Life Insurance Types With This Type Of Coverage, The Premium Amount Is On Some Types Of Term Life Insurance, The Death Benefit Will Go Down Over Time.

Life Insurance Types. With This Kind Type Of Whole Life Some Types Of Whole Life Policies Allow You To Pay Premiums For Shorter Periods Of Time, Such As 20.

SELAMAT MEMBACA!

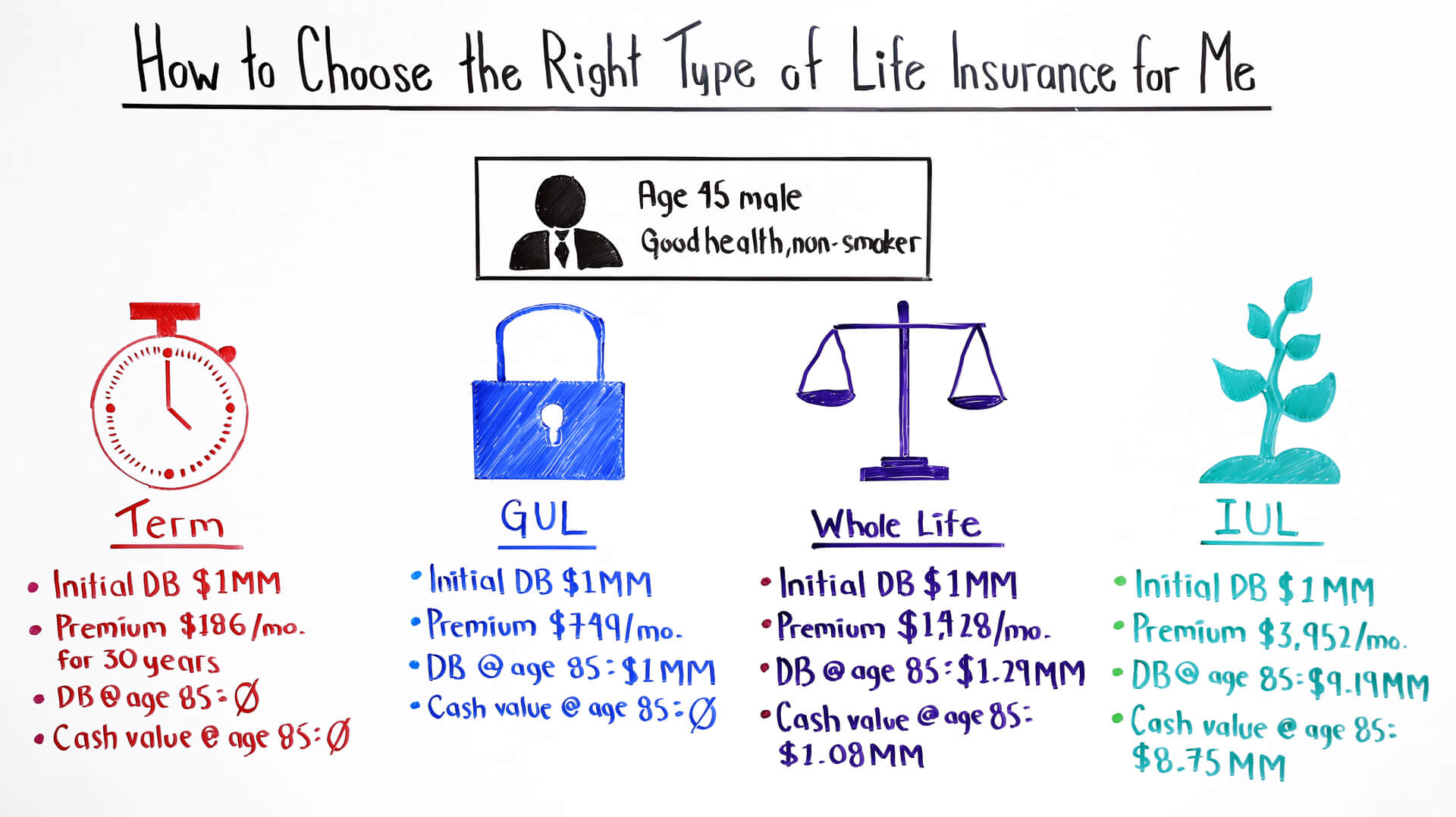

What type of life insurance is best for you?

Understanding the types of life insurance policies doesn't have to be complicated.

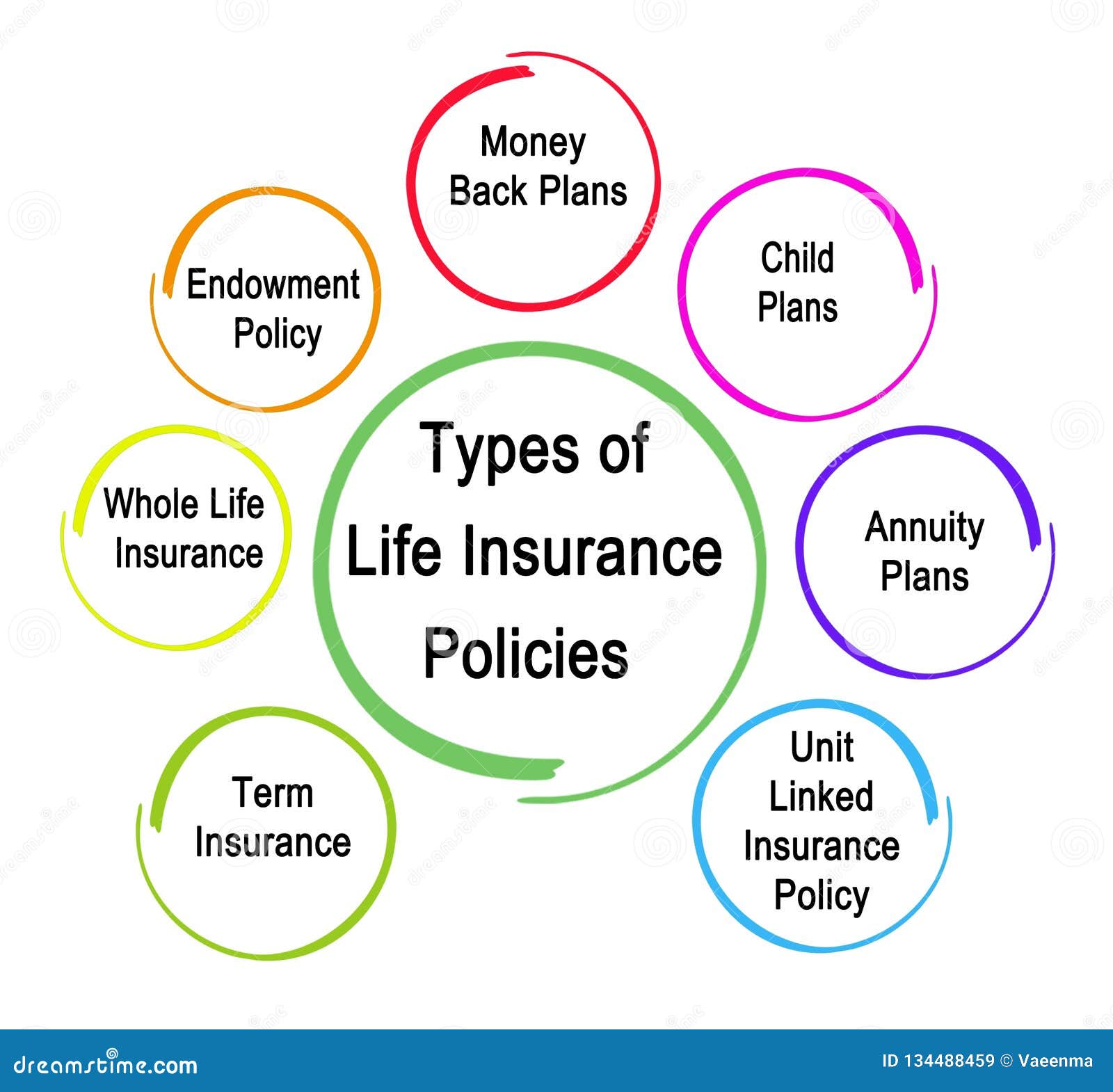

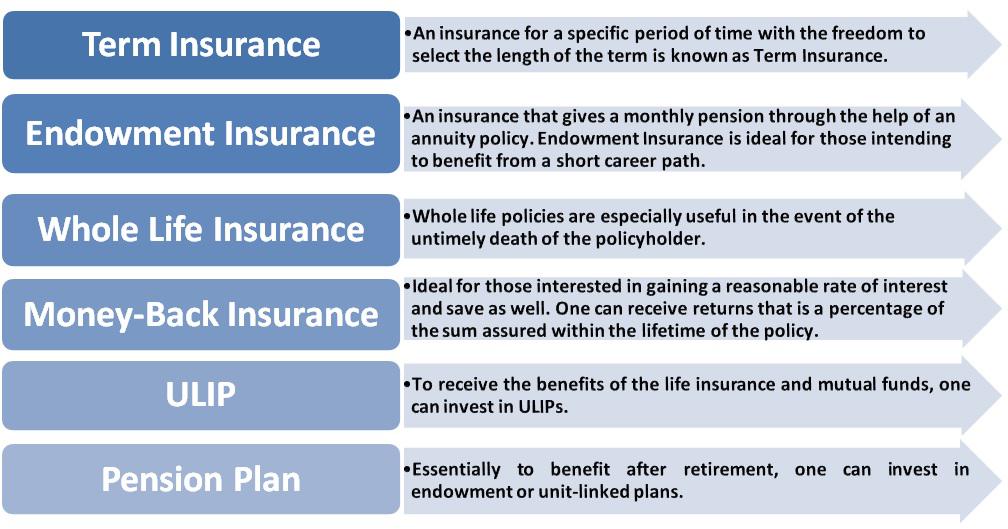

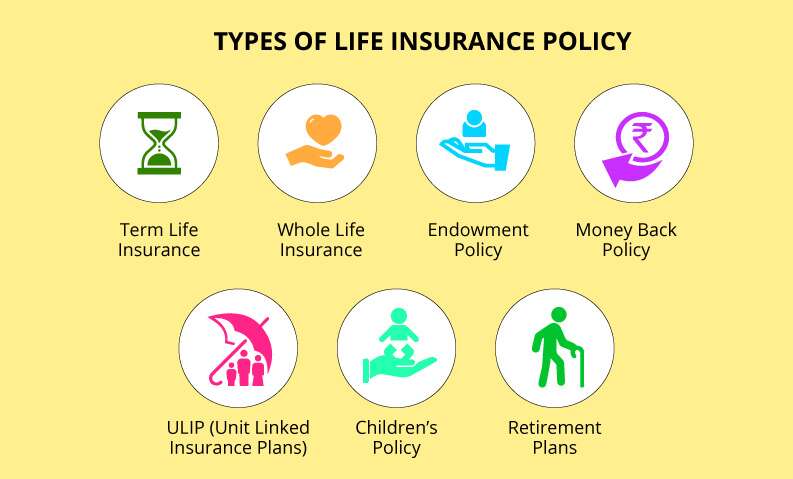

There are many types of life insurance policies that can help protect your family, and they all fall into two main.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

When deciding which type and amount of life insurance is right for you, you'll need to answer these.

Learn about the different types of life insurance coverage to help you narrow your policy options.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Learn the differences of life insurance from protective life!

There are three common types of permanent insurance policies

Learn about term, whole life.

There are many types of life insurance options available for you and your family.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

The most common type of whole life insurance is ordinary life.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same.

The many types of life insurance available can be overwhelming.

Another important question to ask may be for how long.

The simplest type of permanent life insurance coverage is whole life.

With this type of coverage, the premium amount is on some types of term life insurance, the death benefit will go down over time.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type of life insurance is best for your family's needs.

The two main types of life insurance.

The company has to provide your family or other beneficiaries with a certain.

Rop term life insurance is a specialized type of term life.

With this type of policy, at the end of a guaranteed period, you can receive a refund of all the premiums you have paid.

Some companies don't offer all types of coverage.

So, if you call up a typical agency you are only going to be able to get.

Choosing the right life insurance policy depends on many factors, including the length of the policy, how much learn about the different types of life insurance to decide which one meets your needs.

Final expense and burial insurance are both types of whole life insurance policies that focus on people.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

This post will help you make sense of all of your life insurance choices.

In addition to traditional term life insurance and permanent life insurance, there are several other types of life and health insurance available.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium.

So, how many different types of life insurance are there in today's marketplace?

Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life.

These types of life insurance bundle you and your spouse into one policy under which you pay joint premiums in order to insure both of your lives under one policy.

Ternyata Mudah Kaget Tanda Gangguan MentalTernyata Tidur Terbaik Cukup 2 Menit!Awas, Bibit Kanker Ada Di Mobil!!Mana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Multi Guna Air Kelapa HijauManfaat Kunyah Makanan 33 KaliCegah Celaka, Waspada Bahaya Sindrom HipersomniaSegala Penyakit, Rebusan Ciplukan ObatnyaTips Jitu Deteksi Madu Palsu (Bagian 1)Mulai Sekarang, Minum Kopi Tanpa Gula!!Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life. Life Insurance Types. These types of life insurance bundle you and your spouse into one policy under which you pay joint premiums in order to insure both of your lives under one policy.

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Understanding the types of life insurance policies doesn't have to be complicated.

In a term policy, it's defined as a specific number of years, such as 10, 20, or 30.

A permanent policy lasts for the life of the insured, for whole life as long as premiums are paid, and for universal life as long as the policy is.

What are the differences between term life & permanent life?

Who will benefit from term life?

Types of term life insurance.

In most types of term insurance, including homeowners and auto insurance, if you haven't had a claim under the policy by the time it expires, you get no refund of the premium.

Your premium bought the protection that you had but didn't need, and you've received fair value.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

Pays the people you choose—your spouse, children, or other beneficiaries—a fixed amount of money if you die.

Term life insurance is a life insurance policy that covers the policyholder for a specific term, or amount of time.

Some types of life insurance policies require a medical examination.

Term life insurance actually gets the name from the fact that it is life insurance purchased to cover you for a specified period or term.

Those other types are decreasing term and yearly (or annually) renewable term insurance.

The vast majority of term life insurance sold today is level term.

Term life insurance policies are the simplest, most popular, and the most often purchased;

But, in the life insurance menu of options, it's not the only choice.

Today, there is a wide variety of life insurance policies available, the most basic of which are term and permanent.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

There are five types of term life insurance, each following a basic model of coverage for a set period of time.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance types fall into two main buckets:

Term life insurance and permanent life insurance (also referred to as whole.

It covers a specific time period, and is usually purchased to cover the financial needs of children and surviving spouse until the children are grown.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

Coverage for a specific period of time, like until you reach retirement or your children are grown.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

Term life insurance is the best life insurance policy for applicants looking to obtain the largest amount of insurance for the lowest possible cost.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type term life can provide the most coverage for the least amount of money.

More complex types of life insurance exist to address more complex needs.

Compared to other types of life insurance, term life tends to be the least expensive coverage.

Thanks for reading our article, life insurance types explained.

Would you'd like to learn more about this subject?

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Life insurance has different options that protect you and your future.

Read this informative article on the differences between whole, universal and term life insurance policies and how some life insurance options can earn cash value.

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance term life insurance is a life cover policy that runs for a specified amount of time, or 'term'.

What is term life insurance?

There's nothing too complicated about term policies.

1 full underwriting for new contracts will be required if a type c death benefit option is requested.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense.

Its purpose is to make sure the mortgage is paid up if you were to die while you still owed money.

It's a decreasing benefit, factoring in your repayments over the course of the loan.

Here, you're buying a policy that pays a stated, fixed a term policy is straight insurance with no investment component. Life Insurance Types. You're buying life coverage that lasts for a set period of time provided you pay.Nanas, Hoax Vs FaktaSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat Ramadhan3 Jenis Daging Bahan Bakso TerbaikStop Merendam Teh Celup Terlalu Lama!Cegah Alot, Ini Cara Benar Olah Cumi-CumiResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangNikmat Kulit Ayam, Bikin SengsaraKuliner Jangkrik Viral Di JepangResep Beef Teriyaki Ala CeritaKulinerIkan Tongkol Bikin Gatal? Ini Penjelasannya

Comments

Post a Comment