Life Insurance Types Of Cover The Significant Difference Between Them Is That Term Life Covers You For A Period;

Life Insurance Types Of Cover. As The Name Suggests, This Type Of Policy Will Guarantee Your Dependants A Payment Irrespective Of When You Die.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

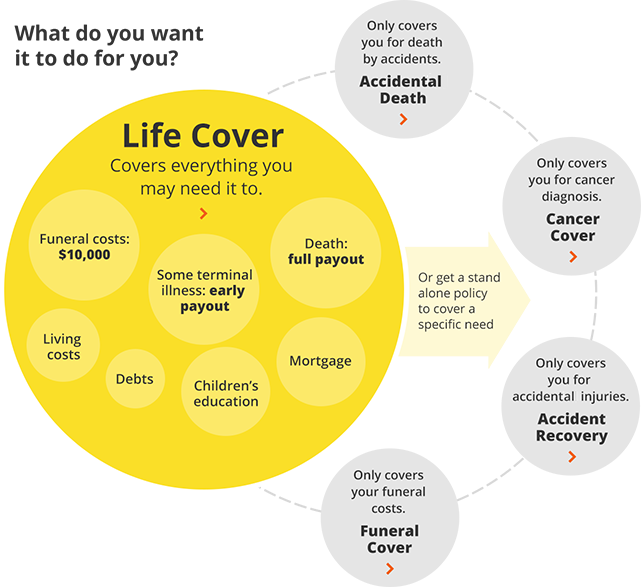

That depends on a variety of factors, including how long you want the policy to last, how much people often buy this type of life insurance if they've been turned down elsewhere due to their health but they want to cover final expenses, such as funeral costs.

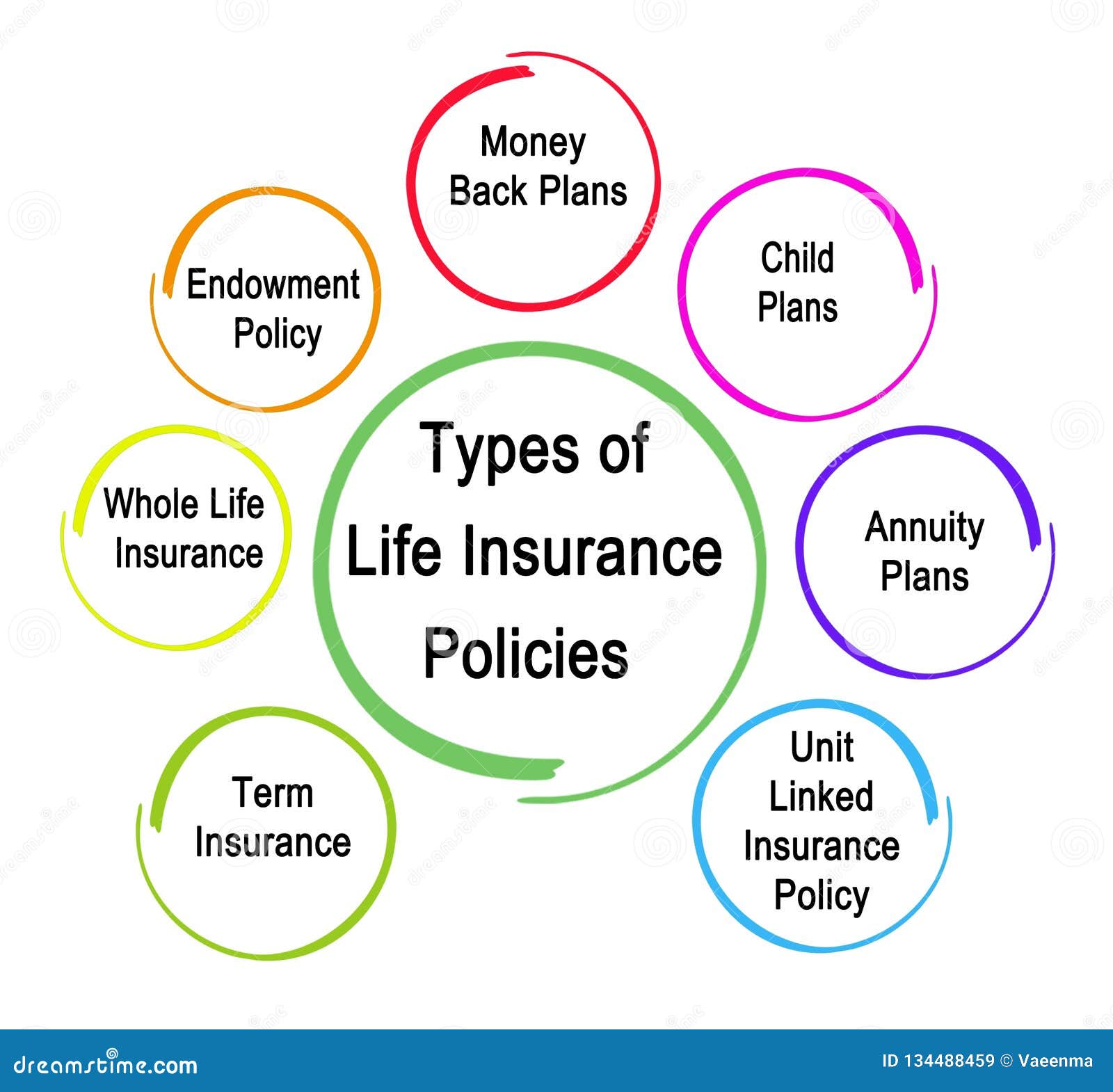

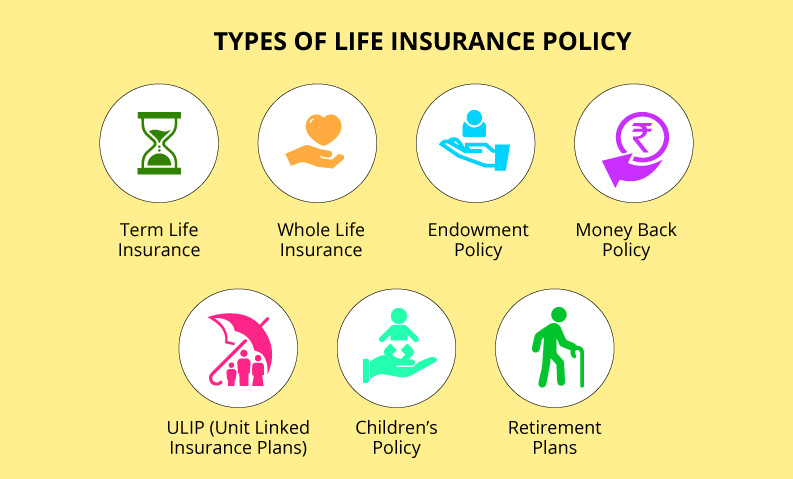

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance joint life insurance is life cover for yourself and your partner in one policy.

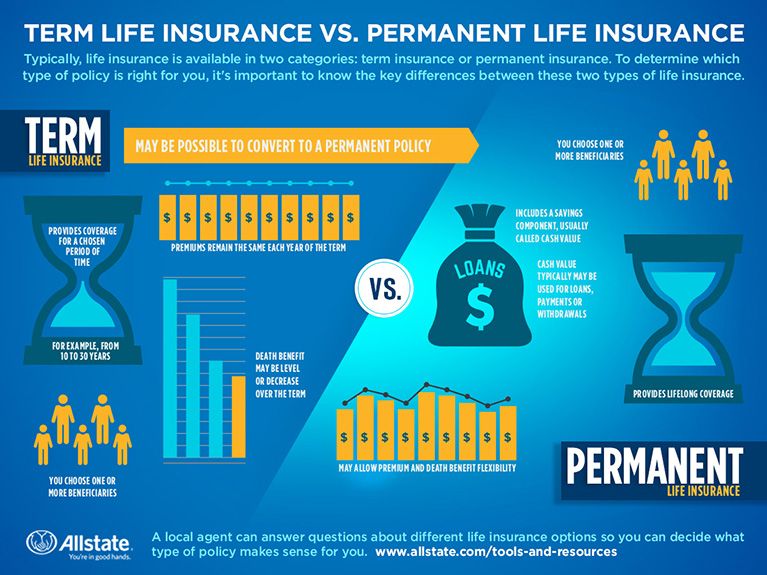

In new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Life insurance also offered and issued by third party companies not affiliated with allstate.

Each company is solely responsible for the financial obligations accruing under the products it issues.

Find out what life insurance covers—and what it doesn't—so you can set your family up for.

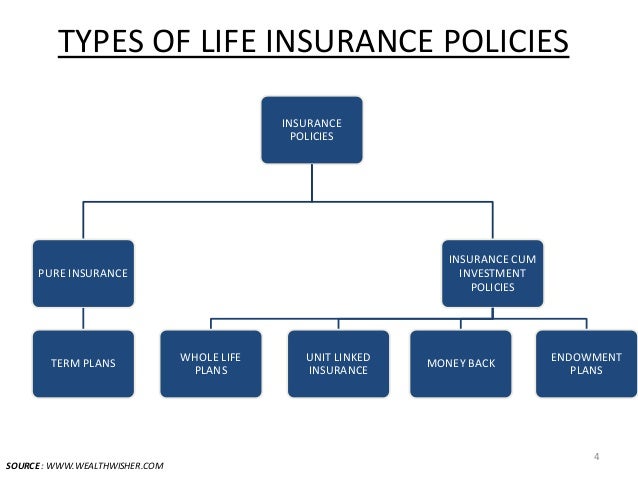

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

As the name suggests, this type of policy will guarantee your dependants a payment irrespective of when you die.

Other types of cover (see below) will only pay out if you die before a specified date.

This can be appropriate, for example, if the insurance is only needed to.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

The two main types of life insurance.

The company has to provide your what are the main life insurance benefits?

After your death, your family member/ members can use the returns to cover different types of.

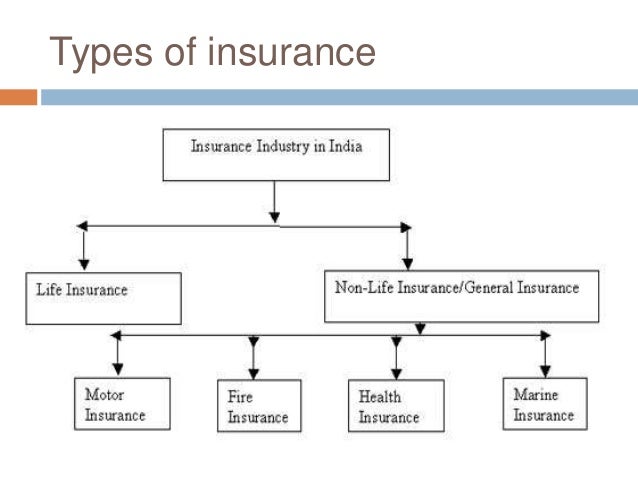

Health insurance motor insurance travel insurance home insurance fire insurance 2.

It pays for or reimburses the amount you pay towards the treatment of any injury.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

We will make your big decisions easier.

From life insurance to income protection, we've got something for you!

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Bycharlene arsenault| updated on august 31, 2020.

The two major life insurance categories are term and permanent life.

The significant difference between them is that term life covers you for a period;

Whole life insurance is the granddaddy of permanent life insurance policies.

It's called whole life because it covers you until death, regardless of your age at that time.

There are several types of life insurance.

We can help you choose.

Currently, the most affordable life insurance available, term life insurance is considered temporary life insurance because it is acquired to cover the temporary.

Term insurance is the simplest form of life insurance available in the market.

Our guides cover life insurance companies, the various types of life insurance cover and how to manage your circumstances to get the cheapest life mortgage protection life insurance this is life insurance cover where the sum to be paid reduces in line with what's outstanding on your mortgage.

As the cost of living increases over the years this means that money buys you less.

Learn about and compare the different types of life insurance policies.

Life insurance can be confusing.

Understand the range of insurance types available including critical illness, income protection and more.

Critical illness insurance, also known as trauma insurance, can provide cover for a covered serious medical issue.

Unlike term life insurance, permanent life insurance is designed to cover you for life.

You won't have to worry about going without coverage in your later years or not leaving an depending on the type of life insurance policy you have, that cash might sit in a savings account you can borrow against.

A renewable life insurance policy lets you renew your cover when the initial term expires without having to undergo another health.

Whatever cover you're considering, the amount you qualify for is generally based on a number of personal factors, which also affects your monthly repayments.

Life insurance is an umbrella term that covers various types of life insurance plans under it.

These are listed as follows though life insurance covers the death of the insured person, yet there are specific clauses which are not covered by life insurance.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Its purpose is to make sure the mortgage is.

Typically purchased by seniors, burial life insurance coverage cover the cost associated with a funeral, headstone, burial, flowers, and memorial service.

Mortgage life insurance is a type of insurance that will pay out directly to your mortgage company if you were to pass away.

Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85.

3 X Seminggu Makan Ikan, Penyakit Kronis Minggat4 Manfaat Minum Jus Tomat Sebelum TidurCara Baca Tanggal Kadaluarsa Produk MakananKhasiat Luar Biasa Bawang Putih PanggangTips Jitu Deteksi Madu Palsu (Bagian 2)Hindari Makanan Dan Minuman Ini Kala Perut KosongFakta Salah Kafein KopiTernyata Mudah Kaget Tanda Gangguan MentalResep Alami Lawan Demam AnakAwas, Bibit Kanker Ada Di Mobil!!Mortgage life insurance is a type of insurance that will pay out directly to your mortgage company if you were to pass away. Life Insurance Types Of Cover. Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85.

Compare online the range of life insurance plans and policies to protect you and your family.

Unlike, term plans, which are for a specified term.

This is just a simplified guide to different types of life insurance policies.

Get an expert's advice from coverfox.com on buying the right life.

Compare/buy/renew insurance plans online instantly.

Car, bike, term, health, ulips, all forms of insurance from various insurers under one roof.

Insurance made simple for you.

Whole life insurance • this type of life insurance provides coverage to the policyholder for as long as he survives.

€� this policy is provided for securing an individual till 100 years or for whole life.

Everything you need to know about mediclaim policy.

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

This is what has been brewing at coverfox lately.

With a new term product (and more) up and about, our aim to provide a seamless.

Prudential can help you learn about the different types of life insurance and policies that you can choose from.

Check out our life insurance chart to understand the plans and what life insurance you may need.

Understanding the types of life insurance policies doesn't have to be complicated.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

83,276 likes · 62 talking about this · 759 were here.

We are the largest insurtech platform in india offering.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

In new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Insurance needs guidance and facilitation at the time of claim.

You can consider buying acko 2 wheeler insurance policy considering the requirement.

Employees covered by this type of life insurance might include executive officers, specialized skill players, and highly effective members of the salesforce.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

This makes it very attractive to people, but if you outlive the length of the term policy.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Nearly all types of life insurance also offer some sort of living benefit nowadays as well.

The two most common other than calling it whole life are straight life or permanent life.

Coverfox insurance broking was incorporated in 2013 and is based in mumbai, maharashtra, india.

Different types of life insurance cover:

Learn more about life cover from standard bank, or interact with our customers and consultants in the life insurance section of our support community.

Bringing a whole new life into this world is certainly no piece of cake.

Plan well and insure adequately to make this experience a memorable one.

Coverfox insurance is an online insurance destination.

All types of policies across carriers can be directly b.

At coverfox, we believe buying insurance is not about avoiding risk, it's about outfoxing it.

Coverfox insurance is a insurance company and has headquarters in mumbai, maharashtra, india.

The two main types of life insurance.

When you buy life insurance, you sign a contract with an insurance company.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

Permanent life insurance products include whole life, universal life, variable life, and combination life.

We'll explain each of these products soon.

A pure protection plan, a term insurance offers a 4.

Unit linked insurance plans (ulips) combining insurance and investment in a single product, ulips offer life protection as well as the opportunity for.

There are several types of life insurance.

We can help you choose.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose.

Participating life insurance is a type of permanent insurance, in which you're typically eligible to earn dividends.

Your beneficiaries will still get a death benefit after you die.

You need life insurance, but which type is best?

Life insurance types fall into two main buckets:

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

Term life insurance and permanent life insurance (also referred to as whole life insurance). Life Insurance Types Of Cover. Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.Resep Ayam Suwir Pedas Ala CeritaKulinerResep Selai Nanas Homemade3 Jenis Daging Bahan Bakso TerbaikResep Yakitori, Sate Ayam Ala Jepang9 Jenis-Jenis Kurma TerfavoritAmpas Kopi Jangan Buang! Ini ManfaatnyaKuliner Legendaris Yang Mulai Langka Di DaerahnyaKuliner Jangkrik Viral Di Jepang5 Makanan Pencegah Gangguan PendengaranSejarah Kedelai Menjadi Tahu

Comments

Post a Comment