Life Insurance Types Wikipedia Life Insurance (or Life Assurance, Especially In The Commonwealth Of Nations) Is A Contract Between An Insurance Policy Holder And An Insurer Or Assurer.

Life Insurance Types Wikipedia. Understanding The Types Of Life Insurance Policies Doesn't Have To Be Complicated.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

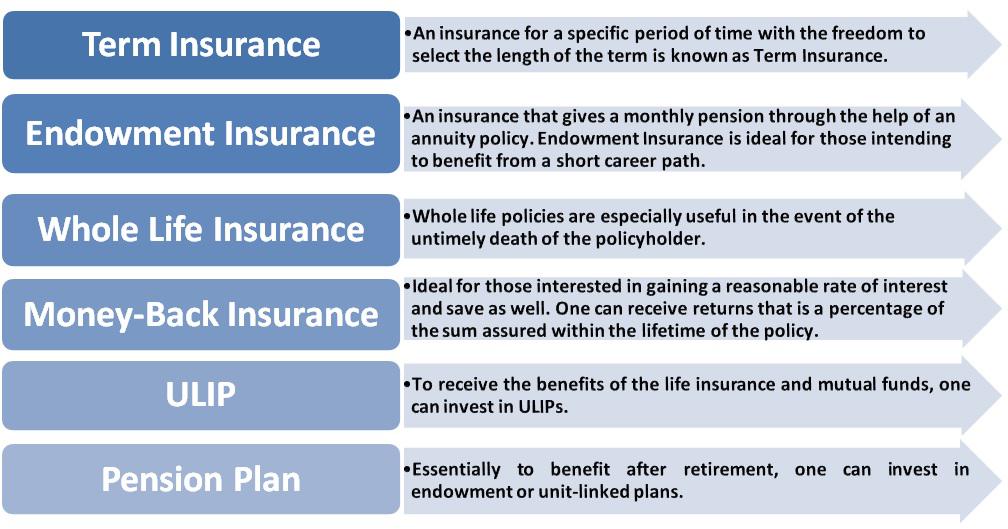

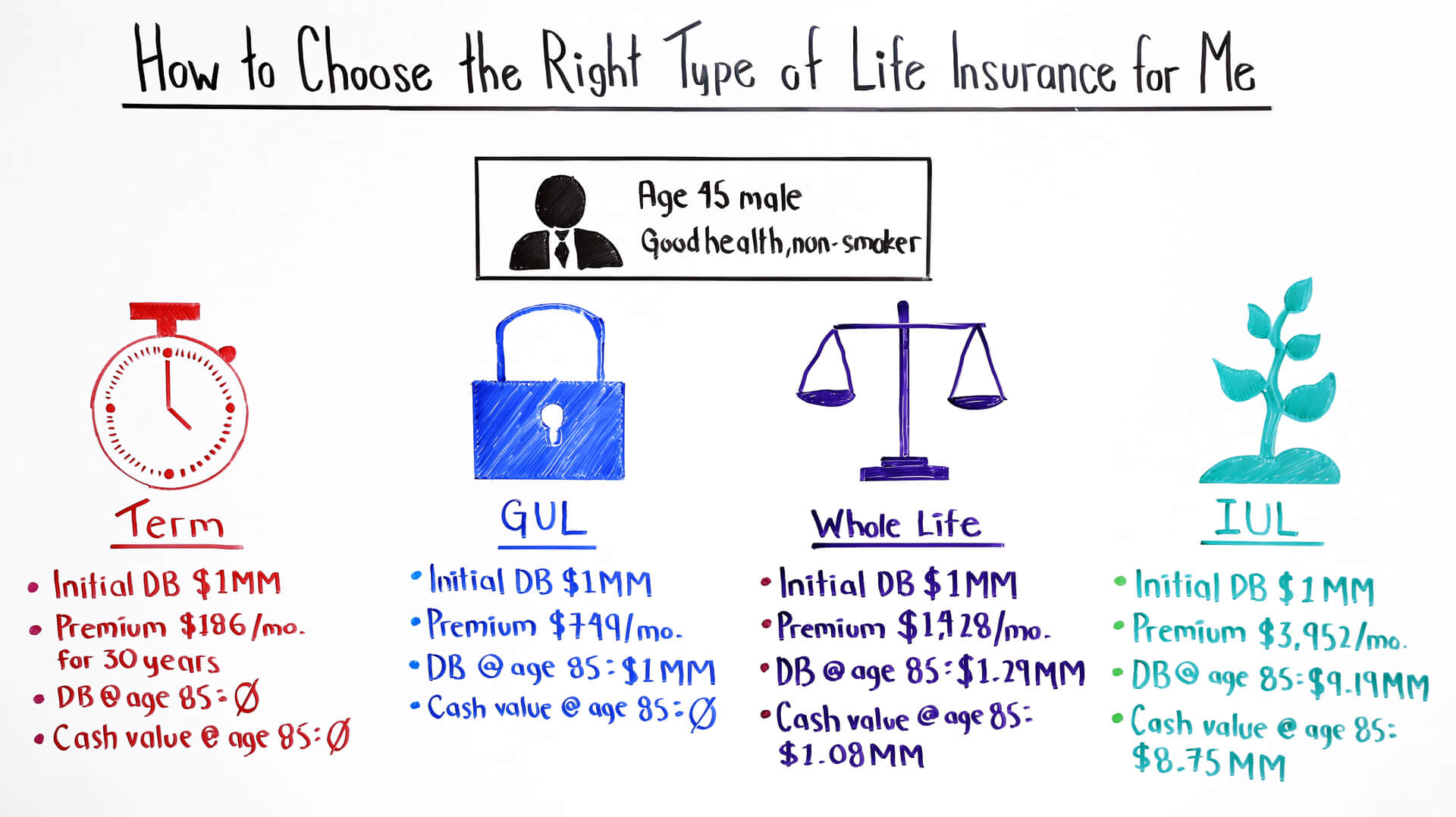

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

Best life insurance best term life insurance companies best senior life insurance companies compare life insurance quotes cheap life insurance guide to whole life read this next.

What happens if your insurance company goes out of business?

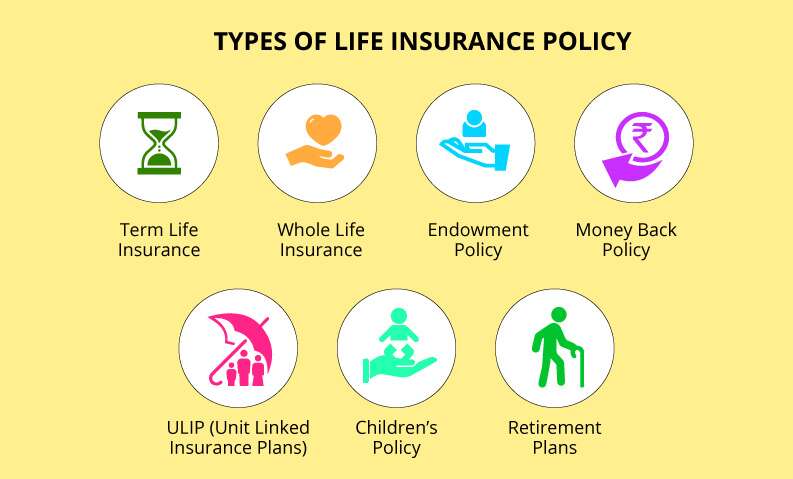

Types of life insurance policies.

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

Universal life—a type of permanent life insurance with a cash value component that earns interest, universal life insurance has premiums that are.

There are different kinds of life insurance to suit people's different needs.

Find out what's right for you.

There are many types of life insurance policies that can help protect your family, and they all fall into two main.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

You need the security of insurance.

Insurance companies and the types of services they offer.

An insurance company primarily offers insurance services to clients.

Insurance, as defined by wikipedia, is a means of protection from any kind of loss, be it the loss of life, or of property.

Answering those questions can help you understand which type of life insurance would work for your situation.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

The most common type of permanent life insurance is whole life insurance.

So, how many different types of life insurance are there in today's marketplace?

It's really almost like a trick question because each insurance company has created a variety of unique product names.

This can make things very confusing for people that are trying to compare contracts.

The two main categories of life insurance are term life and permanent life.

Within each are different types of policies.

Find out which one suits you.

Life insurance has different options that protect you and your future.

Learn the differences of life insurance from protective life!

In contrast, permanent life insurance policies don't have a set expiration date.

These are special types of life insurance policies which help parents build a corpus to fund their child's higher education or marriage.

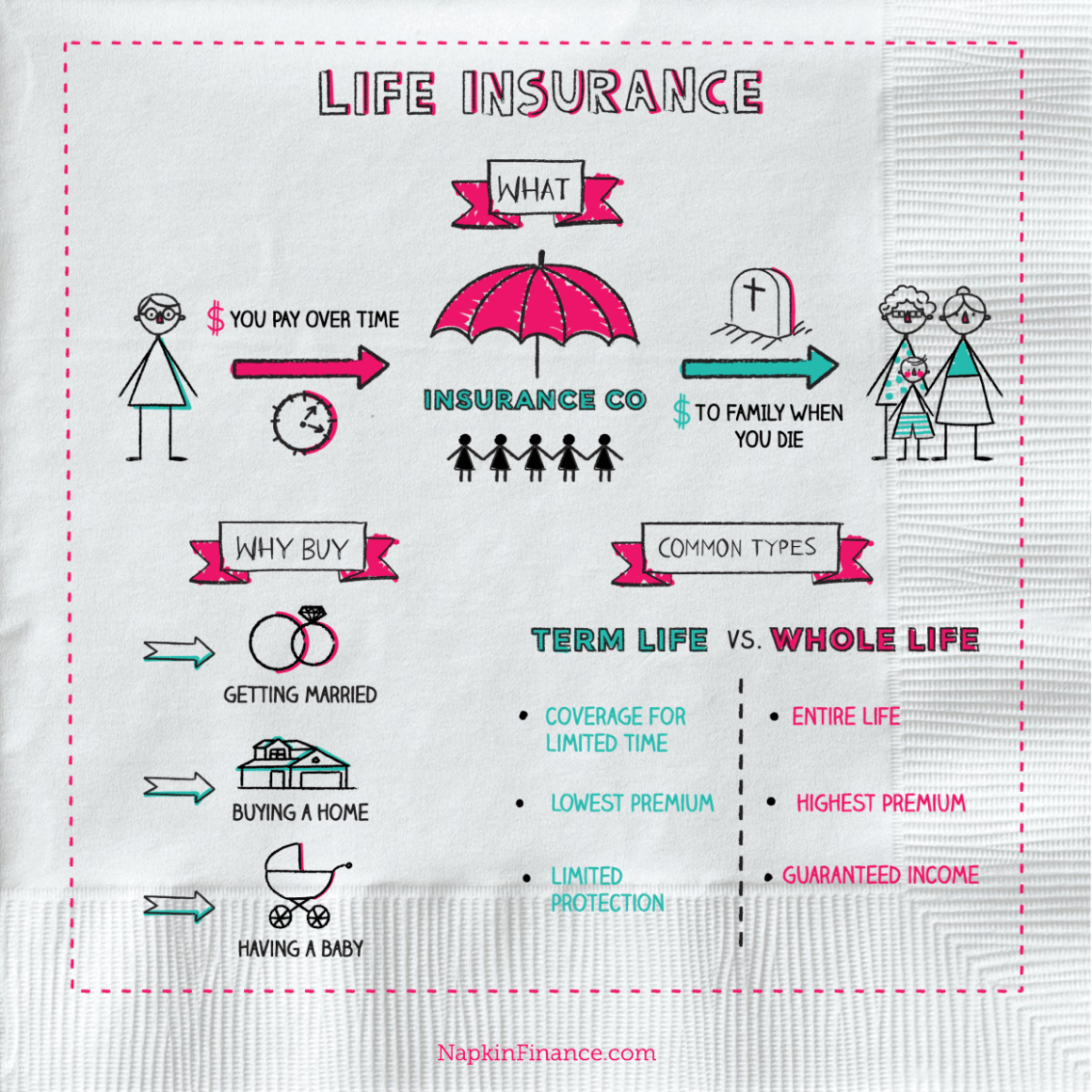

Term life and whole life insurance explained with chart and infographics in pdf.

When you buy life insurance , you sign a contract with an insurance company.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

Permanent life insurance products include whole life, universal life, variable life, and combination life.

We'll explain each of these products soon.

The most common are term, whole life and universal life insurance.

We can help you choose.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

With so many different types of life insurance, choosing a policy can feel overwhelming.

Bank is here to help break them down for you — and a financial advisor show you how to incorporate insurance into a overall wealth plan.

Yearly renewable term, once popular, is no longer a top seller.

Most companies will not sell term insurance to an applicant for a term that ends past his or her 80th.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Understand the two different types of life insurance.

We explain the difference between term & permanent.

Ternyata Tertawa Itu Duka5 Manfaat Meredam Kaki Di Air EsCara Benar Memasak SayuranTips Jitu Deteksi Madu Palsu (Bagian 1)Ini Cara Benar Cegah HipersomniaTernyata Tahan Kentut Bikin KeracunanTernyata Menikmati Alam Bebas Ada ManfaatnyaAwas, Bibit Kanker Ada Di Mobil!!5 Olahan Jahe Bikin SehatTernyata Pengguna IPhone = Pengguna NarkobaCompare your life insurance type understanding the different types of life insurance policies is an intimidating task, that's what you may think. Life Insurance Types Wikipedia. But, once you know that there are only two.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

Best life insurance best term life insurance companies best senior life insurance companies compare life insurance quotes cheap life insurance guide to whole life read this next.

What happens if your insurance company goes out of business?

Types of life insurance policies.

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

Universal life—a type of permanent life insurance with a cash value component that earns interest, universal life insurance has premiums that are.

There are different kinds of life insurance to suit people's different needs.

Find out what's right for you.

There are many types of life insurance policies that can help protect your family, and they all fall into two main.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

You need the security of insurance.

Insurance companies and the types of services they offer.

An insurance company primarily offers insurance services to clients.

Insurance, as defined by wikipedia, is a means of protection from any kind of loss, be it the loss of life, or of property.

Answering those questions can help you understand which type of life insurance would work for your situation.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

The most common type of permanent life insurance is whole life insurance.

So, how many different types of life insurance are there in today's marketplace?

It's really almost like a trick question because each insurance company has created a variety of unique product names.

This can make things very confusing for people that are trying to compare contracts.

The two main categories of life insurance are term life and permanent life.

Within each are different types of policies.

Find out which one suits you.

Life insurance has different options that protect you and your future.

Learn the differences of life insurance from protective life!

In contrast, permanent life insurance policies don't have a set expiration date.

These are special types of life insurance policies which help parents build a corpus to fund their child's higher education or marriage.

Term life and whole life insurance explained with chart and infographics in pdf.

When you buy life insurance , you sign a contract with an insurance company.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

Permanent life insurance products include whole life, universal life, variable life, and combination life.

We'll explain each of these products soon.

The most common are term, whole life and universal life insurance.

We can help you choose.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

With so many different types of life insurance, choosing a policy can feel overwhelming.

Bank is here to help break them down for you — and a financial advisor show you how to incorporate insurance into a overall wealth plan.

Yearly renewable term, once popular, is no longer a top seller.

Most companies will not sell term insurance to an applicant for a term that ends past his or her 80th.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Understand the two different types of life insurance.

We explain the difference between term & permanent.

Compare your life insurance type understanding the different types of life insurance policies is an intimidating task, that's what you may think. Life Insurance Types Wikipedia. But, once you know that there are only two.Sejarah Gudeg JogyakartaWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Resep Ayam Suwir Pedas Ala CeritaKulinerKuliner Legendaris Yang Mulai Langka Di Daerahnya5 Cara Tepat Simpan TelurIkan Tongkol Bikin Gatal? Ini PenjelasannyaPecel Pitik, Kuliner Sakral Suku Using BanyuwangiResep Cream Horn PastryResep Ayam Kecap Ala CeritaKulinerResep Beef Teriyaki Ala CeritaKuliner

Comments

Post a Comment