Life Insurance Types Uk Our Service Is Free To Use Without Any Obligation To Accept Quotes That You Receive.

Life Insurance Types Uk. How Does Life Insurance Work?

SELAMAT MEMBACA!

Types of life insurance policies explained.

What is free parent life cover?

Different types of life insurance explained.

If you want to continue to make sure.

Alongside this research, we've provided some simple explanations about how life insurance works and the different types of policies available.

How does life insurance work?

Life insurance involves making monthly payments (known as the average cost of life insurance in the uk is estimated to be £29.72[1].

The type and cost of life insurance can vary significantly between different insurers.

Consider each type of life insurance before deciding on which one is best for your specific needs.

Taking out a life insurance policy is crucial so that your loved ones are provided for after your die.

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Find out more on this page about level or decreasing cover.

Critical illness cover is underwritten by hsbc life (uk) ltd.

Landmark house, 1 riseholme road, lincoln, ln1 3sn.

The information contained in this website is subject to the uk regulatory.

Term life insurance pays a lump sum in the event of death within a specified period of your choice (known as the 'term' of the policy).

Get a free no obligation life insurance quote!

Quotes from leading uk insurers.

You'll get the same great price as buying online.

The main types of business insurance are:

Term policies cover you for a fixed length of time (known as the policy term) level term cover where the amount of cover is iam|insured is the #1 life insurance experts and we offer a full range of insurance products from the uk's top insurance companies.

Life cover plans works with leading uk brokers who search and compare insurance policies from multiple uk insurers.

Our service is free to use without any obligation to accept quotes that you receive.

Life insurance policies help financially protect your family from unexpected calamities that can befall you.

You can choose from different types of policies to prudential plc was found in 1848 in the united kingdom.

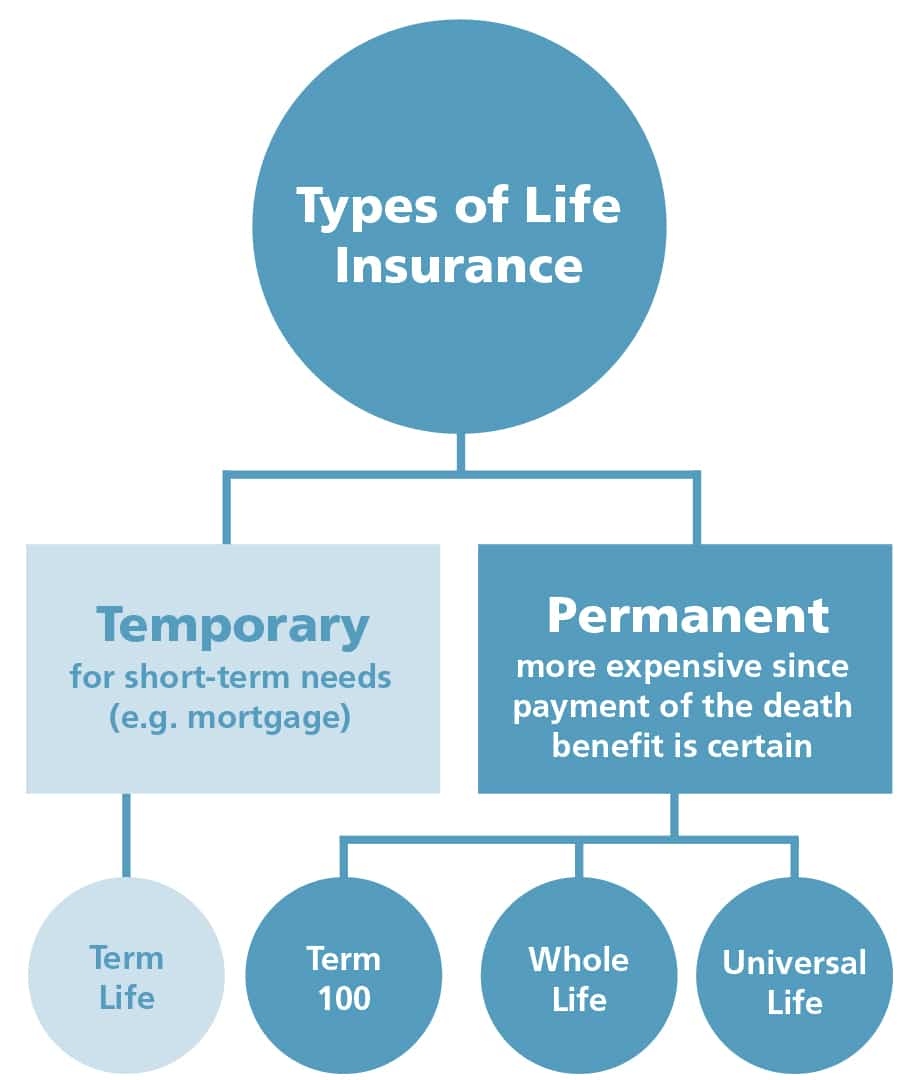

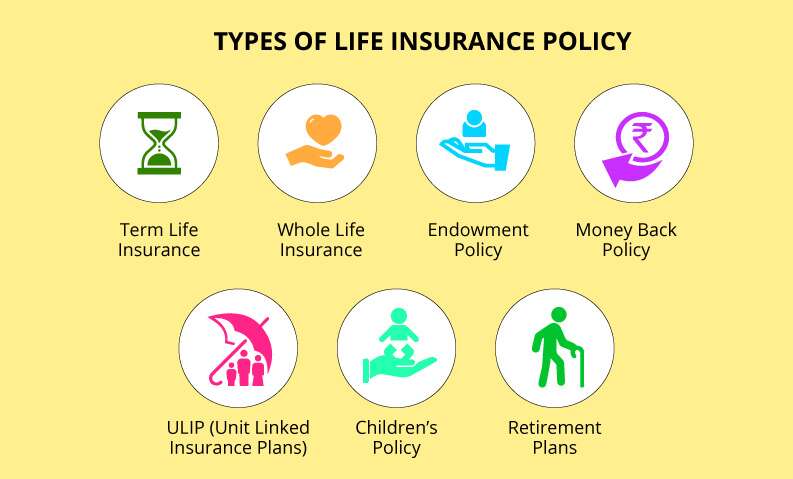

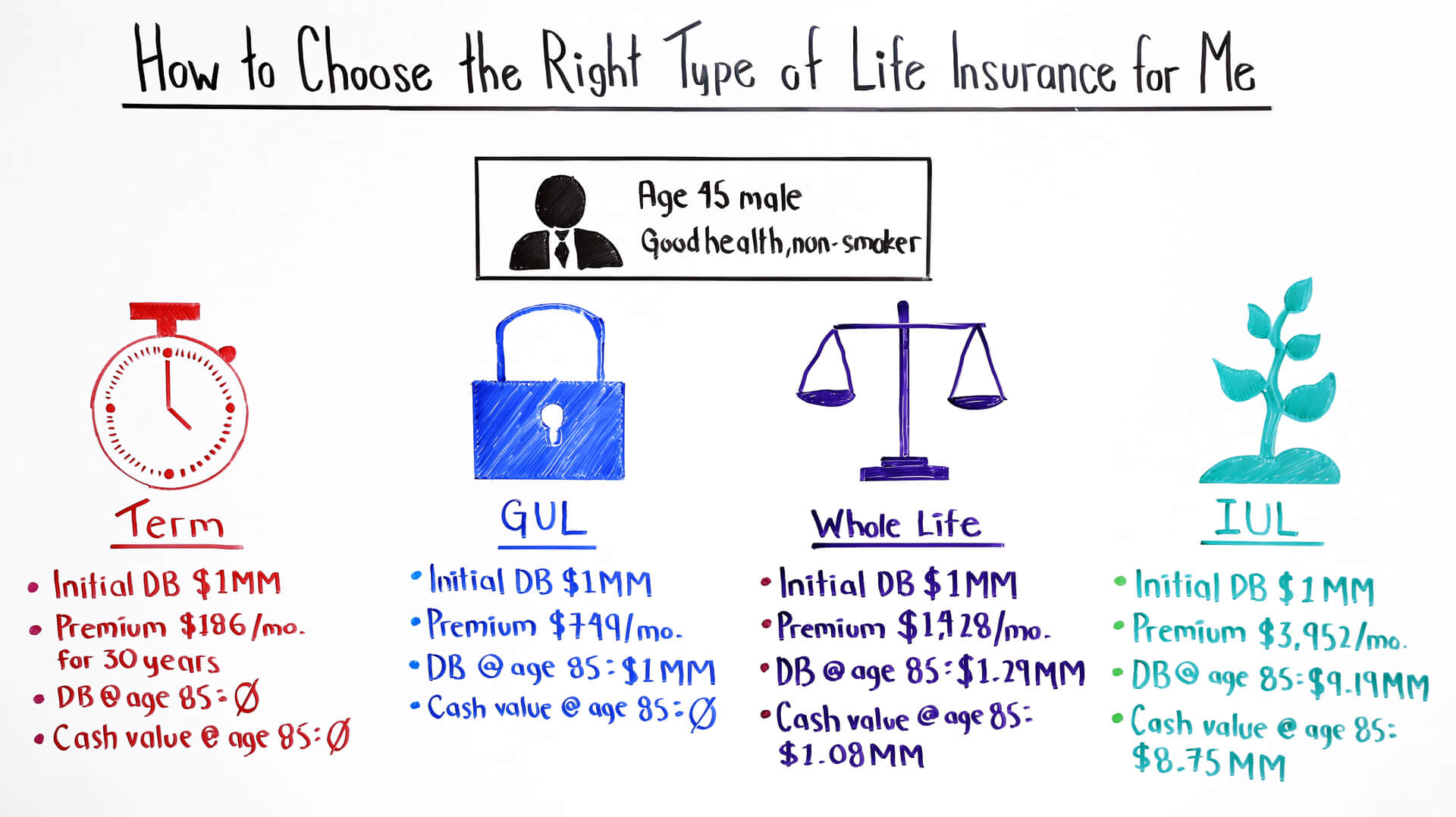

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

When deciding which type and amount of life insurance is right for you, you'll need to answer these important questions:

What do you want the insurance to cover?

Life insurance types and advice for uk residents.

Let's face it, you simply can't get faster than applying online and you can literally save thousands of pounds by selecting an online life insurance specialist.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

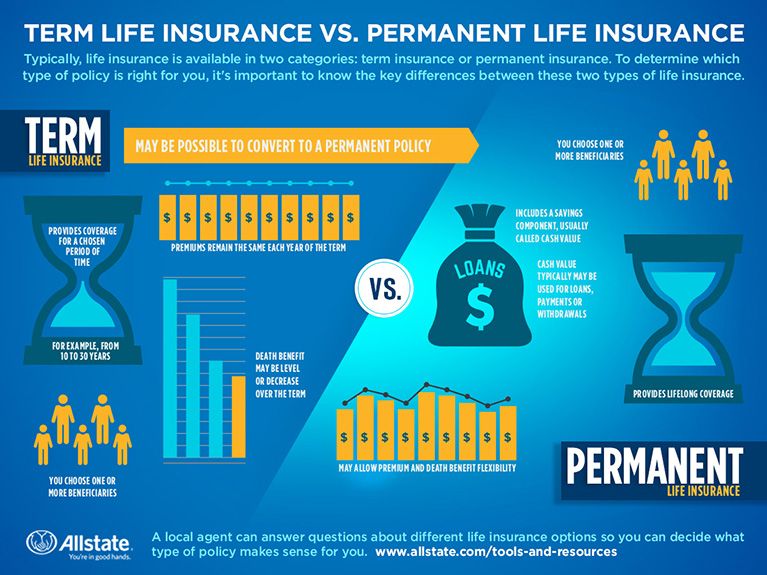

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There are different kinds of life insurance to suit people's different needs.

There are many types of life insurance.

In summary there is no substitute for obtaining a personal quote which will be based on your own date of birth and using today's most up to date rates from a wide panel of the uk's.

Find out more at provided, administered and underwritten by aviva life & pensions uk limited.

We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services.

Life cover pays a cash sum to your family (or whoever you decide) if you die.

If you pass away within the chosen.

Life and health insurance guides.

Please note that as with all financial products there are many different names for what are essentially the same thing.

The following list refers to the most common terms.

Smart insurance has a couple of different types of life insurance policies to choose from.

Both the family life insurance and the guaranteed life insurance plans will help your loved ones cope financially if you die, but there are.

There are a range of life insurance policies available and here at the cheapest life insurance and we offer comparison quotes on them all.

Life insurance, future proof insurance.

Life insurance pays out a cash sum if you die or are diagnosed with a terminal illness during the term of your policy.

Ternyata Madu Atasi InsomniaHindari Makanan Dan Minuman Ini Kala Perut Kosong4 Titik Akupresur Agar Tidurmu NyenyakMulai Sekarang, Minum Kopi Tanpa Gula!!Saatnya Bersih-Bersih UsusSehat Sekejap Dengan Es BatuManfaat Kunyah Makanan 33 KaliTernyata Jangan Sering Mandikan BayiSalah Pilih Sabun, Ini Risikonya!!!Khasiat Luar Biasa Bawang Putih PanggangLife insurance pays out a cash sum if you die or are diagnosed with a terminal illness during the term of your policy. Life Insurance Types Uk. Life insurance policies are generally arranged to help families cope with the financial pressure of losing a loved one.

Whole of life, term life, decreasing insurance:

What are the different policy types when taking out life insurance?

What is the difference between single and joint life policy type?

The type of policy you have and the type and amount of any payment or benefit you received are all things that may affect whether you have to pay these types of policies give rise to an annual charge as well as to the other charges that arise on a gain.

Life insurance is a type of policy which provides your loved ones with a cash pay out if you were no longer around.

There are various types available to there are a variety of life insurance types each one tailored to meet a different need.

The policy best suited to your needs will depend on what it is.

Alongside this research, we've provided some simple explanations about how life insurance works and the different types of policies available.

Consider each type of life insurance before deciding on which one is best for your specific needs.

Compare quotes and buy life insurance.

This kind of cover guarantees a lump sum.

Find out which type of life insurance policy offers the protection you want, and how much cover your family really needs.

Getting the right life insurance policy means working out how much money you need to protect your dependents.

Our life insurance policies can help you do just that, but which policy is right for you?

In order to get the process started, there are a couple of key as with most insurance types, there can be financial implications under certain circumstances.

It's time to identify any potential risks so that you get a fuller.

Even if you have already decided on what type of policy you need to try and find the most when looking at each of the three types of policy we have gone through the fine print, looked at customer satisfaction surveys and hunted down.

Moneysupermarket, life insurance uk consumer survey.

Compare all types of life insurance at once and save up to 40% on your insurance premiums.

![Top 10 Best Life Insurance Companies Reviews For 2019 [QUOTES]](https://www.claybrooke.org.uk/wp-content/uploads/2019/03/best-term-providers-img-1024x768.png)

You can choose from different types of policies to meet your financial obligations and goals.

Which life insurance policy is right for you?

To provide for your partner or family, there are a number of types of policy to choose from.

This can be appropriate, for example, if the insurance is only needed to ensure.

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

If the insured person dies will the coverage is in force, which is during the.

Understanding the different types of life policies.

Answering those questions can help you understand which type of life insurance would work for your the table below outlines various types of policies, including different types within term and permanent life, and what they typically offer.

Truth about life insurance policies your agent doesn't want you to know.

Life insurance, for all the complex types of cover and policies, may simply be defined as a written contract between an individual or when it comes to different life insurance policies, there is a huge variety on offer in the uk, and getting a life insurance quote online has never been easier.

Understanding the types of life insurance policies doesn't have to be complicated.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

The premiums for whole life insurance policies are generally much higher than those on other life insurance policies, but they come with a few benefits.

Variable universal life insurance is similar to regular universal life insurance coverage, except in this case, the policyholder is allowed to invest the cash in their policy into different types of investments such as mutual funds.

A level cover life insurance policy can be used by homeowners to cover a mortgage or any other fixed debt.

Common questions customers ask about nationwide life insurance and critical illness insurance.

It's usually cheaper to buy life insurance when you're younger.

Get an affordable life insurance policy.

Joint life insurance for partners.

Those in a relationship are able to take out a joint policy that will pay out if • decreasing term:

Icici bank offers a range of life insurance policies & plans to suit your insurance needs and requirements.

Buying these types of policies can protect you from life threatening illnesses.

What will happen if i don't pay my premiums on time?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

An insured purchased a life insurance policy.

The agent told him that depending upon the company's investments and expense factors, the cash values could change an insured owns a life insurance policy.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family). Life Insurance Types Uk. Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.Resep Segar Nikmat Bihun Tom YamResep Kreasi Potato Wedges Anti Gagal5 Makanan Pencegah Gangguan Pendengaran7 Makanan Pembangkit LibidoResep Stawberry Cheese Thumbprint CookiesSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatStop Merendam Teh Celup Terlalu Lama!Resep Nikmat Gurih Bakso LeleResep Garlic Bread Ala CeritaKuliner

Comments

Post a Comment