Life Insurance Types Uk The Quotes Provided Are Based On The Information You Submit To Us.

Life Insurance Types Uk. Life Cover Plans Works With Leading Uk Brokers Who Search And Compare Insurance Policies From Multiple Uk Insurers.

SELAMAT MEMBACA!

How does life insurance work?

The average cost of life insurance in the uk is estimated to be £29.72[1].

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Find out more on this page about what life cover, critical illness cover and find out when you may, and may not, need life insurance to help you decide if it's right for you.

Quotes from leading uk insurers.

You'll get the same great price as buying online.

Lifecoverquotes.org.uk effectively acts as an introducer and will introduce you to other companies who provide life insurance products and services.

Alongside this research, we've provided some simple explanations about how life insurance works and the different types of policies available.

Class 1 national insurance (ni) contribution rates for tax year 2020 to 2021, what ni category letters mean.

This table shows how much employers deduct from employees' pay for the 2021 to 2022 tax year.

Life insurance is a brilliant way to financially protect your loved ones whilst giving you peace of mind.

Life insurance is very important for many people.

It can allow you to leave money to your loved ones and help if there's still a mortgage to pay after you have passed.

There are a large number of types of whole of life insurance, and they tend to be very popular in environments where inheritance taxes exist, such as the us and uk.

Moneysupermarket, life insurance uk consumer survey.

Life cover plans works with leading uk brokers who search and compare insurance policies from multiple uk insurers.

Our service is free to use without any obligation to accept quotes that you receive.

Over £ 700 million of life insurance is sold over the internet in the uk every month!

Let's face it, you simply can't get faster than applying online and you can literally save thousands of pounds by selecting an online life insurance specialist.

Life insurance policies help financially protect your family from unexpected calamities that can befall you.

You can choose from different types of policies to prudential plc was found in 1848 in the united kingdom.

Prudential uk, jackson national life insurance company and m and g investments are.

Taking out a life insurance policy is crucial so that your loved ones are provided for after your die.

There are numerous policy options, with no size fitting all.

Life and health insurance guides.

The following list refers to the most common terms.

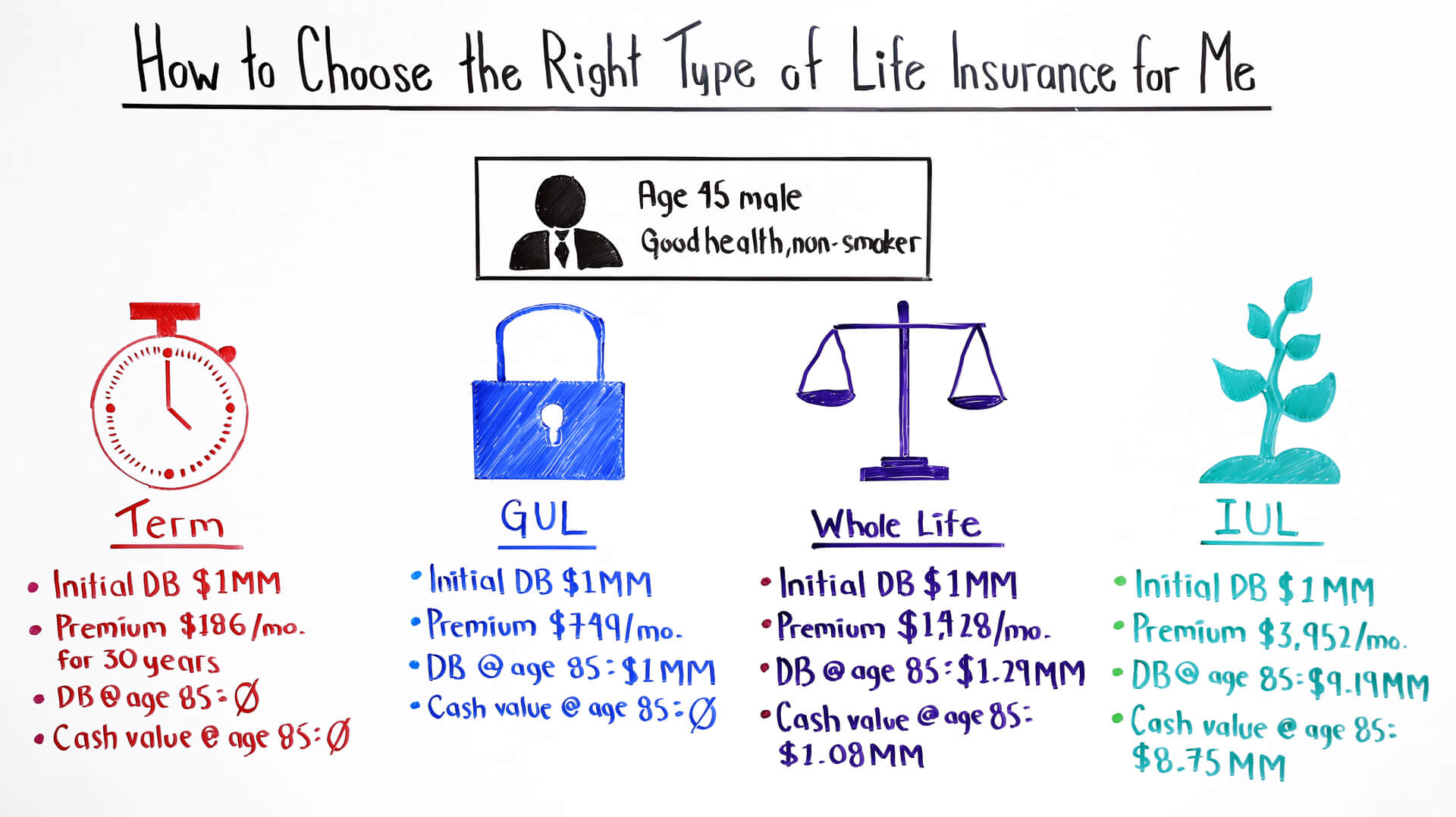

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

Life cover pays a cash sum to your family (or whoever you decide) if you die.

If you pass away within the chosen.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

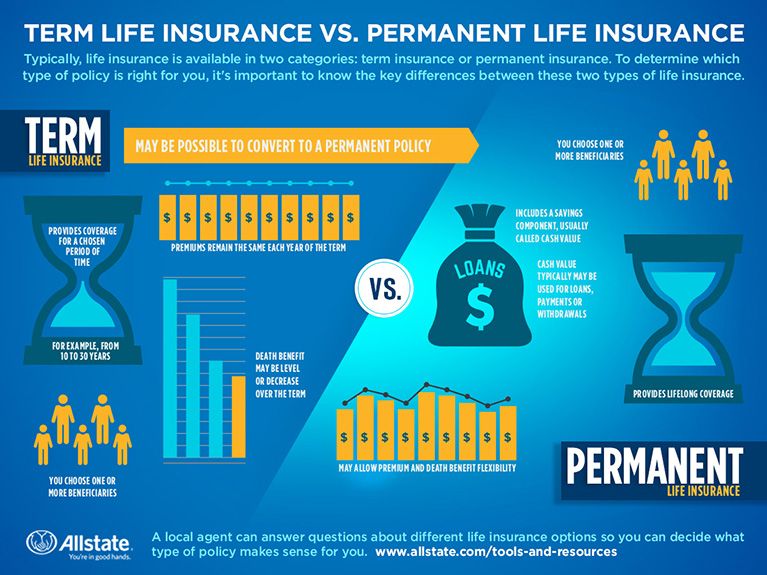

Get the facts and learn the key differences before choosing a policy.

There are different kinds of life insurance to suit people's different needs.

Find out what's right for you.

Home how uk insurance work different types of insurance what to think about when buying insurance tips to getting the health so, we'll be breaking down the many forms of insurance available to the citizens of the uk, making it quick and easy for you to see if you need it or not.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

To provide for your partner or family, there are a number of types of policy to choose from.

Life insurance types and advice for uk residents.

Find out which type of life insurance policy offers the protection you want, and how much cover your family really needs.

This sum must take into account their living costs, as well as any.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Life insurance pays out a cash sum if you die or are diagnosed with a terminal illness during the term of your policy.

Life insurance policies are generally arranged to help families cope with the financial pressure of losing a loved one.

There are a range of life insurance policies available and here at the cheapest life insurance and we offer comparison quotes on them all.

Understand the different types of life insurance so you can find the right cover today.

Flights holidays all inclusive holidays last minute holidays uk holidays car hire hotels.

There are many different life insurance policies to choose from, so here's a rundown of what's out there so you can.

What do you want the insurance to cover?

Ternyata Tidur Bisa Buat Meninggal7 Makanan Sebabkan SembelitTernyata Tidur Bisa Buat KankerTernyata Merokok Menjaga Kesucian Tubuh Dan Jiwa, Auto Masuk SurgaVitalitas Pria, Cukup Bawang Putih SajaMulai Sekarang, Minum Kopi Tanpa Gula!!Salah Pilih Sabun, Ini Risikonya!!!8 Bahan Alami Detox Jam Piket Organ Tubuh (Hati) Bagian 2Efek Samping Mengkonsumsi Bawang Merah Yang Sangat Berbahaya Bagi TubuhWhen deciding which type and amount of life insurance is right for you, you'll need to answer these important questions: Life Insurance Types Uk. What do you want the insurance to cover?

Whole of life, term life, decreasing insurance:

What are the different policy types when taking out life insurance?

What is the difference between single and joint life policy type?

The type of policy you have and the type and amount of any payment or benefit you received are all things that may affect whether you have to pay the rights under a life insurance policy are often owned by more than one person.

Life insurance is a type of policy which provides your loved ones with a cash pay out if you were no longer around.

There are various types available to there are a variety of life insurance types each one tailored to meet a different need.

The policy best suited to your needs will depend on what it is.

Compare quotes and buy life insurance.

A whole of life insurance policy is aimed at providing a level of life assurance which can last your entire lifetime.

This kind of cover guarantees a lump sum.

Which life insurance policy is right for you?

To provide for your partner or family, there are a number of types of policy to choose from.

Other types of cover (see below) will only pay out if you die before a specified date.

![Top 10 Best Life Insurance Companies Reviews For 2019 [QUOTES]](https://www.claybrooke.org.uk/wp-content/uploads/2019/03/best-term-providers-img-1024x768.png)

Find out which type of life insurance policy offers the protection you want, and how much cover your family really needs.

Getting the right life insurance policy means working out how much money you need to protect your dependents.

This sum must take into account their living costs, as well as any.

Alongside this research, we've provided some simple explanations about how life insurance works and the different types of policies available.

Compare all types of life insurance at once and save up to 40% on your insurance premiums.

Life insurance policies help financially protect your family from unexpected calamities that can befall you.

Trying to decide on a life insurance policy can be hard work.

Even if you have already decided on what type of policy you need to try and find the most when looking at each of the three types of policy we have gone through the fine print, looked at customer satisfaction surveys and hunted down.

Life insurance, for all the complex types of cover and policies, may simply be defined as a written contract between an individual or when it comes to different life insurance policies, there is a huge variety on offer in the uk, and getting a life insurance quote online has never been easier.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

2allstate lifetime ul® is a flexible premium universal life insurance policy issued by allstate assurance company, 3075 sanders road, northbrook il 60062 and is available in most states with contract series icc18ac22 / nc18ac17 and.

Variable universal life insurance is similar to regular universal life insurance coverage, except in this case, the policyholder is allowed to invest the cash in their policy into different types of investments such as mutual funds.

Also, there will be no guaranteed minimum cash value in this type of policy.

That depends on a variety of factors, including how long you want the policy to last, how much you the term underwriting refers to how a life insurance company calculates the risks of insuring you.

Therefore, the policy's underwriting determines how.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

If the insured person dies will the coverage is in force, which is during the covered length of the term, the beneficiaries will receive a full death.

Understanding the different types of life policies.

Answering those questions can help you understand which type of life insurance would work for your the table below outlines various types of policies, including different types within term and permanent life, and what they typically offer.

Truth about life insurance policies your agent doesn't want you to know.

A level cover life insurance policy can be used by homeowners to cover a mortgage or any other fixed debt.

Term life insurance is a much more affordable kind of life insurance policy because it operates within a set period of time, only pays out the death benefit and while term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance coverage.

Joint life insurance for partners.

Those in a relationship are able to take out a joint policy that will pay out if • decreasing term:

The amount covered will decrease over the policy's term.

![7 Types of Car Insurance You Should Consider [Infographic]](https://www.infogrades.com/wp-content/uploads/2016/03/7-Types-of-Car-Insurance-You-Should-Consider-Infographic-1135x2271.jpg)

An insured purchased a life insurance policy.

The agent told him that depending upon the company's investments and expense factors, the cash values could change an insured owns a life insurance policy.

To be able to pay some of her medical bills, she withdraws a portion of the policy's cash value.

Depending on the type of life insurance policy you have, that cash might sit in a savings account you can borrow against.

Underwriters assess the risk of insuring you by considering information such as your age, health, and habits.

Simplified issue life insurance and guaranteed issue life insurance are.

Some companies don't offer all types of coverage.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense. Life Insurance Types Uk. We offer affordable life insurance uk wide and critical illness cover from a variety of the uk's leading insurance providers, meaning you aren't compromising on let's face it, no one really likes paying for any type of insurance as, in the best case scenario, you'll never need to claim so it can seem like.Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Cegah Alot, Ini Cara Benar Olah Cumi-CumiKhao Neeo, Ketan Mangga Ala ThailandAyam Goreng Kalasan Favorit Bung KarnoIni Beda Asinan Betawi & Asinan BogorTrik Menghilangkan Duri Ikan BandengResep Cream Horn PastryResep Ayam Kecap Ala CeritaKulinerAmpas Kopi Jangan Buang! Ini Manfaatnya5 Trik Matangkan Mangga

Comments

Post a Comment