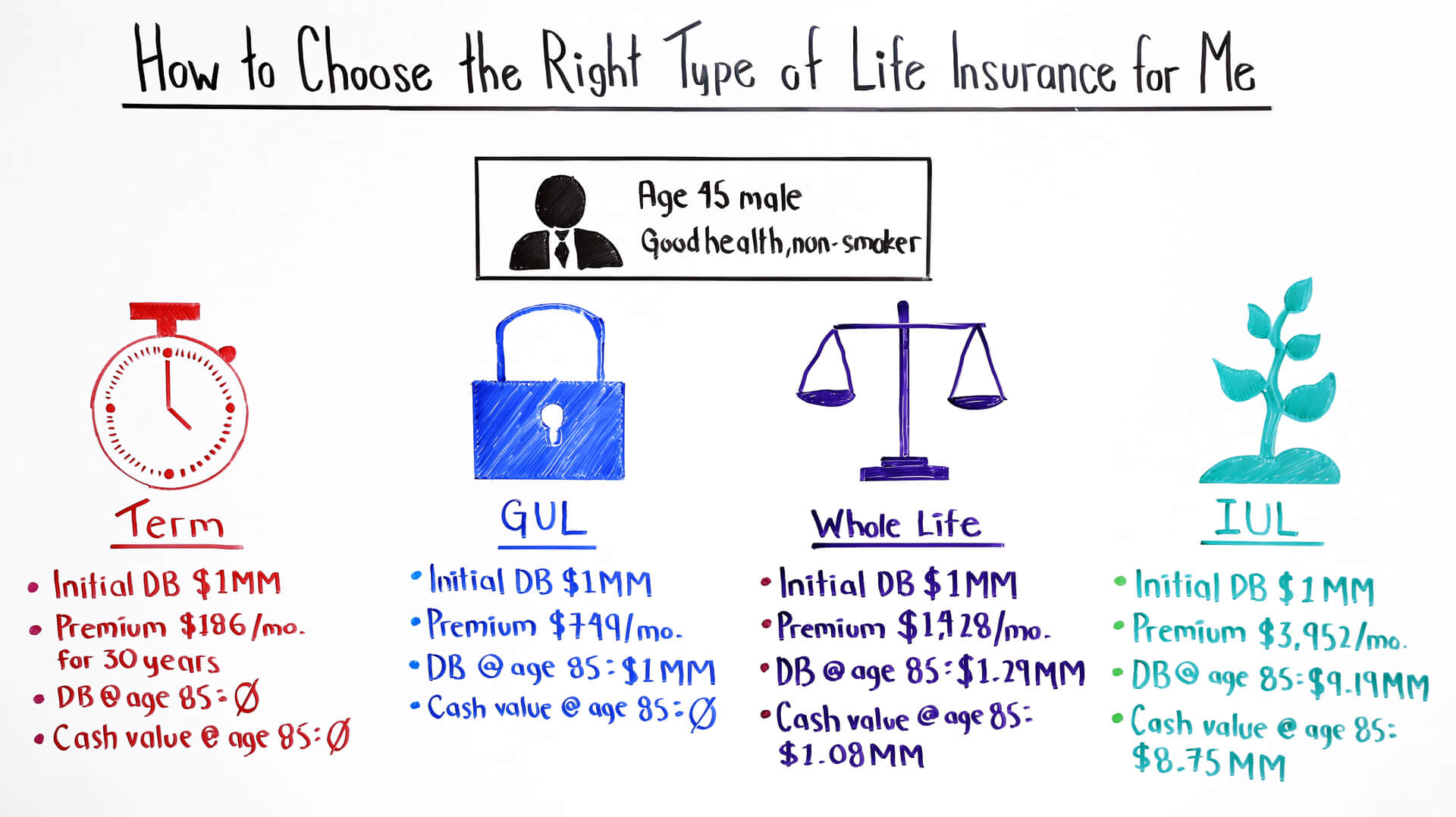

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Understanding the different types of life policies.

Answering those questions can help you understand which type of life insurance would work for your situation.

Universal life—a type of permanent life insurance with a cash value component that earns interest, universal life insurance has premiums that are.

Insurance companies and the types of services they offer.

An insurance company primarily offers insurance services to clients.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

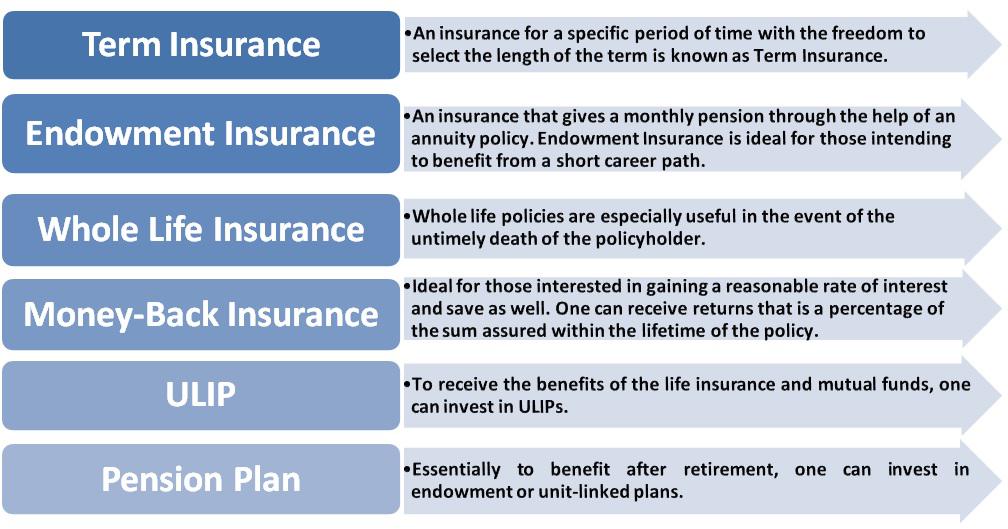

Term insurance is the simplest form of life insurance available in the market.

Make sense of all the types of life insurance available and find out what's right for you and your family.

The most common type of permanent life insurance is whole life insurance.

Term life and whole life insurance explained with chart and infographics in pdf.

The company has to provide your family or other beneficiaries with a certain amount of money in case of your death.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

Permanent life insurance products include whole life, universal life, variable life, and combination life.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

Every type of permanent life insurance last.

Within each are different types of policies.

Choosing the right life insurance policy depends on many factors, including the length of the policy, how much you're willing to spend and whether you can access policy money.

What's the purpose of a life insurance policy if you are not around to enjoy its benefits?.

A life insurance policy isn't for you;

It is for the loved ones you leave behind.

Understand the different types of life insurance so you can find the right cover today.

If you are baffled trying to comprehend the various types of life insurance policies that are available, you are certainly not alone!

These are special types of life insurance policies which help parents build a corpus to fund their child's higher education or marriage.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance types fall into two main buckets:

Term life insurance and permanent life insurance (also referred to as whole.

The most common are term, whole life and universal life insurance.

We can help you choose.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose.

Learn the differences of life insurance from protective life!

In contrast, permanent life insurance policies don't have a set expiration date.

These policies are designed to last your entire life, provided you keep making your.

We explain the difference between term & permanent.

Compare your life insurance type understanding the different types of life insurance policies is an intimidating task, that's what you may think.

But, once you know that there are only two.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance policy that helps them financially.

10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)5 Khasiat Buah Tin, Sudah Teruji Klinis!!3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTernyata Einstein Sering Lupa Kunci Motor7 Makanan Sebabkan SembelitObat Hebat, Si Sisik NagaTips Jitu Deteksi Madu Palsu (Bagian 2)Awas!! Ini Bahaya Pewarna Kimia Pada Makanan4 Manfaat Minum Jus Tomat Sebelum TidurManfaat Kunyah Makanan 33 KaliTypes of life insurance policies explained. Life Insurance Types Wikipedia. Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance policy that helps them financially.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

This guide will help you understand each.

No matter which type of life insurance you choose, it is very important to understand the specific rules and terms of each type of insurance and.

Understanding the types of life insurance policies doesn't have to be complicated.

Find out what's right for you.

There are many types of life insurance policies that can help protect your family, and they all fall into two main.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upon the death of an for faster navigation, this iframe is preloading the wikiwand page for life insurance.

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Understanding the different types of life policies.

Answering those questions can help you understand which type of life insurance would work for your situation.

Universal life—a type of permanent life insurance with a cash value component that earns interest, universal life insurance has premiums that are.

Insurance companies and the types of services they offer.

An insurance company primarily offers insurance services to clients.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Term insurance is the simplest form of life insurance available in the market.

Make sense of all the types of life insurance available and find out what's right for you and your family.

The most common type of permanent life insurance is whole life insurance.

Term life and whole life insurance explained with chart and infographics in pdf.

The company has to provide your family or other beneficiaries with a certain amount of money in case of your death.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

Permanent life insurance products include whole life, universal life, variable life, and combination life.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

Every type of permanent life insurance last.

Within each are different types of policies.

Choosing the right life insurance policy depends on many factors, including the length of the policy, how much you're willing to spend and whether you can access policy money.

What's the purpose of a life insurance policy if you are not around to enjoy its benefits?.

A life insurance policy isn't for you;

It is for the loved ones you leave behind.

Understand the different types of life insurance so you can find the right cover today.

If you are baffled trying to comprehend the various types of life insurance policies that are available, you are certainly not alone!

These are special types of life insurance policies which help parents build a corpus to fund their child's higher education or marriage.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance types fall into two main buckets:

Term life insurance and permanent life insurance (also referred to as whole.

The most common are term, whole life and universal life insurance.

We can help you choose.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose.

Learn the differences of life insurance from protective life!

In contrast, permanent life insurance policies don't have a set expiration date.

These policies are designed to last your entire life, provided you keep making your.

We explain the difference between term & permanent.

Compare your life insurance type understanding the different types of life insurance policies is an intimidating task, that's what you may think.

But, once you know that there are only two.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance policy that helps them financially.

Types of life insurance policies explained. Life Insurance Types Wikipedia. Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance policy that helps them financially.Stop Merendam Teh Celup Terlalu Lama!Segarnya Carica, Buah Dataran Tinggi Penuh KhasiatKhao Neeo, Ketan Mangga Ala ThailandTernyata Asal Mula Soto Bukan Menggunakan DagingAmpas Kopi Jangan Buang! Ini ManfaatnyaIni Beda Asinan Betawi & Asinan BogorFoto Di Rumah Makan PadangPete, Obat Alternatif DiabetesResep Ponzu, Cocolan Ala JepangSejarah Kedelai Menjadi Tahu

Comments

Post a Comment