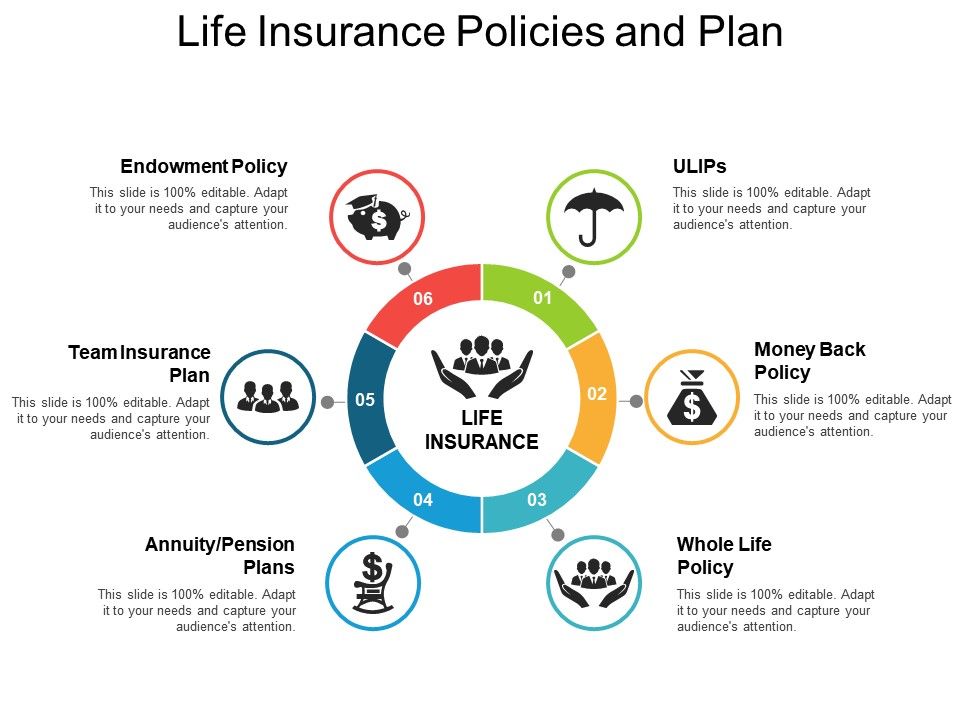

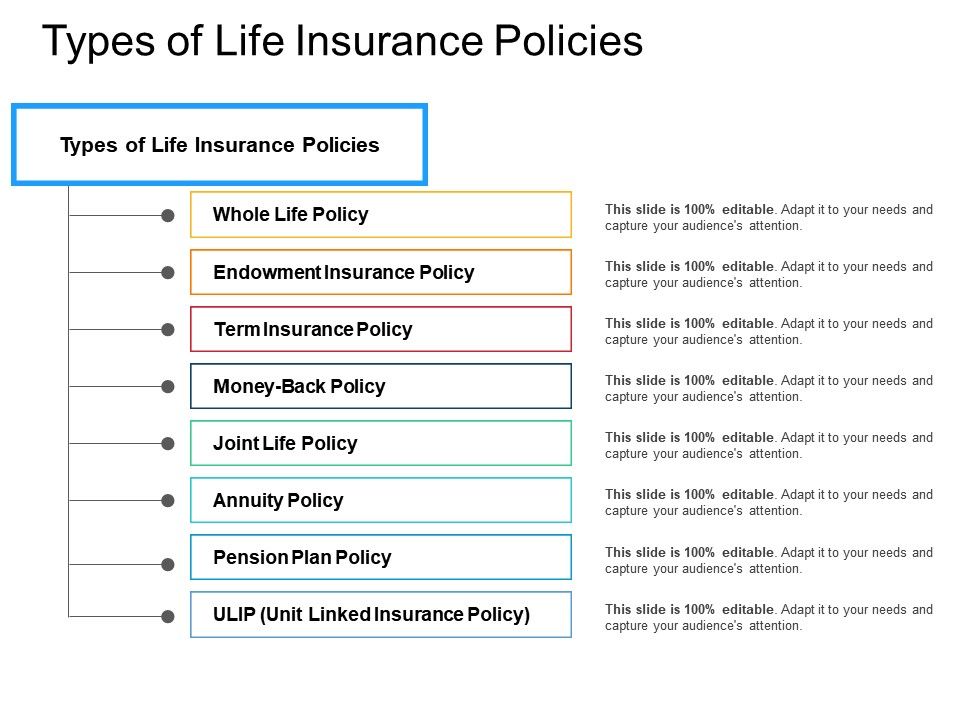

Life Insurance Types Ppt There Are Various Companies Offering Different Types Of Life Insurance Policies.

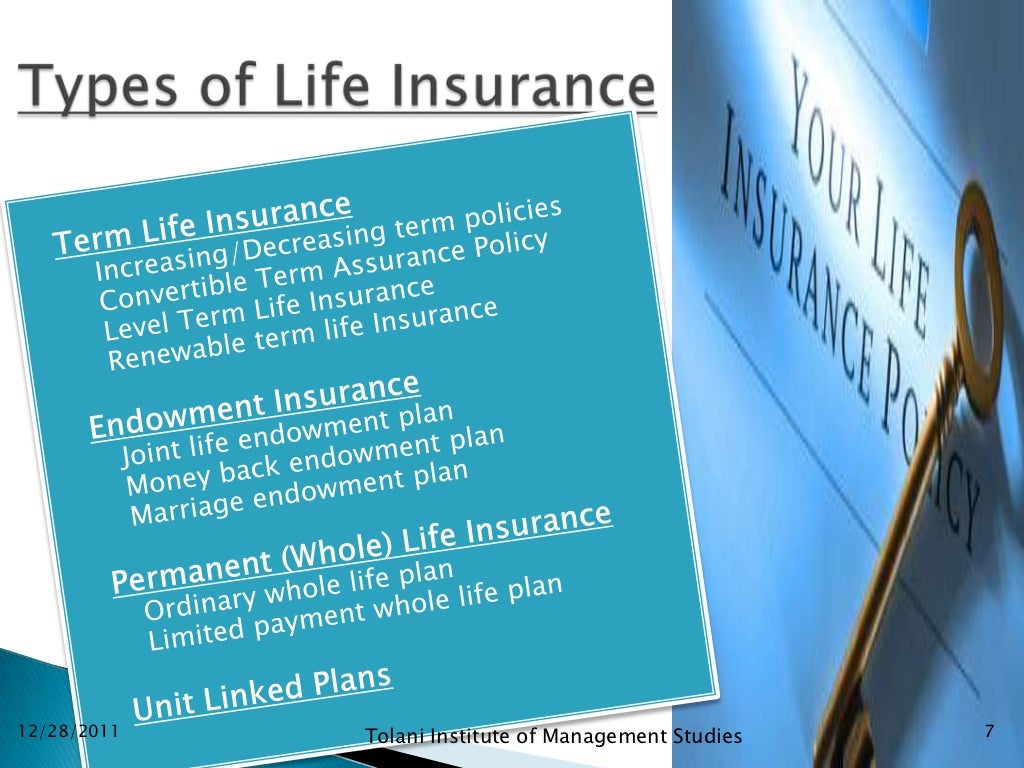

Life Insurance Types Ppt. Term Insurance Is The Simplest Form Of Life Insurance Available In The Market.

SELAMAT MEMBACA!

Health insurance ppt by viswanathan odatt 41257 views.

It experienced growth of 58% sbi life insurance co ltd 15.

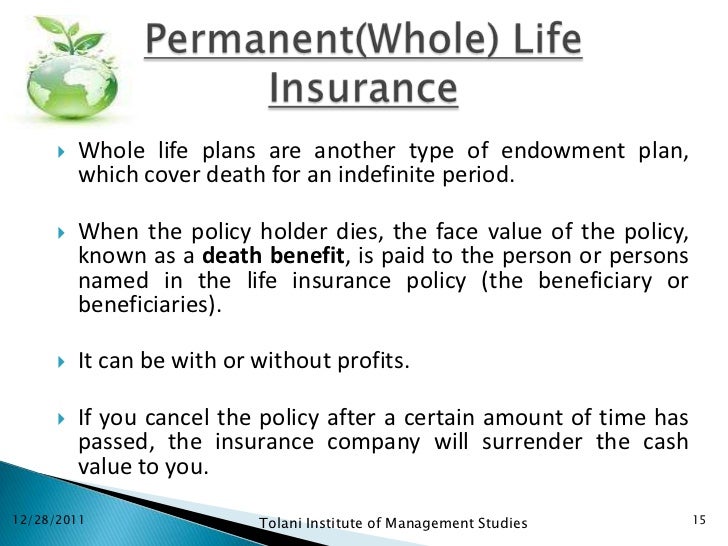

ρ� whole life plans are another type of endowment plan, which cover death for an indefinite period.

10 permanent life insurance life insurance:

Chapter 1 life insurance policies.

If you plan on having insurance for more than 20 years it is usually more advantageous to have whole life insurance.

12 life insurance basic policy types.

Documents similar to life insurance powerpoint.ppt.

Life insurance powerpoint template is a free green template with money arrow and ready to be used for life insurance projects.

Share your findings with friends and colleagues with life insurance powerpoint template, as everyone commends an unbiased person who knows about various.

Term life, whole life, and universal life are just three of the most basic kinds.

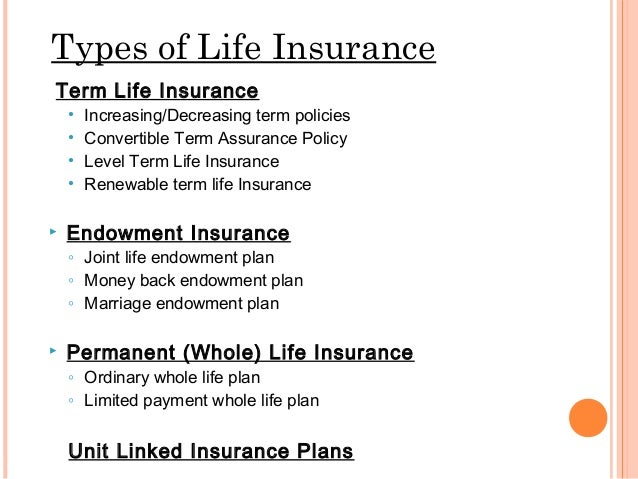

Types of insurance types of insurance in india importance of insurance types of insurance policies types of general insurance.

Tushar joshi, an life insurance agent, will able to provide all kind of life insurance solutions.

Whole life insurance has a level premium structure (the premiums due are the same each year) and will build cash value over time.

When deciding which type and amount of life insurance is right for you, you'll need to answer these important questions:

What do you want the insurance to cover?

Make sense of all the types of life insurance available and find out what's right for you and your family.

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Get the facts and learn the key differences before choosing a policy.

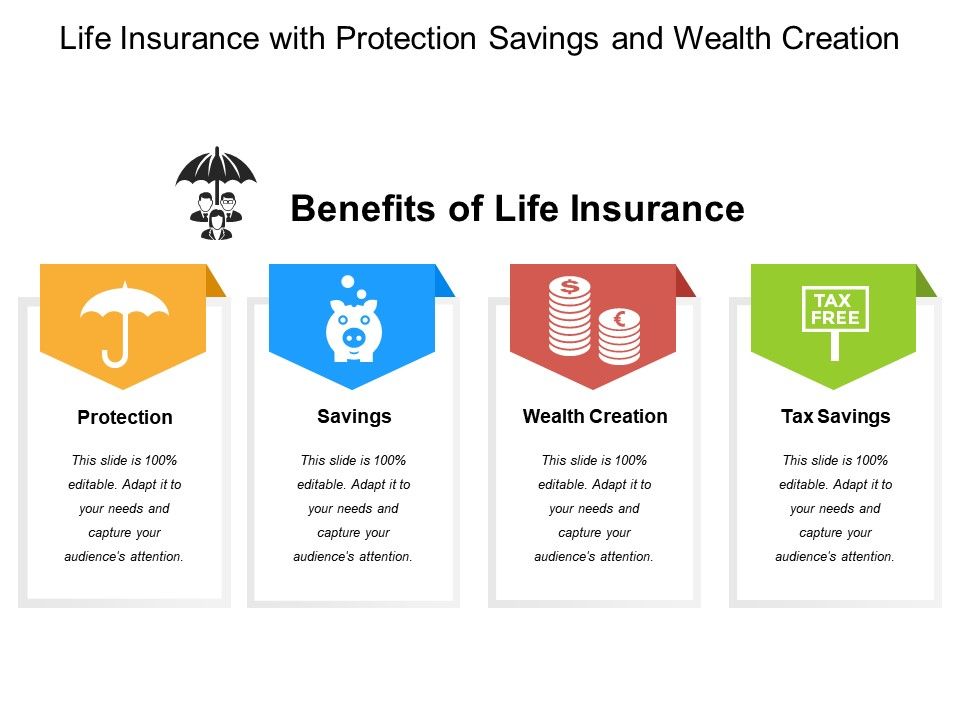

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

They are among the leading providers of life & pensions products in europe.

A person's hands resemble a help others resolve car insurance related disputes and land local deals with the help of free sport car ppt background and car speed ppt theme.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

Frankly speaking, i don't know much about insurance and its types.

Like, are there differences between term life insurance and insurance for final expenses?

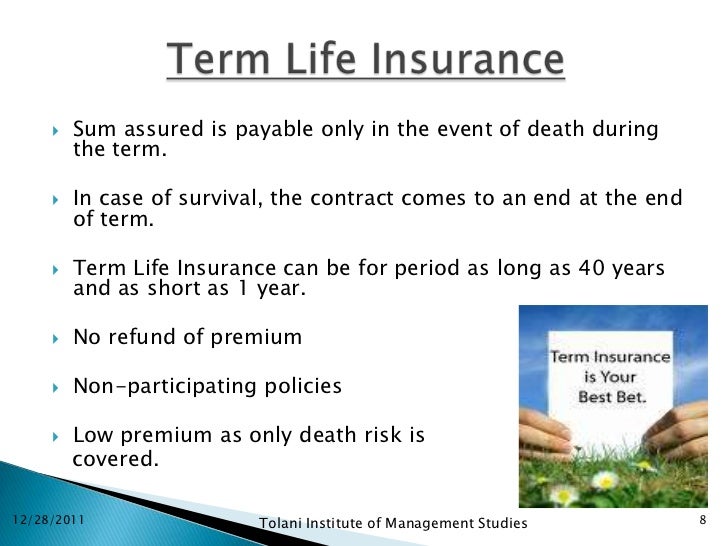

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Learn about and compare the different types of life insurance policies.

What are the differences between term life & permanent life?

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

![7 Required Types of Insurance - [PPT Powerpoint]](https://reader011.fdocuments.in/reader011/slide/20181225/54c937f04a7959856c8b461f/document-1.png?t=1598030767)

We'll explain each of these products soon.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

A pure protection plan, a term insurance offers a large coverage at an affordable premium.

€� decreasing term insurance :

Face value declines each year to keep the premium level.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

The goal of this post, life insurance types explained is to help you understand your options.

Once you get an idea of your options, you can select the appropriate coverage to meet your.

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance policy that helps them financially.

What life insurance policy type is best for me?

Simplified issue life insurance is most commonly a type of term life insurance that allows you to get approved for life insurance extremely fast.

Term life and whole life insurance explained with chart and infographics in pdf.

When you buy life insurance, you sign a contract with an insurance company.

While the types of life insurance covered above are the main products available in canada, there are some other products worth mentioning.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

4 Titik Akupresur Agar Tidurmu NyenyakJam Piket Organ Tubuh (Limpa)6 Jus Menurunkan Kolesterol Dengan Cepat Dan AlamiTips Jitu Deteksi Madu Palsu (Bagian 2)Cara Baca Tanggal Kadaluarsa Produk MakananSaatnya Minum Teh Daun Mint!!Tak Hanya Manis, Ini 5 Manfaat Buah SawoTernyata Jangan Sering Mandikan BayiManfaat Kunyah Makanan 33 KaliJam Piket Organ Tubuh (Lambung)Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out. Life Insurance Types Ppt. Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

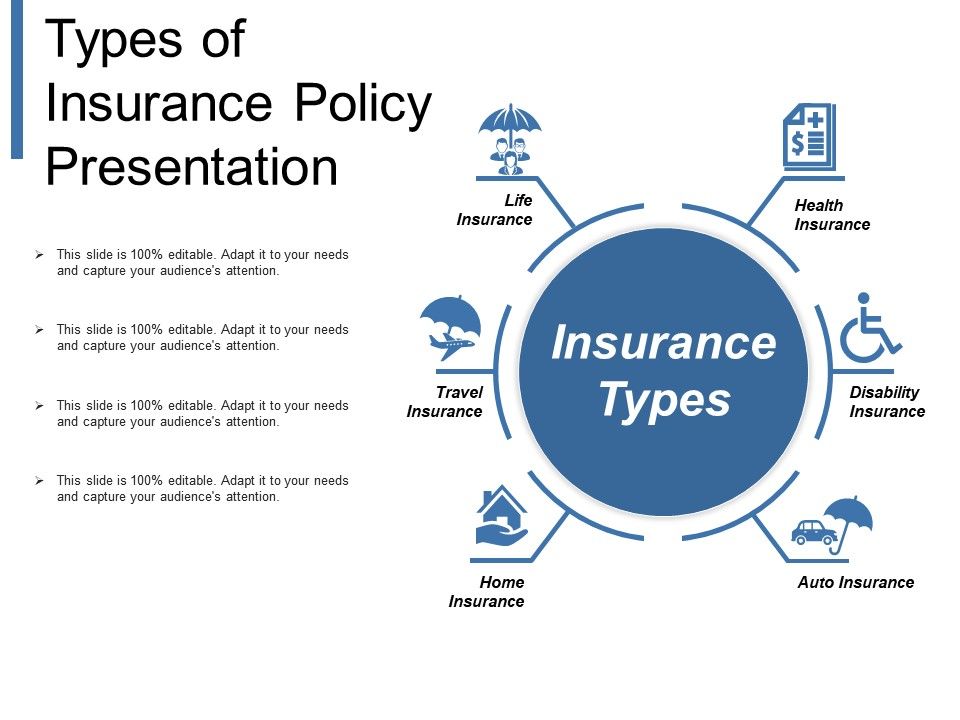

Automobile health life disability homeowner's/renter's.

Insurance education foundation (ief) states there is 70% chance a person will be.

To help you understand we have listed the description of commonly available types of insurance, life and general insurance.

To help you understand we have listed the description of commonly available types of insurance, life and general insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Types of life insurance policies i.

Health insurance ppt by viswanathan odatt 41257 views.

ρ� it has emerged as one of the fastest growing insurance products.

ρ� it is a combination of an investment fund( such.

Basic types of insurance cover.

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an the term underwriting refers to how a life insurance company calculates the risks of insuring you.

Disadvantages of term life insurance the main disadvantage of term life insurance is that a term policy has an end point, like an expiration date.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your the two primary types of life insurance—term life and permanent life—are just the tip of the iceberg.

Insurance companies also offer dozens of.

What do you want the insurance to cover?

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

Insurance powerpoint template is a free template for insurance presentations in powerpoint.

The template is great for insurance products for example if you work selling insurance and you want to put insurance quotes in the slide design, but this is not only limited for top insurance companies.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

This makes it very attractive to people, but if you outlive the length of the term policy.

Know about different types of life insurance policies to secure your family's future with plans such as ulip, term insurance, whole life insurance and best known for:

Benefit of money back plan:

€� insurance and life insurance in different perspectives • legal aspects of life insurance business in india • principles of insurance and their applications to life insurance • important types of life insurance 2.

Top free images & vectors for types of life insurance products ppt in png, vector, file, black and white, logo, clipart, cartoon and transparent.

Participating life insurance is a type of permanent insurance, in which you're typically eligible to earn dividends.

You can buy some of our insurance products online.

There are several types of life insurance.

The most common are term, whole life and universal life insurance.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose.

While the types of life insurance covered above are the main products available in canada, there are some other products worth mentioning.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

While term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance coverage.

The many types of life insurance available can be overwhelming.

When shopping for a policy, the first critical step is determining the ultimate goal.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense.

Jeff rose, cfp® | june 27, 2020.

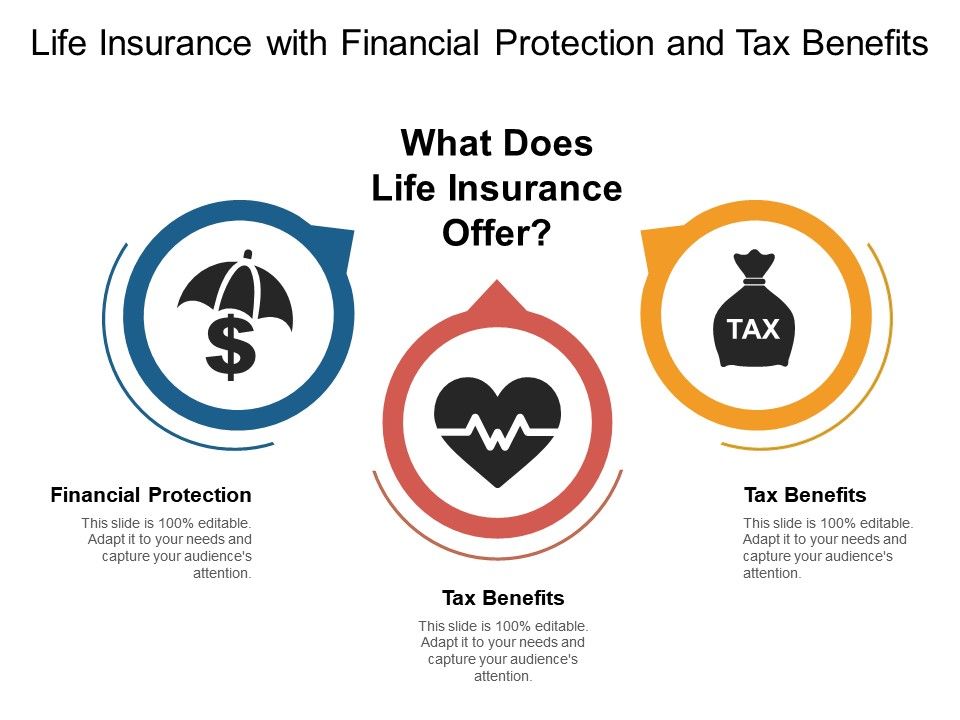

This type of life insurance also provides a death benefit and a cash value component where the ***disclaimer:

I do not sell insurance or have any affiliate links to promote and market insurance products of any.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance what is terminal illness insurance?

What is free parent life cover?

Different types of life insurance explained.

Life insurance is is a type of policy which pays out lump sum amount to your loved ones if you die.which covers the policy.

Types of life insurance products.

Term insurance is a pure risk cover product.

Who needs life insurance cover?

The most suitable type of life insurance policy for you will also depend on your own personal circumstances.

Term life and whole life insurance explained with chart and infographics in pdf.

Do you know the difference between the two main types?

Types of life insurance products.

Types of life insurance products. Life Insurance Types Ppt. Insurance that is kept in force for a person's entire life and pays a benefit upon the person's death, whenever that may be, accumulates cash value.Ternyata Fakta Membuktikan Kopi Indonesia Terbaik Di DuniaIni Beda Asinan Betawi & Asinan BogorTernyata Inilah Makanan Paling Buat Salah PahamTernyata Kue Apem Bukan Kue Asli IndonesiaAmpas Kopi Jangan Buang! Ini ManfaatnyaResep Ayam Kecap Ala CeritaKulinerNanas, Hoax Vs FaktaSejarah Prasmanan Alias All You Can EatAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Resep Selai Nanas Homemade

Comments

Post a Comment