Life Insurance Types Chart Buying Life Insurance Shouldn't Be Complicated.

Life Insurance Types Chart. Check Out Our Life Insurance Chart To Understand The Plans And What Life Insurance You May Need.

SELAMAT MEMBACA!

Check out our life insurance chart to understand the plans and what life insurance you may need.

What do you want the insurance to cover?

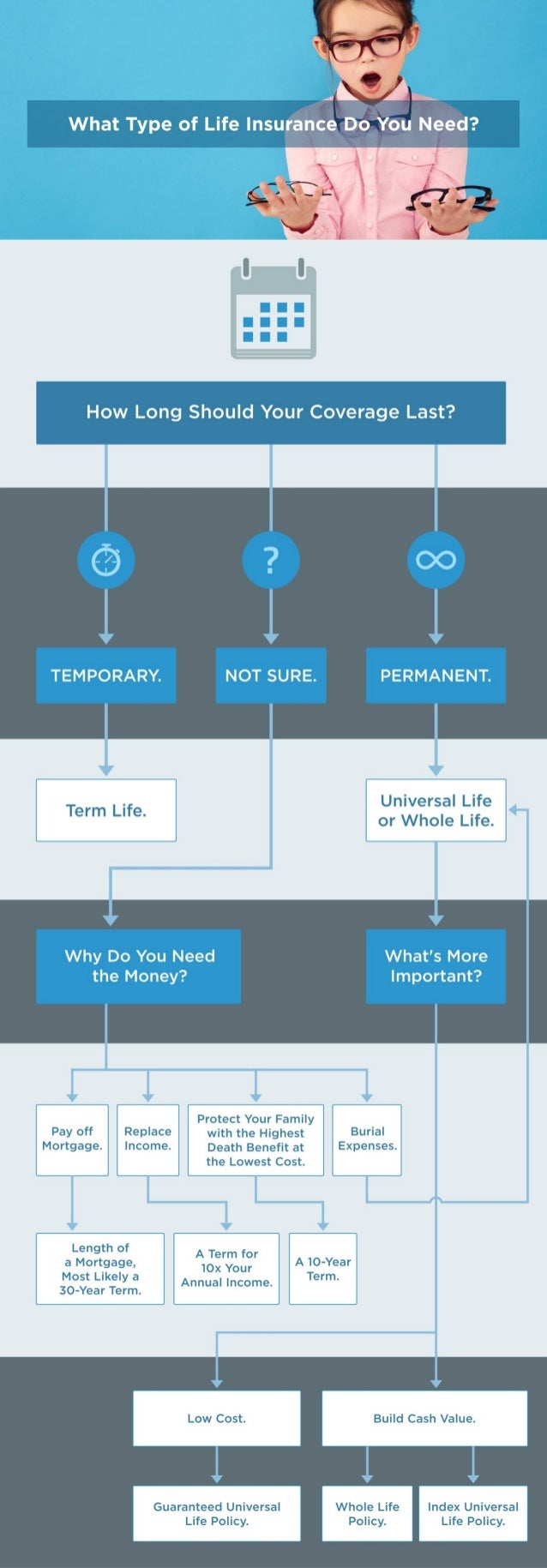

Types of life insurance flow chart visual ly.

Your life insurance plans fhk insurancefhk insurance.

Types of insurance property health life auto chart.

Life insurance for you and your loved ones netquoter ca.

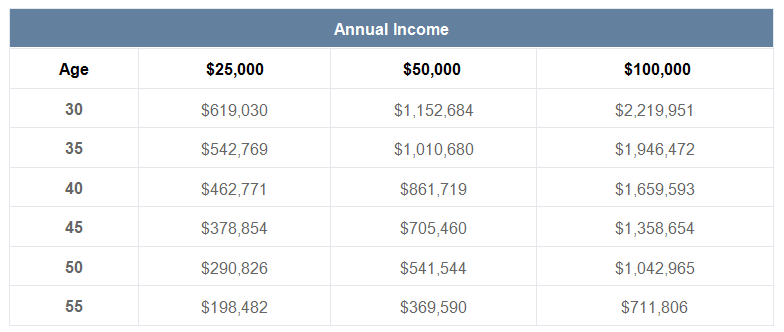

We have whole life insurance charts that give examples of whole life insurance quotes by age below.

Unlike many other types of life insurance, your premium will not change.

Guaranteed access to your money means that you have a contract with the insurance.

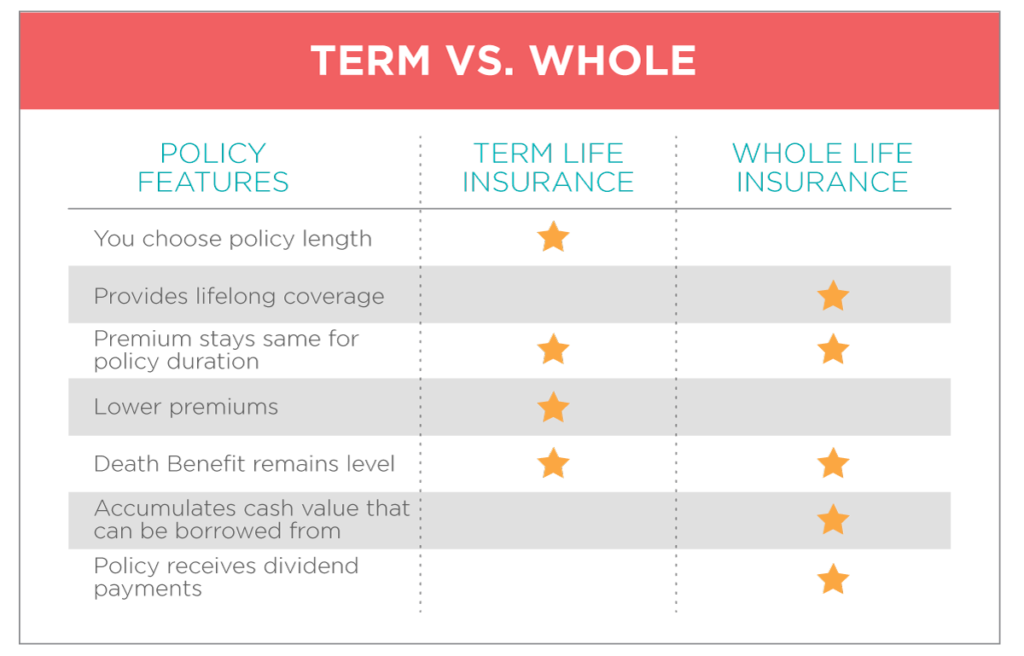

Term life and whole life insurance explained with chart and infographics in pdf.

This will help you to make a comparison between the variety of plans, coverages.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

First, we'll begin with a chart showing the average, monthly whole life insurance rates for a female with $100,000 in coverage

There are various reasons why one may not have purchased before, but now it is needed.

Postponing a life insurance purchase past age 70 will limit the type of life insurance coverage that is available.

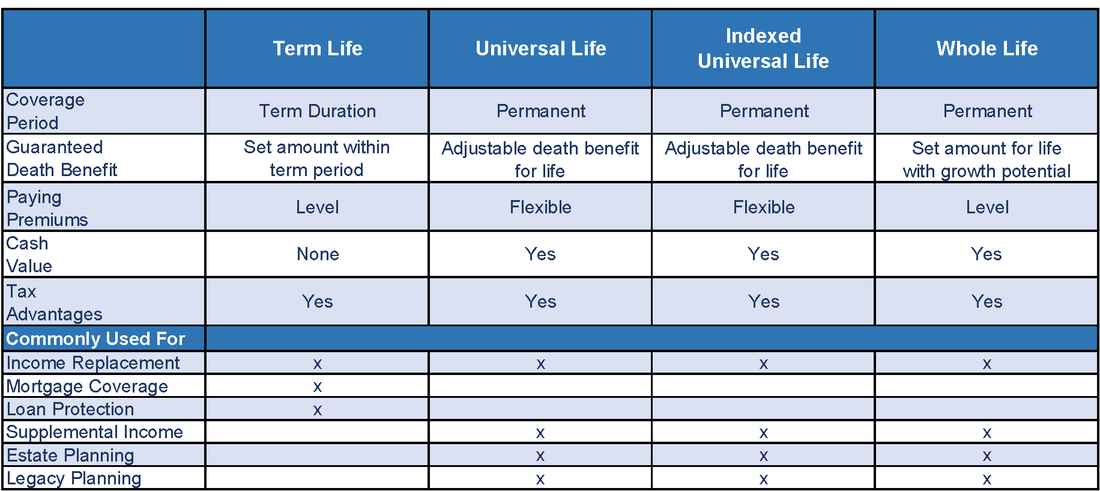

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

This makes it very attractive to people, but if you outlive the length of the term policy.

There are two primary types of life insurance:

Whole life and term insurance.

Look at sample life insurance rates for term life, universal life, and whole life.

The above charts show the best rates for a variety of life insurance policy types and come from some of the best life insurance companies.

What are the permanent life insurance policy types?

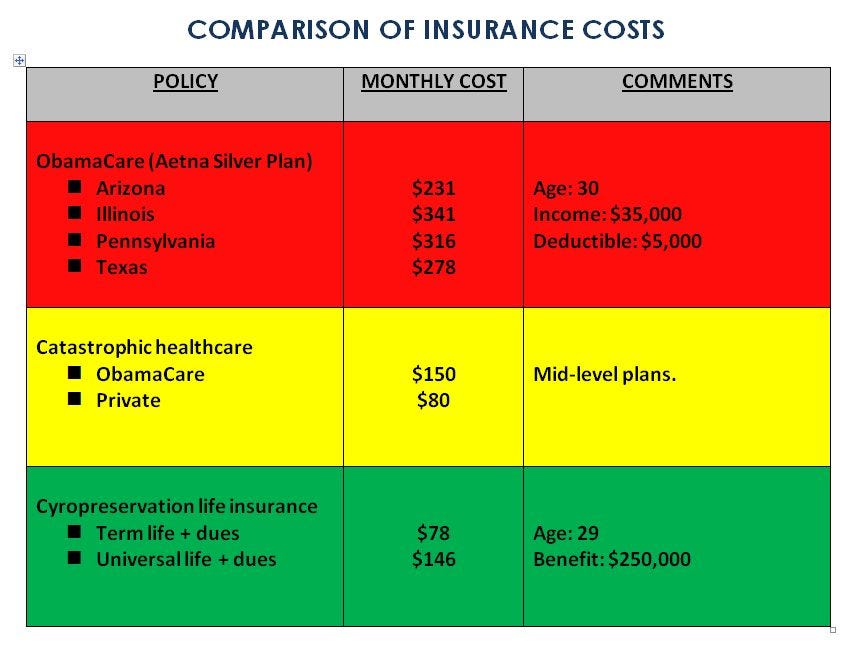

Universal life our life insurance comparison chart highlights the key features of each of the products that we just covered.

Hopefully this chart will assist you.

Understanding the types of life insurance policies doesn't have to be complicated.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life.

Death benefit (the coverage amount being purchased).

Try our life insurance cost widget here.

Ready to find your price?

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Underwriting may be more aggressive if the type of life insurance you choose is universal life vs term life insurance.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

Using life insurance table ratings has helped the life insurance industry have a standardized method of quoting to create a fair and equitable way of providing quotes to consumers.

It also helps protect the insurance companies from individuals with medical problems.

A pure protection plan, a term insurance offers a large coverage at an affordable premium.

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

Two types of life insurance policies.

The difference between term, whole, and universal life insurance.

Product life insurance training from flex coaching these pictures of this page are about:life insurance types chart.

These are listed as follows term insurance is a popular type of life insurance that is bought for a fixed period of time that may range between 5 to 30 years.

Life insurance rating classifications are based on one's medical history and the results of the medical exam (if one is taken).

An insurance company will make an offer (or occasionally decline to make an offer) that reflects its guidelines for a rating class.

Universal life insurance is really a term insurance policy with a savings component attached to it.

Just like all other types of life insurance, there is a whole life insurance is great for those with a greater amount of discretionary income, a long time horizon, and the desire for safety with strong guarantees.

Life insurance is generally used to cover two types of obligations:

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

Understand the different types of life insurance so you can find the right cover today.

Ordinary whole life insurance has some value as an investment.

If you happen to personal a car and also you need to use it legally, you should have legitimate motorcar legal responsibility insurance coverage.

It means monetary protection in your auto, bike or truck in that case for those who become involved in a site visitors accident that.

Life insurance comes in many shapes and sizes, but there are two basic types of life insurance policies:

Take a look at this chart to better understand the two main types of life insurance

Ternyata Mudah Kaget Tanda Gangguan MentalFakta Salah Kafein Kopi5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ternyata Madu Atasi InsomniaPentingnya Makan Setelah Olahraga8 Bahan Alami Detox Resep Alami Lawan Demam AnakSaatnya Minum Teh Daun Mint!!Cara Benar Memasak SayuranTernyata Merokok + Kopi Menyebabkan KematianTerm or temporary life insurance and permanent life insurance. Life Insurance Types Chart. Take a look at this chart to better understand the two main types of life insurance

Health insurance comparison spreadsheet and life insurance, life insurance policy comparison chart life insurance, no med foresters comparison chart canada insurance plan, 9 different types of life insurance explained, 10 best pet insurance companies of 2020 consumersadvocate org.

Life insurance rates can vary by individual due to their age, gender, health history, and even their driving record.

If you're young and healthy, you.

For the average consumer, however, any comparison between types of life insurance will likely come down to the term vs.

What do you want the insurance to cover?

Compare quotes from top companies and save.

Term life insurance is one of the types of life insurance most people look to for the lowest rates;

First, we'll begin with a chart showing the average.

Life insurance types flow chart life insurance types life, buy life insurance policy online india quiz compare rates, life insurance rate tables is your offer the best, 9 different types of life insurance explained, know about the returns you can get from your insurance.

Term life and whole life insurance explained with chart and infographics in pdf.

This will help you to make a comparison between the variety of plans.

Our guide to life insurance quotes allows you to compare quotes online and the information to understand what affects a life insurance quote.

There are other factors that you have little or no control over, such as your age, gender, and location.

Hopefully this chart will assist you finding the best type of life insurance policy for your family.

Getting free life insurance comparisons is a easy with affordable life usa.

Your life insurance coverage needs may change if your personal situation changes.

We have whole life insurance charts that give examples of whole life insurance quotes by age below.

Life insurance sites often show the comparison between whole life vs term life rates, as term is less expensive unlike many other types of life insurance, your premium will not change.

We recommend having one of our network members contact you to discuss which type of life insurance is best for your needs.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

This makes it very attractive to people, but if you outlive the length of the term policy.

9 different types of life insurance explained in detail.

Comparison chart for health savings account, health reimbursement arrangement, health care flexible claims for reimbursement must be submitted by april 30 following the end of the plan year.

What type(s) of corresponding health.

Understanding the types of life insurance policies doesn't have to be complicated.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

Various types of life insurance.

Graph for life insurance comparison graph.

Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.

The cost of life insurance is very competitive in new zealand and the existence of price comparison websites to show quotes makes it more affordable than ever before.

Life insurance comparison charts and tables help provide a summary of the cover you could expect for your budget.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

But burial insurance, which is also a type of cash value insurance, is a completely emotional purchase that makes absolutely no sense financially.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option.

Different types of life insurance have different costs.

You should know the type of insurance you pick, which will greatly impact your rates.

The difference can be anywhere from 5 to 7 times more premium.

Compare different types of life insurance plans and check the benefits of life insurance, cover and how to claim.

A term insurance policy is the cheapest policy in comparison to other life insurance policy, as it contains no cash value, and thus no maturity benefits are availed on the survival of the.

If you read this far, you should follow us:

Term life insurance vs whole life insurance. comments:

Term life insurance vs whole life insurance.

Postponing a life insurance purchase past age 70 will limit the type of life insurance coverage that is available.

It will also limit the amount of companies that are available to shop from.

Types of supplemental life insurance policies.

Common life insurance terms and their meanings.

What's the best type of life insurance policy for you?

What type of life insurance is best for you?

Term insurance is the simplest form of life insurance available in the market.

A pure protection plan, a term insurance offers a large coverage at an affordable a general health insurance plan is an indemnity plan that pays for hospitalisation expenses up to the sum insured.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Your life insurance portfolio should be flexible enough to weather the storms as well as take advantage of opportunities as they arise.

Your life insurance portfolio should be flexible enough to weather the storms as well as take advantage of opportunities as they arise. Life Insurance Types Chart. We'll help maximize your life insurance potential to the fullest.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTernyata Bayam Adalah Sahabat WanitaStop Merendam Teh Celup Terlalu Lama!Sejarah Kedelai Menjadi TahuResep Ayam Kecap Ala CeritaKuliner3 Cara Pengawetan CabaiBakwan Jamur Tiram Gurih Dan NikmatTernyata Kue Apem Bukan Kue Asli IndonesiaBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi Luwak5 Makanan Pencegah Gangguan Pendengaran

Comments

Post a Comment