Life Insurance Types Term During A Medical Exam, A Medical Technician Will Evaluate The Potential Policyholder's Health, Which May.

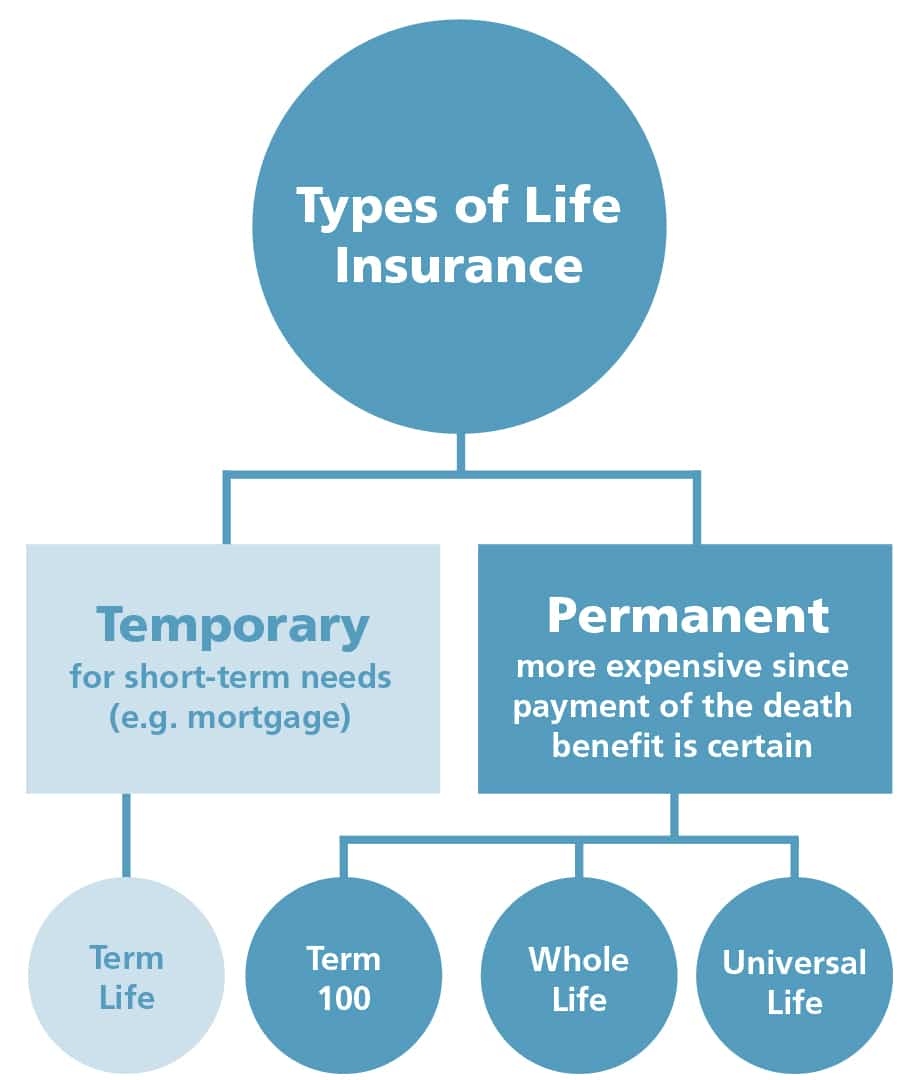

Life Insurance Types Term. Term Policies Pay Benefits To Your Family Only If You Die Whole Life Is The Most Common Type Of The Permanent Coverage, So The Two Main Types Are More Known As Whole Life And Term Insurance.

SELAMAT MEMBACA!

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one thing only:

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Typically policies will last 10, 15.

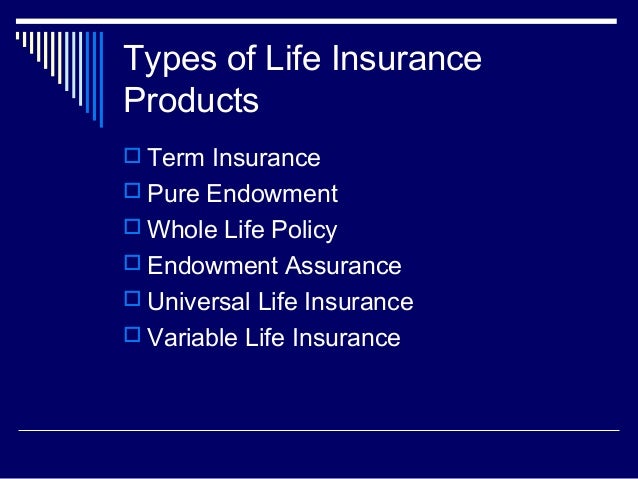

There are several different types of term life insurance;

The best option will depend on your individual circumstances. 1.

Understanding the types of life insurance policies doesn't have to be complicated.

A permanent policy lasts for the life of the insured, for whole life as long as premiums are paid, and for universal life as long as the policy is.

In most types of term insurance, including homeowners and auto insurance, if you haven't had a claim under the policy by the time it expires, you get no refund of the premium.

Your premium bought the protection that you had but didn't need, and you've received fair value.

The table below outlines various types of policies, including different types within term and permanent life, and what they.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Term life insurance and permanent life insurance (also referred to as whole.

Term life insurance actually gets the name from the fact that it is life insurance purchased to cover you for a specified period or term.

Those other types are decreasing term and yearly (or annually) renewable term insurance.

The most common type of term life insurance, guaranteed level premiums and death benefits are set for the specified term.

Term life insurance offers protection for beneficiaries for a certain time period —comonly from 1 to 20 years.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance term life insurance is a life cover policy that runs for a specified amount of time, or 'term'.

Learn about and compare the different types of life insurance policies.

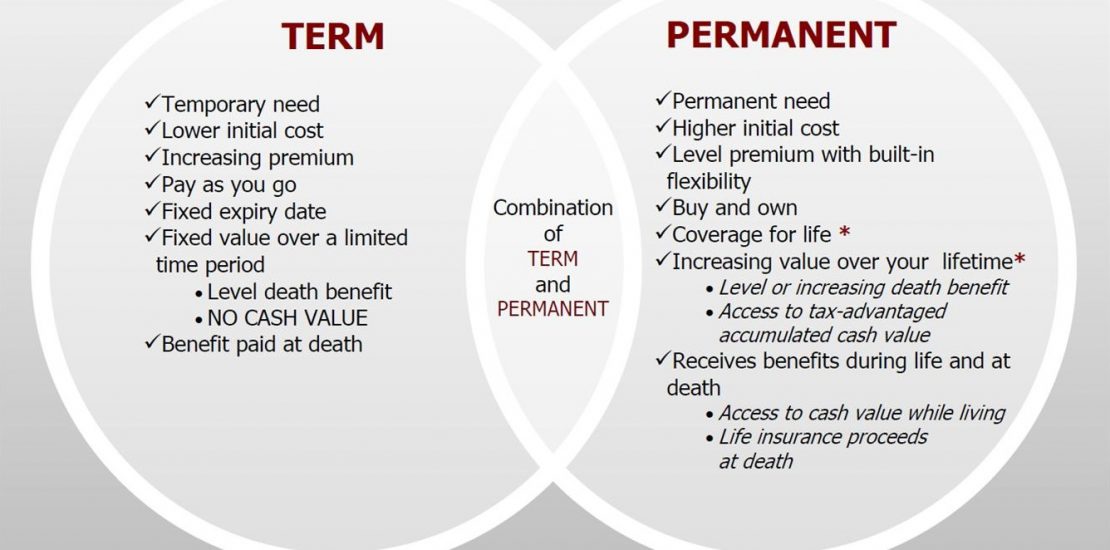

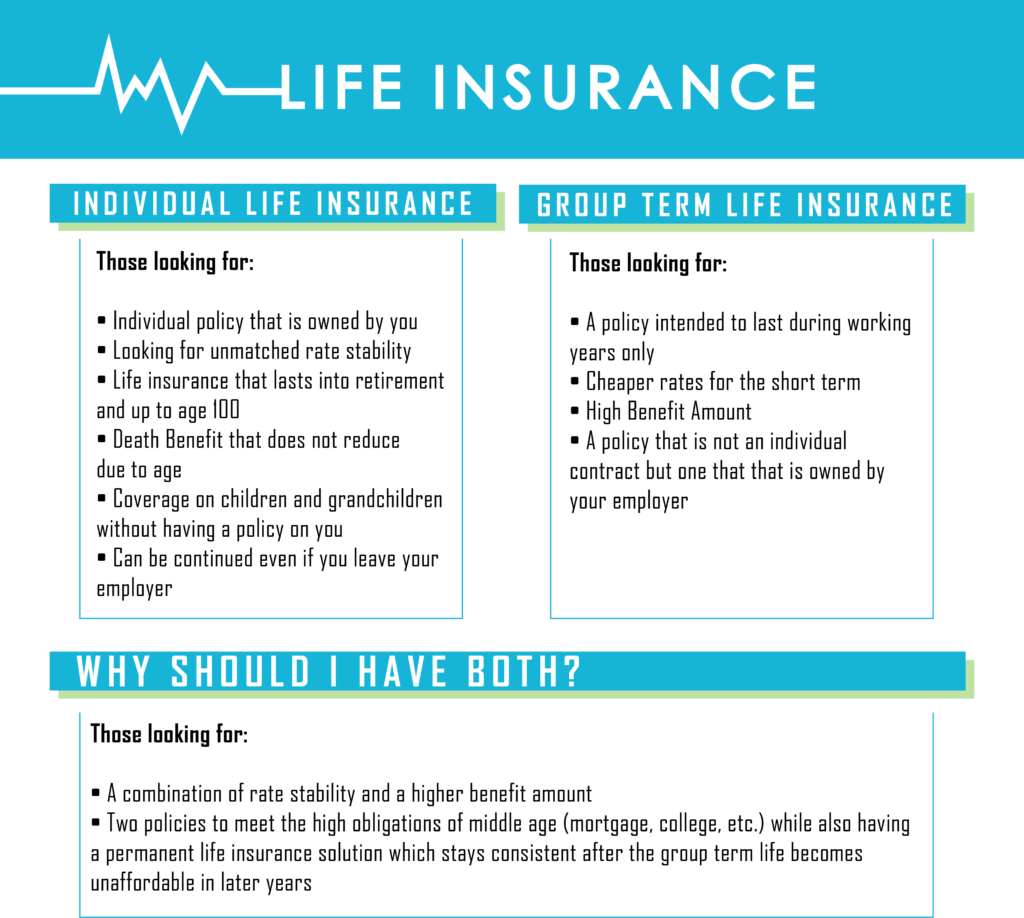

What are the differences between term life & permanent life?

Coverage for a specific period of time, like until you reach retirement or your children are grown.

Some types of life insurance policies require a medical examination.

During a medical exam, a medical technician will evaluate the potential policyholder's health, which may.

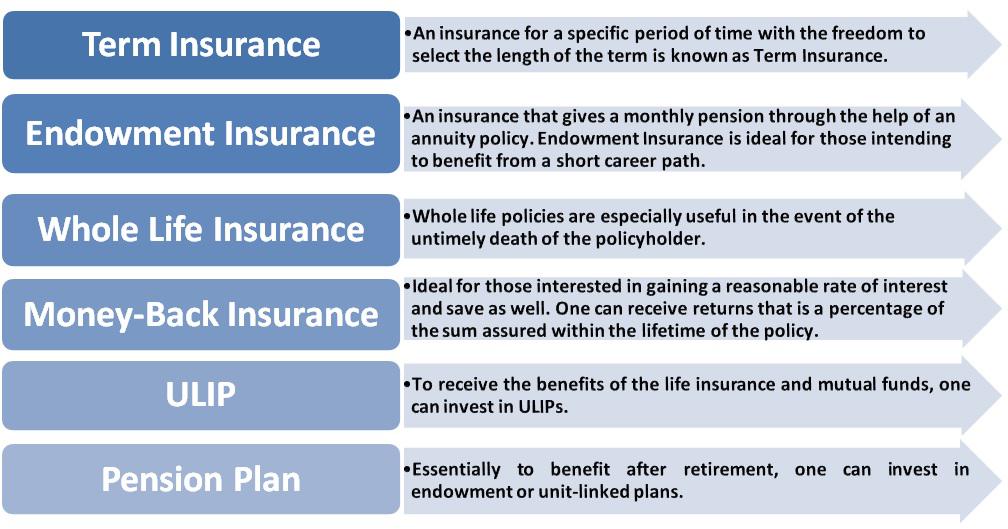

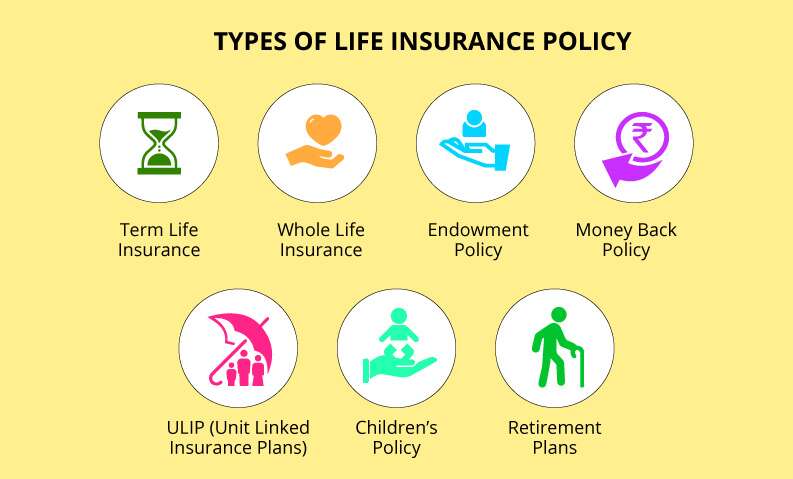

The different types of life insurance are:

These types of life insurance policies are sold by mortgage lenders and are also referenced to as either mortgage life insurance or mortgage.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

Term insurance is the cheapest life insurance policy available.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

Thanks for reading our article, life insurance types explained.

Would you'd like to learn more about this subject?

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

Every type of permanent life insurance last.

A pure protection plan, a term insurance offers a large coverage at an affordable premium.

Understand the different types of life insurance so you can find the right cover today.

Term insurance is a popular type of life insurance that is bought for a fixed period of time that may range between 5 to 30 years.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

Ternyata Kalau Mau Hamil Bayi Kembar Wajib Makan Gorengan Ini10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)4 Titik Akupresur Agar Tidurmu NyenyakSehat Sekejap Dengan Es BatuTernyata Menikmati Alam Bebas Ada Manfaatnya5 Makanan Tinggi KolagenTernyata Tidur Terbaik Cukup 2 Menit!Hindari Makanan Dan Minuman Ini Kala Perut Kosong7 Makanan Sebabkan Sembelit6 Jus Menurunkan Kolesterol Dengan Cepat Dan AlamiSo, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense. Life Insurance Types Term. Different types of life insurance policies in india term insurance is a life insurance product offered by an insurance company which offers financial coverage to the policy holder for a specific time period.

Term life insurance is easier to understand and costs much less than whole life insurance, but it has an end date.

Unlike term insurance, whole life policies cover you for life and add cash value that you can tap for future needs.

Two of the oldest varieties of life insurance, term and whole life, remain among the most popular types.

Not that insurance companies haven't tried to make it more complicated to reach.

We'll provide an overview of these two popular types of life insurance so you can get an idea of what might be a good fit for you.

Find out more by contacting an insurance agent.

Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you whole life plans are generally more expensive than term life.

Let's say we have a friend named greg who's in his 30s and.

Whole life insurance is a type of permanent life insurance, which is designed to provide a death benefit for your entire life, even if you live to a ripe old age.

This difference in number of policies vs.

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between 10 and 30 the biggest difference between the two types of policies is that while both pay a death benefit to your beneficiaries, whole life also provides.

Term life insurance can be a great way to protect yourself.

Types of term life insurance include annual renewable and guaranteed level.

Whole life insurances are of different types:

If you need insurance for a term of less than 10 years, term life.

This insurance doesn't just have a death benefit.

It also includes a savings similar to whole life, except with two lives insured.

Which is best for you?

The key difference between whole life insurance and term life insurance is, as the names may suggest, the duration the insurance lasts for.

Term life insurance or whole life insurance:

What's the difference, which is best?

While there are many types of life insurance policies to choose from, two categories you'll see frequently are term and whole.

Whole life insurance is more complex and offers coverage until death.

Money expert clark howard likes term life for most everyone.

Term and whole life insurance differ in costs, duration of coverage, and the inclusion of a cash value component for whole life.

Whole life is a type of permanent insurance policy, meaning that coverage extends for your entire lifetime so long as you continue to pay the premiums.

Unlike term life policies, whole life insurance policies (also known as permanent life insurance) offer coverage for your entire life.

Whole life insurance (or can even make the decision to choose to get both types of policies).

Term life insurance and whole life insurance are two of the most familiar types of policies.

Both feature a number of benefits, but it can be confusing.

Term insurance is sometimes referred to as pure life insurance because its sole purpose is to provide financial protection for your dependents in the event of your death.

Unlike whole/universal life insurance, a term policy has no value other than the death benefit.

One of the biggest benefits of.

Part of each monthly or annual premium goes to the insurance company and part of it goes toward the cash value, which earns a.

Term life insurance and whole life insurance policies differ in length of protection and cash benefits.

But it can be confusing choosing between the two types, term life insurance and whole life insurance.

If you or your spouse passes away during this time, your typically this works out to be $7 per month in 20 yr term, vs $100 with whole life cash value.

Term life has no cash value until the death occurs, so it's not.

Meanwhile, like other permanent life insurance, whole life policies last your entire lifetime.

Term insurance is life insurance taken for a certain period or term.

In case of death of the policyholder, the sum assured is paid to the what is whole life insurance?

The life policies are legal contracts and the terms and conditions mentioned describe the limitations of the insured events.

Term vs whole life insurance.

In contrast to term life insurance, whole life insurance provides permanent coverage from the day the policy is purchased until the death of the insured individual, as long as you make and stay current on all of the payments.

It does not matter if you live for another 10 years or 90 years.

Avoid making the mistake of buying the wrong coverage.here's how.

This post may contain affiliate links.

Please read our disclosure for more info.

Most whole life policies require you to pay below are monthly cost comparisons between term life vs.

Whole life insurance for a $500,000 policy.

Because there's no direct comparison, we.

The main difference between term life insurance and whole as you're weighing the features of each type of plan, it's important to also take a look at the cost difference between the two.

Due to its higher value.

Whether you prefer term or whole life insurance will depend on many factors.

Should the insured person pass away.

Find out which type is right for you.

This type of policy only pays your beneficiaries if your death occurs within the period of time.

In fact, there are many differences between the different types of life insurance plans.

One of the most common questions we answer at intelliquote® is about the differences between term life insurance.

In fact, there are many differences between the different types of life insurance plans. Life Insurance Types Term. One of the most common questions we answer at intelliquote® is about the differences between term life insurance.Bir Pletok, Bir Halal BetawiNanas, Hoax Vs FaktaSejarah Kedelai Menjadi TahuKuliner Legendaris Yang Mulai Langka Di DaerahnyaTrik Menghilangkan Duri Ikan BandengFakta Perbedaan Rasa Daging Kambing Dan Domba Dan Cara Pengolahan Yang BenarResep Stawberry Cheese Thumbprint CookiesJangan Sepelekan Terong Lalap, Ternyata Ini ManfaatnyaBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakTernyata Jajanan Pasar Ini Punya Arti Romantis

Comments

Post a Comment