Life Insurance Types Term During A Medical Exam, A Medical Technician Will Evaluate The Potential Policyholder's Health, Which May.

Life Insurance Types Term. Term Life Insurance And Permanent Life Insurance (also Referred To As Whole.

SELAMAT MEMBACA!

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

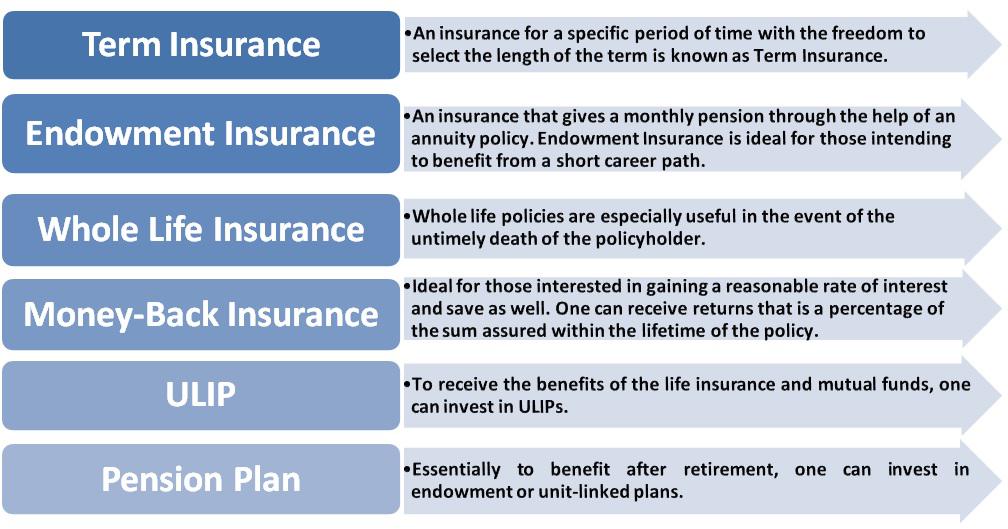

Within both of these main types of life insurance are different types of policies.

The table below outlines various types of policies, including different types within term and permanent life, and what they.

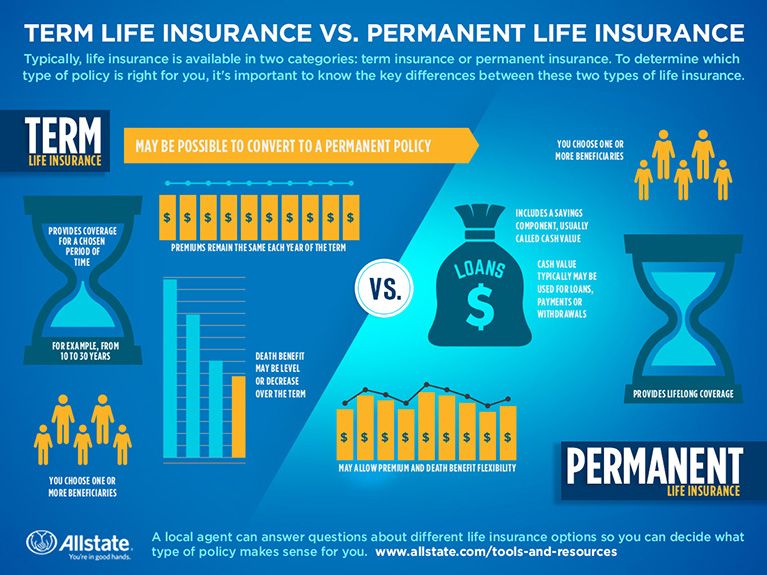

Term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Typically policies will last 10, 15, 20, or 30 years, but there are also other.

Who will benefit from term life?

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Learn about and compare the different types of life insurance policies.

What are the differences between term life & permanent life?

Your premium bought the protection that you had but didn't need, and you've received fair value.

Understanding the types of life insurance policies doesn't have to be complicated.

In a term policy, it's defined as a specific number of years, such as 10, 20, or 30.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance types fall into two main buckets:

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one thing only:

Pays the people you choose—your spouse, children, or other beneficiaries—a fixed amount of money if you die.

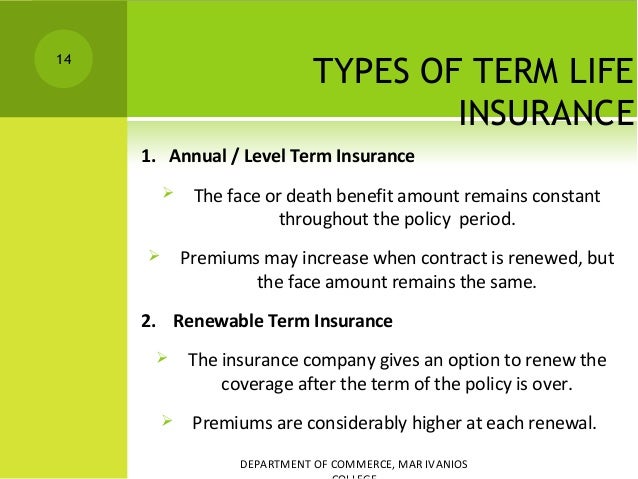

There are five types of term life insurance, each following a basic model of coverage for a set period of time.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

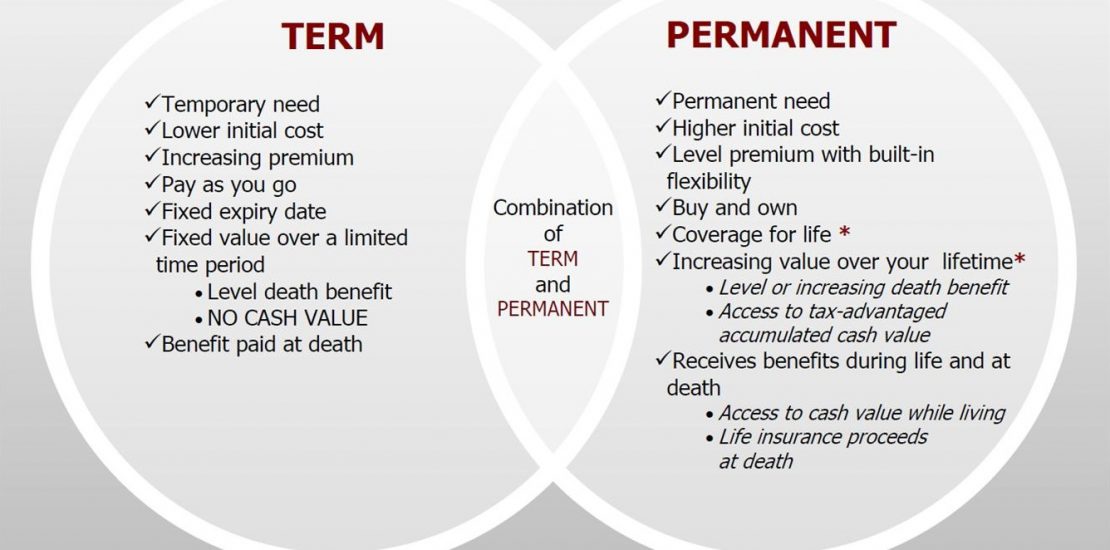

Term life insurance is a much more affordable kind of life insurance policy because it operates within a set period of time, only pays out the death benefit and while term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance coverage.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

Life insurance falls into two categories:

Term life policies provide coverage for a specified period, while permanent life insurance offers extended protection.

Term life insurance is a life insurance policy that covers the policyholder for a specific term, or amount of time.

Some types of life insurance policies require a medical examination.

During a medical exam, a medical technician will evaluate the potential policyholder's health, which may.

.jpg)

When it comes to types of life insurance, term may be the most popular but it's not the only option.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Term life insurance policies are the simplest, most popular, and the most often purchased;

Today, there is a wide variety of life insurance policies available, the most basic of which are term and permanent.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type term life can provide the most coverage for the least amount of money.

Understand the different types of life insurance so you can find the right cover today.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Its purpose is to make sure the mortgage is paid up if you were to die while you still owed money.

Term insurance is the cheapest life insurance policy available.

It covers a specific time period, and is usually purchased to cover the financial needs of children and surviving spouse until the children are grown.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

These types of life insurance policies are sold by mortgage lenders and are also referenced to as either mortgage life insurance or mortgage.

Consider term life insurance if you have a temporary need for coverage, a limited budget or a particular business application for it.

Compared to other types of life insurance, term life tends to be the least expensive coverage.

Would you'd like to learn more about this subject?

Have a question or comment?

Types of life insurance policies explained.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.

Segala Penyakit, Rebusan Ciplukan Obatnya5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatMulai Sekarang, Minum Kopi Tanpa Gula!!Mengusir Komedo MembandelMengusir Komedo Membandel - Bagian 2Khasiat Luar Biasa Bawang Putih PanggangIni Efek Buruk Overdosis Minum KopiFakta Salah Kafein KopiSaatnya Bersih-Bersih UsusTerm life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years. Life Insurance Types Term. But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Within both of these main types of life insurance are different types of policies.

The table below outlines various types of policies, including different types within term and permanent life, and what they.

Term life insurance lasts exactly as its name implies, for a specified length of time, or in other words a specified or term.

Typically policies will last 10, 15, 20, or 30 years, but there are also other.

Who will benefit from term life?

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Learn about and compare the different types of life insurance policies.

What are the differences between term life & permanent life?

Your premium bought the protection that you had but didn't need, and you've received fair value.

Understanding the types of life insurance policies doesn't have to be complicated.

In a term policy, it's defined as a specific number of years, such as 10, 20, or 30.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance types fall into two main buckets:

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one thing only:

Pays the people you choose—your spouse, children, or other beneficiaries—a fixed amount of money if you die.

There are five types of term life insurance, each following a basic model of coverage for a set period of time.

Riders can also be added to the types of term life insurance so you can customize each policy to meet your needs.

Term life insurance is a much more affordable kind of life insurance policy because it operates within a set period of time, only pays out the death benefit and while term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance coverage.

Term policies pay benefits to your family only if you die whole life is the most common type of the permanent coverage, so the two main types are more known as whole life and term insurance.

Life insurance falls into two categories:

Term life policies provide coverage for a specified period, while permanent life insurance offers extended protection.

Term life insurance is a life insurance policy that covers the policyholder for a specific term, or amount of time.

Some types of life insurance policies require a medical examination.

During a medical exam, a medical technician will evaluate the potential policyholder's health, which may.

When it comes to types of life insurance, term may be the most popular but it's not the only option.

In contrast to term life insurance, whole life insurance policies do not define a time period during which they are in effect.

A whole life policy is a form of permanent life insurance.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Term life insurance policies are the simplest, most popular, and the most often purchased;

Today, there is a wide variety of life insurance policies available, the most basic of which are term and permanent.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type term life can provide the most coverage for the least amount of money.

Understand the different types of life insurance so you can find the right cover today.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Its purpose is to make sure the mortgage is paid up if you were to die while you still owed money.

Term insurance is the cheapest life insurance policy available.

It covers a specific time period, and is usually purchased to cover the financial needs of children and surviving spouse until the children are grown.

Term insurance can be bought for 1, 5, 10, or 20 years, and is renewable without needing to.

These types of life insurance policies are sold by mortgage lenders and are also referenced to as either mortgage life insurance or mortgage.

Consider term life insurance if you have a temporary need for coverage, a limited budget or a particular business application for it.

Compared to other types of life insurance, term life tends to be the least expensive coverage.

Would you'd like to learn more about this subject?

Have a question or comment?

Types of life insurance policies explained.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years. Life Insurance Types Term. But since premiums are based on risk of death, once you are outside of the level premium period, a term life policy generally gets more expensive as you grow older.Susu Penyebab Jerawat???Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Ternyata Jajanan Pasar Ini Punya Arti RomantisResep Garlic Bread Ala CeritaKuliner Resep Cumi Goreng Tepung MantulAmpas Kopi Jangan Buang! Ini ManfaatnyaResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangBakwan Jamur Tiram Gurih Dan NikmatSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat Ramadhan5 Makanan Pencegah Gangguan Pendengaran

Comments

Post a Comment