Life Insurance Types Of Reserves There Are Many Types Of Life Insurance Policies That Can Help Protect Your Family, And They All Fall Into Two Main Categories:

Life Insurance Types Of Reserves. The Products And Services That Appear In The Advertisement Section Of This Website.

SELAMAT MEMBACA!

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

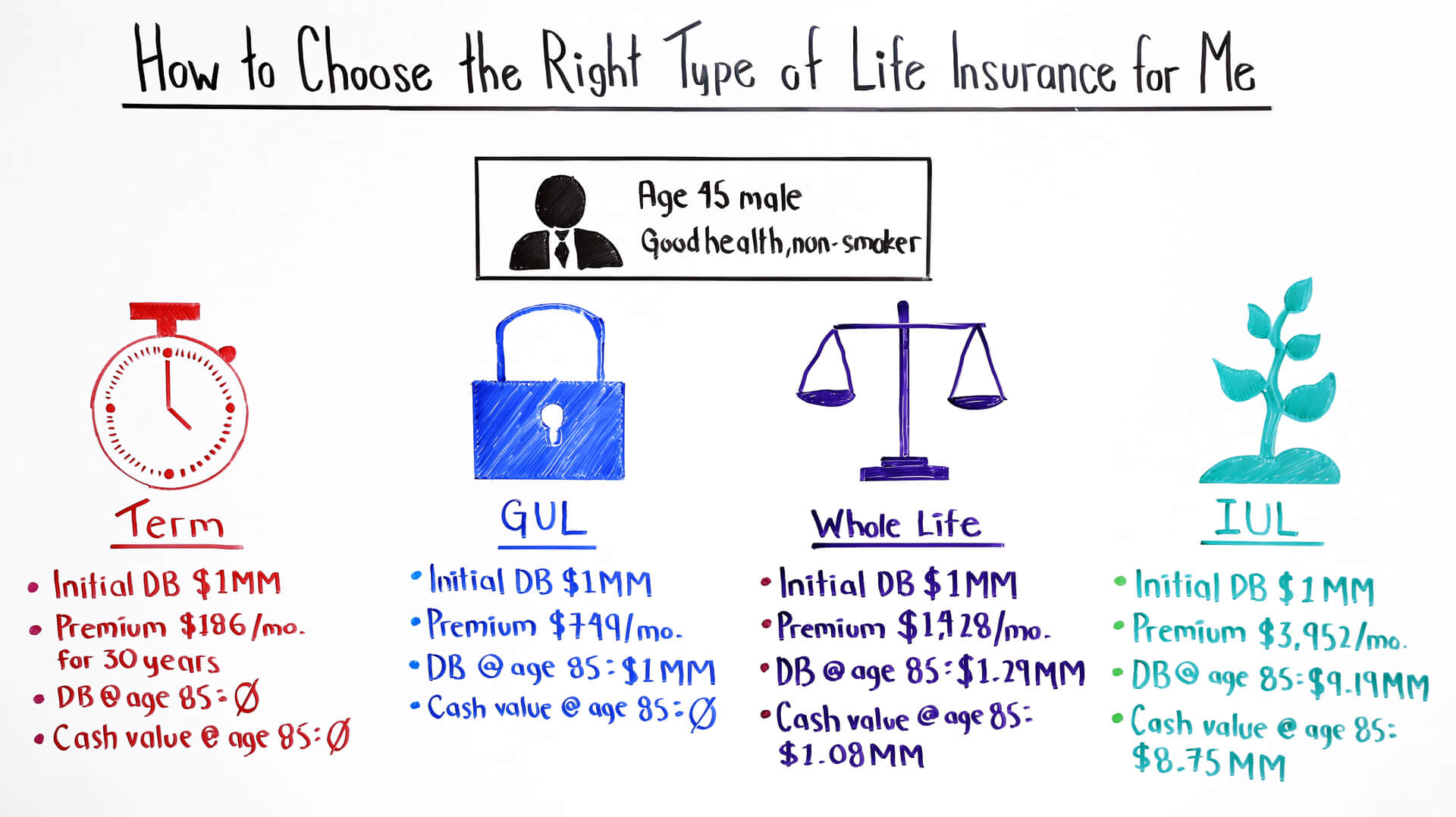

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

What do you want the insurance to cover?

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

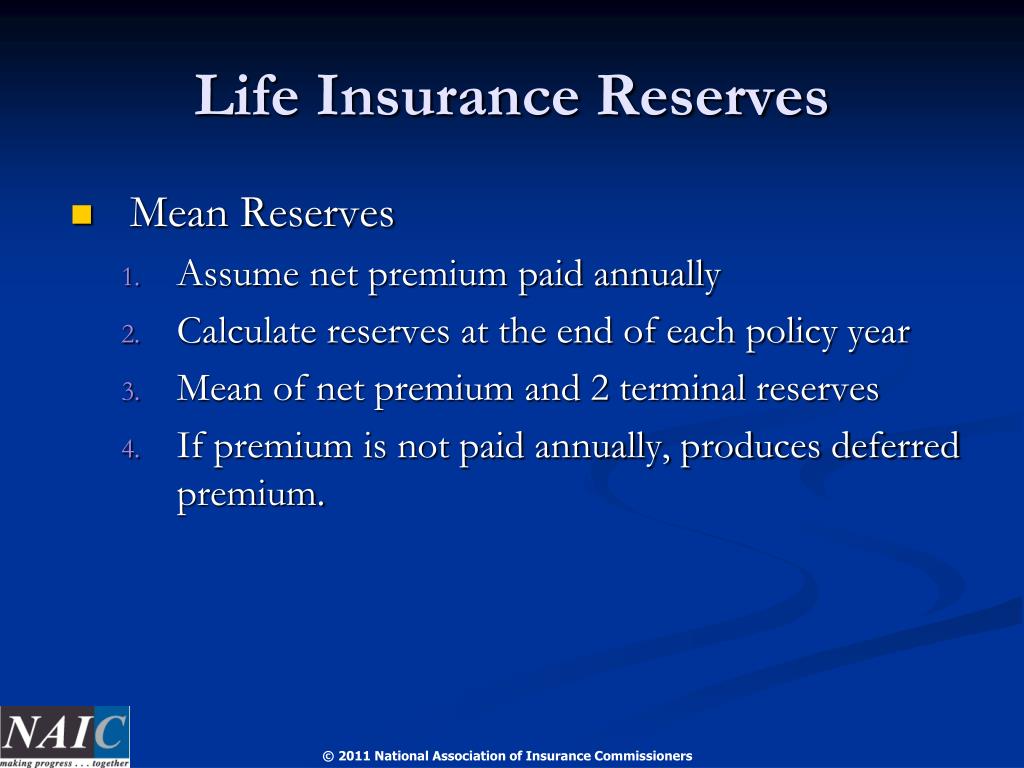

A life insurance reserve is a fixed liability of the insurer.

Types of reserves and surplus on balance sheet 1 general reserve.

To replace your income for your family if you die.

But with all the choices available, finding a policy that's just right for you could lead to extreme confusion.

Insure.com is a part of the insurance.com family.

The products and services that appear in the advertisement section of this website.

Universal life insurance is really a term insurance policy with a savings component attached to it.

In a universal life policy, this is known as the cost of insurance and it is clearly disclosed for you.

There are two primary types of life insurance:

Whole life and term insurance.

As a result of this, insurance companies are required to accumulate a cash reserve during the early years of a whole life policy.

The many types of life insurance available can be overwhelming.

When shopping for a policy, the first critical step is determining the ultimate goal.

It provides temporary coverage while a family has a permanent life insurance products include whole life, universal life, variable life, and combination life.

We'll explain each of these products soon.

Comparing popular types of life insurance.

All policies guarantee a death benefit, or the money your beneficiaries receive after you die.

If you purchase a term life policy, death benefit coverage may last 10, 20 or 30.

The two main types of life insurance.

The company has to provide your family or other beneficiaries with a certain amount of money in case of your death.

The number of life insurance types, choices and options that are available to consumers can be very stressful and time consuming.

You need life insurance, but which type is best?

I understand that by calling the phone number above i will reach a licensed sales agent.

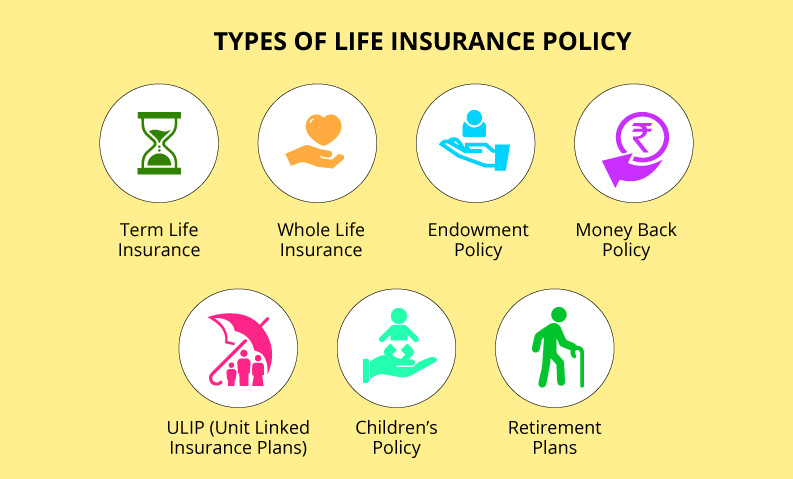

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Compare term, whole, variable, universal, iul, guaranteed issue, and more.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Here are the 2 types of life insurance:

So,what type of life insurance should i get?

Your first step in selecting the best life insurance product for your young folks simply need a low cost life insurance policy until more cash reserves can be.

Employees covered by this type of life insurance might include executive officers, specialized skill players, and highly effective members of the salesforce.

But it can be tough to know how much, or what type of life insurance you need.

5dividends are reviewed annually and are not guaranteed.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

There are several types of life insurance, including term life insurance, participating whole life insurance, universal life insurance, guaranteed issue life learn more about the main differences among these types of life insurance and find the type of insurance that best meets your needs.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

The goal of this post, life insurance types explained is to help you understand your options.

Life insurance is a financial product sold through insurance companies.

It is a contract between an insurer and a policyholder.

A life policy guarantees the insurer that upon the death of the insured policyholder.

Bank is here to help break them down for you — and a financial advisor show you how to incorporate insurance into a overall wealth plan.

Tax benefits on life insurance:

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

In case a person outlives the term insurance policy, the.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

5 Manfaat Meredam Kaki Di Air EsSalah Pilih Sabun, Ini Risikonya!!!Awas, Bibit Kanker Ada Di Mobil!!Gawat! Minum Air Dingin Picu Kanker!Ternyata Tidur Terbaik Cukup 2 Menit!PD Hancur Gegara Bau Badan, Ini Solusinya!!Ini Cara Benar Cegah HipersomniaIni Manfaat Seledri Bagi KesehatanObat Hebat, Si Sisik NagaUban, Lawan Dengan Kulit KentangWhile all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance. Life Insurance Types Of Reserves. Every type of permanent life insurance last.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

What do you want the insurance to cover?

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

A life insurance reserve is a fixed liability of the insurer.

Types of reserves and surplus on balance sheet 1 general reserve.

To replace your income for your family if you die.

But with all the choices available, finding a policy that's just right for you could lead to extreme confusion.

Insure.com is a part of the insurance.com family.

The products and services that appear in the advertisement section of this website.

Universal life insurance is really a term insurance policy with a savings component attached to it.

In a universal life policy, this is known as the cost of insurance and it is clearly disclosed for you.

There are two primary types of life insurance:

Whole life and term insurance.

As a result of this, insurance companies are required to accumulate a cash reserve during the early years of a whole life policy.

The many types of life insurance available can be overwhelming.

When shopping for a policy, the first critical step is determining the ultimate goal.

It provides temporary coverage while a family has a permanent life insurance products include whole life, universal life, variable life, and combination life.

We'll explain each of these products soon.

Comparing popular types of life insurance.

All policies guarantee a death benefit, or the money your beneficiaries receive after you die.

If you purchase a term life policy, death benefit coverage may last 10, 20 or 30.

The two main types of life insurance.

The company has to provide your family or other beneficiaries with a certain amount of money in case of your death.

The number of life insurance types, choices and options that are available to consumers can be very stressful and time consuming.

You need life insurance, but which type is best?

I understand that by calling the phone number above i will reach a licensed sales agent.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Compare term, whole, variable, universal, iul, guaranteed issue, and more.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Here are the 2 types of life insurance:

So,what type of life insurance should i get?

Your first step in selecting the best life insurance product for your young folks simply need a low cost life insurance policy until more cash reserves can be.

Employees covered by this type of life insurance might include executive officers, specialized skill players, and highly effective members of the salesforce.

But it can be tough to know how much, or what type of life insurance you need.

5dividends are reviewed annually and are not guaranteed.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

There are several types of life insurance, including term life insurance, participating whole life insurance, universal life insurance, guaranteed issue life learn more about the main differences among these types of life insurance and find the type of insurance that best meets your needs.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

The goal of this post, life insurance types explained is to help you understand your options.

Life insurance is a financial product sold through insurance companies.

It is a contract between an insurer and a policyholder.

A life policy guarantees the insurer that upon the death of the insured policyholder.

Bank is here to help break them down for you — and a financial advisor show you how to incorporate insurance into a overall wealth plan.

Tax benefits on life insurance:

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

In case a person outlives the term insurance policy, the.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same principles, they differ greatly from term life insurance. Life Insurance Types Of Reserves. Every type of permanent life insurance last.Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Bir Pletok, Bir Halal BetawiBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakResep Ayam Kecap Ala CeritaKulinerResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangFoto Di Rumah Makan PadangPete, Obat Alternatif DiabetesTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiKhao Neeo, Ketan Mangga Ala ThailandResep Garlic Bread Ala CeritaKuliner

Comments

Post a Comment