Life Insurance Types The Company Has To Provide Your Family Or Other Beneficiaries With A Certain.

Life Insurance Types. So, If You Call Up A Typical Agency You Are Only Going To Be Able To Get.

SELAMAT MEMBACA!

What type of life insurance is best for you?

Understanding the types of life insurance policies doesn't have to be complicated.

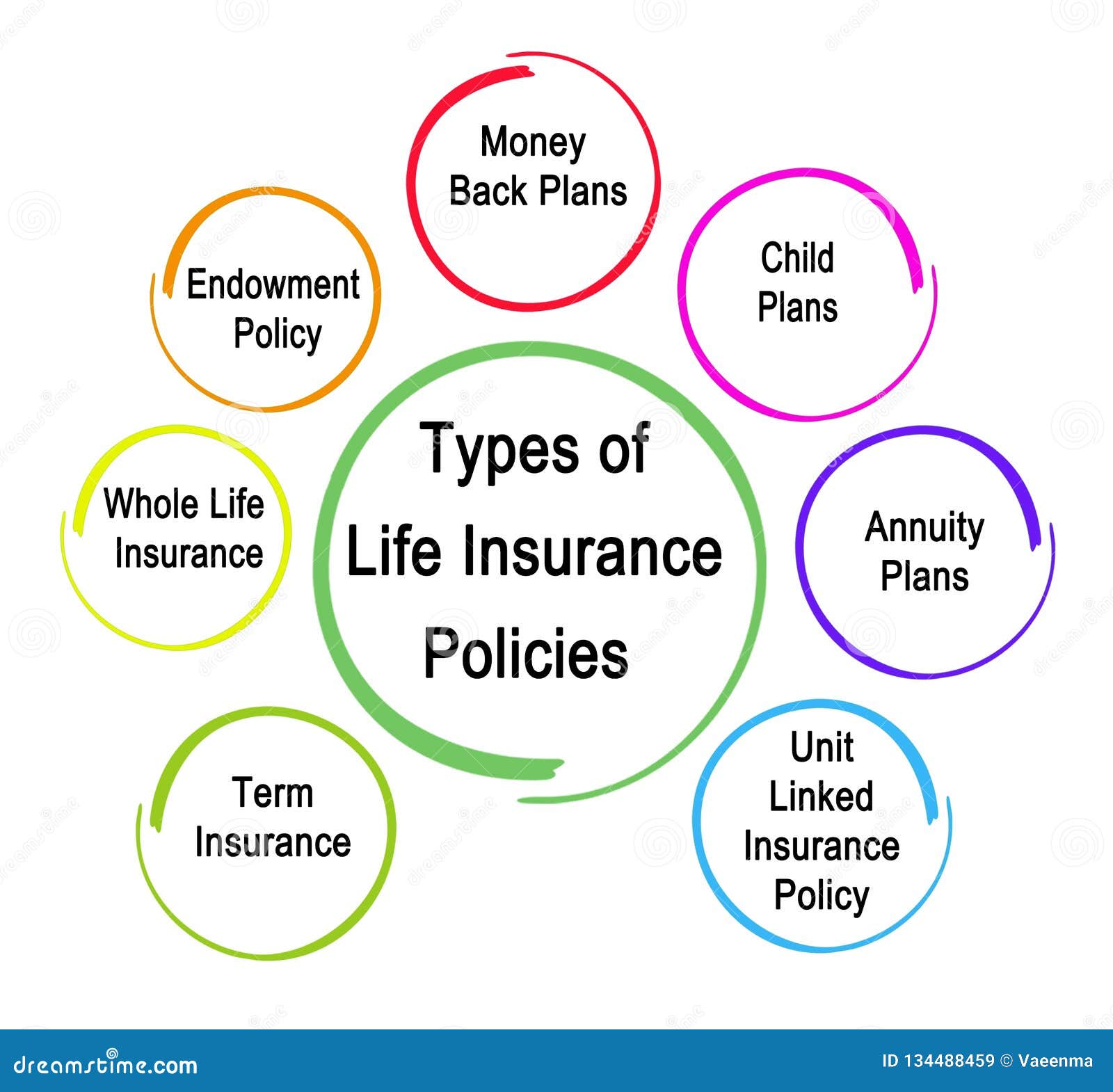

There are many types of life insurance policies that can help protect your family, and they all fall into two main.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

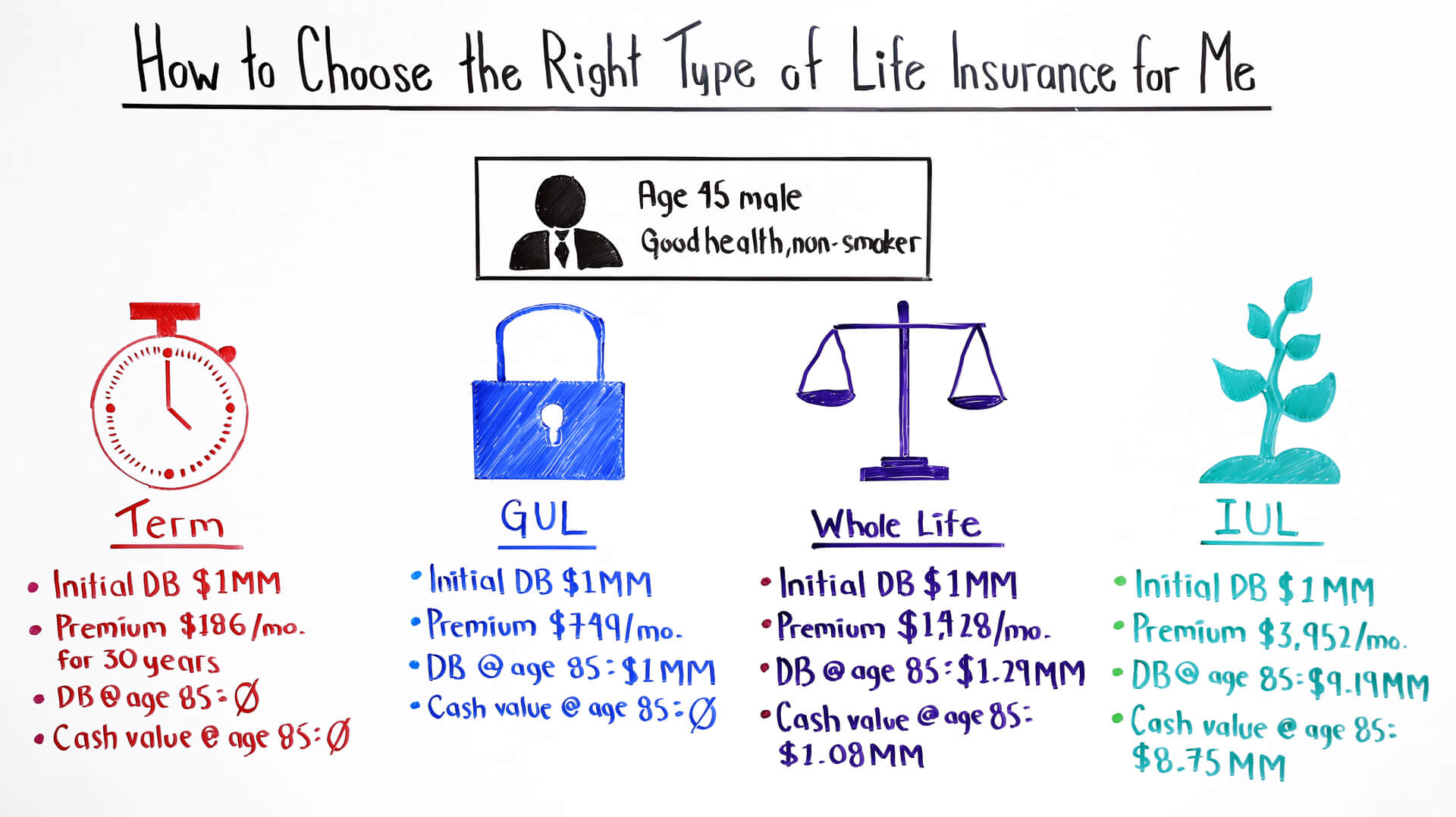

When deciding which type and amount of life insurance is right for you, you'll need to answer these.

Term life, whole life, and universal life are just three of the most basic kinds.

On top of that, many life insurance companies sell multiple types and sizes of policies, and some specialize in meeting specific needs, such as policies for people with chronic health conditions.

The simplest type of permanent life insurance coverage is whole life.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

The many types of life insurance available can be overwhelming.

When shopping for a policy, the first critical step is determining the ultimate goal.

Learn about term, whole life.

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type of life insurance is best for your family's needs.

Learn the differences of life insurance from protective life!

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

The two main types of life insurance.

When you buy life insurance , you sign a contract with an insurance company.

Permanent life insurance is a type of coverage that provides insurance for the life of the it's clear:

There are many types of life insurance options available for you and your family.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

Whole life insurance provides death benefits for as long as you live.

The most common type of some types of whole life policies allow you to pay premiums for shorter periods of time, such as 20.

Choosing the right life insurance policy depends on many factors, including the length of the policy, how much learn about the different types of life insurance to decide which one meets your needs.

There are many different life insurance policies to choose from, so here's a rundown of what's out there so you.

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

An individual today has an array of options to choose from when it comes to financial planning.

Most people focus on the wealth creation aspect and compromise with the.

Whole life insurance is a type of permanent life insurance, and it will last for your entire life.

Life insurance is undoubtedly one of the best ways to safeguard the financial interests of your loved ones in your absence.

But with all of the different types of coverage, where do you begin?

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium.

5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ternyata Jangan Sering Mandikan BayiMengusir Komedo MembandelCara Baca Tanggal Kadaluarsa Produk MakananHindari Makanan Dan Minuman Ini Kala Perut KosongTernyata Ini Beda Basil Dan Kemangi!!Ternyata Tidur Bisa Buat MeninggalMengusir Komedo Membandel - Bagian 2Ternyata Tidur Terbaik Cukup 2 Menit!Ini Manfaat Seledri Bagi KesehatanThis post will help you make sense of all of your life insurance choices. Life Insurance Types. Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium.

Is one of canada's largest online life insurance providers and resources.

There are two basic types of life insurance in canada, dictated by how life insurance premiums are paid.

Universal life insurance is a type of permanent life insurance that combines life insurance with an investment account.

Types of investments you choose to hold in your account.

This covers the 5 types of life insurance policies available in canada and helps you decide between term, whole life and other insurances.

We've listed the 5 different types of life insurance plans available in canada and compare them so you are a little more prepared to make a big decision.

Life insurance can help you and your family prepare for the future.

What are the different types of life insurance policies available in canada?

We offer different types of life insurance and we can help you find the solution that's right for you.

The two main types of life insurance in canada are term insurance and permanent insurance.

There are a few options within each category, as.

What type of life insurance is right for me?

There are two main types of life insurance available in canada:

Term life insurance expires after a specific period, while a permanent insurance policy.

While the types of life insurance covered above are the main products available in canada, there are some other products worth mentioning.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Idc insurance direct canada inc.

National service centre 4400 dominion st., suite 260 burnaby, bc v5g 4g3.

We've reviewed several life insurance policies available to canadians, which you can find.

You have options to choose from, including term life insurance, permanent life insurance and universal life insurance.

Apply online at sunlife.ca and get a quote today.

Or talk to a sun life financial advisor to learn more about how life insurance.

If you have a less serious health condition, or were previously refused insurance, deferred term is the right.

This infographic shows nearly all life insurance companies in canada.

Find out more about 40+ life insurers and discover who owns whom.

Many life insurance shoppers are becoming more aware of the importance of this type of insurance.

This is driving them to become more informed before they make their final decisions.

Type of cover life insurance joint life insurance life + critical illness critical illness insurance disability insurance mortgage life insurance no what plan is right for you?

Life insurance in canada life insurance is something everyone has in their life time.

It is the money someone (spouse) gets when their parents or family members die.

The thing is every country has their own rules and regulations regarding life insurance and medical commodities.

Term insurance provides protection during 10 or 40 year terms.

There are two types of permanent insurance policies available in the market.

Universal life insurance and whole life insurance policies…

We understand it can be difficult to make these types of decisions, so we're here to help guide you.

Summary there are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

However choosing from the different types of life insurance in canada isn t like deciding what flavour of ice cream to try for dessert.

The satisfaction of their clients.

This insurance company sells attractive life insurance and investment products.

Assumption life is a company that advocates mutual aid, integrity, modernization and the greatest possible commitment to.

Get a headstart on personal finances in canada.

Compare life insurance quotes & explore your coverage options.

Protect the financial security of your loved ones today.

Term life and permanent life insurance.

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

A specified amount of insurance is provided during the term for a fixed rate.

Without meaning to sound morbid, it is a certainty that you will die, so how do you help those you leave behind to cope with losing any financial security that you provided.

Type of insurance life insurance term life insurance permanent life insurance mortgage life insurance whole life insurance term 100 with a legacy as canada's oldest insurance company, the canada life assurance company has built trust with canadians across the nation with their.

Compare quotes from canada's best insurance companies.

Become a homeowner, raise a family, provide tuition for children what are the different life insurance types?

Temporary life insurance is affordable and valid for a.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life. Life Insurance Types. When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.5 Cara Tepat Simpan TelurResep Stawberry Cheese Thumbprint CookiesTernyata Bayam Adalah Sahabat Wanita3 Jenis Daging Bahan Bakso TerbaikPecel Pitik, Kuliner Sakral Suku Using BanyuwangiTernyata Asal Mula Soto Bukan Menggunakan Daging3 Cara Pengawetan CabaiAmpas Kopi Jangan Buang! Ini ManfaatnyaSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanSusu Penyebab Jerawat???

Comments

Post a Comment