Life Insurance Types In India This Type Of Life Insurance Plan Has Only The Insurance Component.

Life Insurance Types In India. Ulip Life Insurance Plans Are Found In India And Are Typically Used To Cover Specific Types Of Risk.

SELAMAT MEMBACA!

Life insurance is one of the fastest growing sectors in india since 2000 as government allowed private players and fdi up to 26% and recently cabinet approved a proposal to increase it to 49%.

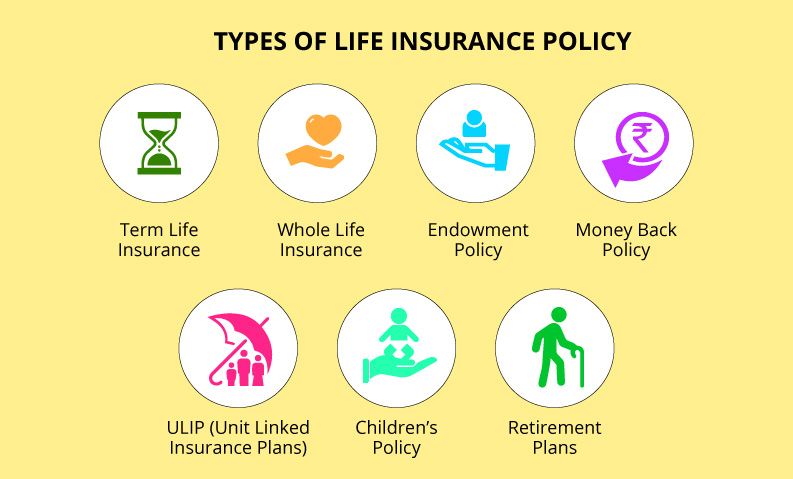

Know about different types of life insurance policies to secure your family's future with plans such as ulip, term insurance, whole life insurance and others.

Or maybe you need to know the different types of life insurance policies available in the market to make a wise choice!

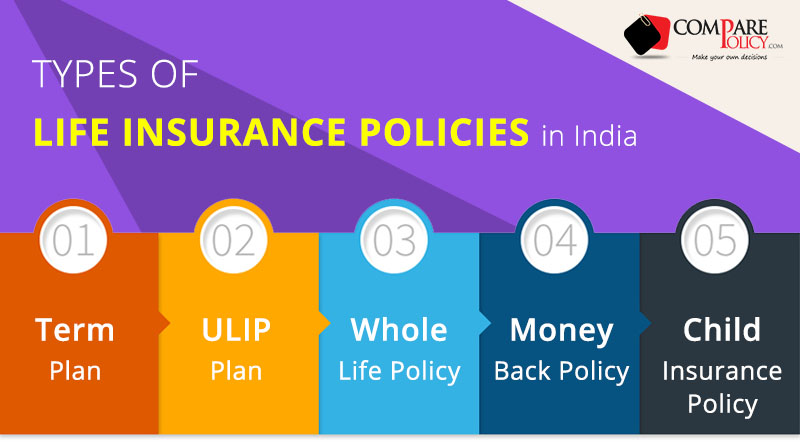

Different insurance types in india.

An individual today has an array of options to choose from when it comes to financial planning.

Insuring your life for the financial security of your dependents must be paramount before proceeding to address any other aspects.

Choosing from the different types of life insurance in india is a crucial financial decision, as it helps you protect your loved ones from life's uncertainties.

A detailed guide about different types of insurance policies in india.

In life, unplanned expenses are a bitter truth.

Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security.

Choosing from the different types of life insurance in india is a crucial decision.

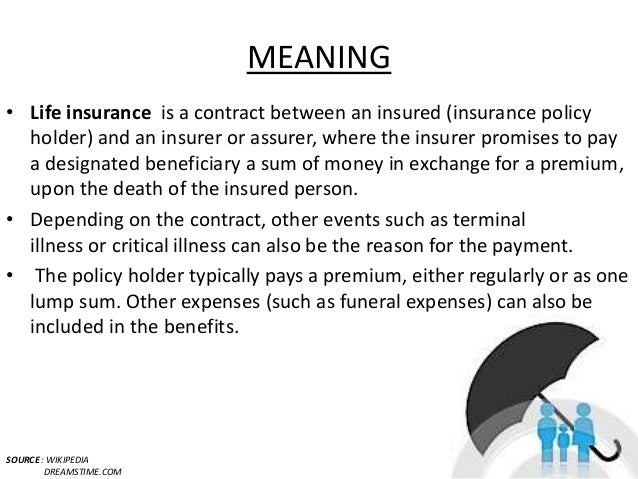

A life insurance policy is a contract with an insurance company.

In this policy, a person has to make regular payments(known as premiums)to the insurance company in order to receive a sum of money that will.

Lic's insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement.

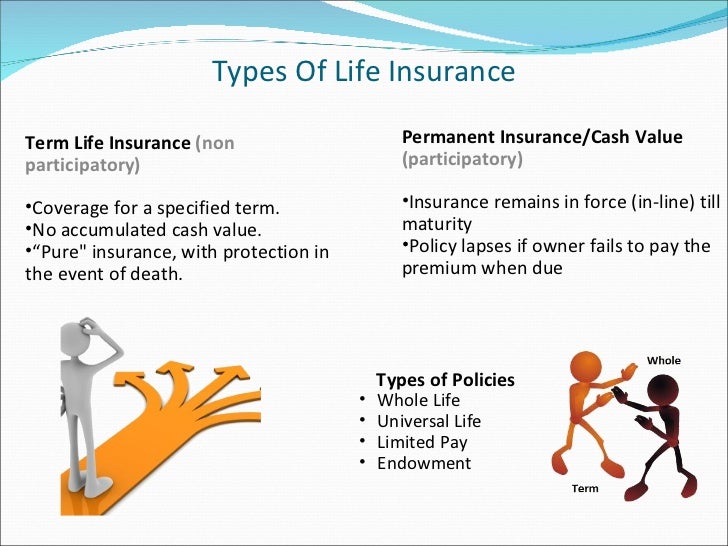

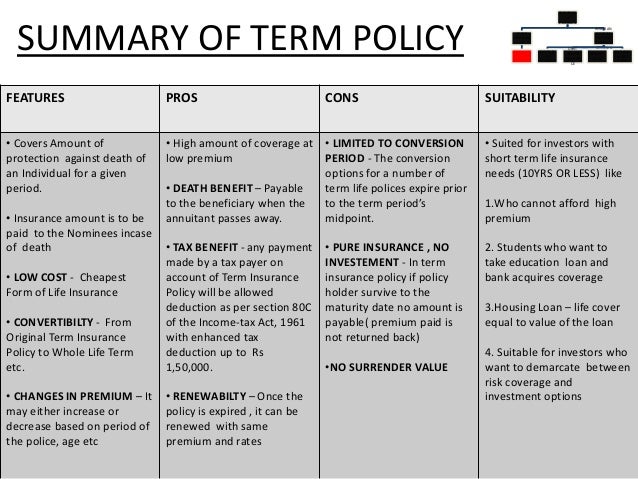

Unlike a whole life insurance policy, a term plan comes with a limited duration.

In case if the insured passes away during this duration, the one of the best life insurance policy in india to plan your retirement is a pension and retirement plan.

Group life insurance is a type of life insurance that covers a group of people.

It is mostly provided by companies to its employees.

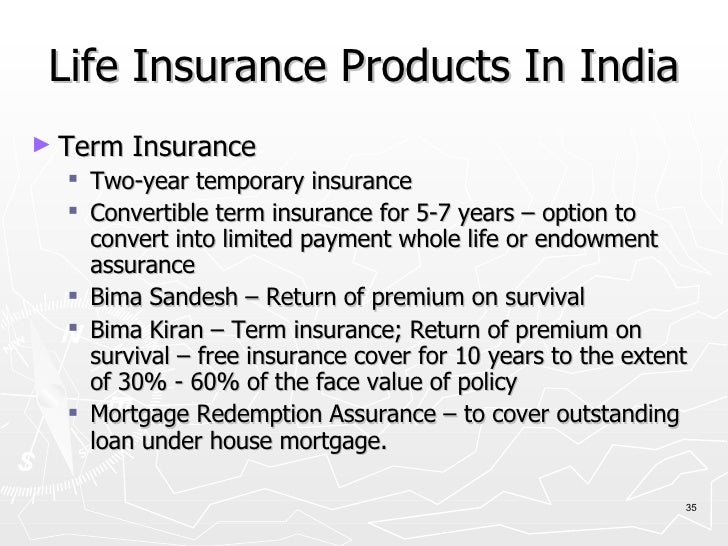

In india, do you have policies that return the premium paid for term insurance in case the policyholder survives the plan?

Whole life policy offers a savings component (also known as to apply online for best credit cards in india, life insurance plans, secured loans and unsecured loans, visit www.mymoneymantra.com, the leading online.

Life insurance in india is a kind of agreement that offers monetary compensation in the case of disability or death of the insured person.

What are the types of life insurance in india?

Best life insurance plans & policies in india 2021.

Compare features benefits eligibility policy term death benefits & reviews online.

Visit the bankbazaar website to know about the top insurance plans for the year 2019.

There are varied types of life insurance policies offered by many insurance companies in india.

The dependents'needs, as well as the policyholder's needs, are fulfilled with the life insurance policy.

Life without life insurance is risky business for your family.

Ulip life insurance plans are found in india and are typically used to cover specific types of risk.

This type of life insurance plan is different because the premium you pay will go against you as risk cover, whereas another part of it will be invested in funds which have been decided by your providers.

Life insurance, thus, provides for financial security of the survivors upon unfortunate death of the earning member of the family.

Life insurance covers the dependents in case of the untimely death of the policyholder.

Know more about types of life insurance policies in india.

It pays your family a sum of money in case of your death, during the policy term.

These funds can be used for emergencies.

One might have to submit certain documents to avail of the benefits.

Benefit & features of life insurance plans in india.

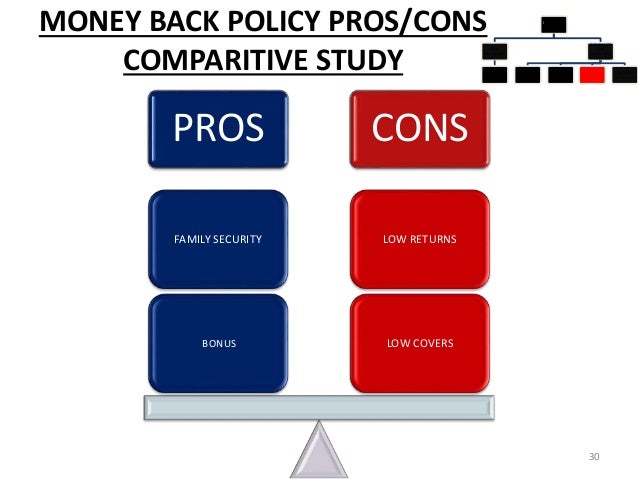

People often mix life insurance with investments and end up in taking the in this article we will go through the the different types of life insurance policies in india and understand key differences between them.

Compare different types of life insurance plans and check the benefits of life insurance, cover and how to there are 24 life insurance companies in india, which offer a host of insurance policies.

Though life insurance covers the death of the insured person, yet there are specific clauses which.

This video will help you in understanding the types of life insurance policies in india.

In india life insurance is the most availed form along with health and accident based plans.

Life insurance is taken primarily to secure oneself and/or one's family when the ability to earn is less or provide for the dependents when the insured is either deceased or.

Sbi life insurance individual death claims paid ratio is 92.13%.

The unique proposition is the increase in sum assured @10% at the end of every 5 years.

Bharti axa flexi life has two types of term insurance plans to match individual needs.

Life insurance also provides financial security for those unexpected ups and downs in life.

The life insurance company pools in the premium ofthousands of people and disburse a lump sum if there is a death amongst those who are covered by a policy.

The types of life insurance policies vary greatly.

Life insurance companies in india.

Insurance provides risk coverage to the insured family in form of monetary compensation in lieu of premium paid.

This type of life insurance plan has only the insurance component.

There is no saving/investment component.

Therefore, you would not get back any amount from the policy.

Find the best life insurance policy, life insurance quotes, compare the life insurance plans and premium of other life insurance products in india only at myinsuranceclub.com.

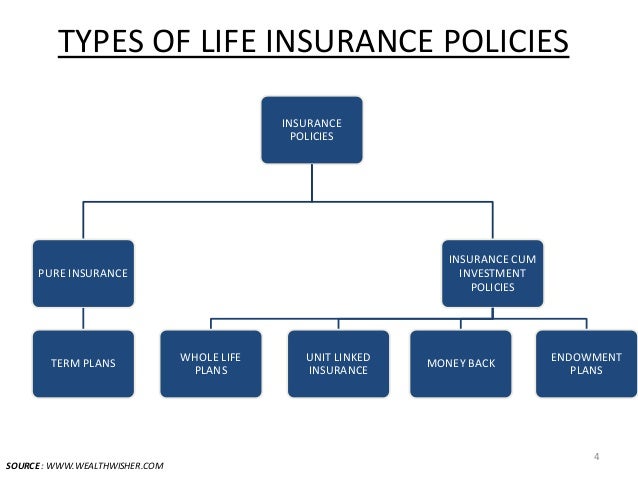

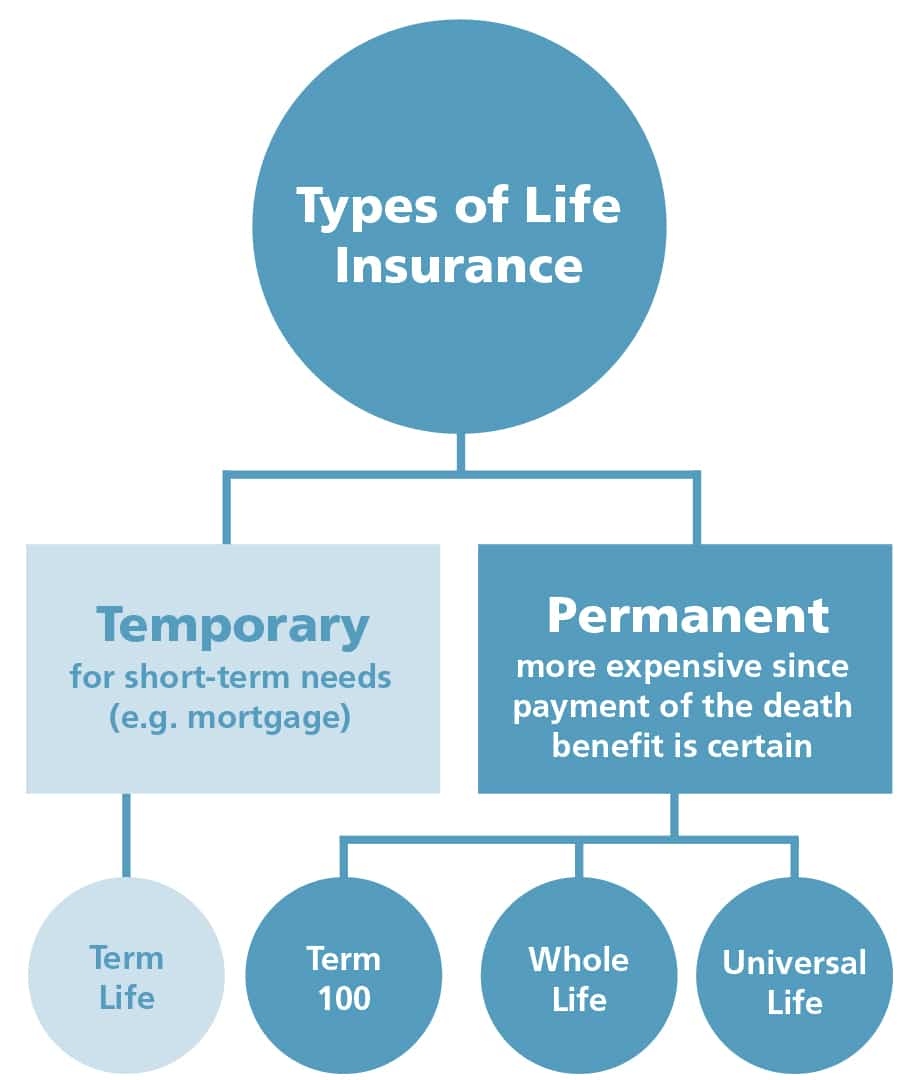

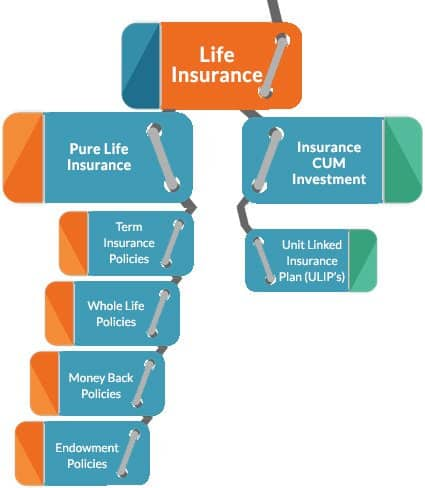

Life insurance plans can be broadly classified in 2 different ways.

Ternyata Tertawa Itu DukaAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`8 Bahan Alami Detox Ini Cara Benar Cegah HipersomniaTernyata Tidur Terbaik Cukup 2 Menit!Gawat! Minum Air Dingin Picu Kanker!Jam Piket Organ Tubuh (Hati)Ini Efek Buruk Overdosis Minum KopiTernyata Einstein Sering Lupa Kunci Motor4 Manfaat Minum Jus Tomat Sebelum TidurWhat are the different types of life insurance? Life Insurance Types In India. Life insurance plans can be broadly classified in 2 different ways.

Life insurance is one of the fastest growing sectors in india since 2000 as government allowed private players and fdi up to 26% and recently cabinet approved a proposal to increase it to 49%.

Know about different types of life insurance policies to secure your family's future with plans such as ulip, term insurance, whole life insurance and others.

However, if the life assured outlives the age of 100 years, the insurance company pays the matured endowment coverage to the life insured.

Term insurance is pure life cover, unlike other types of life insurance policies which have a saving component.

Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period.

If the policyholder survives until the end of the period, or term, the insurance coverage ceases without value and a payout or death claim cannot be made.

Life insurance in india is a kind of agreement that offers monetary compensation in the case of disability or death of the insured person.

Types of life insurance in india:

Choosing from the different types of life insurance in india is a crucial decision.

A life insurance policy is a contract with an insurance company.

A detailed guide about different types of insurance policies in india.

In life, unplanned expenses are a bitter truth.

Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security.

It is mostly provided by companies to its employees.

In india, do you have policies that return the premium paid for term insurance in case the policyholder survives the plan?

A term life insurance policy is one of the simplest and most affordable life insurance plans that you can buy.

Insurance planning / personal finance.

Types of life insurance policies in india.

These policies provide you risk cover for entire lifetime extending even up to 100 years of age.

Best life insurance plans & policies in india 2021.

Compare features benefits eligibility policy term death benefits & reviews online.

This will help you know about the type of insurance product that you are looking for yourself and which is the best insurance policy that you can purchase.

Life insurance in india made its debut well over 100 years ago.

In our country, which is one of the most populated in the world, the prominence of it should, however, be clearly understood that the following content is by no means an exhaustive description of the terms and conditions of an lic.

Buy lowest premium best term insurance there are various types of term insurance plans available in the market, all of which are designed to suit different needs of the customers.

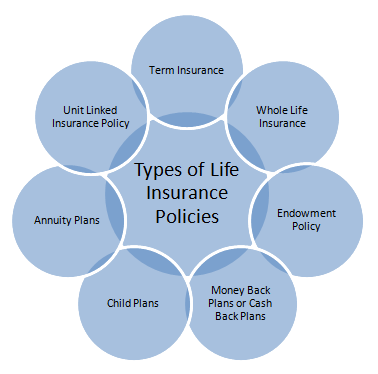

The image is given below gives you an at a glance idea of the types of insurance policies in india.

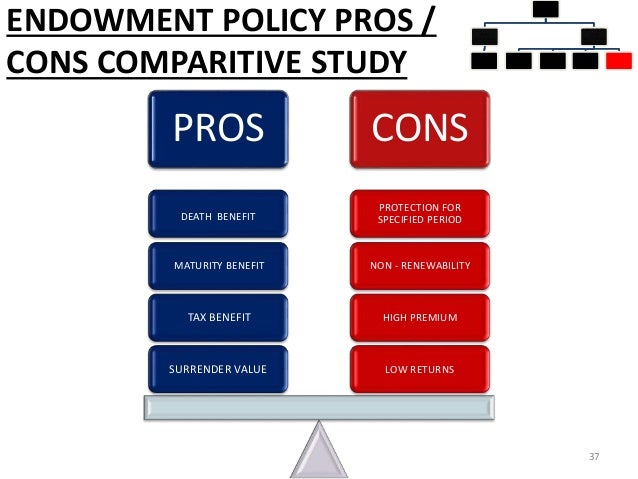

Thus the pure endowment policy is the opposite of the term policy because the insured is paid if he survives in pure endowment.

Term life insurance is a type of life insurance that provides coverage for a specific period, and offers financial security to your family if the policyholder dies these include critical illness rider, accidental death rider, waiver of premium rider etc.

Term insurance is a type of life insurance that provides coverage for a specific period of time or years.

This type of life insurance provides financial protection to the nominee in case of any unfortunate event with the policyholder during the policy term.

Term insurance policies provide high.

Thus, it is essential to understand the different types and opt for a plan that best suits your if an insured individual loses his/her life within the policy term, the nominees will receive the sum assured as specified in the policy.

Term plans provide a life cover for a specific term.

However, no payments are made if the insured person survives the tenure.

Know more about types of life insurance policies in india.

Max life insurance is one of the most preferred companies for term insurance due to its high claim settlement ratio.

The company has a 99.22 bharti axa flexi life has two types of term insurance plans to match individual needs.

This video will help you in understanding the types of life insurance policies in india.

In this video, we have explained life insurance types in hindi.

Term insurance is a popular type of life insurance that is bought for a fixed period of time that may range between 5 to 30 years.

Thus, before choosing one out of all, choosing the one that gives maximum.

Term life insurance plans are specifically designed to provide financial security to the family in the event of demise of the policyholder during the tenure of the policy.

To choose the best term plan in india, it is important to know the types of term insurance plans offered by the insurance companies.

This type of insurance applies to the life of an individual in case they die during the term of the policy.

With life insurance policies, only when a policyholder dies or the policy matures does a policyholder receive the insurance amount.

Life is full of expected and unexpected events or situations wherein one doesn't get a second chance to reassure the faith term life insurance:

When it comes to the financial industry (with that's probably one reason why life insurance companies were not offering term insurance for so long in india.

The term life insurance plans or term assurance plans are availed to receive a fixed payment rate over a period of time, which is the term period.

Once the period comes to an end the policy owner can discontinue the policy or extend it.

Life insurance plans & policies:

Icici bank provides various type of life insurance policies that include term insurance plans, health ~~death benefit is payable on diagnosis of terminal illness.

To know more about definitions, terms & conditions applicable for terminal illness, kindly refer to.

If death occurs of the policyholder during the policy period, then his/her nominee will receive the sum lic stands in lowest with red in colour along with life insurance companies like bajaj allianz, exide, future genereli, idbi federal, india first, max.

Bajaj allianz life insurance etouch online term insurance plan.

Bajaj allianz life insurance etouch online term insurance plan. Life Insurance Types In India. This plan offers waiver of premium under 'shield' option.Resep Ponzu, Cocolan Ala JepangFoto Di Rumah Makan PadangTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Ramuan Kunyit Lada Hitam Libas Asam Urat & Radang3 Jenis Daging Bahan Bakso TerbaikKhao Neeo, Ketan Mangga Ala ThailandWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Nikmat Kulit Ayam, Bikin SengsaraResep Kreasi Potato Wedges Anti GagalCegah Alot, Ini Cara Benar Olah Cumi-Cumi

Comments

Post a Comment