Life Insurance Types Of Cover Life Insurance Also Offered And Issued By Third Party Companies Not Affiliated With Allstate.

Life Insurance Types Of Cover. There Are Many Different Kinds Of Life Insurance.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

That depends on a variety of factors, including how long you want the policy to last, how much people often buy this type of life insurance if they've been turned down elsewhere due to their health but they want to cover final expenses, such as funeral costs.

In new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Life insurance also offered and issued by third party companies not affiliated with allstate.

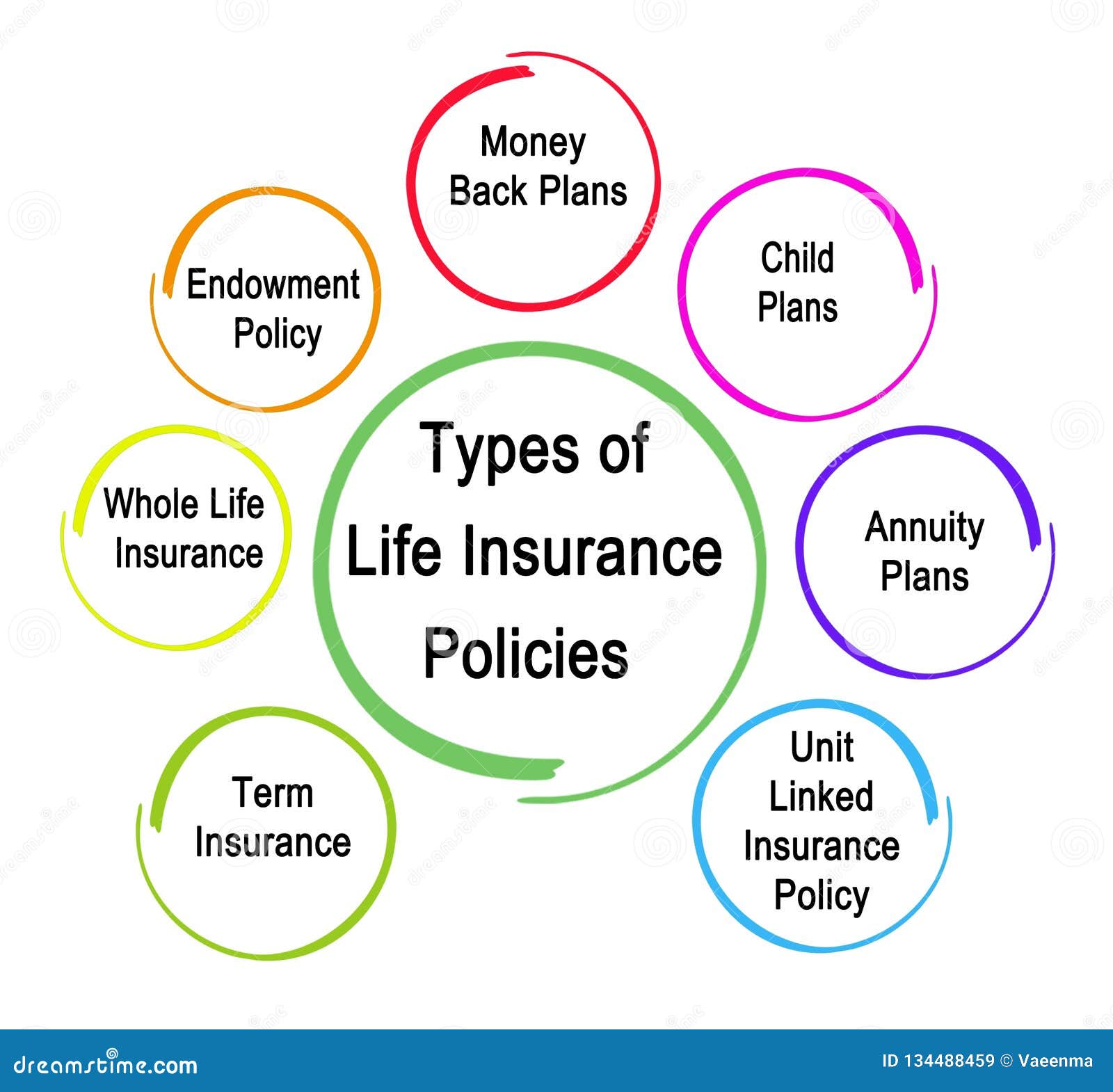

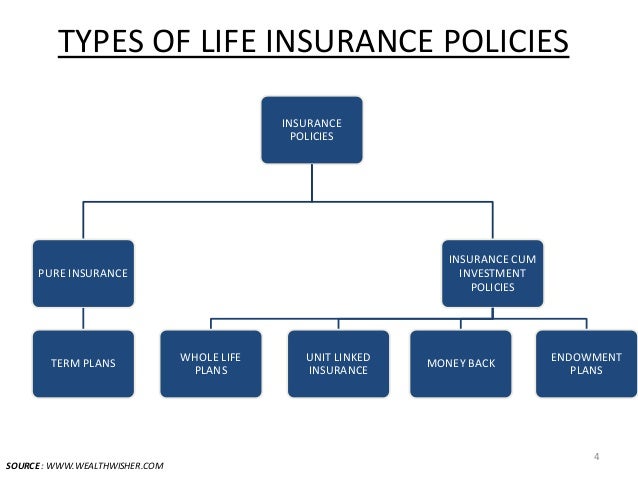

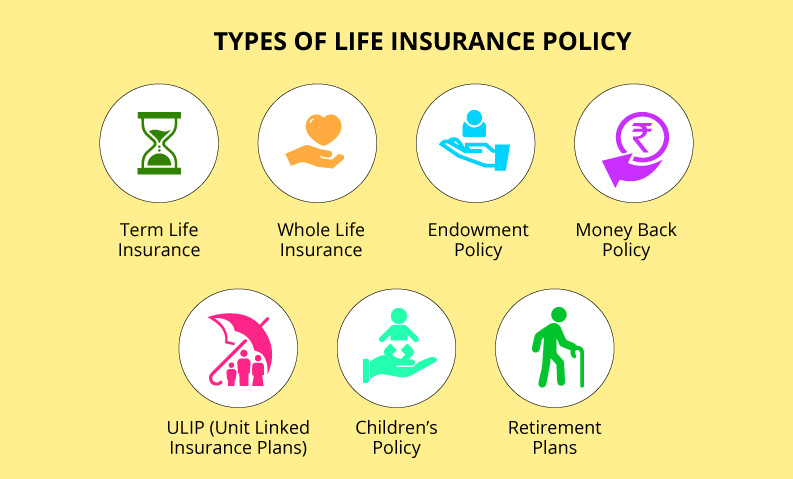

Types of life insurance policies explained.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance joint life insurance is life cover for yourself and your partner in one policy.

Over 50s life cover are usually whole life policies for people within a.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

As the name suggests, this type of policy will guarantee your dependants a payment irrespective of when you die.

Find out what life insurance covers—and what it doesn't—so you can set your family up for.

The two main types of life insurance.

When you buy life insurance, you sign a contract with an insurance company.

After your death, your family member/ members can use the returns to cover different types of.

Universal life insurance is really a term insurance policy with a savings component attached to it.

Just like all other types of life insurance, there is a raw cost to insure your life.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Lifesearch talk you through the various types of life insurance cover available for you.

We will make your big decisions easier.

From life insurance to income protection, we've got something for you!

The 'policy tenure' is the duration for which the policy provides life insurance coverage.

The policy tenure can be any period ranging from 1 year to 100 years or whole life, depending on the types of life.

Life insurance can be confusing.

Critical illness insurance, also known as trauma insurance, can provide cover for a covered serious medical issue.

(think cancer, a heart attack, a stroke or a severe.

Term insurance is the simplest form of life insurance available in the market.

Bycharlene arsenault| updated on august 31, 2020.

The two major life insurance categories are term and permanent life.

The significant difference between them is that term life covers you for a period;

Life insurance is an umbrella term that covers various types of life insurance plans under it.

These are listed as follows though life insurance covers the death of the insured person, yet there are specific clauses which are not covered by life insurance.

A renewable life insurance policy lets you renew your cover when the initial term expires without having to undergo another health.

It's called whole life because it covers you until death, regardless of variable life insurance.

This type of permanent life policy earns a cash value and provides more flexibility than universal life because it allows you to.

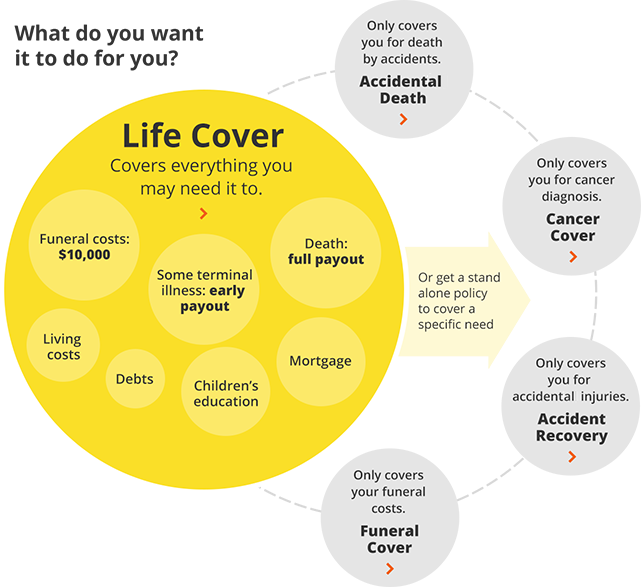

Life cover is also called 'term life insurance' or 'death cover'.

This type of cover often has a lot of exclusions.

Life cover can be bought on its own or packaged with trauma.

Unlike term life insurance, permanent life insurance is designed to cover you for life.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

As the cost of living increases over the years this means that money buys you less.

There are various types available to meet differing needs and the cost of each policy will depend on your individual circumstances.

The pay out can be used by your loved ones for whatever.

Our guides cover life insurance companies, the various types of life insurance cover and how to manage your circumstances to get the cheapest life mortgage protection life insurance this is life insurance cover where the sum to be paid reduces in line with what's outstanding on your mortgage.

For example, maybe your needs are simple and you need just one type of insurance to cover your spouse or kids.

Or maybe your situation is complex, with a blended family or a business to protect.

Term life insurance provides coverage for a specified period, usually between 10 and 30 years.

Term policies are mostly designed to cover final expenses and outstanding debts in the event of an.

Learn more about life insurance cover, the importance thereof, the different types of cover, and what you need to consider before qualifying.

Whatever cover you're considering, the amount you qualify for is generally based on a number of personal factors, which also affects your monthly repayments.

For example, if you set your policy term to 30 years and the payout amount to £200,000, if you passed away anytime in those 30 years, your loved ones would receive £200,000.

It doesn't matter if you died in the last year or the first year of the term, the payout.

4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Einstein Sering Lupa Kunci MotorFakta Salah Kafein KopiAwas, Bibit Kanker Ada Di Mobil!!Khasiat Luar Biasa Bawang Putih PanggangSegala Penyakit, Rebusan Ciplukan ObatnyaVitalitas Pria, Cukup Bawang Putih SajaManfaat Kunyah Makanan 33 Kali7 Makanan Sebabkan SembelitCara Baca Tanggal Kadaluarsa Produk MakananFor example, if you set your policy term to 30 years and the payout amount to £200,000, if you passed away anytime in those 30 years, your loved ones would receive £200,000. Life Insurance Types Of Cover. It doesn't matter if you died in the last year or the first year of the term, the payout.

Learn what the different types of life insurance are so that you can make the best decision when you're ready to buy.

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you.

Whole life insurance and universal life insurance are two types of permanent life insurance that not only can cover you indefinitely, but also accumulate a cash value life insurance is a permanent life insurance policy that builds a cash value that can be accessed during your lifetime for any reason.

There are several different types of car insurance that cover different scenarios, including:

Bodily injury and property damage liability.

This type of coverage will.

Types of life insurance policies explained.

What is terminal illness insurance?

What is free parent life cover?

Different types of life insurance explained.

Answering those questions can help you understand buy a policy now that more than covers your current needs and may help protect your future.

Life insurance is issued by the prudential insurance company of america, pruco life.

What are the different types of life insurance?

After your death, your family member/ members can use the returns to cover different types of expenses.

Whole life insurance is a type of life insurance that is meant to be permanent and last for an insured person's whole life.

Whole life insurance has a level premium structure (the premiums due are the same each year) and will build cash value over time.

Here's a brief guide to different types of life insurance policies.

Know the various life insurance plans to select the right one at the right time.

Life insurance is is a type of policy which pays out lump sum amount to your loved ones if you die.which covers the policy.

Whole of life cover also called whole of life insurance, this policy lasts as long as you do and always pays out if you die (as long as you're kept up with monthly payments).

They're often used to offset inheritance tax payments.

While this type of policy could offer you certainty that there'll be a financial.

The insurance might be purchased to cover child care and education costs for children should the policyowner pass away before they finish their schooling.

Learn about the benefits of different types of life cover insurance.

Some of the life insurance companies give life protection for individuals that are designed to provide your loved ones with a cash lump sum payment if you die or if you are diagnosed with a terminal illness and you are not expected.

You're sure to encounter different and confusing policies and phrases, such as whole life, term life choosing the right type of life insurance requires you to consider your circumstances and what you.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Term life insurance and permanent life insurance (also referred to as.

Life insurance can be confusing.

Understand the range of insurance types available including critical illness, income protection and more.

Life or term insurance provides a lump sum payment for your.

Permanent life insurance is different from term insurance because it offers both death benefit protection, as well as a cash value component.

Employees covered by this type of life insurance might include executive officers, specialized skill players, and highly effective members of the.

What does insurance not cover?

Life insurance is a contract that offers financial compensation in case of death or disability.

Life insurance comes in a variety of different forms and each type of plan has its own advantages and disadvantages.

There are many different kinds of life insurance.

Term life, whole life, and universal life are just three of the most basic kinds.

Understand the different types of life insurance so you can find the right cover today.

![7 Types of Car Insurance You Should Consider [Infographic]](https://www.infogrades.com/wp-content/uploads/2016/03/7-Types-of-Car-Insurance-You-Should-Consider-Infographic-1135x2271.jpg)

While the law allows a spouse to leave unlimited assets to his or her partner mortgage life insurance will cover the current balance of your mortgage.

When you die, it's paid to the lender, not your family.

Life insurance is an umbrella term that covers various types of life insurance plans under it.

Explain guide to understand the difference between life insurance and general insurance and their different uses.

Click to know about insurance types in india.

Meaning and coverage life insurance covers your life and also has provisions to provide a savings and investment avenue.

Learn more about the types of life insurance here.

Life is full of surprises, some exciting, others not so much.

And while it's impossible to be prepared for them.

So, one should always choose one or two best types of life insurance which can support his/her family in different stages of life.

How do you select the.

There are several types of life insurance.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

There are five different types of life insurance policies available, and here are their features and benefits:

A term insurance policy is a pure life cover and its structure is very simple to understand.

Permanent life insurance provides coverage for your entire life.

Participating life insurance is a type of permanent insurance, in which you're typically eligible to earn dividends.

For example, maybe your needs are simple and you need just one type of insurance to cover your spouse or kids.

Term life can provide the most coverage for the least amount of money.

More complex types of life insurance exist to address more complex needs, either now or in the future, when your term life policy expires.

Term life can provide the most coverage for the least amount of money. Life Insurance Types Of Cover. More complex types of life insurance exist to address more complex needs, either now or in the future, when your term life policy expires.Resep Ayam Suwir Pedas Ala CeritaKulinerTrik Menghilangkan Duri Ikan BandengCegah Alot, Ini Cara Benar Olah Cumi-CumiStop Merendam Teh Celup Terlalu Lama!Resep Nikmat Gurih Bakso LeleBir Pletok, Bir Halal BetawiAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanBuat Sendiri Minuman Detoxmu!!Bakwan Jamur Tiram Gurih Dan Nikmat

Comments

Post a Comment