Life Insurance Types Of Cover Typically Purchased By Seniors, Burial Life Insurance Coverage Cover The Cost Associated With A Funeral, Headstone, Burial, Flowers, And Memorial Service.

Life Insurance Types Of Cover. After Your Death, Your Family Member/ Members Can Use The Returns To Cover Different Types Of.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

That depends on a variety of factors, including how long you want the policy to last, how much people often buy this type of life insurance if they've been turned down elsewhere due to their health but they want to cover final expenses, such as funeral costs.

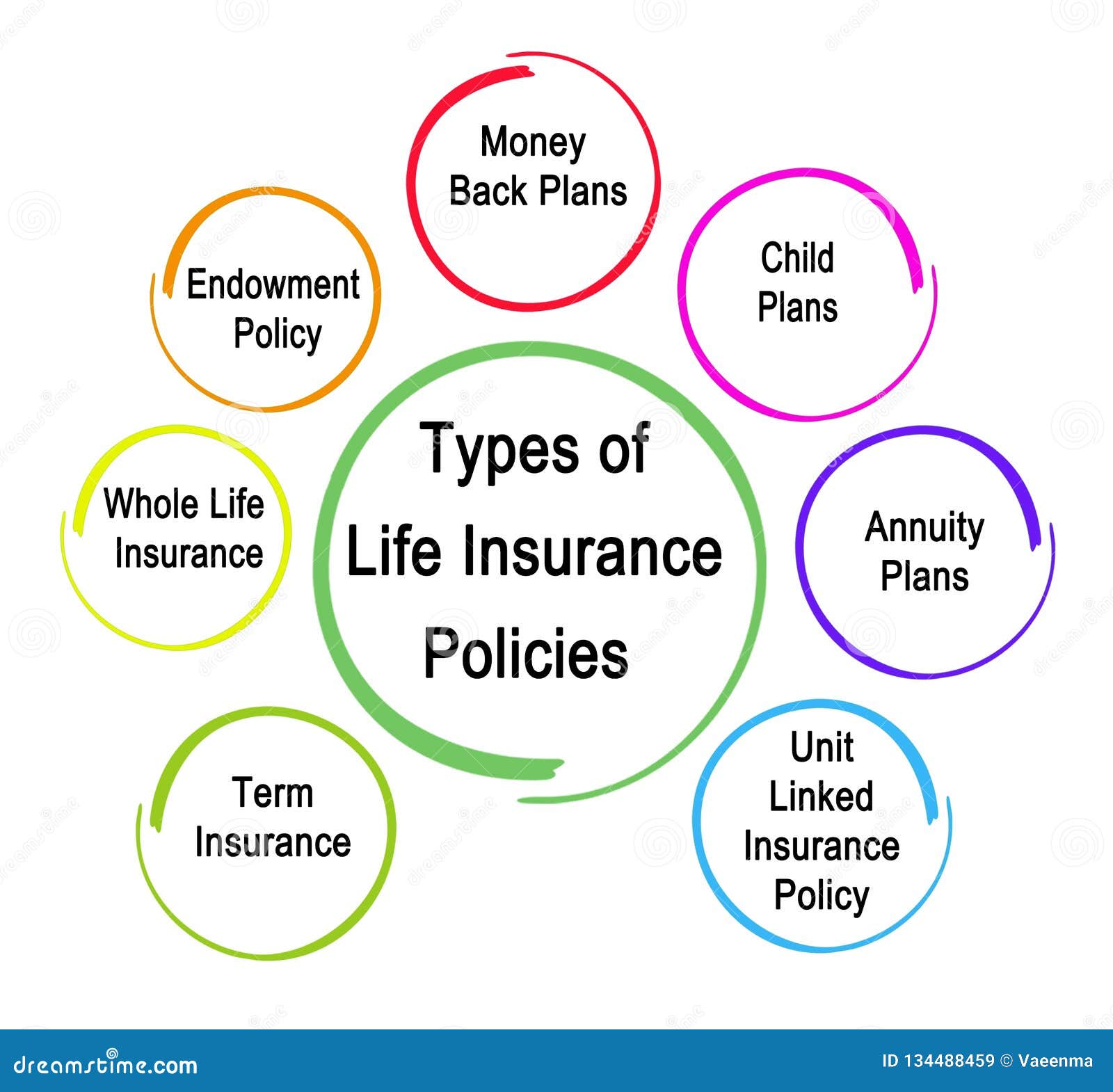

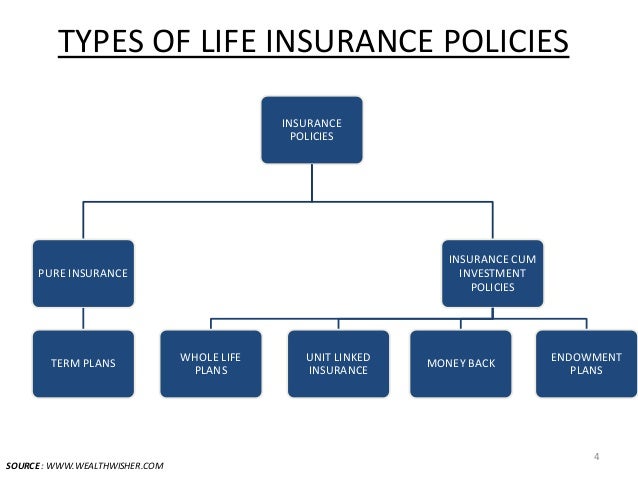

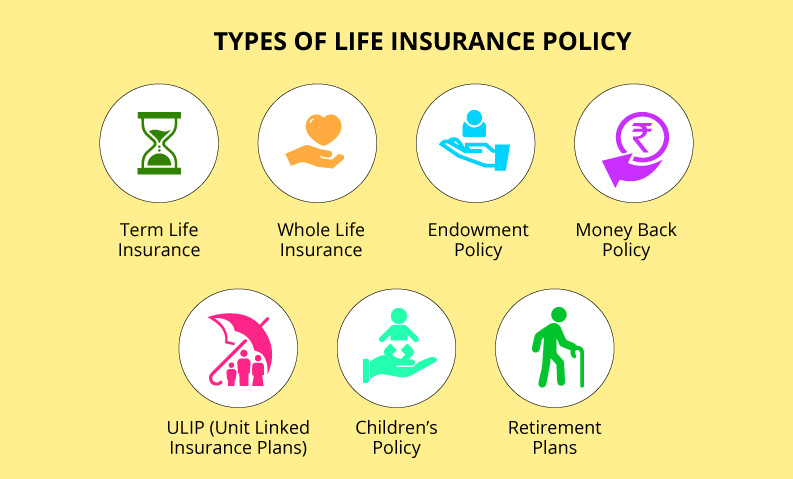

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance joint life insurance is life cover for yourself and your partner in one policy.

In new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Life insurance also offered and issued by third party companies not affiliated with allstate.

Each company is solely responsible for the financial obligations accruing under the products it issues.

Find out what life insurance covers—and what it doesn't—so you can set your family up for.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

As the name suggests, this type of policy will guarantee your dependants a payment irrespective of when you die.

Other types of cover (see below) will only pay out if you die before a specified date.

This can be appropriate, for example, if the insurance is only needed to.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

The two main types of life insurance.

The company has to provide your what are the main life insurance benefits?

After your death, your family member/ members can use the returns to cover different types of.

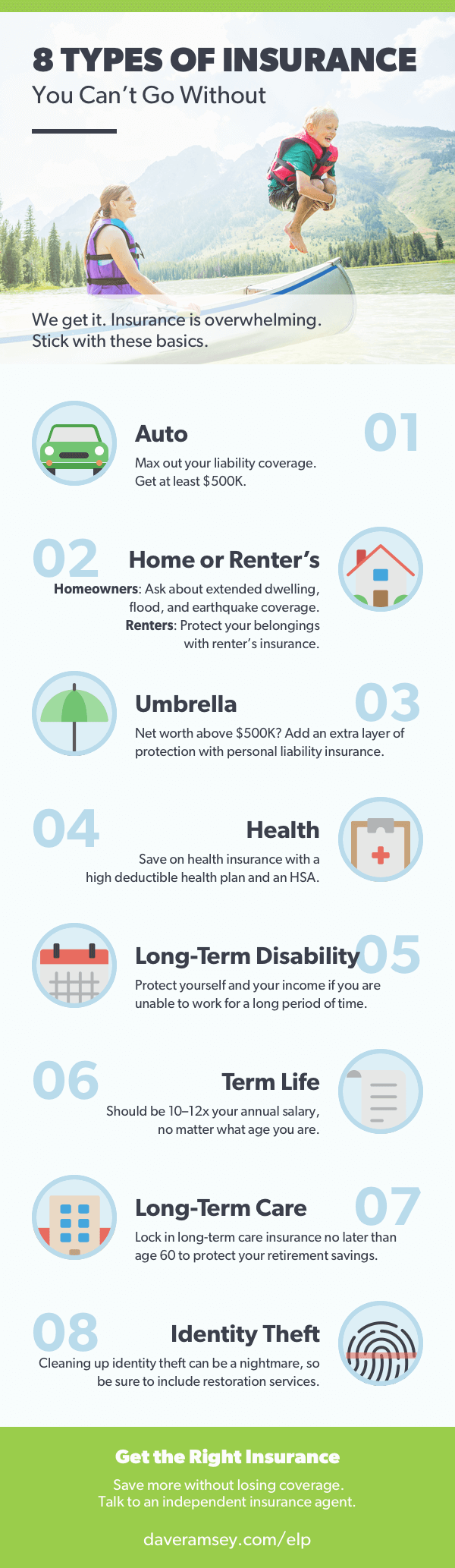

Health insurance motor insurance travel insurance home insurance fire insurance 2.

It pays for or reimburses the amount you pay towards the treatment of any injury.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

We will make your big decisions easier.

From life insurance to income protection, we've got something for you!

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Bycharlene arsenault| updated on august 31, 2020.

The two major life insurance categories are term and permanent life.

The significant difference between them is that term life covers you for a period;

Whole life insurance is the granddaddy of permanent life insurance policies.

It's called whole life because it covers you until death, regardless of your age at that time.

There are several types of life insurance.

We can help you choose.

Currently, the most affordable life insurance available, term life insurance is considered temporary life insurance because it is acquired to cover the temporary.

Term insurance is the simplest form of life insurance available in the market.

Our guides cover life insurance companies, the various types of life insurance cover and how to manage your circumstances to get the cheapest life mortgage protection life insurance this is life insurance cover where the sum to be paid reduces in line with what's outstanding on your mortgage.

As the cost of living increases over the years this means that money buys you less.

Learn about and compare the different types of life insurance policies.

Life insurance can be confusing.

Understand the range of insurance types available including critical illness, income protection and more.

Critical illness insurance, also known as trauma insurance, can provide cover for a covered serious medical issue.

Unlike term life insurance, permanent life insurance is designed to cover you for life.

You won't have to worry about going without coverage in your later years or not leaving an depending on the type of life insurance policy you have, that cash might sit in a savings account you can borrow against.

A renewable life insurance policy lets you renew your cover when the initial term expires without having to undergo another health.

Whatever cover you're considering, the amount you qualify for is generally based on a number of personal factors, which also affects your monthly repayments.

Life insurance is an umbrella term that covers various types of life insurance plans under it.

These are listed as follows though life insurance covers the death of the insured person, yet there are specific clauses which are not covered by life insurance.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Its purpose is to make sure the mortgage is.

Typically purchased by seniors, burial life insurance coverage cover the cost associated with a funeral, headstone, burial, flowers, and memorial service.

Mortgage life insurance is a type of insurance that will pay out directly to your mortgage company if you were to pass away.

Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85.

Manfaat Kunyah Makanan 33 KaliTips Jitu Deteksi Madu Palsu (Bagian 1)Mulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Cewek Curhat Artinya SayangCara Baca Tanggal Kadaluarsa Produk MakananTernyata Jangan Sering Mandikan Bayi5 Khasiat Buah Tin, Sudah Teruji Klinis!!Obat Hebat, Si Sisik NagaMengusir Komedo Membandel - Bagian 2Melawan Pikun Dengan ApelMortgage life insurance is a type of insurance that will pay out directly to your mortgage company if you were to pass away. Life Insurance Types Of Cover. Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85.

Whole life insurance is a type of permanent life insurance designed to provide lifetime coverage.

Life insurance can provide coverage in the case of suicide, but many policies have special provisions that suicide provisions can also vary according to the type of coverage you have if the death certificate is inconclusive or includes a questionable cause of death, the insurance company may.

Life insurance covers a policyholder's suicidal death in many cases.

The types of infractions that may lead to a claim denial will vary from company to company.

In case the policyholder dies due to any type of critical illness.

Life insurance typically provides more coverage than ad&d insurance.

Life insurance covers instances of death resulting from illnesses or accidental death and dismemberment insurance does not cover death by all accidents, however.

This is a white board animation explaining types of death covered under life insurance.

Most of the people take life insurance policy to take care of his.

Does military life insurance cover suicidal death?

Does your term insurance policy cover death due to a medical condition, accident or only covers natural death?

Term insurance premium is the lowest amongst all types of life insurance plans.

There are although some plans available that offer return on premiums paid if the policy holder.

This type of life insurance doesn't require you to complete a medical exam.

If you don't like needles, you won't need to do any blood tests or.

Will life insurance pay out if the policyholder commits suicide?

Reassured compare quotes from leading insurers.

It's likely that if you declare previous drug use during the life insurance application, they'll write into your contract that upon your death, autopsy.

Does life insurance pay for death by natural causes?

This type of life insurance covering natural death requires payment until you die.

The good news is you pay the same premium forever, unlike some universal plans that can change as far as the.

Life insurance will cover all causes of death except for suicide(which can be contested in the first two years there are two different types of life insurance that you have to choose between term and does accidental life insurance cover work related accidental death?

Death due to any condition that existed while availing the term insurance policy will not be settled getty images.

Death by participating in an adventure or hazardous activity is not covered by term however, not many know that there certain types of death that are not covered by life insurance.

What does accidental death insurance cover?

Accidental death insurance is typically less expensive than other types of life insurance because it is a bit more limited in what it covers.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

Life insurance companies do not cover suicide, subject to the suicide clause limitation in all life insurance policies.

The suicide clause stats that no death payment will be made if an insured commits suicide within the first two years (one year in colorado) that the policy is in force.

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg.

Decreasing term life insurance was designed to provide a death benefit that decreases in proportion with a decrease in.

Life insurance does cover death by cancer.

However, it is common for someone diagnosed with cancer to seek out a life insurance policy, and at that point in time it is very difficult to obtain coverage.

Cancer is covered accidental death policies application dishonesty contestability period life insurance after cancer protecting against cancer.

Luckily, the answer to this question is usually yes.

Most insurance policies today will indeed cover a death caused by cancer, so your loved ones.

As you can see, life insurance covers a broad range of death causes.

However, there are some exceptions, including life insurance policies pay the covered amount after you die.

Your beneficiary will need to obtain a certified copy of your death certificate and.

What does life insurance cover?

This is true for all types of products.

Term life policies have no value other than the death.

Make sure that your loved ones will be provided for if the worst what is free parent life cover?

Different types of life insurance explained.

What type of life insurance do you need?

Health insurance motor insurance travel insurance home insurance fire.types of fire insurance.

What does insurance not cover?

Life insurance is a contract that offers financial compensation in case of death or disability.

Life insurance protects your loved ones with a lump sum payout life insurance covers common causes of death such as illness, disease, cancer, heart attacks or accidents.

Whole life insurance is a type of life insurance that is meant to be permanent and last for an insured person's whole life.

Whole life insurance has a level premium structure (the premiums due are the same each year) and will build cash value over time.

Whole life insurance offers coverage until death occurs while term life offers coverage for a predetermined period.

Term life insurance is ideal for people who believe that their dependents may require coverage to as aforementioned, life insurance policies do not cover all types of death.

Should life insurance cover death due to medical mistakes?

He previously covered the philadelphia court system for american.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance cover is essentially an agreement between you and an insurance provider that if you pay regular premiums and meet the terms and conditions laid out in the policy, they will pay out a lump sum in the event of your death.

Many people decide to take out a life insurance policy to provide.

Life insurance cover is essentially an agreement between you and an insurance provider that if you pay regular premiums and meet the terms and conditions laid out in the policy, they will pay out a lump sum in the event of your death. Life Insurance Types Of Cover. Many people decide to take out a life insurance policy to provide.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanBir Pletok, Bir Halal BetawiTernyata Asal Mula Soto Bukan Menggunakan DagingResep Nikmat Gurih Bakso LeleTernyata Bayam Adalah Sahabat WanitaPetis, Awalnya Adalah Upeti Untuk RajaResep Beef Teriyaki Ala CeritaKulinerResep Segar Nikmat Bihun Tom YamStop Merendam Teh Celup Terlalu Lama!

Comments

Post a Comment