Life Insurance Types Canada What Are The Different Types Of Life Insurance Policies Available In Canada?

Life Insurance Types Canada. However Choosing From The Different Types Of Life Insurance In Canada Isn T Like Deciding What Flavour Of Ice Cream To Try For Dessert.

SELAMAT MEMBACA!

Whole life insurance is a type of permanent life insurance that provides you coverage for your life time.

Types of investments you choose to hold in your.

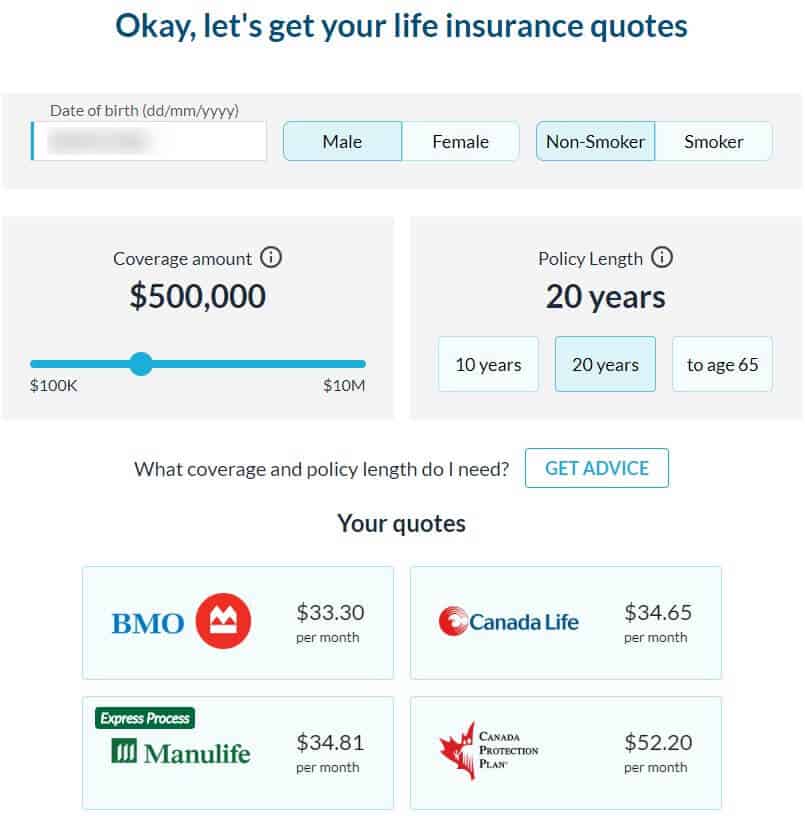

Is one of canada's largest online life insurance providers and resources.

We provide you with access to over 20 life summary.

This covers the 5 types of life insurance policies available in canada and helps you decide between term, whole life and other insurances.

We've listed the 5 different types of life insurance plans available in canada and compare them so you are a little more prepared to make a big decision.

Life insurance can help you and your family prepare for the future.

What are the different types of life insurance policies available in canada?

There are two main types of life insurance available in canada:

Term insurance and permanent insurance.

There are three primary categories of.

The two main types of life insurance in canada are term insurance and permanent insurance.

As the names imply, term insurance covers the policy holder for a given period only, while permanent insurance covers the policy holder for life.

We've reviewed several life insurance policies available to canadians, which you can find.

We offer different types of life insurance and we can help you find the solution that's right for you.

While the types of life insurance covered above are the main products available in canada, there are some other products worth mentioning.

Its purpose is to make sure the mortgage is.

Idc insurance direct canada inc.

National service centre 4400 dominion st., suite 260 burnaby, bc v5g 4g3.

You have options to choose from, including term life insurance, permanent life insurance and universal life insurance.

Apply online at sunlife.ca and get a quote today.

Or talk to a sun life financial advisor to learn more about how life insurance.

If you have a less serious health condition, or were previously refused insurance, deferred term is the right.

A td life insurance plan in canada, is a way to help protect your family's financial future, even after you've passed away, so there is less of a financial burden left behind during a challenging time.

We understand it can be difficult to make these types of decisions, so we're here to help guide you.

Many life insurance shoppers are becoming more aware of the importance of this type of insurance.

This is driving them to become more informed before they make their final decisions.

Type of cover life insurance joint life insurance life + critical illness critical illness insurance disability insurance mortgage life insurance no what plan is right for you?

Life insurance in canada life insurance is something everyone has in their life time.

It is the money someone (spouse) gets when their parents or family members die.

The thing is every country has their own rules and regulations regarding life insurance and medical commodities.

Term insurance provides protection during 10 or 40 year terms.

There are two types of permanent insurance policies available in the market.

Universal life insurance and whole life insurance policies…

As long as you continue to pay the premiums, each of these types of insurance policies will provide you with a benefit upon death regardless of how long you live.

These three types of permanent life insurance.

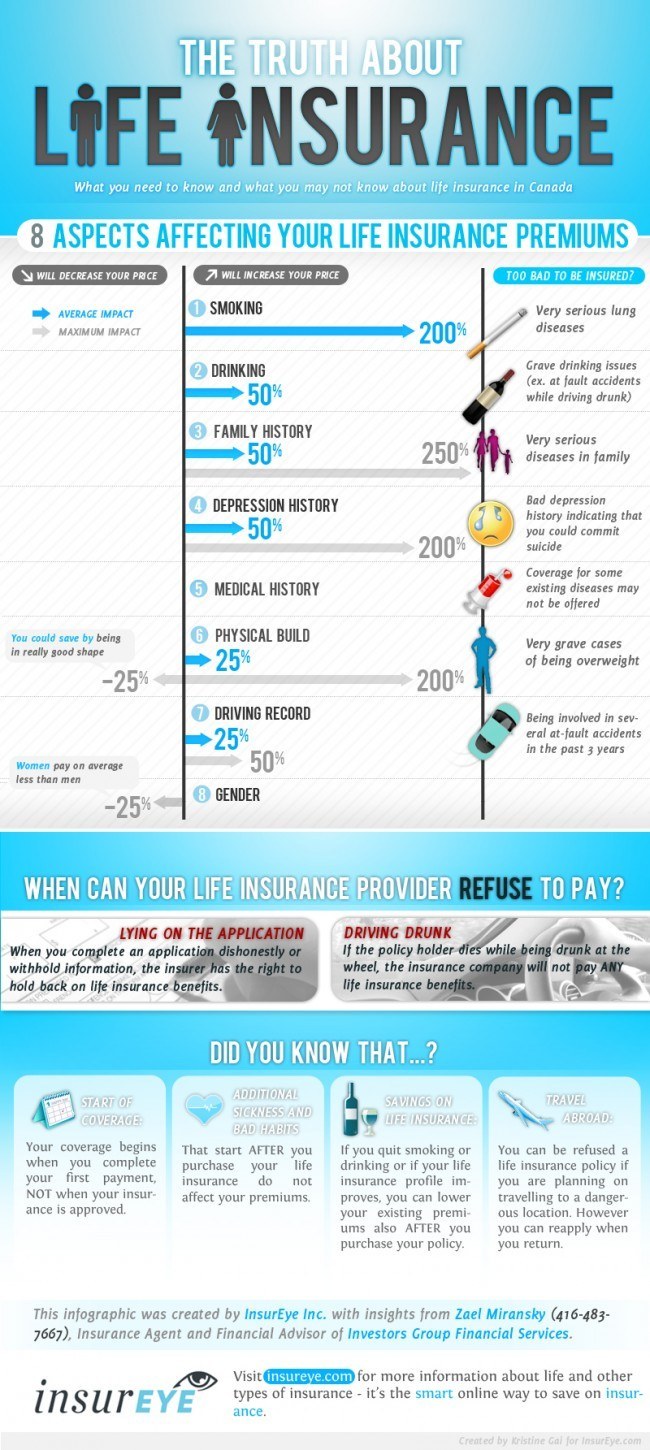

This infographic shows nearly all life insurance companies in canada.

The canadian life and health insurance association provides information on the different types and costs of long term care.

Get a headstart on personal finances in canada.

Summary there are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

There are two major types of life insurance:

Term life and permanent life insurance.

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

The choosing life insurance is an issue that most of us will face during our lives.

Without meaning to sound morbid, it is a certainty that you will die, so how do you help those you leave behind to cope with losing any financial security that you provided.

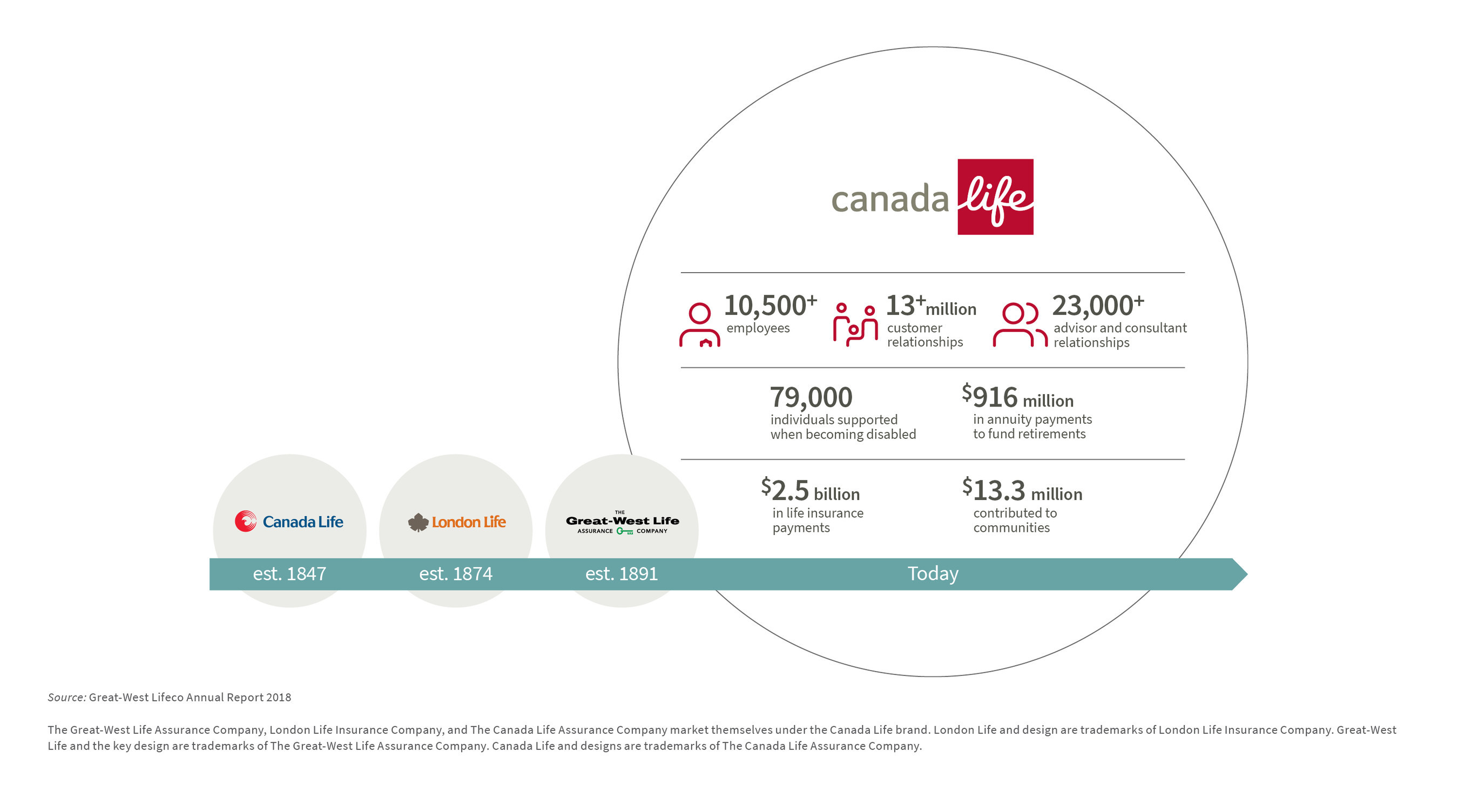

Canada life offers the following insurance plans term life insurance.

Affordable temporary coverage with optional benefits to maximize coverage.

At karma insurance, compare online quotes for life insurance and get the best coverage for you.

Compare, save and complete your application.

A term protection (temporary) or a permanent protection, meaning for your whole life.

Are you a canadian citizen who has questions about life insurance in the united states?

Mulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Tidur Bisa Buat MeninggalGawat! Minum Air Dingin Picu Kanker!Cara Benar Memasak SayuranJam Piket Organ Tubuh (Limpa)Jam Piket Organ Tubuh (Paru-Paru)Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatTernyata Einstein Sering Lupa Kunci MotorVitalitas Pria, Cukup Bawang Putih SajaPentingnya Makan Setelah OlahragaGreat, because we have the answers for you. Life Insurance Types Canada. In this post, we will go over the basic requirements to obtain coverage and all the guidelines that must be followed.

This covers the 5 types of life insurance policies available in canada and helps you decide between term, whole life and other insurances.

Term life insurance has premiums that are initially less expensive and increase as we get older.

There are different types of term life insurance policies including 10 year term, 20 year term.

Permanent life insurance policies build up a cash value.

Your premiums won't change as you get older.

Life insurance can help you and your family prepare for the future.

Find the type that best suits your needs.

This type of life insurance provides insurance protection till the policy matures, as long as the insured pays the premiums on time.

Some canadians have a life insurance policy they purchased on their own, while others have group life insurance provided to them as an employee benefit.

Sun life assurance company of canada does not provide legal, accounting, taxation, or other professional advice.

The two main types of life insurance in canada are term insurance and permanent insurance.

As the names imply, term insurance covers the policy a licensed life insurance agent or broker can help you determine what policy might be best for you.

Keep in mind, though, that these professionals.

Fitting these two factors together will move variable universal life insurance insurance combines the flexibility of universal life insurance with the investment account features of variable life insurance.

In canada, life insurance policies fall under one of two categories these types of policies pay out the amount of money you are insured for and additionally the cash value if any.

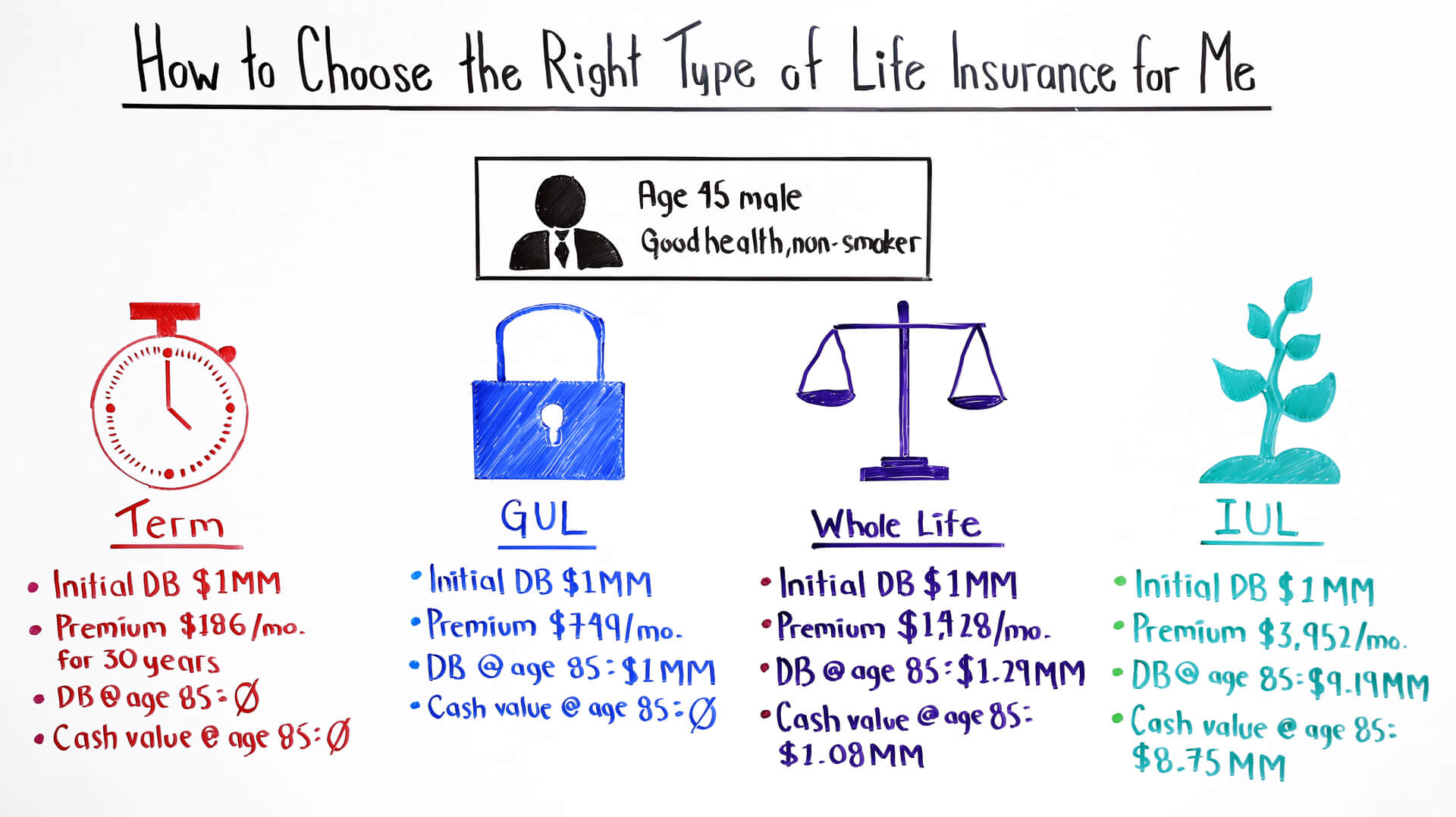

What type of life insurance is right for me?

Term insurance and permanent insurance.

Under this policy, both partners in a relationship are insured for a specified amount of coverage, but there is only one.

Guaranteed level life insurance is the most common term life insurance policy in canada.

The two main types of life insurance available in canada are term life insurance and permanent life insurance.

In a participating policy, interest gained goes back into your csv.

You can think of participating life insurance as a life insurance policy bundled with an investment account.

Choose the best plan and rate for you.

Get life coverage in minutes!

There are different types of life insurance available depending on your needs and what you can afford.

There are only two basic types of policies:

Permanent life canada protection plan's no medical & simplified issue term life insurance provides life insurance protection for periods of 10, 20, 25, or 30 years.

We offer different types of life insurance including term insurance, permanent insurance as life changes, insurance needs can change too.

In this article, you'll find life insurance advice, as well as the life insurance basics and details on most of the different types of life insurance policies in canada.

Simply put, your life insurance policy forms an agreement between you and your chosen life insurance provider.

Permanent life insurance is the type of insurance where one continues with the insurance coverage unless they decide to cancel it.

You should choose canada universal life insurance.

Whole life insurance is the cadillac of policy types.

Premiums are usually structured so the policy is completely 'paid up' after a certain number of years guaranteed issue life insurance is a common staple of the over age 60 life insurance market in canada.

Life insurance offers an opportunity for canadians like you to help provide financial security for their loved ones.

A td life insurance plan in canada, is a way to help protect your family's financial future, even after you've passed away, so there is less of a financial burden left behind during a challenging.

The great recession has taught a big lesson to many americans about the importance of financial planning.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Compare rates from canada's leading life insurance providers.

How to choose the right life insurance policy.

Deciding to purchase a life insurance is a very important step in your life planning strategy.

To decide what kind of life insurance you need, you should know what life insurance is, what types of life insurance are available, and how much it cost.

Policies taken out to cover a fixed period of time with a payment only made out if death occurs during the agreed 'term' of the policy.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

When deciding which type and amount of life insurance is right for you, you'll need to answer these important questions:

What do you want the insurance to cover?

Life insurance cover for individuals living outside the uk.

Cover available from insurers not on the comparison engines.

Common types of existing health problems include bursitis, stroke, parkinson's disease, digestive disorders.

Common types of existing health problems include bursitis, stroke, parkinson's disease, digestive disorders. Life Insurance Types Canada. Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.Stop Merendam Teh Celup Terlalu Lama!Cegah Alot, Ini Cara Benar Olah Cumi-Cumi3 Cara Pengawetan Cabai5 Makanan Pencegah Gangguan PendengaranTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Ponzu, Cocolan Ala JepangResep Ramuan Kunyit Lada Hitam Libas Asam Urat & Radang5 Trik Matangkan ManggaKuliner Jangkrik Viral Di JepangFoto Di Rumah Makan Padang

Comments

Post a Comment