Life Insurance Types Ppt Once You Get An Idea Of Your Options, You Can Select The Appropriate Coverage To Meet Your.

Life Insurance Types Ppt. Term Life, Whole Life, And Universal Life Are Just Three Of The Most Basic Kinds.

SELAMAT MEMBACA!

Health insurance ppt by viswanathan odatt 40752 views.

It experienced growth of 58% sbi life insurance co ltd 15.

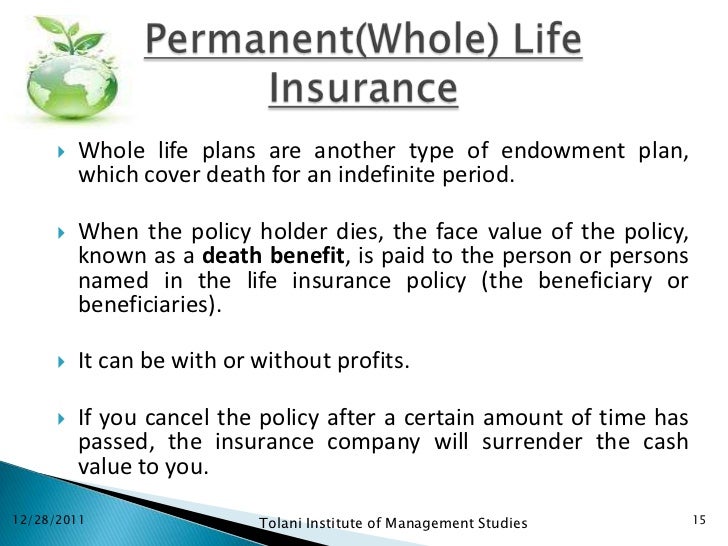

ρ� whole life plans are another type of endowment plan, which cover death for an indefinite period.

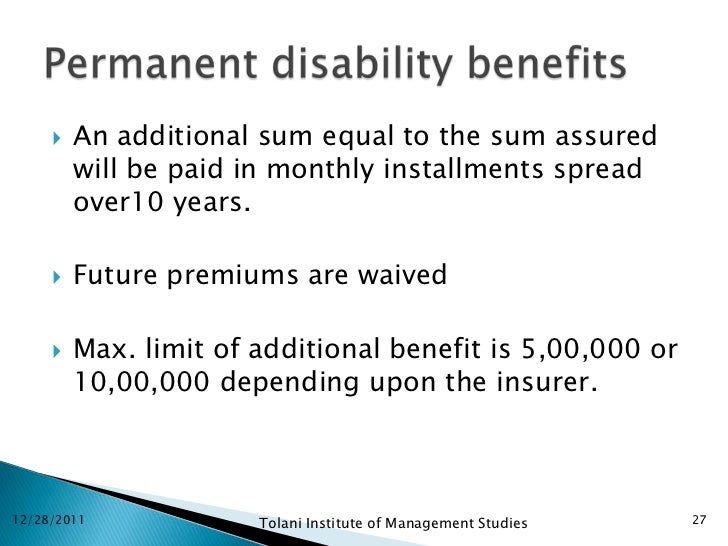

10 permanent life insurance life insurance:

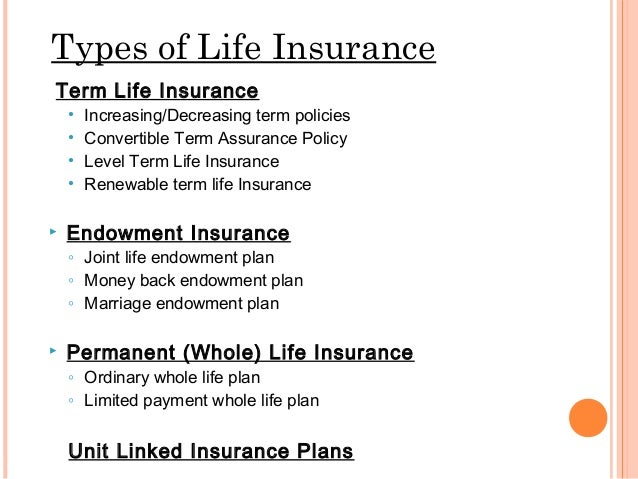

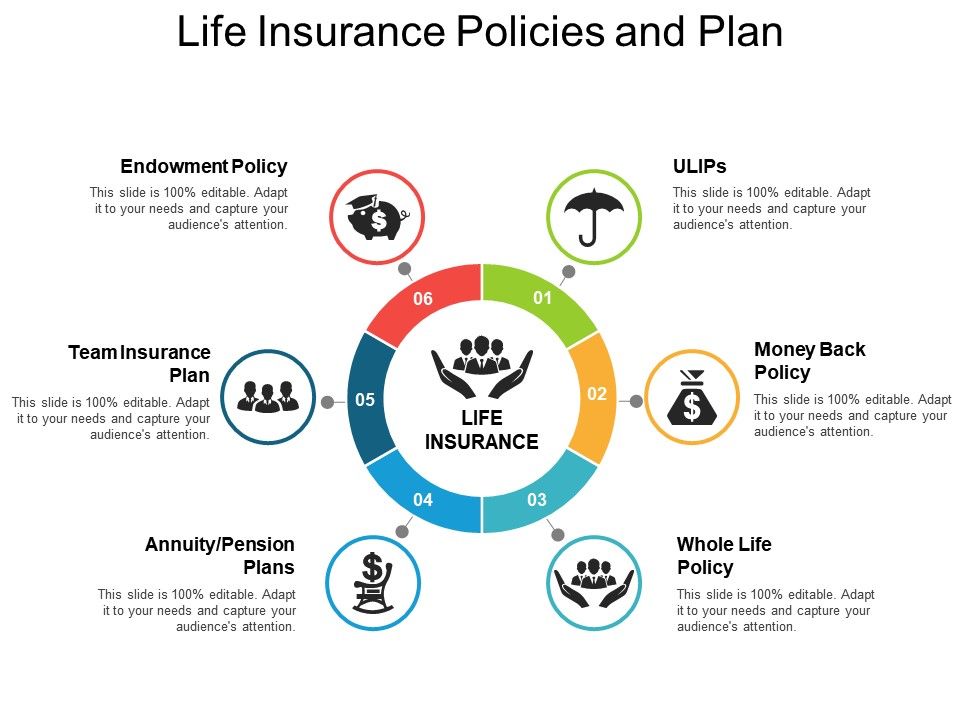

Chapter 1 life insurance policies.

If you plan on having insurance for more than 20 years it is usually more advantageous to have whole life insurance.

12 life insurance basic policy types.

Documents similar to life insurance powerpoint.ppt.

Powerpoint ppt presentation free to view.

Insurance meaning and types ppt.

Introduction introduction life insurance marine insurance fire insurance miscellaneous insurance prospects of insurance business insurance.

Life insurance powerpoint template is a free green template with money arrow and ready to be used for life insurance projects.

Share your findings with friends and colleagues with life insurance powerpoint template, as everyone commends an unbiased person who knows about various.

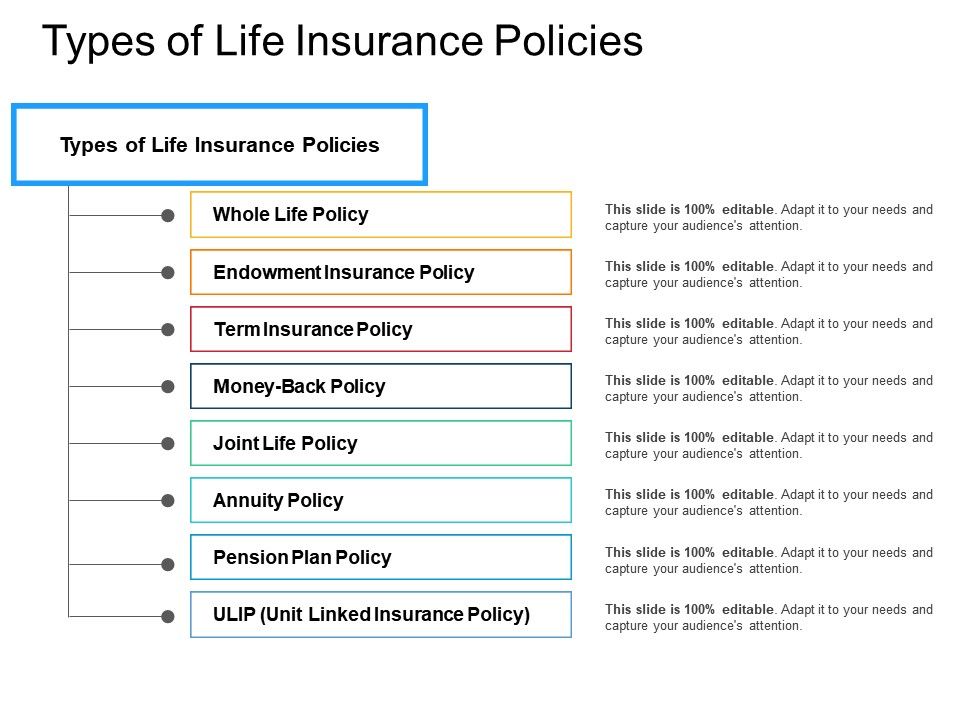

Term life, whole life, and universal life are just three of the most basic kinds.

When deciding which type and amount of life insurance is right for you, you'll need to answer these important questions:

What do you want the insurance to cover?

Make sense of all the types of life insurance available and find out what's right for you and your family.

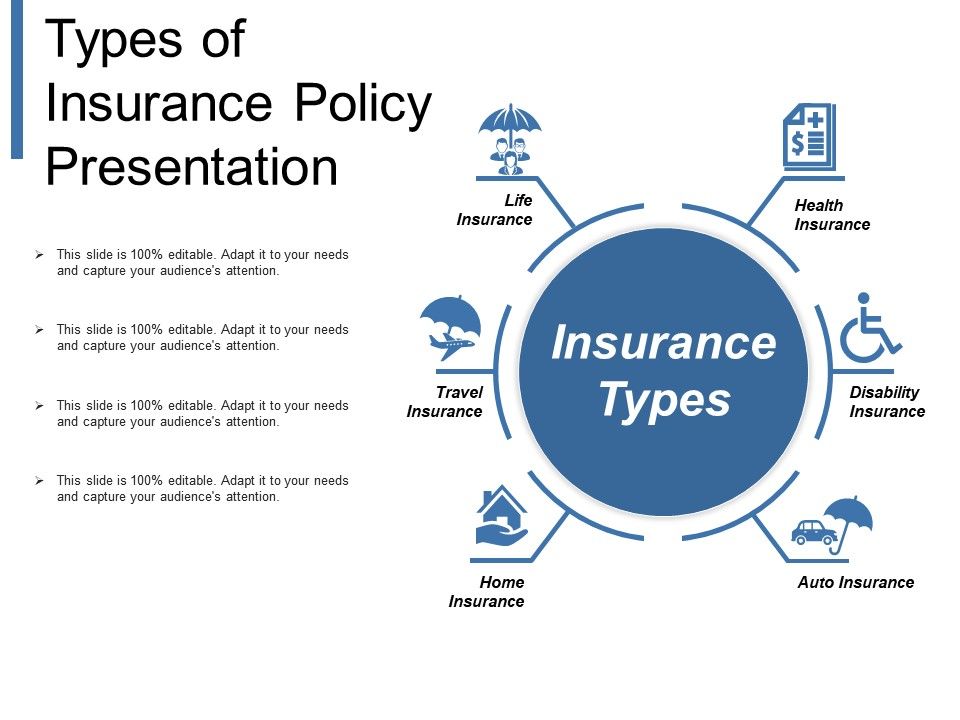

Types of insurance types of insurance in india importance of insurance types of insurance policies types of general insurance.

Tushar joshi, an life insurance agent, will able to provide all kind of life insurance solutions.

You can use those dividends to reduce your premiums or get more coverage.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

Whole life insurance is a type of life insurance that is meant to be permanent and last for an insured person's whole life.

Whole life insurance has a level premium structure (the premiums due are the same each year) and will build cash value over time.

They are among the leading providers of life & pensions products in europe.

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

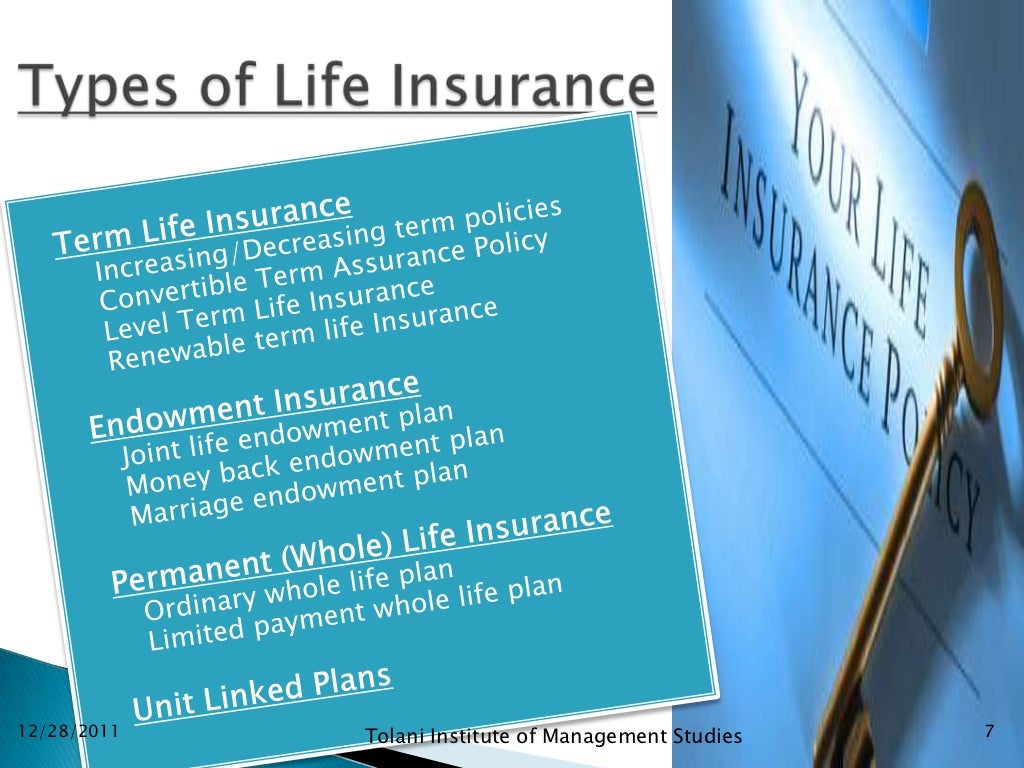

Endowment plan is another type of life insurance plan, which is a combination of insurance and saving.

Universal life insurance is really a term insurance policy with a savings component attached to it.

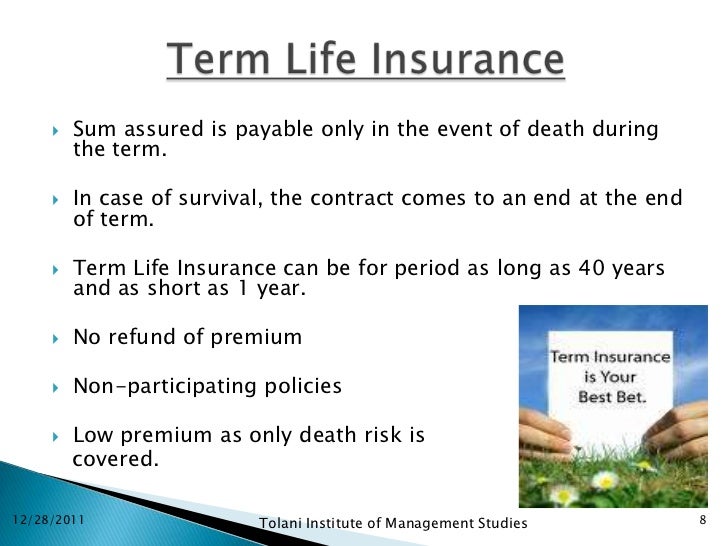

Term insurance is the simplest form of life insurance available in the market.

A pure protection plan, a term insurance offers a large coverage at an affordable premium.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

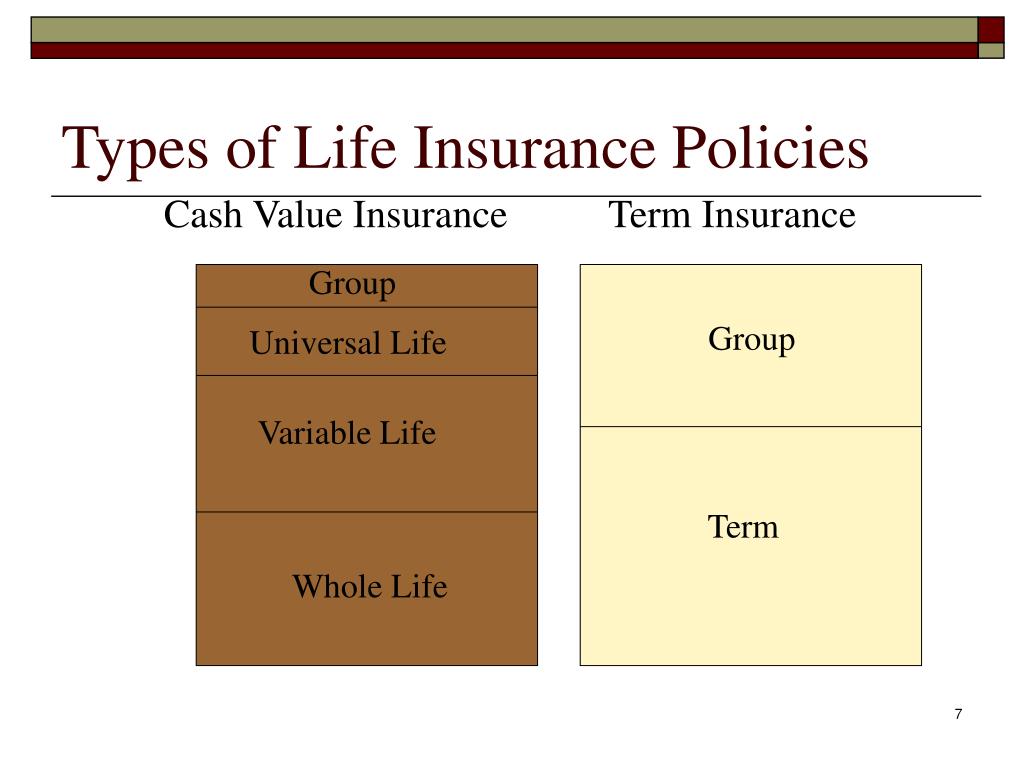

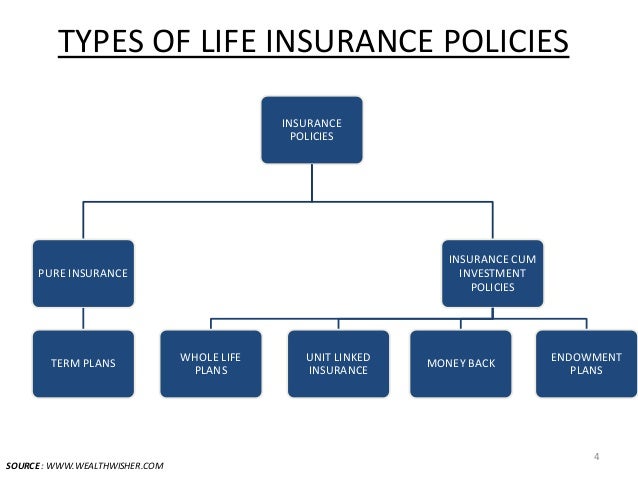

Permanent life insurance products include whole life, universal life, variable life, and combination life.

We'll explain each of these products soon.

Learn about and compare the different types of life insurance policies.

Powerpoint presentation life insurance ppt presentation this powerpoint insurance presentation focuses on how to structure term with permanent insurance.

Permanent insurance when combined with term insurance, will reduce the long term costs, or even eliminate all costs of insurance.

There are various companies offering different types of life insurance policies.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense.

Term life and whole life insurance explained with chart and infographics in pdf.

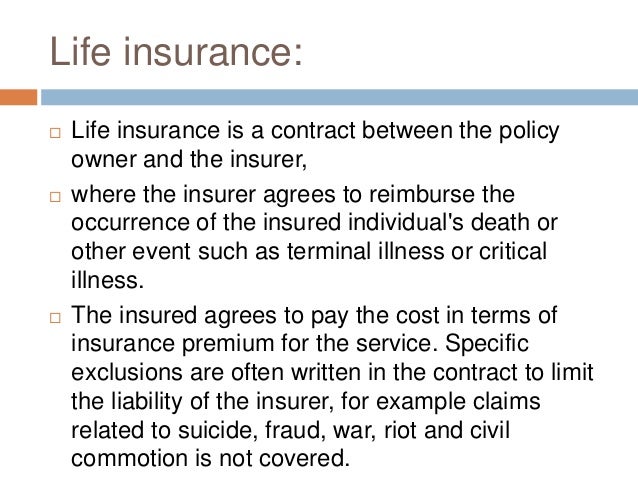

When you buy life insurance, you sign a contract with an insurance company.

Understand the different types of life insurance so you can find the right cover today.

Frankly speaking, i don't know much about insurance and its types.

Like, are there differences between term life insurance and insurance for final expenses?

Learn about the different types of life insurance coverage to help you narrow your policy options.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

The goal of this post, life insurance types explained is to help you understand your options.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatManfaat Kunyah Makanan 33 KaliAwas!! Ini Bahaya Pewarna Kimia Pada MakananFakta Salah Kafein Kopi4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Tidur Bisa Buat MeninggalGawat! Minum Air Dingin Picu Kanker!Mulai Sekarang, Minum Kopi Tanpa Gula!!6 Khasiat Cengkih, Yang Terakhir Bikin HebohIni Cara Benar Hapus Noda Bekas JerawatOnce you get an idea of your options, you can select the appropriate coverage to meet your. Life Insurance Types Ppt. Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

To help you understand we have listed the description of commonly available types of insurance, life and general insurance.

Life insurence ppt by anjiyaa 35194 views.

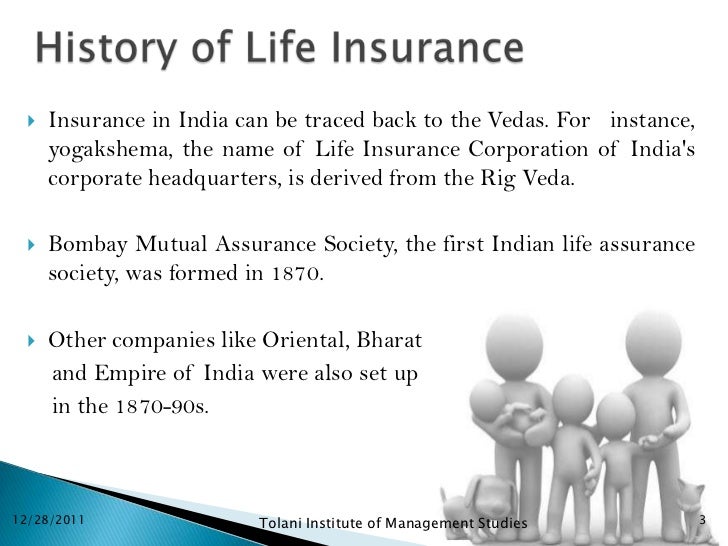

For instance, yogakshema, the name of life insurance corporation of indias corporate headquarters, is 19.

ρ� it has emerged as one of the fastest growing insurance products.

![7 Required Types of Insurance - [PPT Powerpoint]](https://reader011.fdocuments.in/reader011/slide/20181225/54c937f04a7959856c8b461f/document-1.png?t=1598030767)

Term assurance benefit payable only on death.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

When the coverage period ends, you may have the option to renew the policy, depending on the specific policy and with limitations.

When deciding which type and amount of life insurance is right for you, you'll need to answer these important questions:

What do you want the insurance to cover?

Participating life insurance is a type of permanent insurance, in which you're typically eligible to earn dividends.

Universal life insurance offers lifelong protection with a range of investment options.

You can buy some of our insurance products online.

€� insurance and life insurance in different perspectives • legal aspects of life insurance business in india • principles of insurance and their applications to life insurance • important types of life insurance 2.

Know about different types of life insurance policies to secure your family's future with plans such as ulip, term insurance, whole life best known for:

Benefit of money back plan:

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an the term underwriting refers to how a life insurance company calculates the risks of insuring you.

Free life insurance quote powerpoint template contains an arrow and curved template slide style that you can download and use for your presentations.

Share your findings with friends and colleagues with life insurance powerpoint template, as everyone commends an unbiased person who knows.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

This makes it very attractive to people, but if you outlive the length of the term policy.

There different types of life insurance products to fit your budget and financial situation.

There are several types of permanent life insurance, and they invest the cash value of your policy in different ways.

Ppt ( premium paying term) plays a vital role while deciding the type of life insurance you should opt for.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

Types of life insurance products.

Health insurance motor insurance travel insurance home insurance fire.why you need life and general insurance?

Term life and whole life insurance explained with chart and infographics in pdf.

This is a crucial question when you want to choose the best life insurance products for your needs and budget.

Different types of life insurance cover:

If you're young, single and just starting your career, you may rather want disability cover or serious illness cover.

Mortgage life insurance is a type of insurance that will pay out directly to your mortgage company if you were to pass away.

Different types of life insurance policies in india term insurance is a life insurance product offered by an insurance company which offers financial coverage to the policy holder for a specific time period.

Who needs life insurance cover?

The most suitable type of life insurance policy for you will also depend on your own personal circumstances. Life Insurance Types Ppt. Clients select the index they want to track (such as the s&p 500® index) and their cash value potentially.Resep Yakitori, Sate Ayam Ala JepangTrik Menghilangkan Duri Ikan BandengResep Selai Nanas HomemadeSejarah Kedelai Menjadi Tahu3 Jenis Daging Bahan Bakso TerbaikResep Beef Teriyaki Ala CeritaKulinerFoto Di Rumah Makan PadangTernyata Kue Apem Bukan Kue Asli IndonesiaSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatResep Stawberry Cheese Thumbprint Cookies

Comments

Post a Comment