Life Insurance Types Term Life Insurance Types Fall Into Two Main Buckets:

Life Insurance Types Term. Thanks For Reading Our Article, Life Insurance Types Explained.

SELAMAT MEMBACA!

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one thing only:

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Typically policies will last 10, 15.

There are several different types of term life insurance;

The best option will depend on your individual circumstances. 1.

Understanding the types of life insurance policies doesn't have to be complicated.

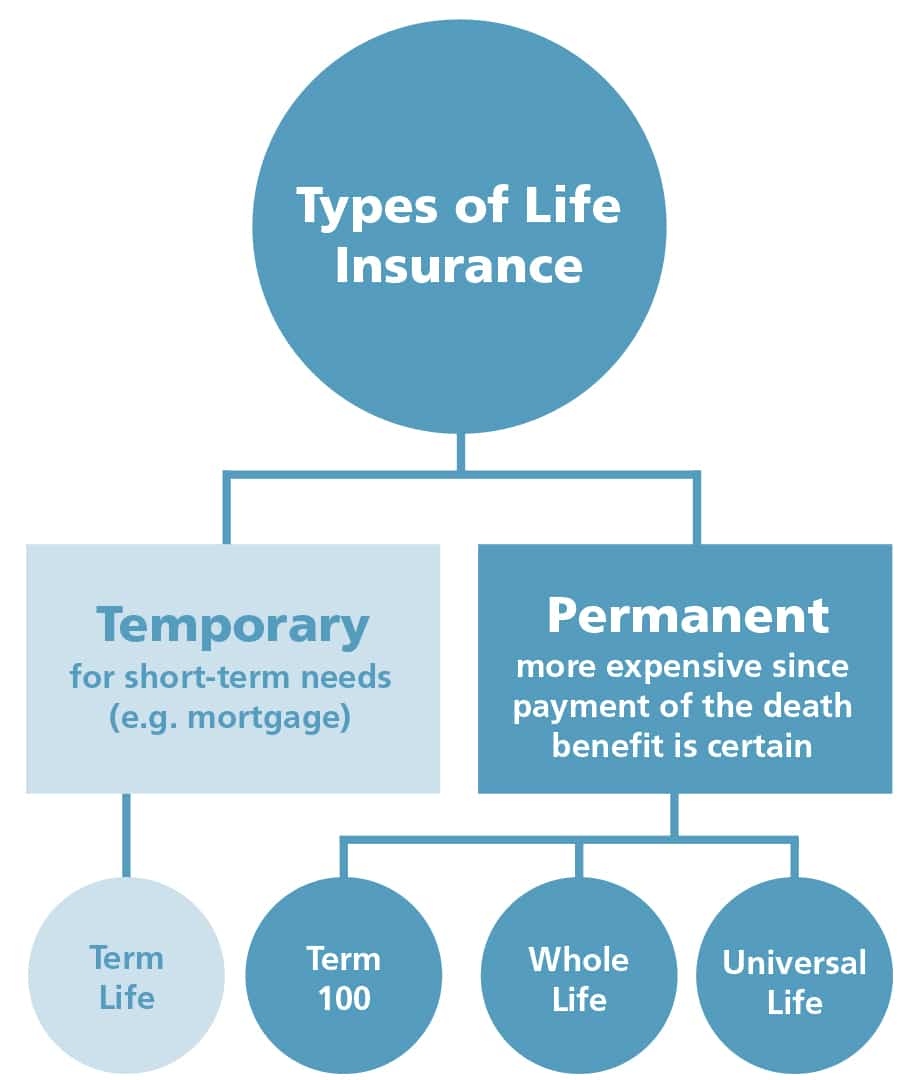

A permanent policy lasts for the life of the insured, for whole life as long as premiums are paid, and for universal life as long as the policy is.

In most types of term insurance, including homeowners and auto insurance, if you haven't had a claim under the policy by the time it expires, you get no refund of the premium.

Your premium bought the protection that you had but didn't need, and you've received fair value.

The table below outlines various types of policies, including different types within term and permanent life, and what they.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Term life insurance and permanent life insurance (also referred to as whole.

Term life insurance actually gets the name from the fact that it is life insurance purchased to cover you for a specified period or term.

Those other types are decreasing term and yearly (or annually) renewable term insurance.

The most common type of term life insurance, guaranteed level premiums and death benefits are set for the specified term.

Term life insurance offers protection for beneficiaries for a certain time period —comonly from 1 to 20 years.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance term life insurance is a life cover policy that runs for a specified amount of time, or 'term'.

Learn about and compare the different types of life insurance policies.

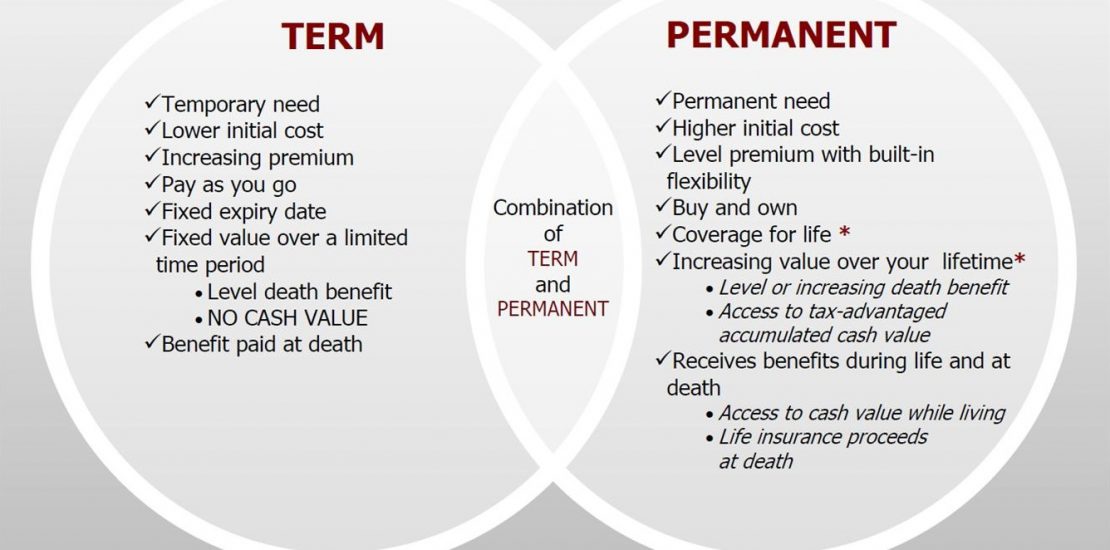

What are the differences between term life & permanent life?

Coverage for a specific period of time, like until you reach retirement or your children are grown.

Some types of life insurance policies require a medical examination.

During a medical exam, a medical technician will evaluate the potential policyholder's health, which may.

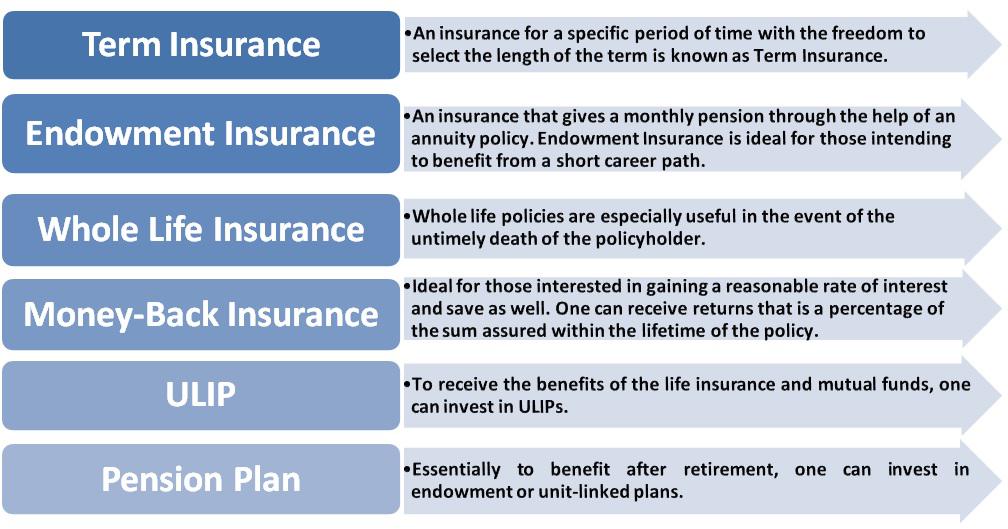

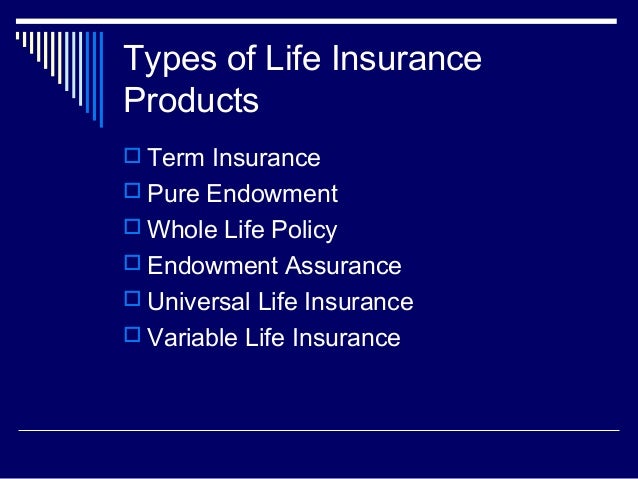

The different types of life insurance are:

These types of life insurance policies are sold by mortgage lenders and are also referenced to as either mortgage life insurance or mortgage.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

Term insurance is the cheapest life insurance policy available.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

Thanks for reading our article, life insurance types explained.

Would you'd like to learn more about this subject?

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

Every type of permanent life insurance last.

A pure protection plan, a term insurance offers a large coverage at an affordable premium.

Understand the different types of life insurance so you can find the right cover today.

Term insurance is a popular type of life insurance that is bought for a fixed period of time that may range between 5 to 30 years.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

Khasiat Luar Biasa Bawang Putih PanggangGawat! Minum Air Dingin Picu Kanker!Ternyata Tertawa Itu DukaJam Piket Organ Tubuh (Lambung)4 Manfaat Minum Jus Tomat Sebelum Tidur5 Manfaat Meredam Kaki Di Air Es6 Khasiat Cengkih, Yang Terakhir Bikin HebohAwas!! Ini Bahaya Pewarna Kimia Pada MakananJam Piket Organ Tubuh (Limpa)Resep Alami Lawan Demam AnakSo, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense. Life Insurance Types Term. Different types of life insurance policies in india term insurance is a life insurance product offered by an insurance company which offers financial coverage to the policy holder for a specific time period.

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one thing only:

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Typically policies will last 10, 15.

There are several different types of term life insurance;

The best option will depend on your individual circumstances. 1.

Understanding the types of life insurance policies doesn't have to be complicated.

A permanent policy lasts for the life of the insured, for whole life as long as premiums are paid, and for universal life as long as the policy is.

In most types of term insurance, including homeowners and auto insurance, if you haven't had a claim under the policy by the time it expires, you get no refund of the premium.

Your premium bought the protection that you had but didn't need, and you've received fair value.

The table below outlines various types of policies, including different types within term and permanent life, and what they.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Term life insurance and permanent life insurance (also referred to as whole.

Term life insurance actually gets the name from the fact that it is life insurance purchased to cover you for a specified period or term.

Those other types are decreasing term and yearly (or annually) renewable term insurance.

The most common type of term life insurance, guaranteed level premiums and death benefits are set for the specified term.

Term life insurance offers protection for beneficiaries for a certain time period —comonly from 1 to 20 years.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance term life insurance is a life cover policy that runs for a specified amount of time, or 'term'.

Learn about and compare the different types of life insurance policies.

What are the differences between term life & permanent life?

Coverage for a specific period of time, like until you reach retirement or your children are grown.

Some types of life insurance policies require a medical examination.

During a medical exam, a medical technician will evaluate the potential policyholder's health, which may.

The different types of life insurance are:

These types of life insurance policies are sold by mortgage lenders and are also referenced to as either mortgage life insurance or mortgage.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

Term insurance is the cheapest life insurance policy available.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

Thanks for reading our article, life insurance types explained.

Would you'd like to learn more about this subject?

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

Every type of permanent life insurance last.

A pure protection plan, a term insurance offers a large coverage at an affordable premium.

Understand the different types of life insurance so you can find the right cover today.

Term insurance is a popular type of life insurance that is bought for a fixed period of time that may range between 5 to 30 years.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense. Life Insurance Types Term. Different types of life insurance policies in india term insurance is a life insurance product offered by an insurance company which offers financial coverage to the policy holder for a specific time period.Trik Menghilangkan Duri Ikan BandengTernyata Kamu Baru Tau Ikan Salmon Dan Tenggiri SamaFoto Di Rumah Makan PadangKuliner Jangkrik Viral Di JepangResep Cream Horn Pastry3 Jenis Daging Bahan Bakso TerbaikPete, Obat Alternatif DiabetesIkan Tongkol Bikin Gatal? Ini PenjelasannyaAyam Goreng Kalasan Favorit Bung Karno9 Jenis-Jenis Kurma Terfavorit

Comments

Post a Comment