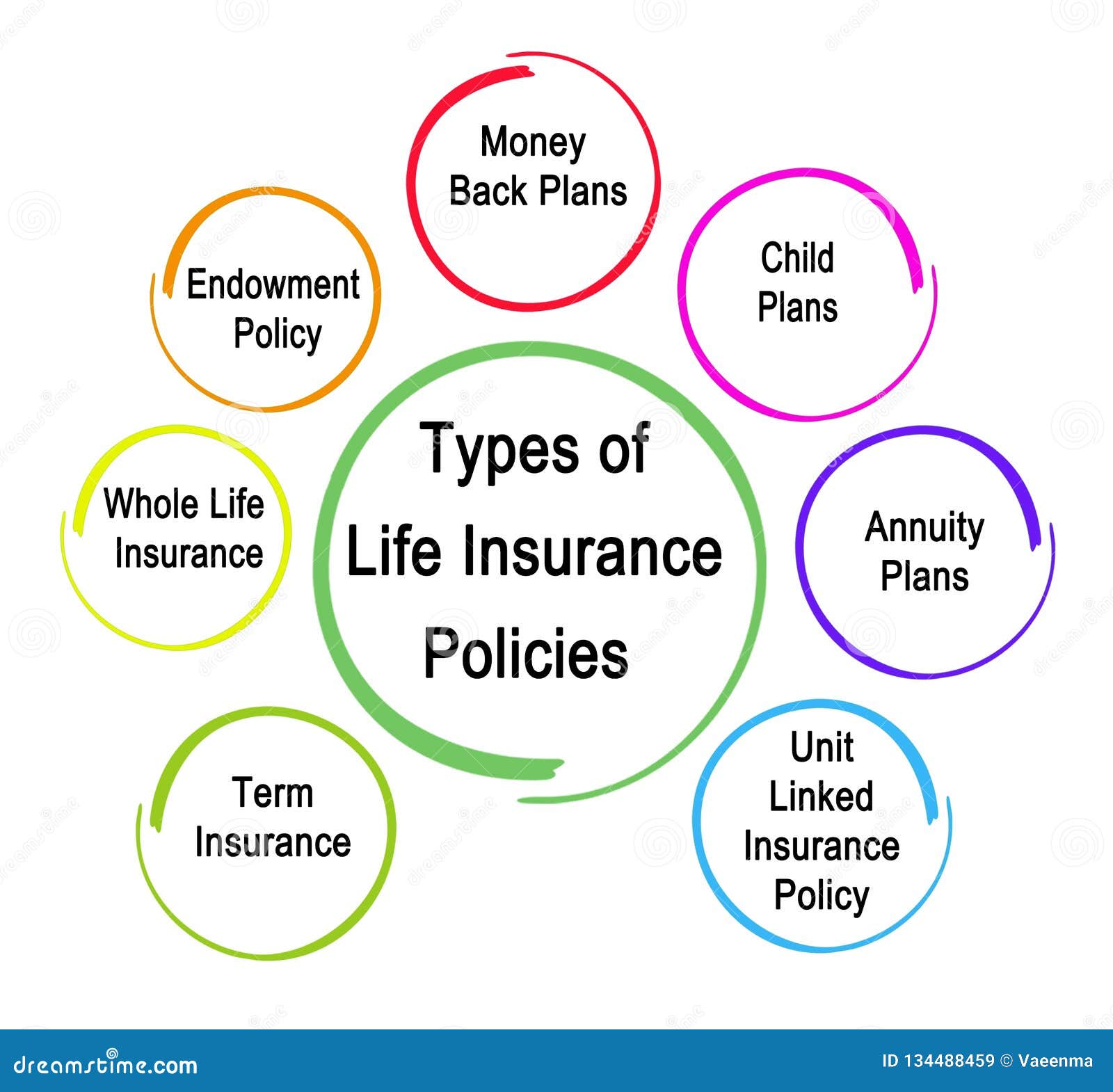

Life Insurance Types Chart Life Insurance Comes In Many Shapes And Sizes, But There Are Two Basic Types Of Life Insurance Policies:

Life Insurance Types Chart. Make Sense Of All The Types Of Life Insurance Available And Find Out What's Right For You And Your Family.

SELAMAT MEMBACA!

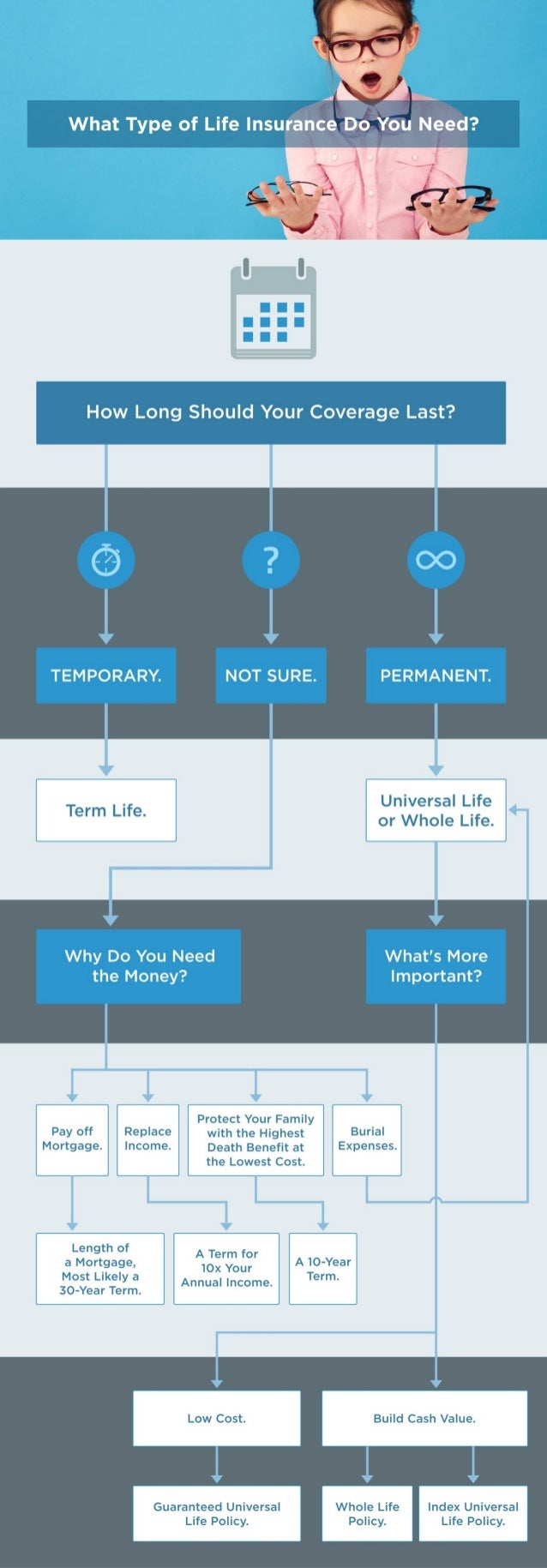

Check out our life insurance chart to understand the plans and what life insurance you may need.

What do you want the insurance to cover?

Types of life insurance flow chart visual ly.

Your life insurance plans fhk insurancefhk insurance.

Types of insurance property health life auto chart.

Life insurance for you and your loved ones netquoter ca.

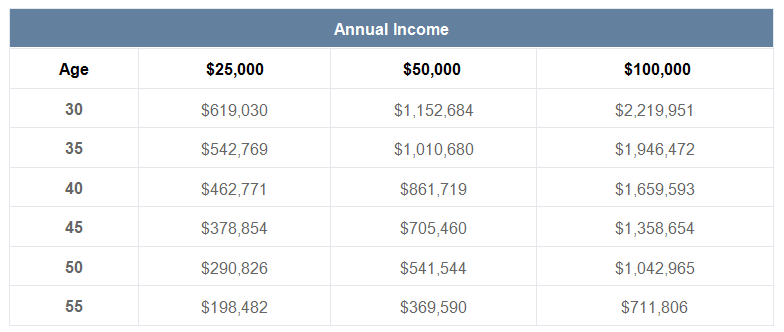

We have whole life insurance charts that give examples of whole life insurance quotes by age below.

Unlike many other types of life insurance, your premium will not change.

Guaranteed access to your money means that you have a contract with the insurance.

There are two primary types of life insurance:

In this guide we walk through the differences and help you understand what is best for you.

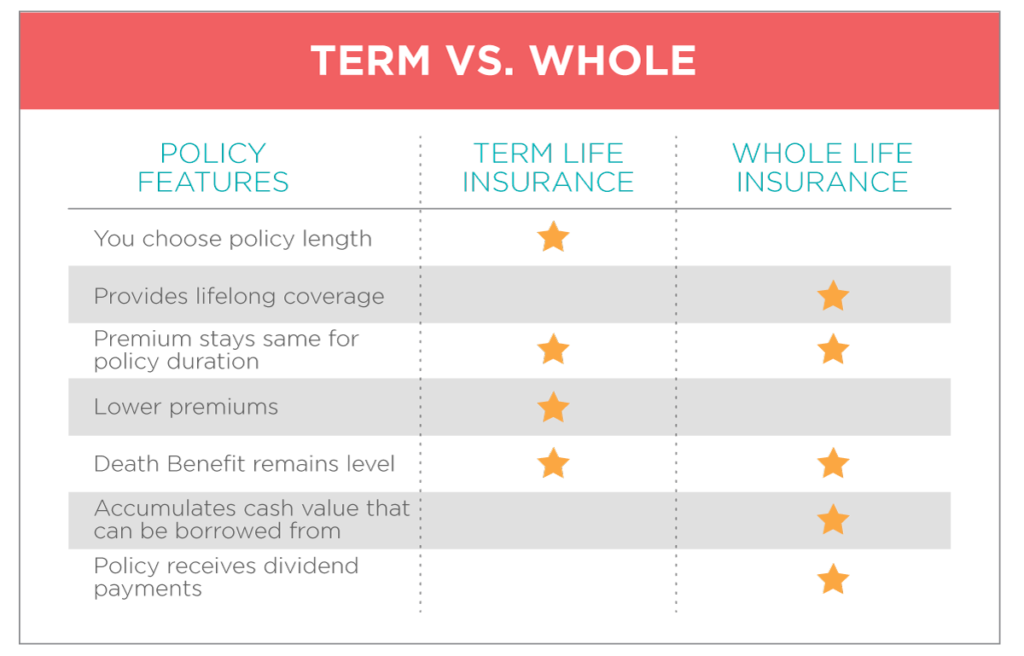

Term life and whole life insurance explained with chart and infographics in pdf.

If the answer is no, here you will find them simple explained in details with chart and infographics in pdf.

What are the permanent life insurance policy types?

Permanent life insurance can be mainly classified into two basic categories:

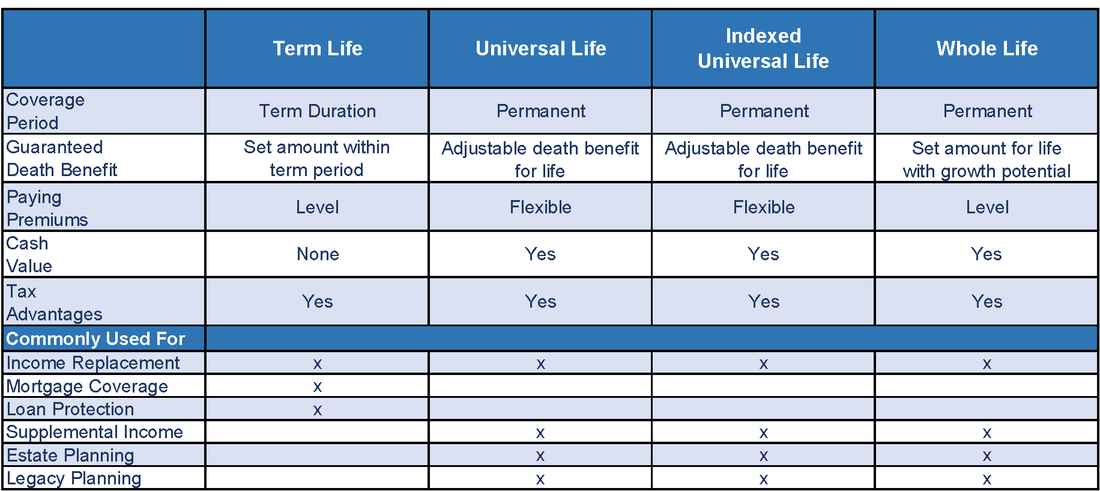

Universal life our life insurance comparison chart highlights the key features of each of the products that we just covered.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

First, we'll begin with a chart showing the average, monthly whole life insurance rates for a female with $100,000 in coverage

Purchasing life insurance in your 70s, 80s, and 90s is very common.

There are various reasons why one may not have purchased before, but now it is needed.

All the basics you need to know about.

Two types of life insurance policies.

The difference between term, whole, and universal life insurance.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

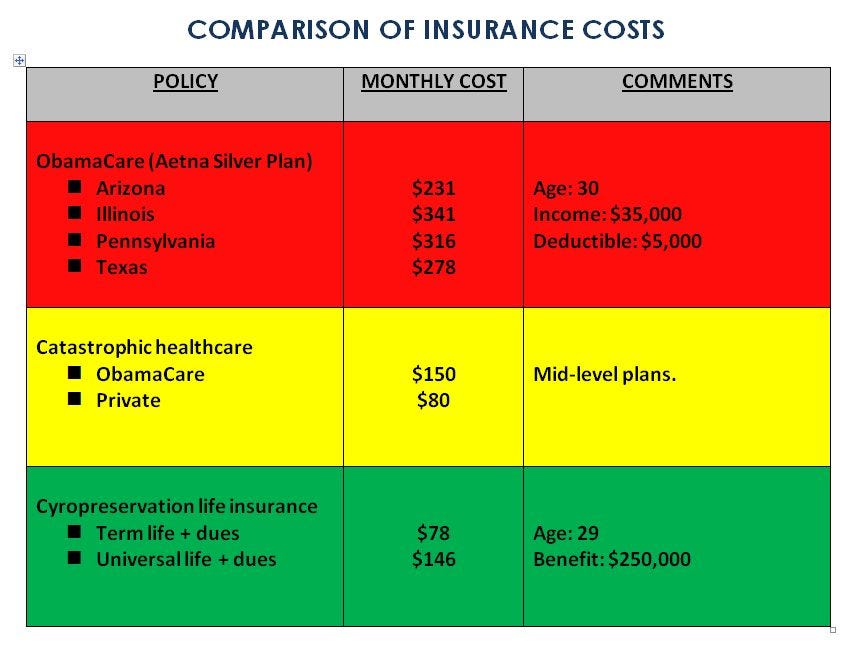

The above charts show the best rates for a variety of life insurance policy types and come from some of the best life insurance companies.

Underwriting may be more aggressive if the type of life insurance you choose is universal life vs term life insurance.

How weight loss affects life insurance.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Learn what the different types of life insurance are so that you can make the best decision when you're ready to buy.

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Policy type (the type of policy such as term or permanent).

Death benefit (the coverage amount being purchased).

Ready to find your price?

Hopefully, by this point you have a good idea about how much life insurance costs.

Using life insurance table ratings has helped the life insurance industry have a standardized method of quoting to create a fair and equitable way of providing quotes to consumers.

Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

Term insurance is the simplest form of life insurance available in the market.

Life insurance comes in many shapes and sizes, but there are two basic types of life insurance policies:

Term or temporary life insurance and permanent life insurance.

Take a look at this chart to better understand the two main types of life insurance

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

The most common type of permanent life insurance is whole life insurance.

Complete guide on the different types of term life insurance, including how to choose terms, coverage amounts, and providers.

Then should life insurance plans be of the same type?

Wouldn't you need different plans for meeting different financial requirements?

Thus, there are different types of life insurance plans and each plan offers something different.

Ordinary whole life insurance has some value as an investment.

The insured pays premiums on this type of insurance until his death.

We recommend having one of our network members contact you to discuss which type of life insurance is best for your needs.

It means monetary protection in your auto, bike or truck in that case for those who become involved in a site visitors accident that.

Cara Benar Memasak SayuranTernyata Tahan Kentut Bikin Keracunan8 Bahan Alami Detox Melawan Pikun Dengan ApelPentingnya Makan Setelah OlahragaGawat! Minum Air Dingin Picu Kanker!3 X Seminggu Makan Ikan, Penyakit Kronis Minggat5 Manfaat Meredam Kaki Di Air EsTernyata Tertawa Itu DukaTips Jitu Deteksi Madu Palsu (Bagian 1)If you happen to personal a car and also you need to use it legally, you should have legitimate motorcar legal responsibility insurance coverage. Life Insurance Types Chart. It means monetary protection in your auto, bike or truck in that case for those who become involved in a site visitors accident that.

Check out our life insurance chart to understand the plans and what life insurance you may need.

What do you want the insurance to cover?

Types of life insurance flow chart visual ly.

Your life insurance plans fhk insurancefhk insurance.

Types of insurance property health life auto chart.

Life insurance for you and your loved ones netquoter ca.

We have whole life insurance charts that give examples of whole life insurance quotes by age below.

Unlike many other types of life insurance, your premium will not change.

Guaranteed access to your money means that you have a contract with the insurance.

There are two primary types of life insurance:

In this guide we walk through the differences and help you understand what is best for you.

Term life and whole life insurance explained with chart and infographics in pdf.

If the answer is no, here you will find them simple explained in details with chart and infographics in pdf.

What are the permanent life insurance policy types?

Permanent life insurance can be mainly classified into two basic categories:

Universal life our life insurance comparison chart highlights the key features of each of the products that we just covered.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

First, we'll begin with a chart showing the average, monthly whole life insurance rates for a female with $100,000 in coverage

Purchasing life insurance in your 70s, 80s, and 90s is very common.

There are various reasons why one may not have purchased before, but now it is needed.

All the basics you need to know about.

Two types of life insurance policies.

The difference between term, whole, and universal life insurance.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

The above charts show the best rates for a variety of life insurance policy types and come from some of the best life insurance companies.

Underwriting may be more aggressive if the type of life insurance you choose is universal life vs term life insurance.

How weight loss affects life insurance.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Learn what the different types of life insurance are so that you can make the best decision when you're ready to buy.

What type of life insurance is best for you?

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Policy type (the type of policy such as term or permanent).

Death benefit (the coverage amount being purchased).

Ready to find your price?

Hopefully, by this point you have a good idea about how much life insurance costs.

Using life insurance table ratings has helped the life insurance industry have a standardized method of quoting to create a fair and equitable way of providing quotes to consumers.

Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

Term insurance is the simplest form of life insurance available in the market.

Life insurance comes in many shapes and sizes, but there are two basic types of life insurance policies:

Term or temporary life insurance and permanent life insurance.

Take a look at this chart to better understand the two main types of life insurance

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

The most common type of permanent life insurance is whole life insurance.

Complete guide on the different types of term life insurance, including how to choose terms, coverage amounts, and providers.

Then should life insurance plans be of the same type?

Wouldn't you need different plans for meeting different financial requirements?

Thus, there are different types of life insurance plans and each plan offers something different.

Ordinary whole life insurance has some value as an investment.

The insured pays premiums on this type of insurance until his death.

We recommend having one of our network members contact you to discuss which type of life insurance is best for your needs.

It means monetary protection in your auto, bike or truck in that case for those who become involved in a site visitors accident that.

If you happen to personal a car and also you need to use it legally, you should have legitimate motorcar legal responsibility insurance coverage. Life Insurance Types Chart. It means monetary protection in your auto, bike or truck in that case for those who become involved in a site visitors accident that.3 Cara Pengawetan Cabai3 Jenis Daging Bahan Bakso TerbaikResep Segar Nikmat Bihun Tom YamResep Beef Teriyaki Ala CeritaKuliner9 Jenis-Jenis Kurma TerfavoritResep Nikmat Gurih Bakso LeleStop Merendam Teh Celup Terlalu Lama!Petis, Awalnya Adalah Upeti Untuk RajaBakwan Jamur Tiram Gurih Dan Nikmat5 Makanan Pencegah Gangguan Pendengaran

Comments

Post a Comment