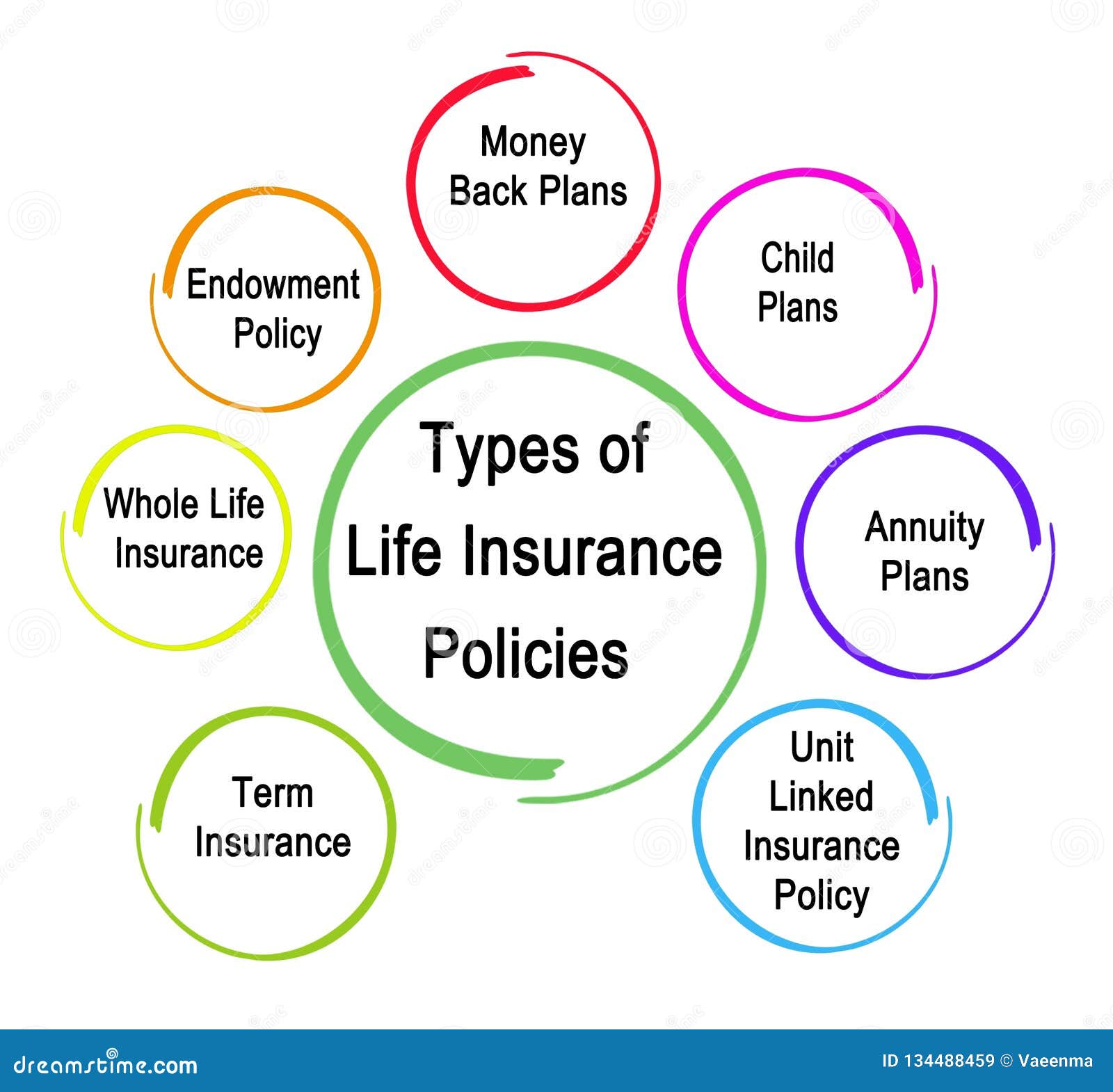

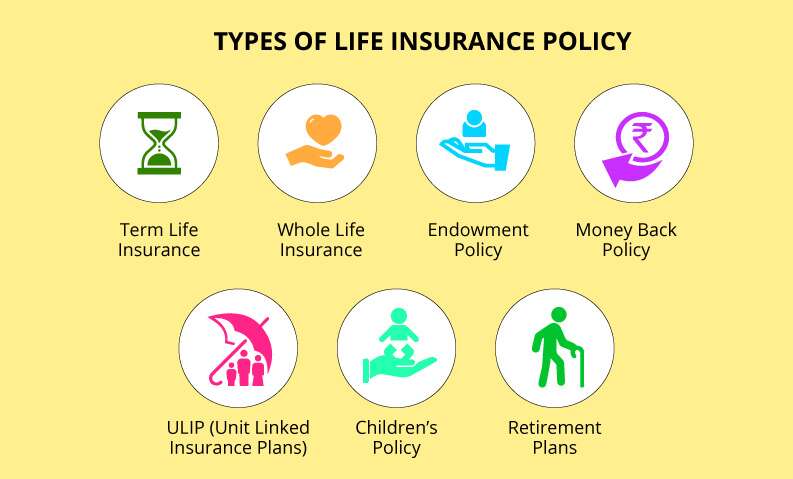

Life Insurance Types There Are Many Types Of Life Insurance Policies That Can Help Protect Your Family, And They All Fall Into Two Main.

Life Insurance Types. Buying Life Insurance Shouldn't Be Complicated.

SELAMAT MEMBACA!

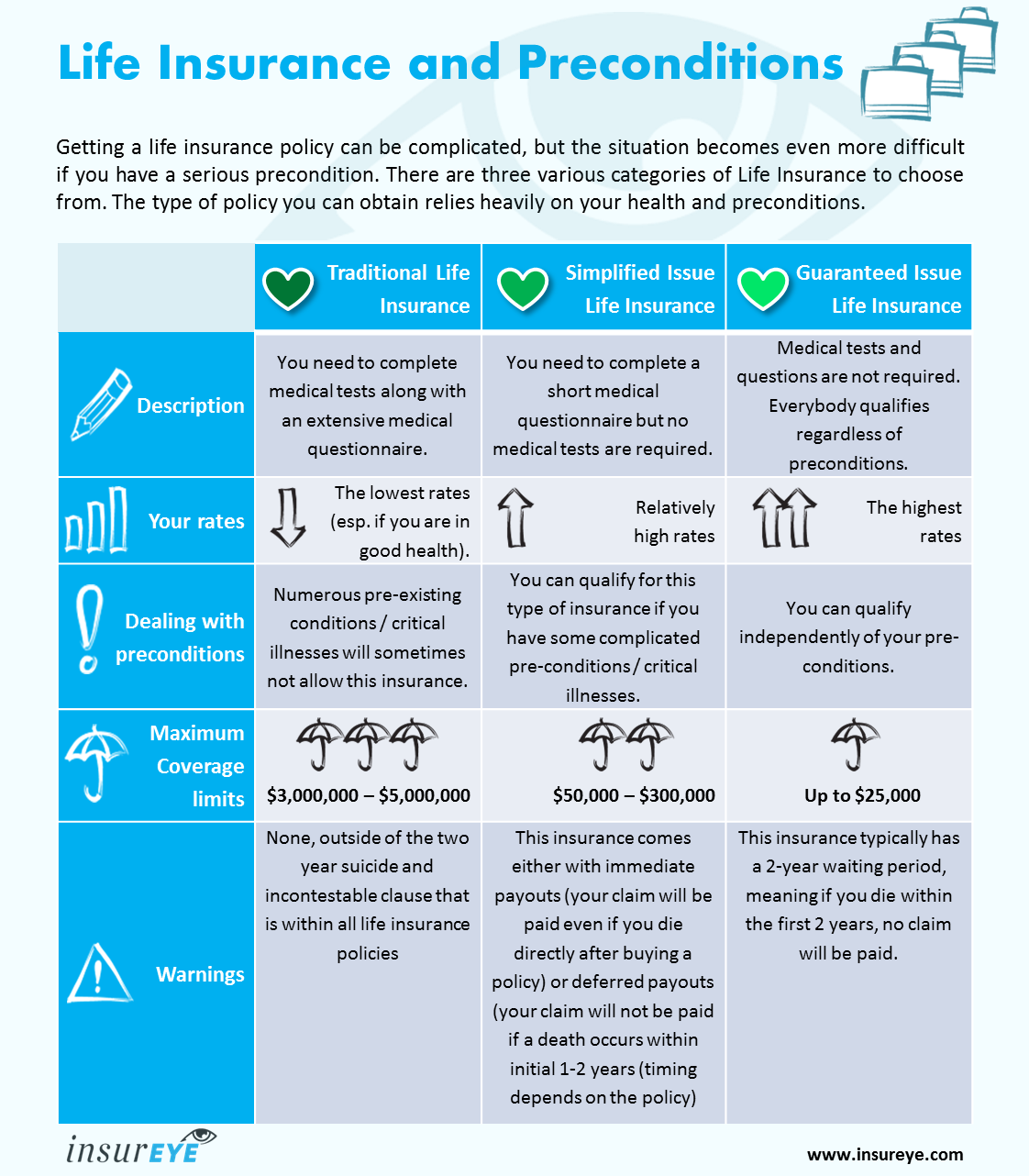

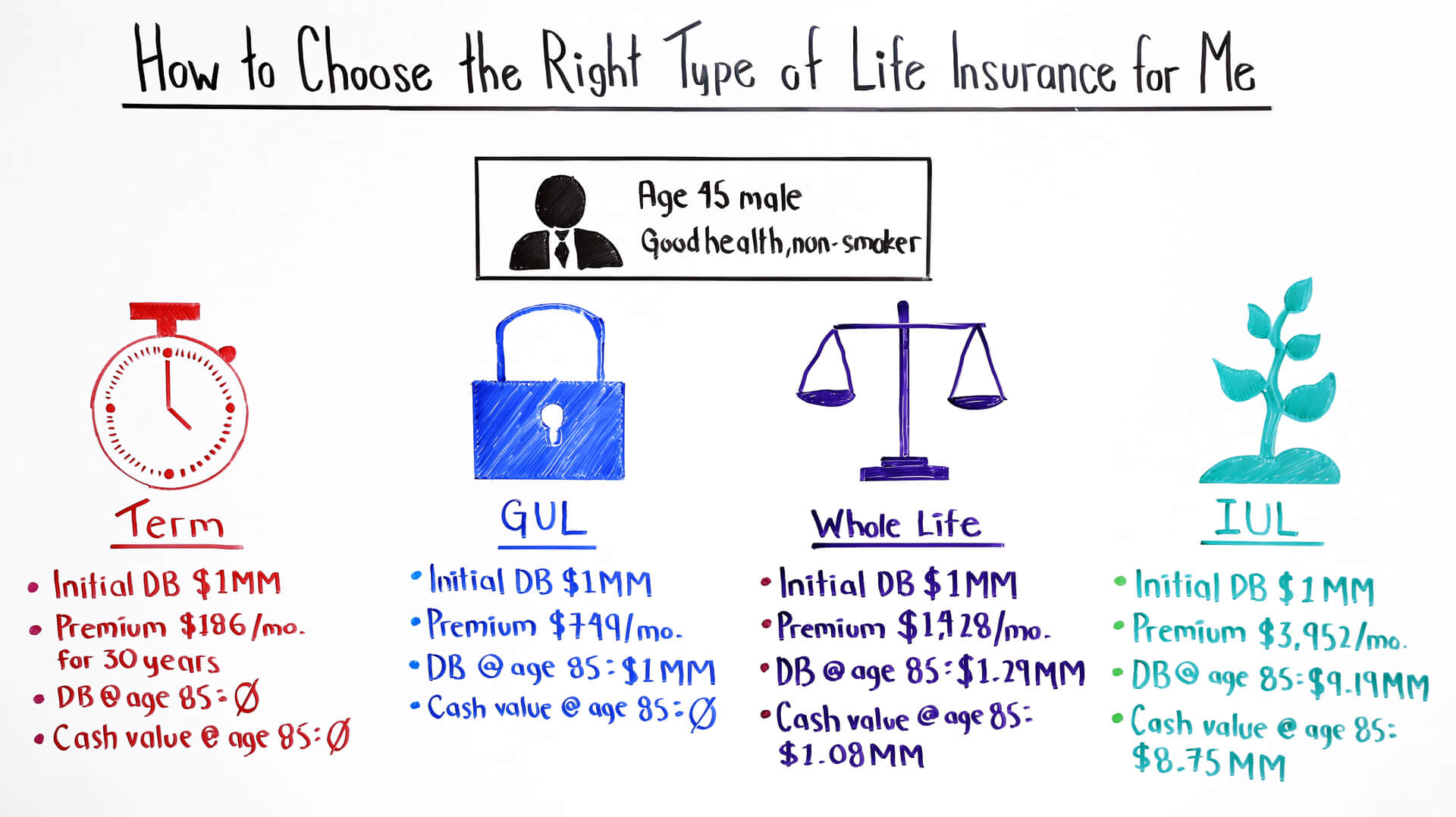

What type of life insurance is best for you?

Understanding the types of life insurance policies doesn't have to be complicated.

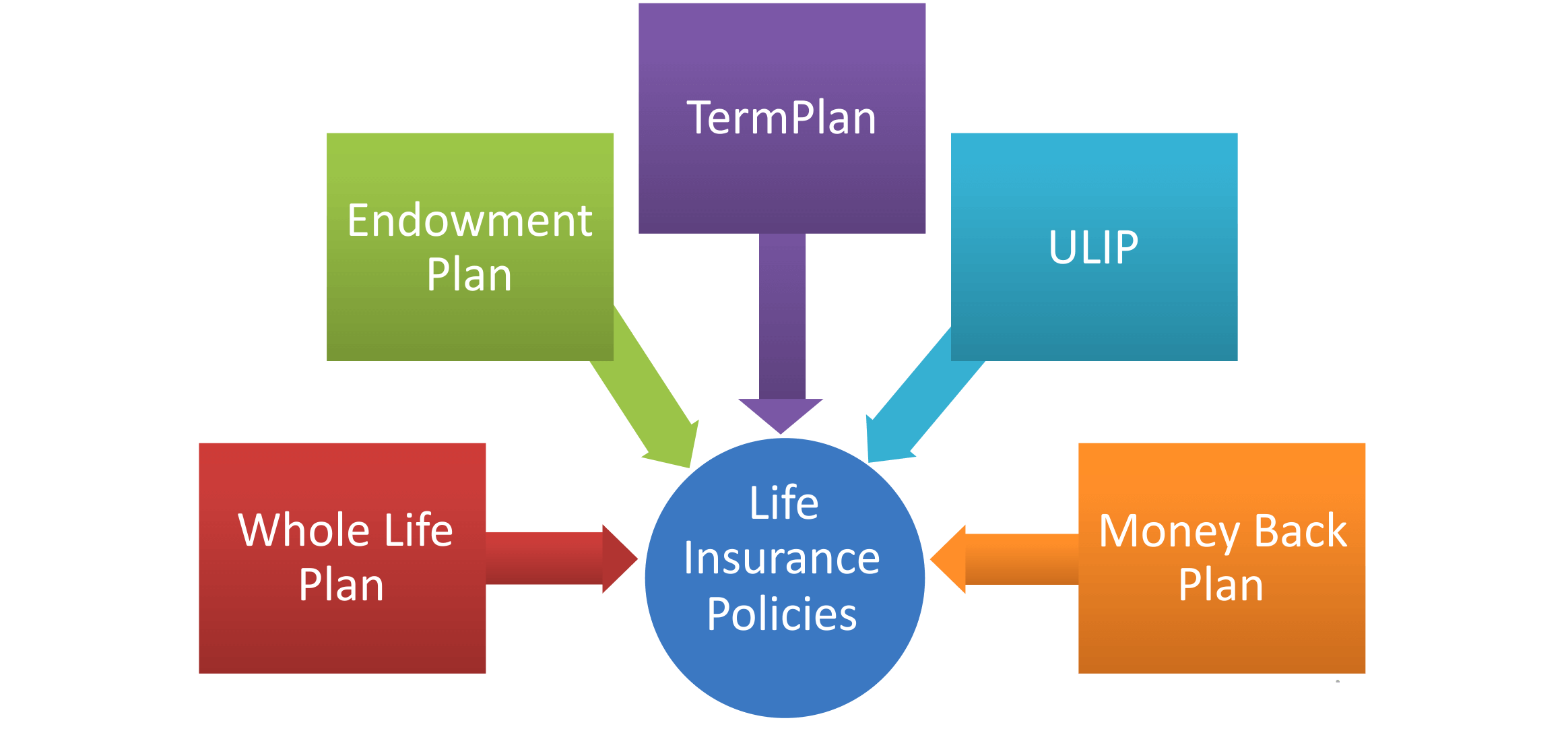

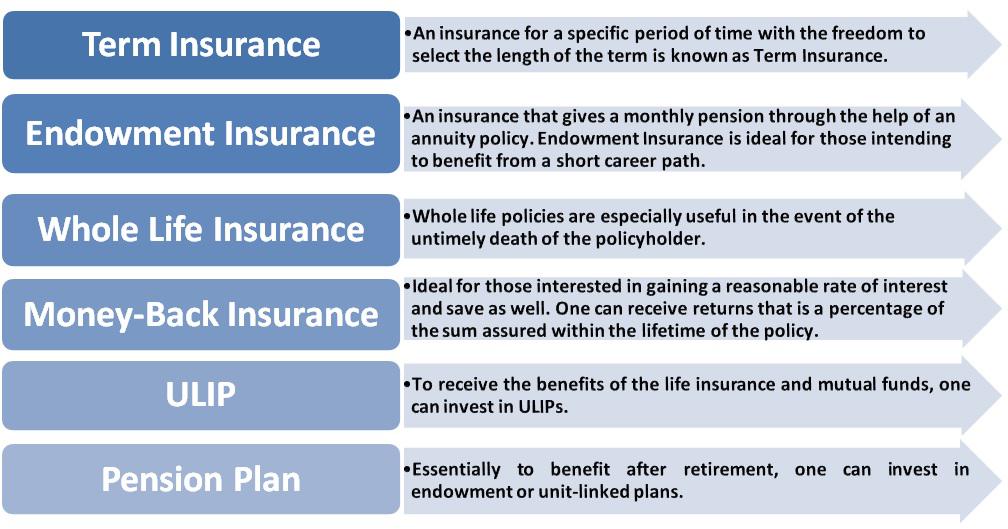

There are many types of life insurance policies that can help protect your family, and they all fall into two main.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

When deciding which type and amount of life insurance is right for you, you'll need to answer these.

Learn about the different types of life insurance coverage to help you narrow your policy options.

There are many different kinds of life insurance.

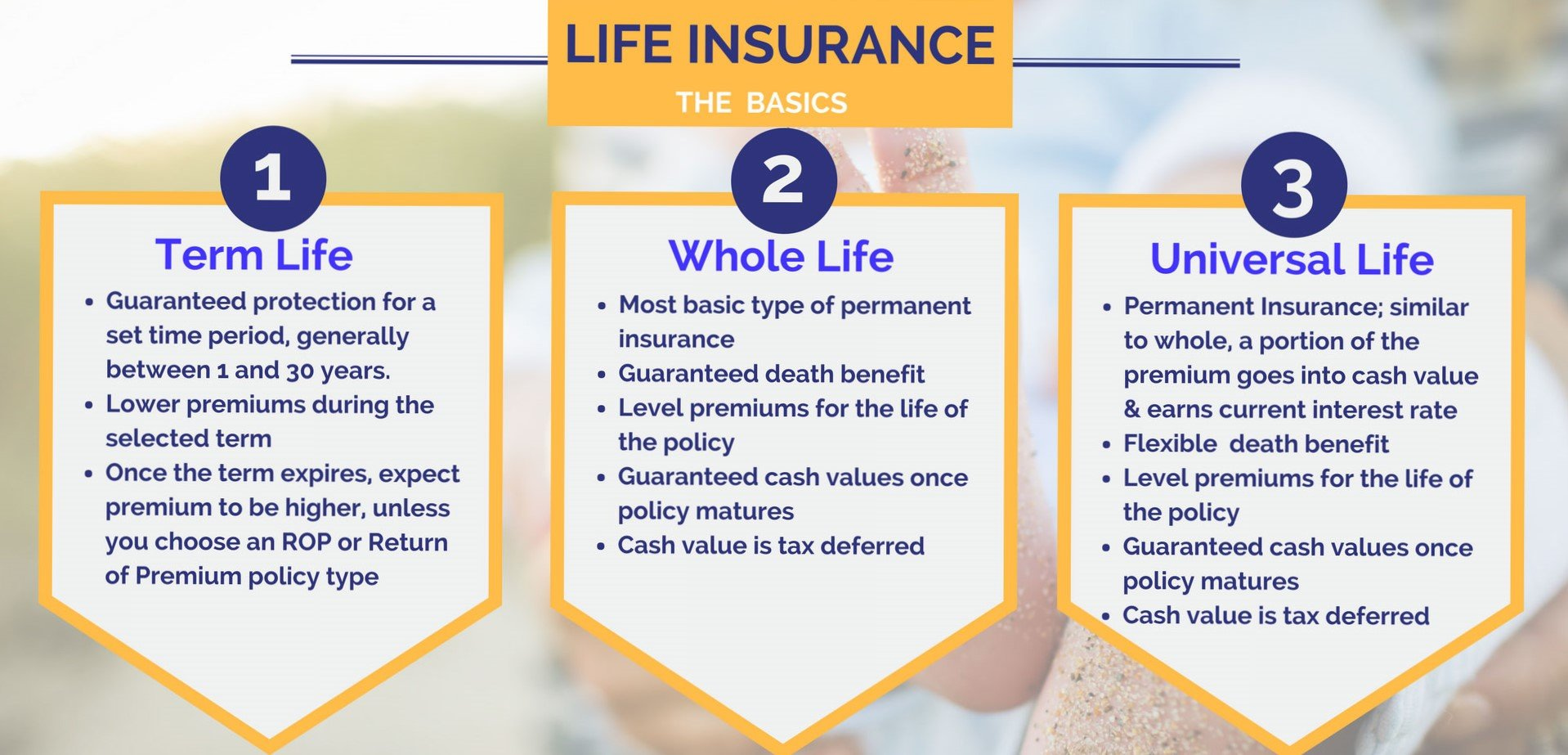

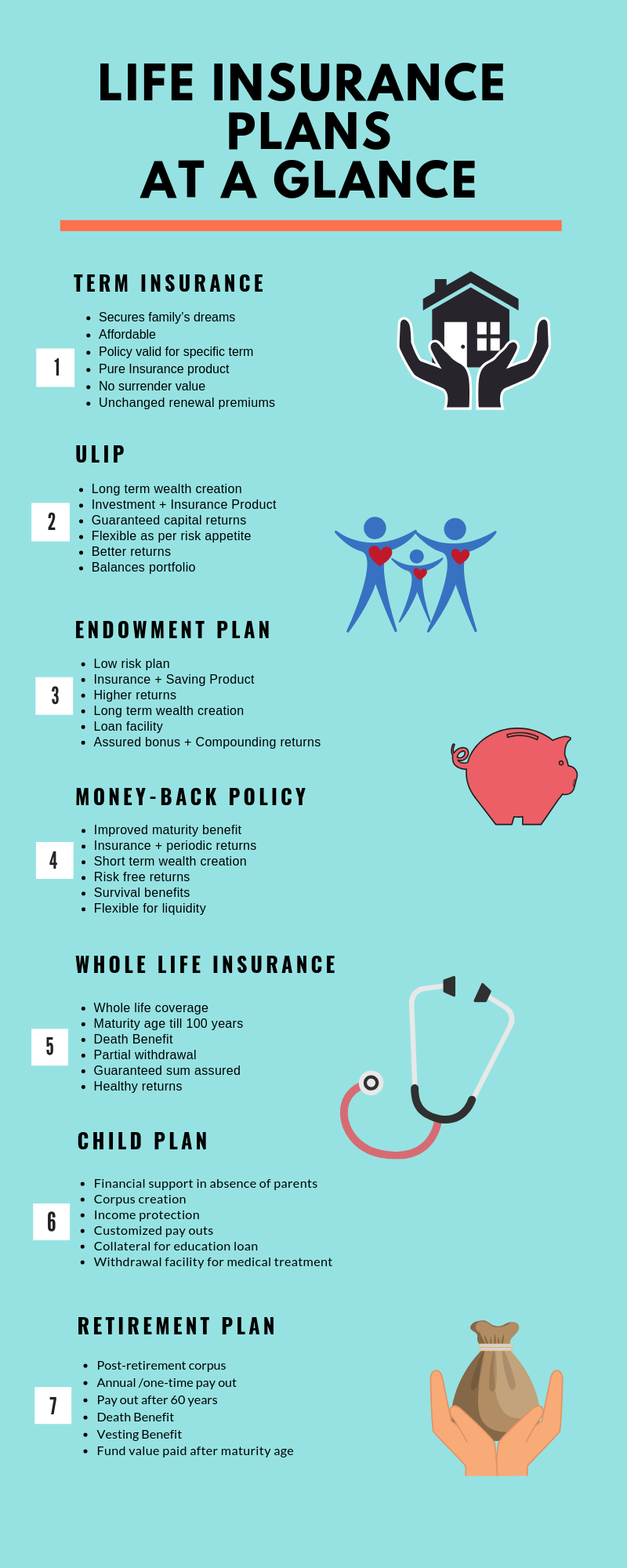

Term life, whole life, and universal life are just three of the most basic kinds.

Learn the differences of life insurance from protective life!

There are three common types of permanent insurance policies

Learn about term, whole life.

There are many types of life insurance options available for you and your family.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

The most common type of whole life insurance is ordinary life.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same.

The many types of life insurance available can be overwhelming.

Another important question to ask may be for how long.

The simplest type of permanent life insurance coverage is whole life.

With this type of coverage, the premium amount is on some types of term life insurance, the death benefit will go down over time.

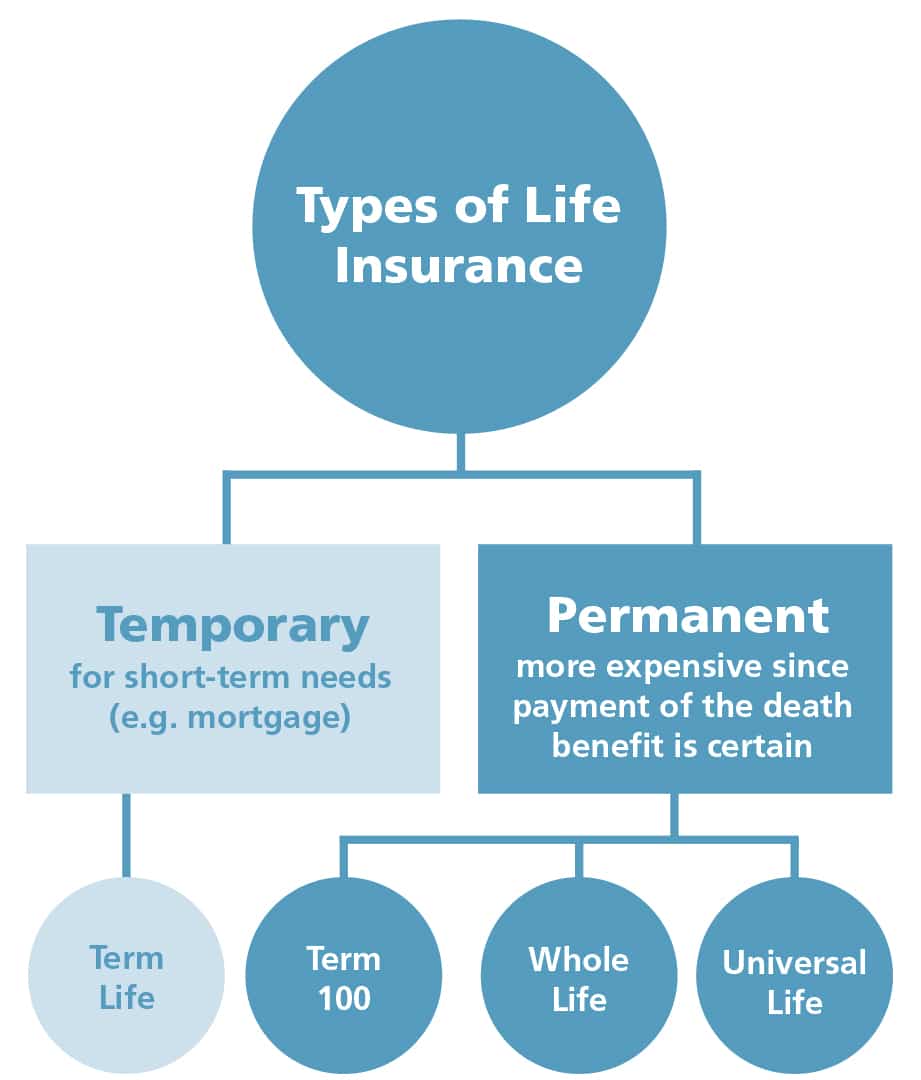

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type of life insurance is best for your family's needs.

The two main types of life insurance.

The company has to provide your family or other beneficiaries with a certain.

Rop term life insurance is a specialized type of term life.

With this type of policy, at the end of a guaranteed period, you can receive a refund of all the premiums you have paid.

Some companies don't offer all types of coverage.

So, if you call up a typical agency you are only going to be able to get.

Choosing the right life insurance policy depends on many factors, including the length of the policy, how much learn about the different types of life insurance to decide which one meets your needs.

Final expense and burial insurance are both types of whole life insurance policies that focus on people.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

This post will help you make sense of all of your life insurance choices.

In addition to traditional term life insurance and permanent life insurance, there are several other types of life and health insurance available.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium.

So, how many different types of life insurance are there in today's marketplace?

Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life.

These types of life insurance bundle you and your spouse into one policy under which you pay joint premiums in order to insure both of your lives under one policy.

Saatnya Bersih-Bersih UsusTernyata Menikmati Alam Bebas Ada ManfaatnyaTernyata Tahan Kentut Bikin KeracunanCegah Celaka, Waspada Bahaya Sindrom HipersomniaTernyata Ini Beda Basil Dan Kemangi!!Awas, Bibit Kanker Ada Di Mobil!!Mulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Tidur Terbaik Cukup 2 Menit!Ternyata Tertawa Itu DukaTips Jitu Deteksi Madu Palsu (Bagian 2)Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life. Life Insurance Types. These types of life insurance bundle you and your spouse into one policy under which you pay joint premiums in order to insure both of your lives under one policy.

Is one of canada's largest online life insurance providers and resources.

There are two basic types of life insurance in canada, dictated by how life insurance premiums are paid.

This covers the 5 types of life insurance policies available in canada and helps you decide between term, whole life and other insurances.

We've listed the 5 different types of life insurance plans available in canada and compare them so you are a little more prepared to make a big decision.

Types of investments you choose to hold in your account.

You can also select how your premiums are invested.

Life insurance can help you and your family prepare for the future.

What are the different types of life insurance policies available in canada?

The two main types of life insurance in canada are term insurance and permanent insurance.

As the names imply, term insurance covers the policy holder for a given period only, while permanent insurance covers the policy holder for life.

We offer different types of life insurance and we can help you find the solution that's right for you.

While the types of life insurance covered above are the main products available in canada, there are some other products worth mentioning.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

We've reviewed several life insurance policies available to canadians, which you can find.

Idc insurance direct canada inc.

National service centre 4400 dominion st., suite 260 burnaby, bc v5g 4g3.

Term insurance and permanent insurance.

The difference between the two is fairly for the average young canadian, however, the monthly premiums may not be worth the eventual payout.

There are three primary categories of.

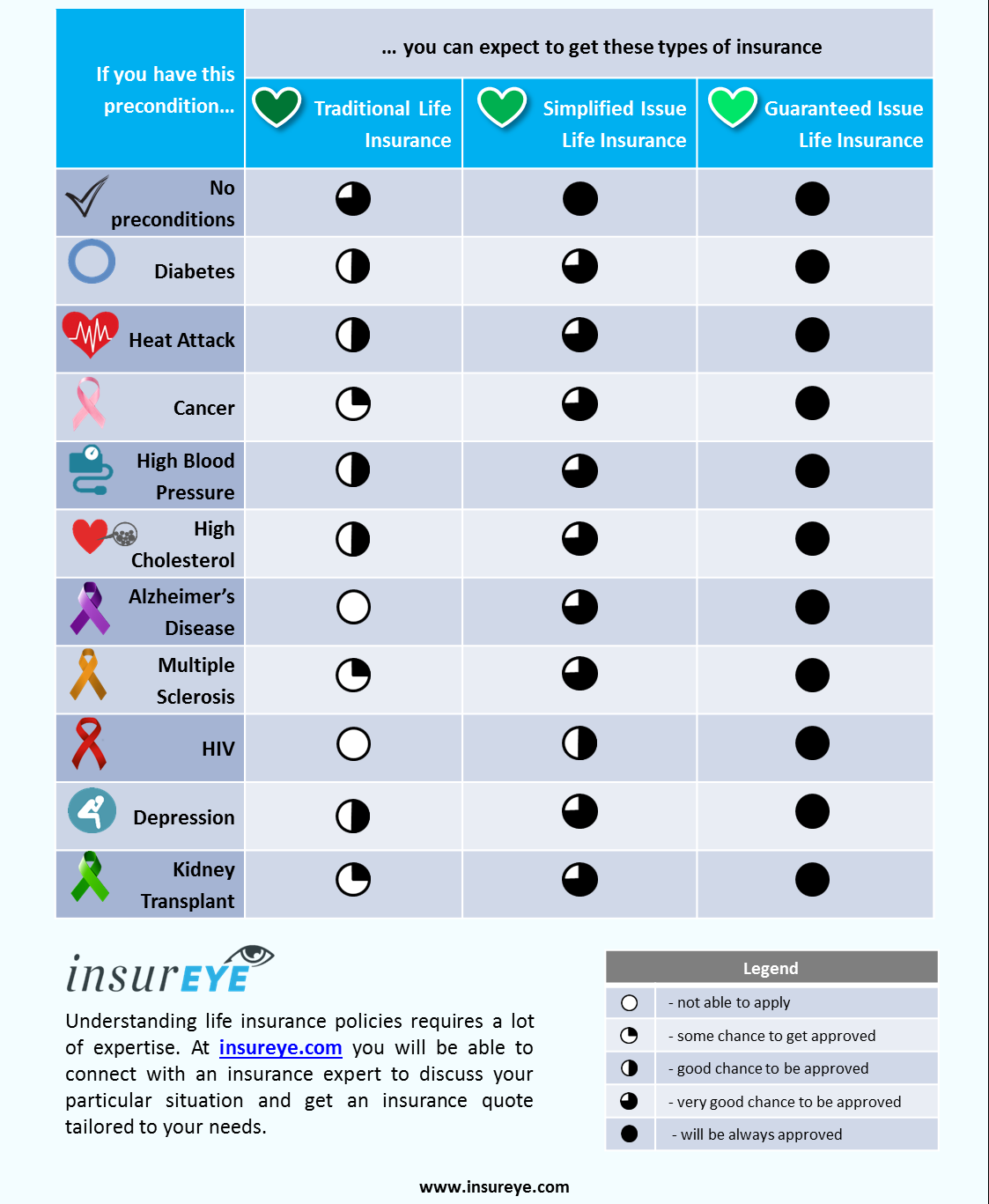

If you have a less serious health condition, or were previously refused insurance, deferred term is the right.

Financially protect your loved ones with life insurance.

You have options to choose from, including term life insurance, permanent life insurance and universal life insurance.

Or talk to a sun life financial advisor to learn more about how life insurance.

When it comes to buying life insurance in canada, it means making a lot of important decisions.

Many life insurance shoppers are becoming more aware of the importance of this type of insurance.

Type of cover life insurance joint life insurance life + critical illness critical illness insurance disability insurance mortgage life insurance no what plan is right for you?

We work with all the largest life insurance providers in canada, and can help you find a plan that works with your budget.

A td life insurance plan in canada, is a way to help protect your family's financial future, even after you've passed away, so there is less of a financial burden left behind during a challenging time.

This infographic shows nearly all life insurance companies in canada.

Find out more about 40+ life insurers and discover who owns whom.

Compare life insurance quotes & explore your coverage options.

The canadian life and health insurance association provides information on the different types and costs of long term care.

Get a headstart on personal finances in canada.

Life insurance in canada life insurance is something everyone has in their life time.

The thing is every country has their own rules and regulations regarding life insurance and medical commodities.

There are two major types of life insurance:

Term life and permanent life insurance.

A specified amount of insurance is provided during the term for a fixed rate.

Term insurance is the least expensive form of life insurance.

Term insurance provides protection during 10 or 40 year terms.

Universal life insurance and whole life insurance policies…

Summary there are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

However choosing from the different types of life insurance in canada isn t like deciding what flavour of ice cream to try for dessert.

Compare, save and complete your application.

There are two types of life insurance policies to best meet your needs :

A term protection (temporary) or a permanent protection, meaning for your whole life.

The company has a strong presence around.

The choosing life insurance is an issue that most of us will face during our lives.

Without meaning to sound morbid, it is a certainty that you will die, so how do you help those you leave behind to cope with losing any financial security that you provided.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life. Life Insurance Types. When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.Resep Garlic Bread Ala CeritaKuliner Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Resep Racik Bumbu Marinasi IkanPete, Obat Alternatif DiabetesFoto Di Rumah Makan PadangSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanNanas, Hoax Vs FaktaResep Ponzu, Cocolan Ala JepangTrik Menghilangkan Duri Ikan Bandeng5 Cara Tepat Simpan Telur

Thank you for sharing such informative content. This Insurance blog provides valuable insights and is very helpful for readers. If anyone needs more guidance or expert support in choosing the right Group health insurance or any other policy, they can connect with Securenow for reliable assistance.

ReplyDelete