Life Insurance Types Canada Or Talk To A Sun Life Financial Advisor To Learn More About How Life Insurance.

Life Insurance Types Canada. Financially Protect Your Loved Ones With Life Insurance.

SELAMAT MEMBACA!

Is one of canada's largest online life insurance providers and resources.

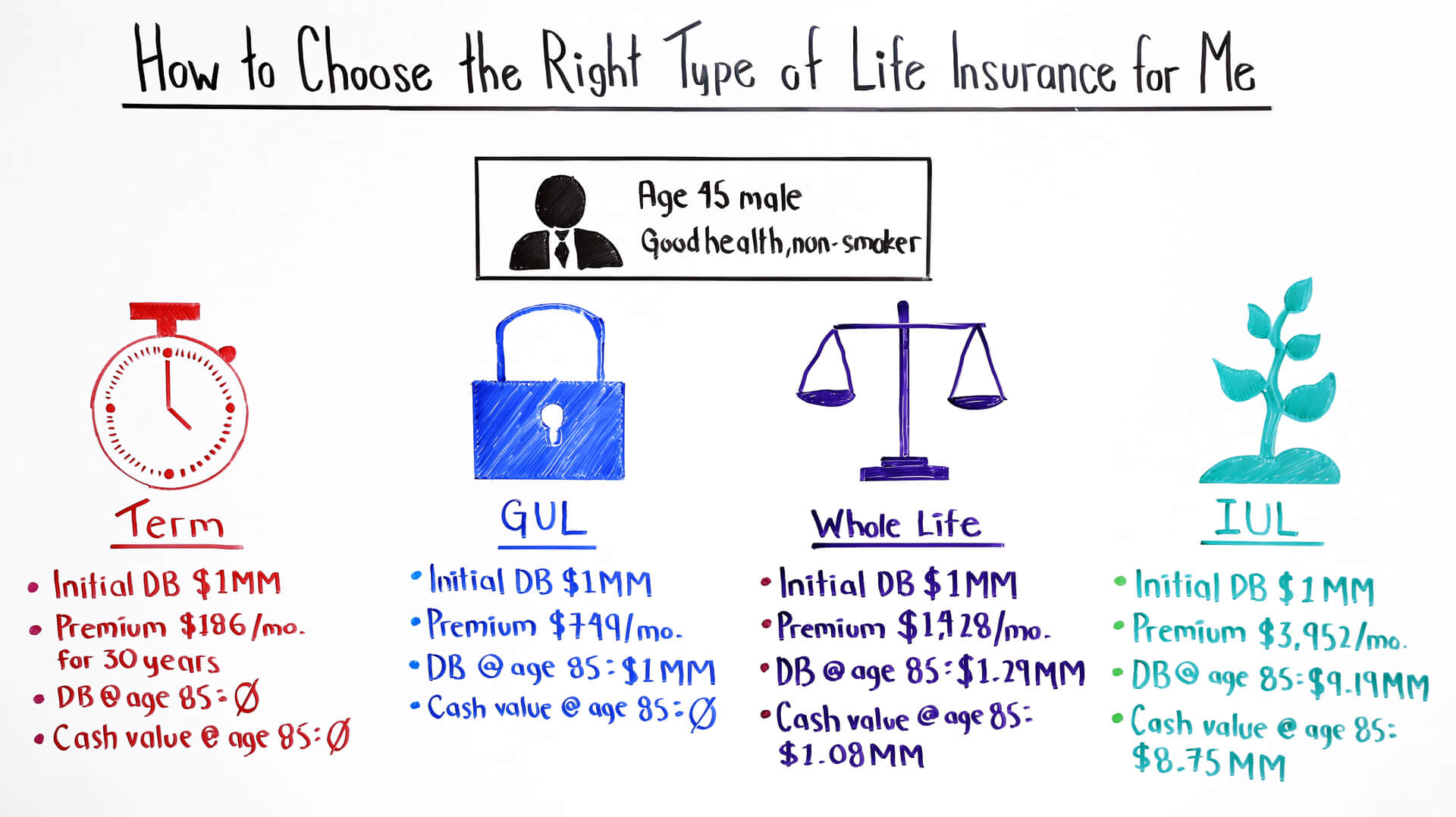

There are two basic types of life insurance in canada, dictated by how life insurance premiums are paid.

This covers the 5 types of life insurance policies available in canada and helps you decide between term, whole life and other insurances.

We've listed the 5 different types of life insurance plans available in canada and compare them so you are a little more prepared to make a big decision.

Types of investments you choose to hold in your account.

You can also select how your premiums are invested.

Life insurance can help you and your family prepare for the future.

What are the different types of life insurance policies available in canada?

The two main types of life insurance in canada are term insurance and permanent insurance.

As the names imply, term insurance covers the policy holder for a given period only, while permanent insurance covers the policy holder for life.

We offer different types of life insurance and we can help you find the solution that's right for you.

While the types of life insurance covered above are the main products available in canada, there are some other products worth mentioning.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

We've reviewed several life insurance policies available to canadians, which you can find.

Idc insurance direct canada inc.

National service centre 4400 dominion st., suite 260 burnaby, bc v5g 4g3.

Term insurance and permanent insurance.

The difference between the two is fairly for the average young canadian, however, the monthly premiums may not be worth the eventual payout.

There are three primary categories of.

If you have a less serious health condition, or were previously refused insurance, deferred term is the right.

Financially protect your loved ones with life insurance.

You have options to choose from, including term life insurance, permanent life insurance and universal life insurance.

Or talk to a sun life financial advisor to learn more about how life insurance.

When it comes to buying life insurance in canada, it means making a lot of important decisions.

Many life insurance shoppers are becoming more aware of the importance of this type of insurance.

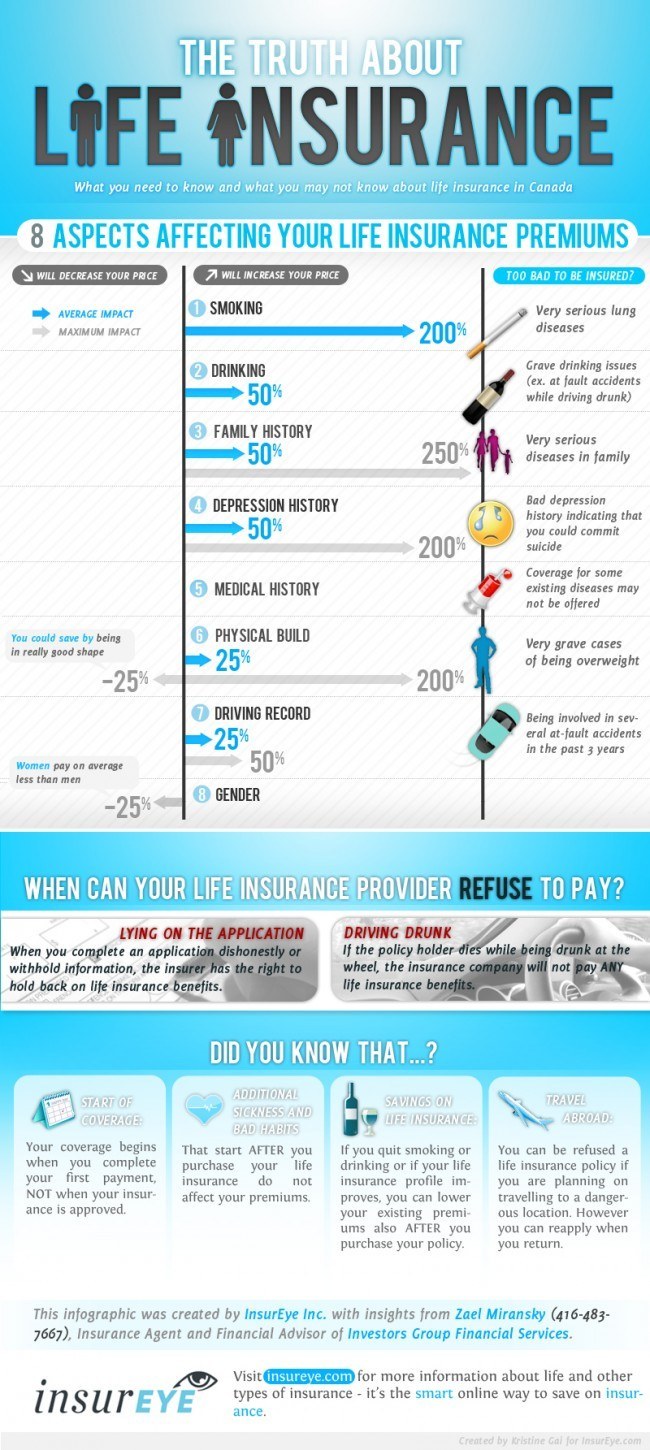

![What Type of Life Insurance Do I Need? [INFOGRAPHIC]](https://infographicplaza.com/wp-content/uploads/Life-Insurance-Infographic-plaza.jpg)

Type of cover life insurance joint life insurance life + critical illness critical illness insurance disability insurance mortgage life insurance no what plan is right for you?

We work with all the largest life insurance providers in canada, and can help you find a plan that works with your budget.

A td life insurance plan in canada, is a way to help protect your family's financial future, even after you've passed away, so there is less of a financial burden left behind during a challenging time.

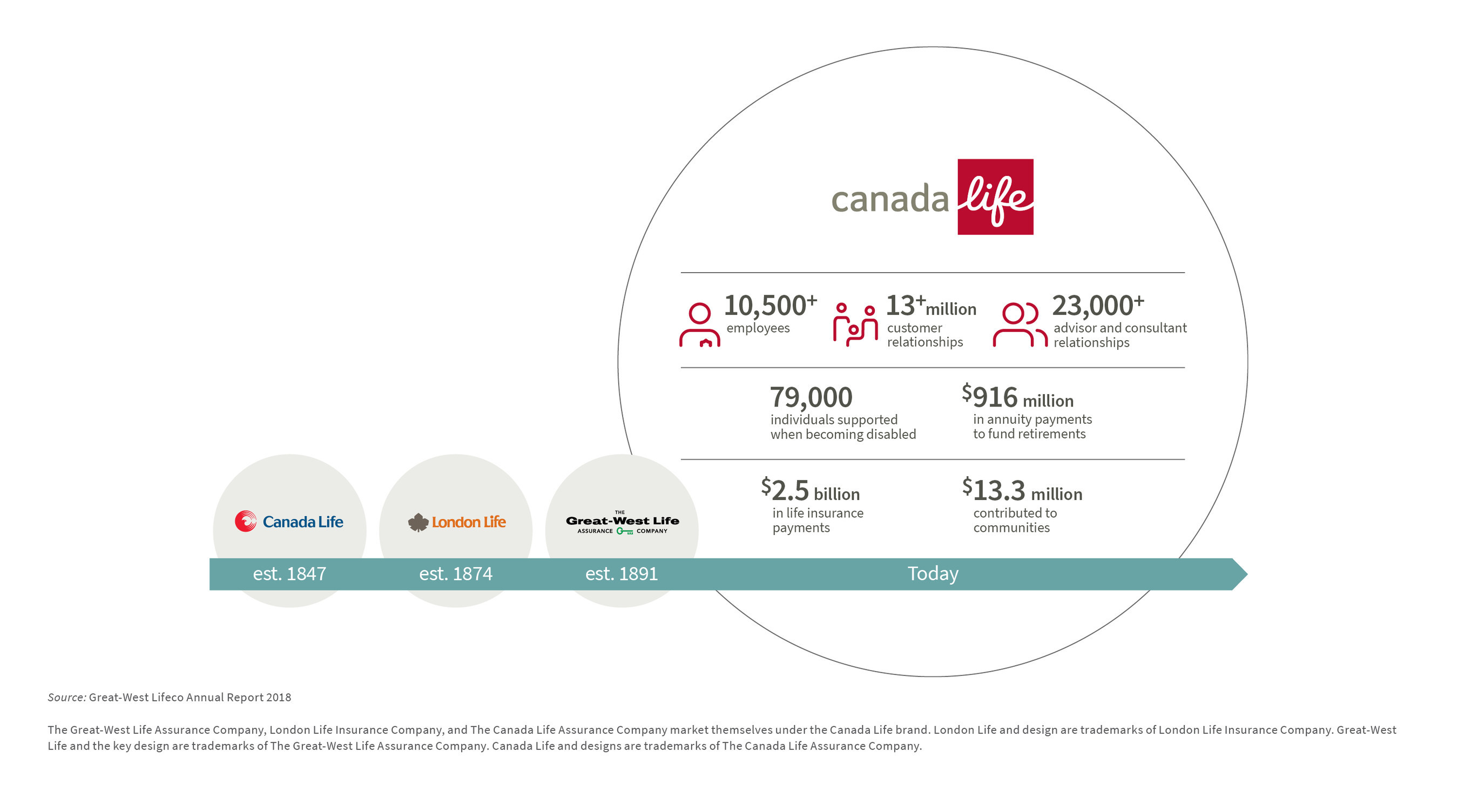

This infographic shows nearly all life insurance companies in canada.

Find out more about 40+ life insurers and discover who owns whom.

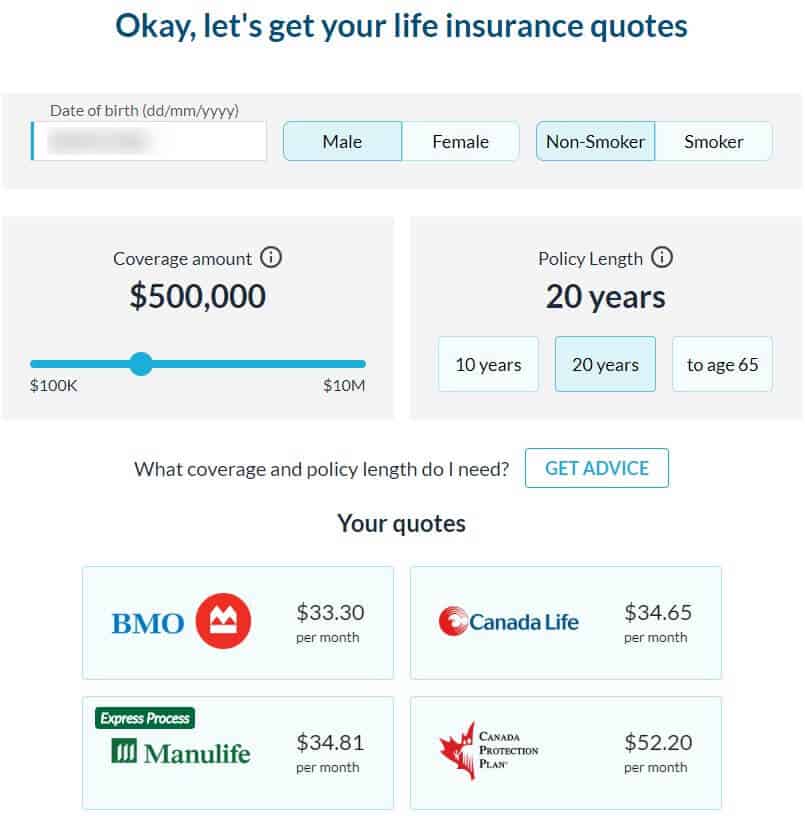

Compare life insurance quotes & explore your coverage options.

The canadian life and health insurance association provides information on the different types and costs of long term care.

Get a headstart on personal finances in canada.

Life insurance in canada life insurance is something everyone has in their life time.

The thing is every country has their own rules and regulations regarding life insurance and medical commodities.

There are two major types of life insurance:

Term life and permanent life insurance.

A specified amount of insurance is provided during the term for a fixed rate.

Term insurance is the least expensive form of life insurance.

Term insurance provides protection during 10 or 40 year terms.

Universal life insurance and whole life insurance policies…

Summary there are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

However choosing from the different types of life insurance in canada isn t like deciding what flavour of ice cream to try for dessert.

Compare, save and complete your application.

There are two types of life insurance policies to best meet your needs :

A term protection (temporary) or a permanent protection, meaning for your whole life.

The company has a strong presence around.

The choosing life insurance is an issue that most of us will face during our lives.

Without meaning to sound morbid, it is a certainty that you will die, so how do you help those you leave behind to cope with losing any financial security that you provided.

When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

5 Manfaat Posisi Viparita Karani5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ternyata Mudah Kaget Tanda Gangguan MentalKhasiat Luar Biasa Bawang Putih Panggang7 Makanan Sebabkan SembelitTernyata Tahan Kentut Bikin KeracunanHindari Makanan Dan Minuman Ini Kala Perut KosongMelawan Pikun Dengan ApelTernyata Einstein Sering Lupa Kunci MotorCara Baca Tanggal Kadaluarsa Produk MakananLearn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life. Life Insurance Types Canada. When deciding between term and permanent life insurance, which includes whole, universal and variable universal coverage, consider the option that.

Is one of canada's largest online life insurance providers and resources.

Universal life insurance is a type of permanent life insurance that combines life insurance with an investment account.

Types of investments you choose to hold in your account.

You can also select how your premiums are invested.

Permanent life insurance (whole life insurance) from sun life financial offers lifelong protection and a growing cash value over time.

Permanent life insurance can be a key part of your financial plan.

Speak with an advisor to determine the right life insurance for your needs or get a quote online.

Find the type that best suits your needs.

The second type of insurance is permanent life insurance.

Just like the name suggests, permanent life insurance will cover you for your entire life.

This combines a permanent life insurance plan with a savings component.

Learn about permanent life insurance and compare quotes from canada's top insurance companies.

There are two basic types of life insurance policies:

Think of life insurance as a contract between you and your insurance company.

Different types of life insurance.

Life insurance plans are lumped into 4 main categories:

Get a life insurance quote today!

As life changes, insurance needs can change too.

Life insurance is a way to help ensure that your family's financial future will be protected.

As the names imply, term insurance covers the as for permanent life insurance, it usually comes down to an investment and estate planning decision.

Many people over the age of 50, for example.

You can use this cash value to secure a loan, or if you cancel your policy early, you'll receive this cash value payout.

Guaranteed life insurance is a form of permanent life insurance that you're guaranteed to be accepted for, with no medical or personal information required.

In canada, life insurance policies fall under one of two categories these types of policies only pay out the amount of money you are insured for.

Term to 100 provides life insurance coverage to age 100 similar to permanent insurance but has no cash value (whereas permanent insurance does).

The two main types of life insurance in canada are term life insurance and permanent life insurance.

Permanent life insurance policies are more expensive than term life policies.

They also have various options including those that allow you to invest and tap into dividends or the cash value.

When shopping for life insurance, you have a choice between two main types:

Although term policies are sufficient for most people, the lifelong coverage and.

Insurance in canada is an important part of your expenses, but it can be hard to decide what types of insurance you need right now.

This means you'll likely pay more than you would with term insurance when you're.

There are various types of life insurance including permanent life insurance.

Let's get into more detail about this type of policy to help you decide if permanent life insurance provides coverage over the total length of your life.

What type of life insurance does canada offer and what are their benefits.

If you plan to live in canada you must consider different types of insurance to make sure your family are looked.

There are two types of permanent insurance:

The first provides full insurance for your entire life this type of insurance is much more expensive than temporary insurance.

For example, a $75,000 permanent life insurance policy may cost the same.

There are two major types of life insurance:

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

A specified amount of insurance is provided during the term for a fixed rate.

Type of insurance life insurance term life insurance permanent life insurance mortgage life insurance whole life insurance term 100 life insurance universal life insurance critical illness insurance disability insurance long term care canada life offers the following insurance plans

Contact us today for a free consultation.

Types of permanent life insurance.

Life insurance quotes in canada an insurance advisor can estimate how much the insurance will cost, but you need to finish the application process and let the.

And with many options to get insured available to you we work with all the largest life insurance providers in canada, and can help you find a plan that works with your budget, your health, and your needs.

Permanent life insurance refers to coverage that never expires, unlike term life insurance, and combines a death benefit with a savings component.

The two primary types of permanent life insurance are whole life and universal life.

Ia financial group offers four types of life insurance to protect your loved ones and save:

Temporary, permanent, universal and with participation.

Why is life insurance important?

It allows your family to maintain their standard of living.

Answers to key questions about life insurance in canada:

How much life insurance do i need?

What type of life insurance do i need?

There are several types of life insurance in.

A permanent life insurance policy can provide coverage for the rest of your life — unlike term life insurance, which covers you for a certain number of years.

Life insurance coverage for canadian residents.

Life insurance is a great way of investing a part there are several types of insurance plans available on the market:

Term, whole life and universal life.

Universal life is the most affordable type of permanent life insurance.

Whole life insurance is the cadillac of policy types.

Whole life insurance is the cadillac of policy types. Life Insurance Types Canada. Premiums are usually structured so the policy is completely guaranteed issue life insurance is a common staple of the over age 60 life insurance market in canada.Resep Cumi Goreng Tepung MantulResep Cream Horn PastryBakwan Jamur Tiram Gurih Dan NikmatTips Memilih Beras BerkualitasSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanSejarah Gudeg JogyakartaSejarah Nasi Megono Jadi Nasi TentaraIni Beda Asinan Betawi & Asinan Bogor5 Trik Matangkan ManggaAmpas Kopi Jangan Buang! Ini Manfaatnya

Comments

Post a Comment